Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The Fed’s dilemma

- The Federal Reserve is uncertain about the direction of interest rates, as tariffs lead to both rising prices and a decrease in consumer demand. Inflation forecasts for 2025 have been raised by 0.3 percentage points to 3.1%, while the anticipated growth has been lowered by the same amount to 1.4%;

- The June "dot plot" shows a significant diversity of opinions among FOMC members regarding the inflation risk in particular;

- Price increases caused by tariffs will likely be offset by disinflation in the services sector, particularly housing costs;

- Labor market conditions continue to deteriorate, and the Fed's reaction function will take employment into greater account in the second half of the year. Once the inflation threat is removed, the Federal Reserve is expected to lower rates toward 3.50%;

- The appointment of Jerome Powell's successor as Fed Chair could nevertheless influence the timing of future interest rate cuts.

Market review: The U.S. strikes Iran

- Trump decides to hit Iran’s nuclear sites;

- The Fed hold rates amid divergent views within the FOMC;

- US 10-Yr note yields about 4.40%, oil prices help short-dated breakevens higher;

- High yield spreads widen but stocks rebound on Friday.

(Listen to) Axel Botte’s podcast:

- Review of the week – The U.S. strike Iran;

- Theme – The Fed’s dilemma.

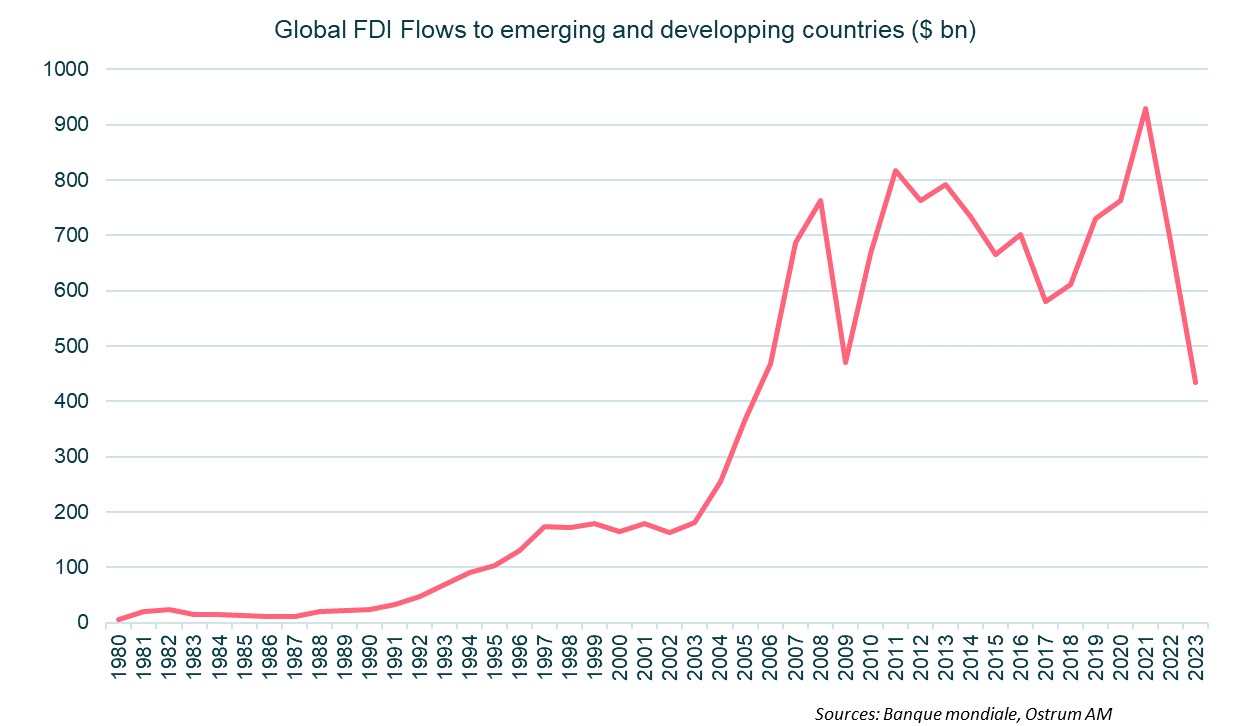

Chart of the week

FDI flows to emerging countries have sharply declined, reaching 435 billion dollars in 2023, marking the lowest level since 2005. The decline is observed in all countries, not just in China, which receives one-third of global FDI. This is related to the increase in trade and investment barriers. These flows are important for developing countries as they help generate economic growth and improve theirs standards of living , particularly in reducing poverty. In 2023, FDI accounted for about half of the external financing for these countries, according to the World Bank. To reverse the trend, it is essential to strengthen institutions and improve the business climate, which are crucial for job creation and achieving development goals.

Figure of the week

121

121 words in the G7 communiqué compared with 19 834 in june last year and

108 words in December 2023.

MyStratWeekly : Market views and strategy

MyStratWeekly – June 24th 2025