Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Zouhoure Bousbih's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Elections in emerging markets: a rather positive outcome !

- Political uncertainty has resulted in increased volatility in currency and equity markets;

- EM external sovereign debt has been more resilient, reflecting a strong credit profile and investor confidence;

- Idiosyncratic risk remains the primary market mover and performance catalyst. Therefore, South African sovereign bonds offer the best performance prospects due to improved political visibility and budgetary outlook;

- The upcoming US presidential election in November represents a significant issue for emerging markets that have served as a rear base for China to circumvent U.S. trade sanctions, like Vietnam.

Market review: Between political risk and uncertain growth

- Risk aversion eases after the first round of the French elections;

- The labor market normalizes in the United States;

- Sovereign and credit spreads tighten;

- European stocks gain 2.5%.

Zouhoure Bousbih's and Aline Goupil-Raguénès' podcast

- Topic of the week: Market News, US Employment and Eurozone Inflation;

- Theme: Elections in emerging markets: a rather positive outcome !

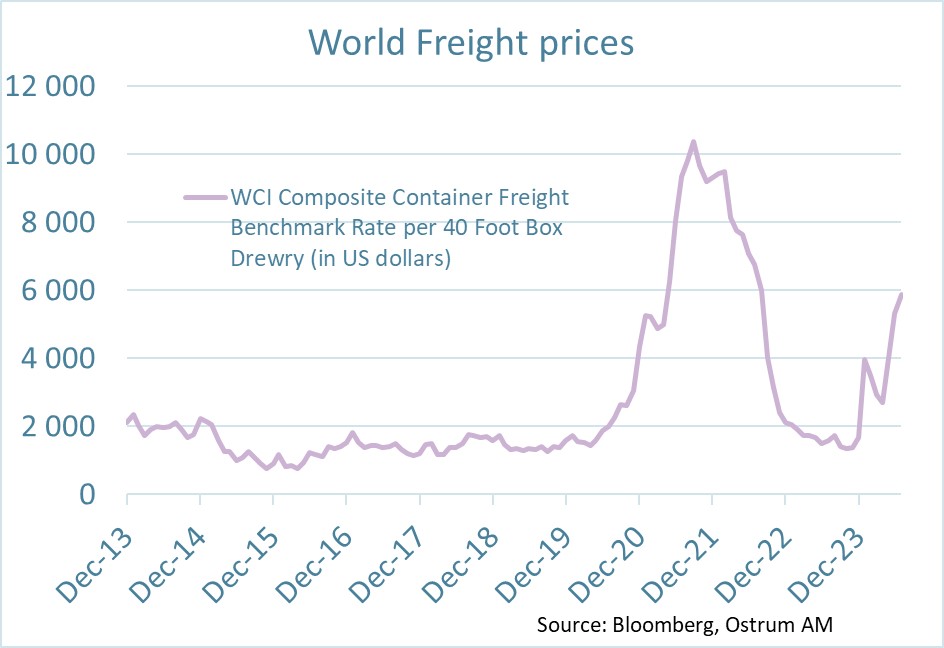

Chart of the week

Global maritime freight prices have increased by 274% year-on-year, reflecting the impact of attacks in the Red Sea.

In anticipation of the busy Christmas season, American and European companies are advancing their orders to be delivered on time, as maritime routes have lengthened.

Concerns about delivery times have significantly increased maritime freight costs, which are expected to impact consumer prices.

Figure of the week

The gap widens between the two candidates in the race to the White House following the first televised debate. D. Trump now leads his rival J. Biden by 6 percentage points with 49% of the vote intentions compared to 43% for the current president.

Source: NYT/Sienna poll

MyStratWeekly : Market views and strategy

MyStratWeekly – July 9th 2024