Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Imminent historic decision from the BoJ

- The first results of the annual spring negotiations indicate the largest wage increase in 33 years, after the largest in 30 years in 2023;

- This increases the probability of a rate hike by the BoJ, for the first time since 2007, from the meeting of March 17 and 18;

- The Central Bank has in fact conditioned a change in its ultra-accommodative monetary policy on a sustained increase in wages in order to trigger a virtuous circle between wages and prices and exit from the deflation that raged for 25 years in Japan;

- The divergence in monetary policy expectations between the BoJ, on the one hand, and the Fed and the ECB, on the other hand, argues for an appreciation of the yen versus the dollar and the euro.

Market review: Will inflation spoil the party (again)?

- The US CPI surprised with an increase of 3.2% in February;

- The T-note rises to 4.30%, the Bund above 2.40%;

- Sovereign debt and credit continue to outperform;

- Stocks remain well oriented, despite profit taking.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the week: Fed, BoE and markets ;

- Theme: Historic decision of the BoJ.

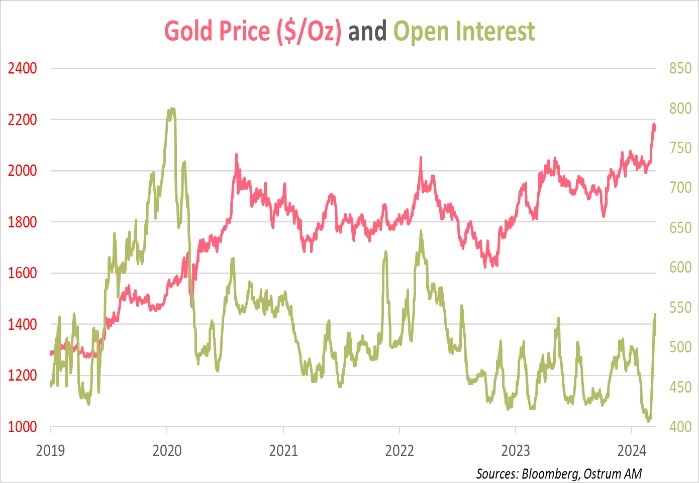

Chart of the week

The price of gold has increased sharply since the end of February to reach historic highs. This was accompanied by a clear increase in long positions on future contracts, indicating a renewed appetite on the part of investors.

This sharp rise in gold, however, occurred without any particular catalyst. Indeed, there have been no significant changes in traditional explanatory factors such as expected rate cuts from the Fed, making gold relatively more attractive, record purchases by central banks or fears linked to geopolitical tensions.

Figure of the week

According to the UN, the number of children dying before the age of 5 fell below 5 million for the first time in 2022, which represents a drop of 51% since 2000 and 62% since 1990.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – March 19th 2024