Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Portugal: The elections do not call into question the continuation of strong improvement in public finances

- The Prime Minister created a surprise by announcing his resignation;

- The legislative elections of March 10 will not call into question the rapid reduction of the public debt;

- Portugal is one of the rare countries in the Eurozone to return to a budget surplus this year and to see its public debt fall below 100% of GDP from 2024 or 2025;

- This is the fruit of years of fiscal prudence, following the sovereign debt crisis, and strong growth;

- Portugal’s performance contrasts with the slow reduction of budgetary imbalances in the Eurozone and more particularly with France, Belgium and Italy, while the EC will reinstate budgetary rules at the start of 2024.

Market review: The German imbroglio

- Germany: budget vote postponed by a week;

- ECB: PEPP reinvestments to be discussed in December;

- Sharp pickup in flows into risky asset funds;

- High yield outperforms.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the week : US real estate, German budget and further market insights;

- Theme : Issues in the euro area in a context of high interest rates.

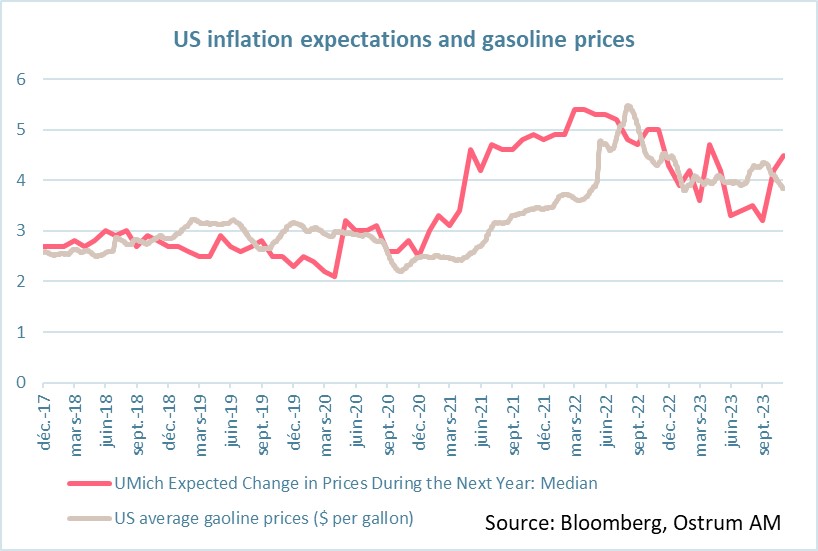

Chart of the week

Despite the drop in gasoline prices since September 20, from $4.4 per gallon to the current $3.8, inflation expectations among American households are increasing. According to the University of Michigan confidence index, median one-year inflation expectations have increased considerably over the past 2 months, going from 3.2% in September to 4.5% in November and returning to the levels reached in April. 5-year inflation expectations also increased, from 3% in October to 3.2% in November, reaching their highest level since March 2011. American households fear that the process of rapid disinflation will not be sustainable.

Figure of the week

The change in basis points in the German 10-Yr yield as the debt agency announces it will cease issuance of inflation-linked bonds from 2024.

MyStratWeekly : Market views and strategy

MyStratWeekly – November 28th 2023Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)