Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: EM Investment Grade sovereign hard currency debt has earned its reputation!

- The EMBIGD Investment Grade index spread is now aligned with that of US IG corporates;

- This reflects the significant improvement in macroeconomic fundam-entals, including low debt levels combined with a good quality sovereign rating;

- This improvement also explains the resilience of the asset class in an environment of high volatility in US sovereign bond markets;

- Central banks that were the first to raise policy rates are now reaping the rewards;

- Decoupling of EM IG sovereign hard currency debt seems to be a given.

Market review: The confidence game

- The ECB lowers its 2024 inflation forecast;

- Powell’s confidence on the disinflation process;

- Italian BTP spreads shrinking to 130 bp;

- Equities and CDS react positively to central banks’ messages.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week: US Employment Report and Inflation and ECB;

- Theme: IG emerging sovereign debt in dollar – a 100% mature asset class!

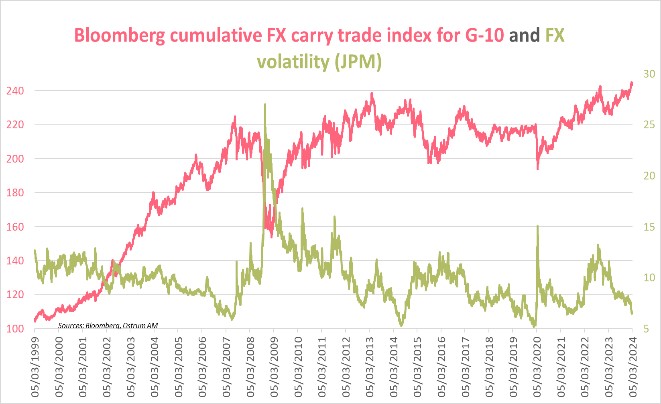

Chart of the week

The Bloomberg cumulative FX Carry-Trade index for G-10 currencies reached an all-time high. The necessary condition for carry-trade strateg¬ies to work is the absence of volatility. However, it has fallen significantly since October 2023.

The yen has been used primarily as a funding currency for these strategies. Market operators borrow the Japanese currency to buy dollar. The appreciation of the greenback over the period increases the gains of the carry-trade strategy.

Figure of the week

Egypt devalued its pound by 35% and raised its policy rate by 600 bps, paving the way for the release of IMF financial support of more than $10 billion.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – March 12th 2024