Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The CIO letter

Between de-escalation and downside risks to activity

The thunderous announcements of Liberation Day on April 2 are gradually giving way to a form of de-escalation. The reality of constraints on access to Chinese rare earths and fears of shortages have compelled Donald Trump to soften his stance. U.S. economic growth is, in fact, at a standstill. Expected price increases are weighing on consumer sentiment and investment decisions. The situation in the Middle East will only make matters worse. The labor market has also become less favorable. However, declining immigration and the lower participation rate are delaying the inexorable rise in unemployment, though both these developments will soon lead to a loss of potential growth. The fiscal challenges remain unresolved, further fueling distrust in the dollar and U.S. assets. In the Eurozone, following a strong first quarter, activity is expected to be impacted by international uncertainty ahead of the rollout of German investment plans next year. China is resisting U.S. protectionism by imposing targeted restrictions on its exports.

Global monetary policy has an easing bias; however, the Fed is resisting political pressures due to inflation risks. The weakness in employment will soon justify a loosening. The ECB is nearing the end of its own easing cycle but may implement another cut this summer. Meanwhile, the PBoC, faced with deflation, will continue adjusting interest rates. On the markets, the yield on the T-note is expected to decline, reflecting growth below potential. The Bund appears to be priced around 2.50%. The stability of risk-free rates favors investments in sovereign or corporate credit. The convergence of peripheral spreads reflects fiscal consolidation in Italy, Spain, and Portugal. Credit is favored by the environment of moderate growth, while tariffs may impact profit margins. European equities are thus expected to consolidate in the second half of the year.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

Central banks are poised to take action as needed. The Fed will closely monitor employment trends, as the recent price shock is not expected to sustain inflation over the long term. However, the timing and sequencing of rate cuts remain uncertain. The ECB is anticipated to reduce rates by 25 basis points this summer and may cut further if there is a more pronounced slowdown in growth. In China, the PBOC continues to ease monetary policy by lowering the reserve requirement ratio and interest rates.

-

Inflation

The rise in tariffs is not yet evident in U.S. inflation, which stood at 2.4% in May. The impact of these taxes appears to be mitigated by a decline in discretionary consumption, particularly in services. In the Eurozone, inflation reached 1.9% in May, with the index excluding energy and food at 2.3%. Inflation may continue to decrease in the short term due to the appreciation of the euro and weak consumer spending. In China, deflation persists with an annual inflation rate of -0.1% in May.

-

Growth

Despite a partial truce on tariffs, activity in the United States is expected to remain subdued in the second quarter before rebounding in the second half of the year, albeit below potential. The labor market is showing signs of weakening. In the Eurozone, growth for the first quarter has been revised upward to 0.6%. However, this improvement is likely to wane in light of the impending contraction in global trade. China experienced a strong first quarter and is implementing measures to mitigate the impact of tariffs on its growth. Signs of de-escalation appear to be emerging.

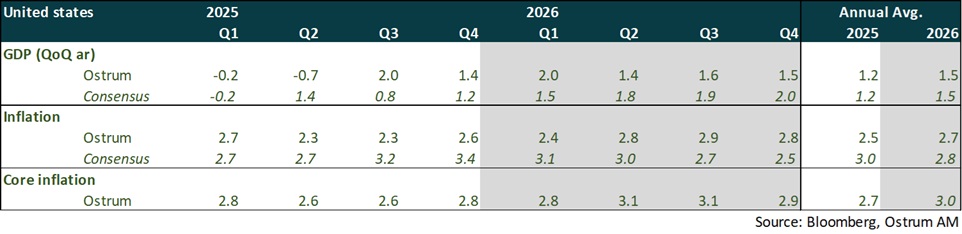

ECONOMY: UNITED STATES

A Year Below Potential, Likely Deterioration of the Labor Market

- Demand: The confidence shock and tariff imposition will weigh on household consumption and business investment following anticipated spending in the first quarter. Imports are expected to normalize in the second quarter in line with inventory destocking. Additionally, the credit quality of households remains a concern.

- Labor Market: Employment is projected to slow, with the unemployment rate expected to rise to 4.5-5% by the end of the year. The number of job openings continues to decline, and the increase in the number of individuals holding multiple jobs obscures the underlying weakness perceived by households.

- Fiscal Policy: The budget is now under review by the Senate. The House has agreed on a plan that places significant strain on public finances, projecting an additional deficit of $3 to $4 trillion over the next ten years. Budget cuts are primarily focused on transfers to the poorest populations, including Medicaid and SNAP. Tariff revenues are expected to be relatively modest, estimated at around $150 billion per year.

- Inflation: The decline in oil prices and reduced discretionary consumption should mitigate the impact of tariffs, which remain subject to various bilateral agreements.

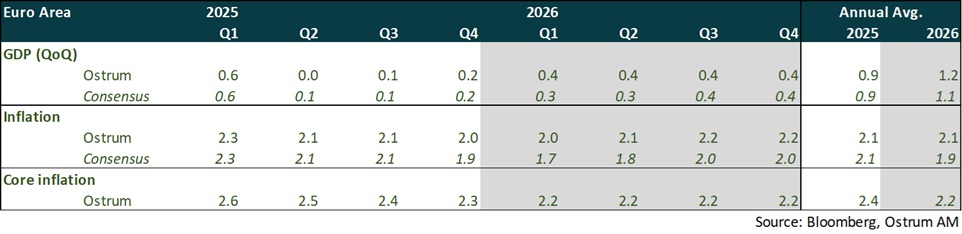

ECONOMY: EURO AREA

The Trade War with the United States to Weigh on Growth in 2025 Before a Recovery in 2026

- Activity : Following an unexpectedly strong first quarter, driven by increased exports, growth is anticipated to slow in 2025. This deceleration will be influenced by declining global trade and the uncertainty generated by the trade war. Surveys of business leaders have started to show signs of deterioration. A recovery is expected to commence in 2026, bolstered by Germany's infrastructure plans.

- Domestic Demand: Uncertainty is dampening household confidence and business leaders' activity outlook, leading to more cautious behavior. This is likely to impact investment, employment, and consumption, offsetting the expected benefits from increased purchasing power and the European Central Bank's monetary easing. A rise in productive investment is anticipated in 2026.

- Fiscal Policy: Germany's €500 billion infrastructure fund and the reform of the debt brake will only impact German and Eurozone growth starting in 2026. In 2025, fiscal flexibility is limited.

- Inflation: Inflation will depend on the EU's retaliatory measures against the U.S. These measures are currently on hold until mid-July, suggesting a short-term reduction in inflation due to falling oil prices, the appreciation of the euro, and weaker demand. There is a risk of a massive influx of highly competitive Asian products. Wage growth continues to slow but remains above inflation rates.

- There are downside risks to growth if trade tensions escalate on July 9.

ECONOMY: CHINA

The Geneva agreement has reduced the risk on short-term growth. Chinese authorities will continue to strengthen their support for the technology and innovation sectors to revive the job market and ultimately consumer confidence.

- Forecast revision: The 90-day truce, along with the limited impact of tariffs on activity in April, leads us to revise our growth forecast for 2025 upwards to 5%.

- Net exports: There is a rebound in exports to the United States. However, American companies seem to be waiting for the complete removal of tariffs. The difficult substitution of high-tech Chinese products should also lead to a reassessment of American tariffs.

- Demand: Economic uncertainty has impacted consumer behavior and investment. The equipment renewal program is expected to continue supporting activity. The real estate market shows signs of stabilization, which should strengthen through support measures for the sector. The priority remains employment, particularly in the technology and innovation sectors, for which policies should be reinforced. A consumption target as a percentage of GDP is expected to be announced in the next five-year plan.

- Monetary policy: Recent cuts in base interest rates by commercial banks will help reduce social financing costs, as well as on mortgage loans indexed to the five-year base rate of 3.5%. The recent reduction in the reserve requirement ratio should revive credit growth, which was weak in April due to economic uncertainty, particularly for households and businesses. The PBOC is expected to continue lowering its rates in the second half of the year and use tools to support strategic sectors.

Monetary Policy

Central banks are plunged into the uncertainty of Trump’s policies.

- The Fed will not hesitate to lower its rates at the first sign of a decline in employment.

At its last meeting on May 7, the Fed kept its rates unchanged for the third consecutive time. The central bank believes it is well positioned to wait for more visibility on the impact of the policies implemented by the White House. The Fed finds itself in an uncomfortable position. The increase in uncertainty surrounding Donald Trump's policies raises the risk of a higher unemployment rate and stronger inflation, according to Jerome Powell. We believe that the Fed will not hesitate to lower its rates at the first signs of deterioration in the labor market, with higher inflation expected to be only temporary. Therefore, we anticipate four rate cuts by the Fed by the end of the year. Additionally, it may slow the pace of contraction of its balance sheet or even suspend it, as long as the issue of the debt ceiling remains unresolved. - A new rate cut from the ECB is expected this summer.

At the meeting on June 5, the ECB made its eighth rate cut, bringing the deposit rate to 2%. The significant reduction in inflation forecasts for 2026 (1.6% compared to 1.9%) is linked to the appreciation of the euro and the decrease in oil prices, and it is expected to be temporary, as inflation is anticipated to return to 2% by 2027. The ECB is thus confident in achieving the 2% target in the medium term and believes that the monetary policy cycle is nearing its end. However, the door remains open for further monetary easing, as the ECB continues to see the risks to growth as oriented downwards due to high uncertainty, particularly regarding trade. We anticipate another rate cut of 25 basis points from the ECB this summer, more likely in September. This reduction could take place as early as July if trade tensions with the United States were to escalate, particularly on July 9, with the potential announcement of reciprocal tariffs. It could lower its rates further in the event of a much sharper slowdown in growth.

Market views

Asset classes

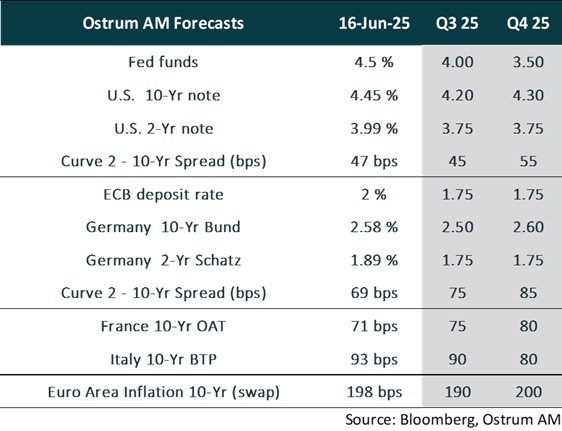

- U.S. Rates: The Federal Reserve is expected to respond to the deterioration in employment; however, the impact on long-term rates is likely to be limited given the budgetary risk.

- European Rates: The European Central Bank (ECB) is anticipated to lower its rate to 1.75%. The 10-year Bund reflects a more ambitious fiscal policy in Germany and benefits from reallocations from the dollar to the euro.

- Sovereign Spreads: The convergence of peripheral spreads towards core countries is expected to accelerate, with spreads on BTPs and OATs projected at 80 basis points.

- Eurozone Inflation: Inflation expectations remain anchored around the 2% target.

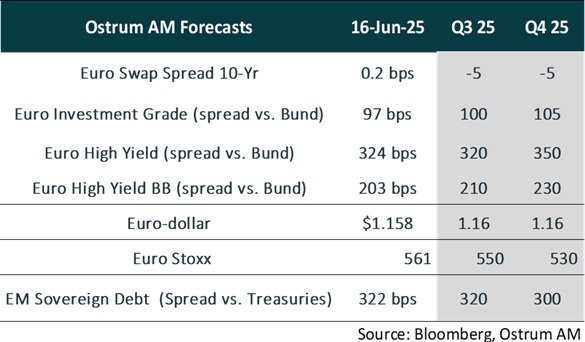

- Euro Credit: Investment-grade credit spreads have tightened significantly, with a modest widening likely.

- Euro high yield: Valuations in the high-yield sector are expected to normalize over the year, with the default rate remaining below the historical average.

- Exchange Rates: Distrust in the dollar has propelled the euro higher, with the single currency expected to approach $1.16 by the end of 2025.

- European equities: Tariffs are likely to weigh on profit margins. The anticipated market decline is somewhat mitigated by upwardly revised earnings multiples.

- Emerging Market Debt: Emerging market spreads have erased the tensions seen in early April and are expected to remain close to their lows for the year.

Ostrum Perspectives June 2025

Download the full PDF - June 2025