Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Reform of EU budgetary rules

- A reform was necessary to compensate for the lack of effectiveness of the previous budgetary framework, rarely respected, and to make it consistent with current conditions;

- The compromise reached by the 27 contains certain advances such as taking into account the specificities of each country and a more gradual adjustment of public debt;

- But the addition of specific and strict targets by so-called frugal countries limits the scope of the reform;

- Highly indebted countries will have to make a significant budgetary adjustment, at the risk of once again making these rules unworkable;

- This compromise is currently being negotiated by the European Parliament with a view to a desired vote before the European elections. Hopefully changes will be made to it to improve it.

Market review: ECB : rate cut… next summer

- Monetary easing to be delayed;

- T-note yields up to 4.15%;

- Credit spreads remain well oriented;

- Nasdaq rebound thanks to semiconductors.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the week : US Economics and Politics, BoJ Decision Ahead of ECB and BoC;

- Theme : The EU budgetary framework reformed.

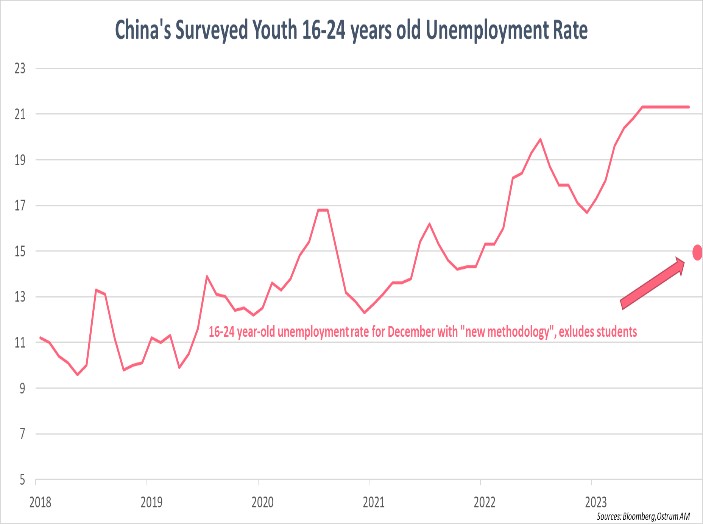

Chart of the week

A return with fanfare of the unemployment rate statistics of young people aged 16-24 in China which appears to have fallen to 14.9% in December 2023.

In June, the Chinese authorities suspended its publication in order to change the calculation methodology. Students are now excluded, which explains the sharp drop compared to the figure published in June 2023 of 21.4%.

China’s statstics bureau has not published the history of the new series, making it difficult to apprehend the recent changes in youth unemployment.

Figure of the week

This is the share of total employment in percentage in developed countries that will be exposed to artificial intelligence, according to an IMF study.

MyStratWeekly : Market views and strategy

MyStratWeekly – January 23rd 2024