Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

Aline Goupil-Raguénès’ and Zouhoure Bousbih’s podcast:

- Review of the week – Market overview, U.S. employment, and Trump's budget legislation;

- Theme – Focus on Asia and the Tariffs.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Notes on the SLR reform

- The Federal Reserve voted to reduce the leverage requirement for systemically important banks, lowering the required capital from 5% to a range of 3.5% to 4.5%;

- The decision has sparked divisions within the Fed, with some members arguing that it would strengthen the resilience of the Treasury market, while others, such as Michael Barr, oppose the reform due to increased risks of bank failure;

- Although the reform could unlock $13 billion in bank capital, critics question its impact on the demand for Treasuries. More targeted solutions seem necessary to mitigate tensions in the market;

- The structure of the Treasury market remains vulnerable, with tensions exacerbated by rising public debt. Latent losses on Treasury holdings echo the context surrounding the failure of SVB;

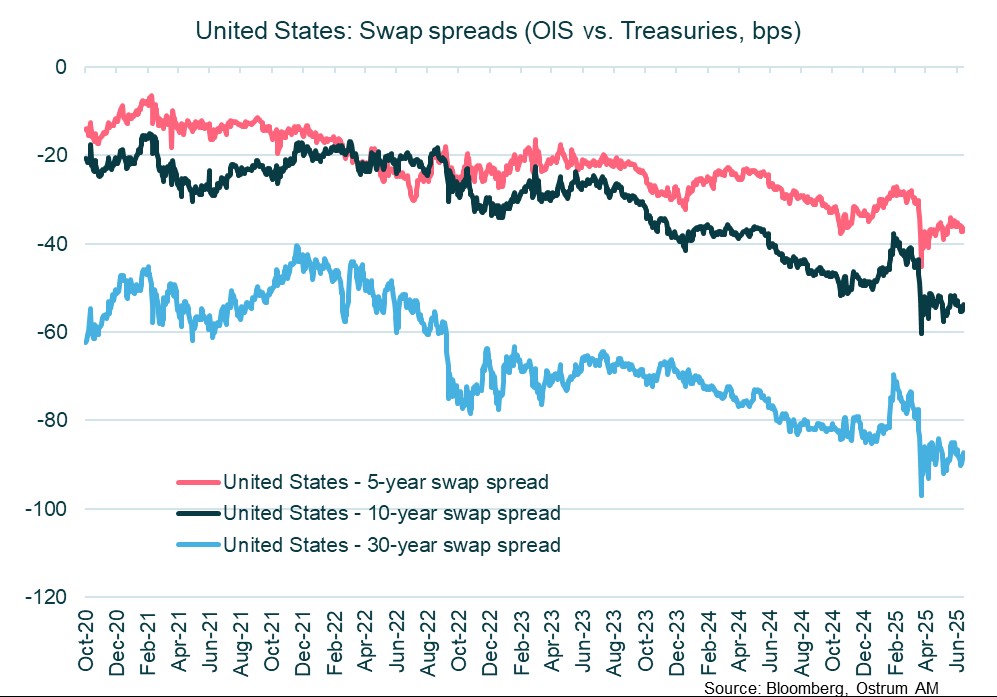

- Swap spreads remain deeply negative, and the SLR reform will not be sufficient to normalize them. The fiscal context will remain decisive for swap spreads.

The Fed agrees to ease capital requirements

Largest banks will get lower capital requirements

The Federal Reserve unveiled plans to roll back an important bank capital rule. Under the SLR framework, global systemically important banks (GSIB) holding companies must maintain tier 1 capital equal to 5 % of total leverage exposure (3 % SLR minimum plus a 2 % eSLR buffer) to avoid limitations on making distributions (e.g., dividends) and certain discretionary bonus payments. The leverage ratio, which went into effect in 2018, treats all assets equally and works as a backstop to other risk-based capital rules. The Fed board voted 5-2 to propose changes to the enhanced supplementary leverage ratio (eSLR), which applies to the largest US banks. The revisions would reduce holding companies’ capital requirement under the ratio to a range of 3.5% to 4.5%, from the current 5%.

The Fed Board’s decision was spilt. “The proposal will help to build resilience in U.S. Treasury markets, reducing the likelihood of market dysfunction and the need for the Federal Reserve to intervene in a future stress event,” said new vice chair for supervision Michelle Bowman (sourced from Bloomberg). On the contrary, Bowman’s predecessor, Governor Michael Barr, objected to the plans. Lower capital requirements would increase of bank failure and disorderly resolution whilst the Deposit Insurance Fund would incur higher losses. Governor Adriana Kugler joined Barr in objecting to the draft rule. Both said it’s unlikely to help the Treasury market, especially in times of stress.

The Fed’s staff said the proposal would reduce the aggregate capital requirements for the eight big banks by $13 billion. Although more than $200 billion of capital would be freed up for the firms’ banking subsidiaries, the restrictions at the holding company level would prevent that from being paid out to shareholders. Furthermore, total loss absorbing capacity requirements for big banks would decline 5%. TLAC forces lenders to hold a certain amount of debt — at the holding-company level — that can be converted to equity. The plan would lower firms’ long-term debt requirements by 16%. Banks welcome the Fed’s proposal. However, banks may seek a carve-out during the planned 60-day public comment period to exclude certain assets like U.S. Treasuries from the ratio calculation. During the Covid crisis, the Fed excluded Treasuries from the SLR to foster lending. The exemption expired in March 2021 allowed them to hold Treasury securities without affecting the regulatory ratio.

In contrast, critics of the proposal for revised eSLR rules question whether banks will use the increased flexibility to buy Treasuries. One possibility of carve-out would be to exclude bank reserves with the Fed from the calculated leverage ratio. In this case, the sweeter regulatory treatment of reserves could exacerbate the preference for cash over Treasury securities if financial institutions became SLR constrained. More targeted solutions could be needed to mitigate issues in the Treasury market.

Treasury market structure and resilience

The U.S. Treasury bond market is deep and liquid but is nevertheless subject to occasional stress. It is always difficult to identify the underlying reasons for market disruption, but excessive regulation would be one of them. Proponents of the reform reckon that continuing to impose unwarranted limits on dealers’ intermediation capacity could exacerbate a future stress event. Jerome Powell, a supporter of the reform, argues that, if the leverage ratio is binding, it discourages banks from undertaking low-margin, fairly safe activities, such as mediation in Treasury markets. Concerns about the levels of market liquidity are shared by most Fed officials.

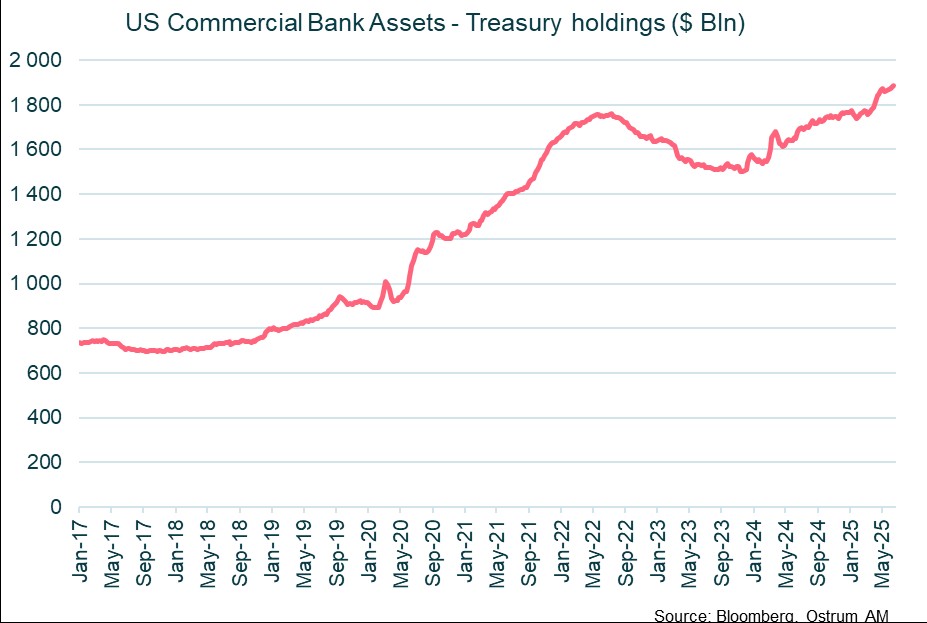

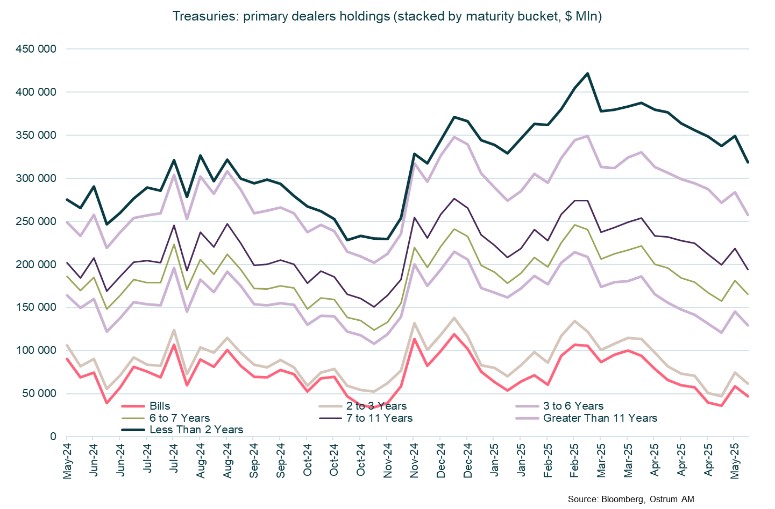

The amount of outstanding US government debt has swelled to almost $29 trillion, the capacity of banks’ balance sheets has not expanded in tandem. Funding costs in the repo market have increased amid Treasury market bottlenecks. Indeed, primary dealers had a tough time absorbing bond selling flows from final investors around Liberation Day. In short, primary dealers have complained the SLR is clogging up the system. Better regulation may help but, as the end of the day, fiscal deficits will have to be reined in to ensure market stability. The size of US Treasury issuance has more than doubled since GFC crisis. In the first quarter of 2025, tariff and budget anxiety sparked widespread selling in Treasuries that primary dealers had to absorb.

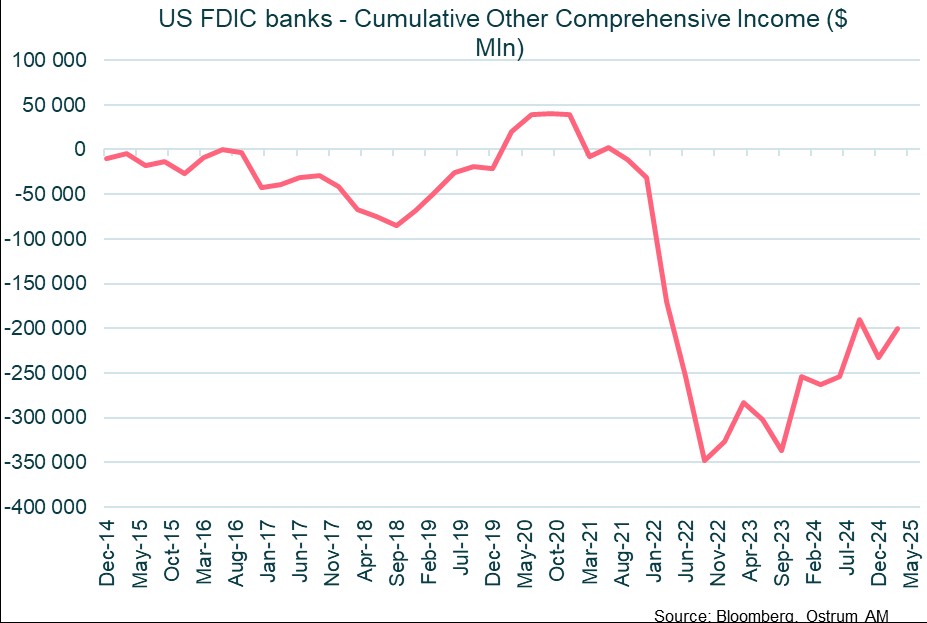

Furthermore, the Silicon Valley Bank failure reminded everyone that bond holdings carry interest rate risk. As depositors withdrew their cash, several banks were forced to sell long-dated Treasuries at a loss leading to their collapses. In the wake of these bankruptcies, the Fed launched the BTFP facility to shield banks from paper losses (in other words, to transfer the risk to taxpayers). On FDIC data, cumulative comprehensive other income (paper losses) on marketable amount to 200 billion in the 1st quarter 2025.

Other risks have welled notably the basis trade. Basis trade positioning is estimated to have doubled in the past five years to about $1 trillion. In such trades, hedge funds and arbitrageurs sell Treasury futures and buy Treasury bonds to turn a margin. Volatility such as that around Liberation Day in early April can force investors to unwind their positions to repay repo loans, creating cascading stop loss sales.

Swap spreads: SLR reform only takes you so far

Negative swap spreads can’t normalize thanks to to SLR reform alone

The SLR reform may have a larger impact on swap spreads than any other assets. Speculation about the rule change has been going on for months and the trend for tighter swap spreads appears intact. In February, when Michael Barr announced his resignation from the Fed’s bank supervision role, swap spreads temporarily rose only to reverse course swiftly thereafter as the U.S. fiscal deficit outlook worsens. The OIS spread to T- note is trading in negative deeply territory indicating that Treasury coupon securities carry extra risk. The fiscal outlook will remain front and center. According to the CBO, the latest version of the budget bill may add $3.3 trillion to the debt over the next ten years (on top of the $20 trillion increase expected under current fiscal policy). The term and credit risk premiums are sizeable at around 55 bps on 10-Yr Treasury note and 90 bps on 30-Yr bonds. Both spreads almost double from four years ago.

Conclusion

The Fed voted to ease bank regulation applied to the largest U.S. banks. The enhanced supplementary leverage ratio will be lowered to free up capital for lending. A majority of Fed Board members believe the reform will enable banks to hold Treasuries and mitigate market liquidity risks. Opponents to the change think there is no certainty that banks will increase their Treasury bond holdings whilst lower capital requirement may raise their financial stability risks. At the end of the day, banks may decide to invest more in Treasuries based on yield levels and the fiscal outlook rather than regulatory tweaks.

Axel Botte

Chart of the week

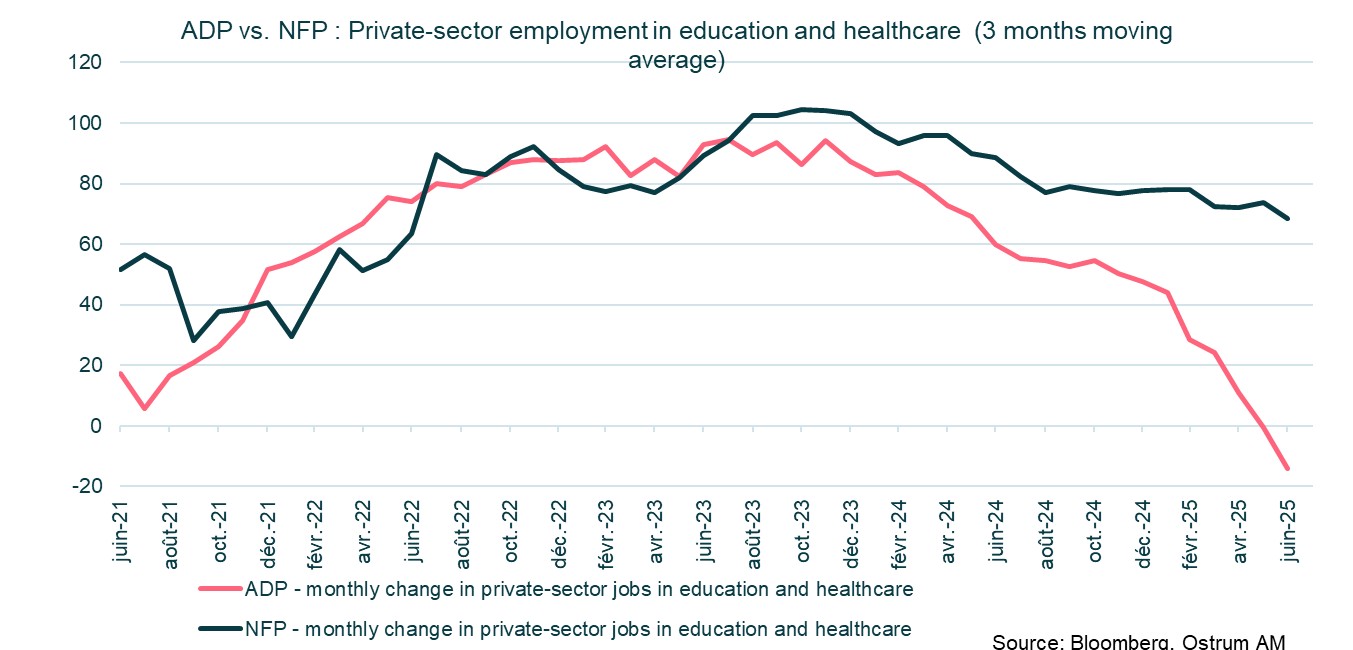

The employment situation in the U.S. may look OK at first glance with unemployment rate falling back to 4.1% in June and resilient job creation. The underlying picture may be less rosy for several reasons (lower participation, increasing share of multiple-job holders…).

Job gains appear concentrated over the past few months in a handful of sectors including education, healthcare and leisure. The BLS’ non farm payrolls indicate healthy 70k+ monthly increases in private education and healthcare. In contrast, the ADP numbers suggest that private-sector payrolls in healthcare and education have slowed materially since the middle of 2024 to an outright contraction in the second quarter of 2025. So which one is right?

Figure of the week

3.4

$3.4 trillion: this is the cumulative deficit increase from the One Big Beautiful Bill over the 2025-2034 according to CBO estimates.

Market review: Markets cutting through data and geopolitical haze

- United States: Job gains of 147k in June mask a much more precarious situation in reality;

- The U.S. budget has been passed, but the trade war continues;

- The T-note trades at 4.35% ahead of the July 4th weekend, amid a brief panic in the Gilt market;

- Credit spreads continue to tighten significantly.

Financial markets are upbeat with U.S. equities making all-time highs with the passage of the budget bill in the U.S. and headlines suggesting a resilient labor market. The trade war is however far from over. Under the hood, the U.S. labor market is also much weaker than meets the eye.

As the summer season kicks in, things look rosy from the market’s point of view. Equities are making record highs ahead of a promising thanks to a much weaker dollar, down more than 10% in 2025, the worst first-half return since 1973. As often, a weaker dollar unleashes a bullish run in markets. Companies with high foreign revenue share including the Magnificent 7 group have led equity indices higher. Treasury yields have reacted to payroll headlines whilst Bunds appear to digest increased supply in Q3. All things spreads are tighter across sovereign and credit markets.

The U.S. economic situation (let alone the international situation) is somewhat worrisome. GDP growth in the second quarter will largely be a function of inventory building amid weakening domestic demand. The labor market data look O.K. though with falling unemployment rate (to 4.1%) and continued job creation. That said, the decline in joblessness appears traceable to lower participation rate, as foreign-born workers have gone missing. As concerns payrolls, the 147k increase in June came as a positive surprise but state and local government jobs in education account for half of the gains. Private sector increases stook at 74k, much below consensus. Furthermore, private-sector job creation is reportedly concentrated in healthcare and education and, to some extent leisure, although equivalent sectoral data from ADP paint a much bleaker picture. Strong job gains in healthcare are dubious in the context of heavy Medicaid spending cuts penciled in the budget bill. It also disturbing to observe diminishing aggregate hours worked. The ISM services employment index indeed fell 3.5 points to 47.2 in June. Wages are soft, indicating that lower unemployment may not add to inflation worries. In the euro area, surveys out of Germany are improving. The prospects of infrastructure spending starting in the second half is gradually feeding through business confidence. France surveys were less upbeat but there is a case to be made that growth is firming up in the euro area. Chinese and Japanese PMI were also encouraging in the context of the ongoing trade war with the U.S.

Financial markets have ignored the fallout from higher tariffs, and geopolitical risks amid a sharp adjustment in the greenback. Weaker data is seen as cementing Fed easing in the second half as Jerome Powell made clear at the ECB symposium in Sintra that rates would have already been lowered without higher tariffs. The Fed will nevertheless pass in July judging that headline labor market data are still good enough for a status quo. The curve steepening trend reversed amid positioning squaring ahead of Independence Day. UK bonds have been under pressure as a U-turn on welfare reform and rumors that Rachel Reeves would be dismissed lit 30-Yr Gilts on fire (up 19 bps in one day). PM Keir Starmer later intervened to calm market fears. In Europe, the Bund supply outlook keeps pressuring the back end. The yield on 30-Yr Bunds is above the 3% mark. The ECB stands ready to act on rates if necessary, but in-line inflation and better growth prospects give the institution some time. Peripheral sovereign spreads are closing in on core bonds with Italian BTPs at 84 bps. In credit, both IG and high yield spreads are shrinking fast as supply dries up. The weak dollar helps U.S. stocks including small caps outperform Europe.

Axel Botte

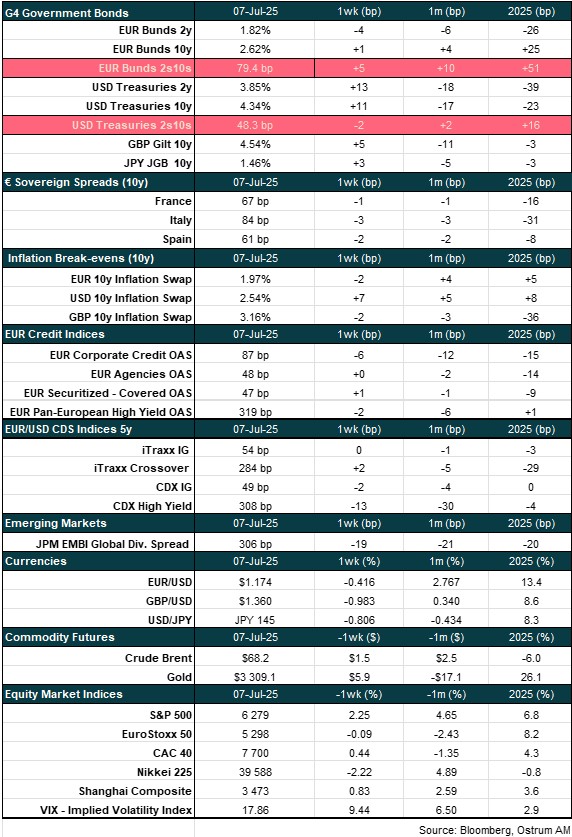

Main market indicators