Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Dedollarization: A Golden Opportunity for the Yuan

- The political shock across the Atlantic has seriously shaken the hegemony of the dollar, providing China with a golden opportunity to accelerate the yuanization of the global economy;

- To achieve this, Chinese authorities can rely on a parallel financial infrastructure based on the Cross-Border Interbank Payment System (CIPS), equivalent to CHIPS;

- And the e-CNY, the digital yuan, which is more controlled by the state, is used in the mBridge platform, providing faster and cheaper alternatives to traditional dollar transactions;

- This allows countries to diversify away from the dollar, providing protection against U.S. sanctions and facilitating the creation of a digital Silk Road through the expansion of the mBridge platform to other countries.

Market review: Has the Hierarchy of Risks Been Disrupted Again?

- Israeli strikes in Iran bring geopolitical risk back to the forefront of market concerns;

- United States: Inflation indices come in below expectations;

- Rates: The T-note is trending back towards 4.40%;

- Sovereign Debt: Italian spreads outperform, while Belgium is downgraded to A+ by Fitch.

(Listen to) Axel Botte’s and Zouhoure Bousbih’s podcast:

- Review of the week – Geopolitical risk takes center stage again;

- Theme – Dedollarization: A Golden Opportunity for the Yuan.

Chart of the week

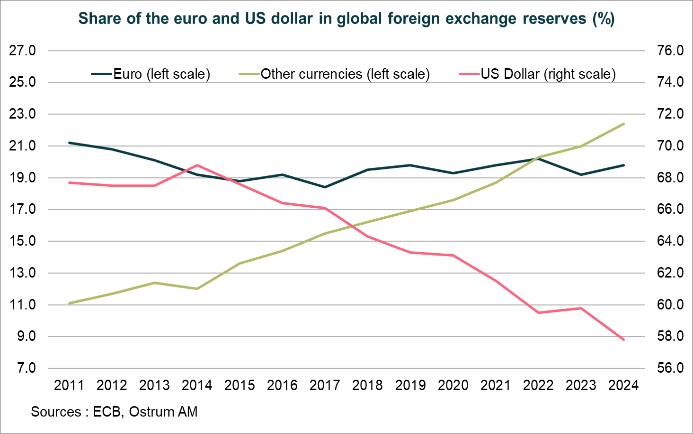

The share of the euro in global foreign reserves (at constant exchange rates) has remained relatively stable since 2011, fluctuating around 20%. This contrasts with the decline in the share of the US dollar, which has decreased since 2016, falling from 67.6% to 57.8% in 2024. This decline has benefited other currencies, which now account for 22.4% of global foreign reserves, particularly the Canadian and Australian dollars for diversification reasons. In 2024, the share of gold in global foreign reserves (at market valuation) increased to 20%, surpassing that of the euro (16%), according to the ECB. Gold has thus become the second-largest reserve asset, behind the dollar, due to record purchases by central banks and a significant rise in the price of gold to record levels. Central bank gold holdings are now close to levels seen in 1965, during the Bretton Woods era. The main reasons for this are diversification to hedge against economic risks (including inflation) and protection against geopolitical risks.

Figure of the week

15

It represents the percentage of the economic output of the Eurozone threatened by water scarcity, the best performance of the MSCI World excluding the United States since the beginning of the year in 40 years, and the rise in crude oil prices following the Israeli attack on Iran.

MyStratWeekly : Market views and strategy

MyStratWeekly – June 17th 2025