Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: China Equity Markets: The Awakening of the Dragon?

- The start of the year is difficult for Chinese equity markets, despite numerous announcements of stabilization ;

- The “snowballs” are partly responsible for the downward spiral at the beginning of the year;

- However, the roots of evil remain domestic economy and geopolitics;

- The rapid emergence of new economic sectors is now reflected in the new CSI A50 stock index, the future of China’s equity markets?

Market review: The Fed’s data-resistance

- US employment skyrockets with 353k net job creations in January;

- Fed rules out March cut but maintains easing bias;

- T-note yields dips back below 4%;

- Risky assets stabilize after a strong January.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week : Employment and Bank Credit Conditions in the US, the Fed’s BTFP;

- Theme : China Equity Market.

Chart of the week

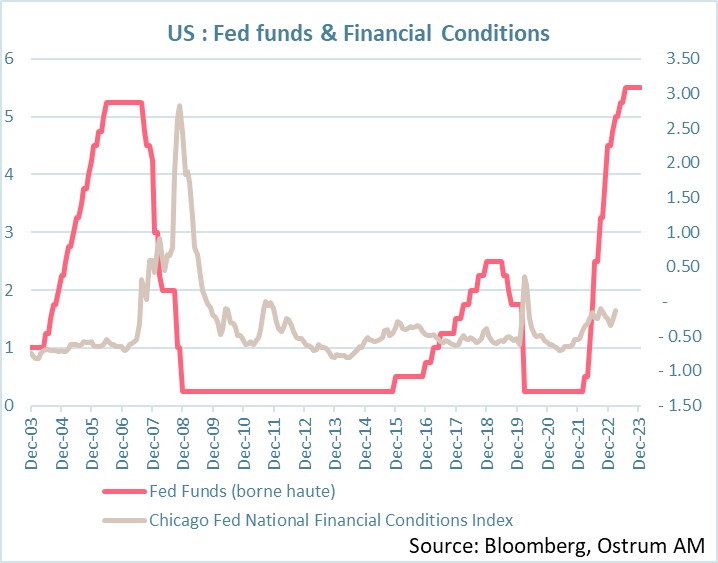

The Federal Reserve has raised its rates by 525 bp since March 2022 after ending the QE implemented during Covid. Several unusual rate increases of 50 and 75 bp even occurred.

It is critical for a Central Bank to see its policy transmitted to the rest of the economy. This is why the authorities are particularly attentive to financial conditions.

Bank credit conditions (notably real estate) have tightened without leading to a massive credit crunch. On markets, the series of rate increases have had a transitory effect on long-term bond yields. In addition, rising stocks and narrowing credit spreads have erased much of the monetary tightening.

Figure of the week

This is the total amount of investment, globally, in renewable energies increasing by 17% in 2023 to 1.8 trillion dollars.

MyStratWeekly : Market views and strategy

MyStratWeekly – February 6th 2024