Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The ECB facing domestic tensions on prices

- Christine Lagarde and Isabelle Schnabel insist on the need for the ECB to remain cautious and not lower rates prematurely;

- Inflation in services has stabilized at 4% for 3 months, reflecting the persistence of domestic tensions linked in particular to wages;

- The ECB forward-looking tracker of negotiated wages in eurozone does not show signs of a slowdown in wages in 2024;

- In a context of low productivity growth, even a slight decline, the evolution of profit margins will be decisive in absorbing the sharp increase in labor costs;

- Salary negotiations and unit profits for the 1st quarter will be decisive in judging the continuation of disinflation;

- The ECB is not expected to lower its rates before June.

Market review: Towards the Fed scenario

- Repricing of Markets’ expectations of Fed rate cuts;

- Outperformance of European stock markets;

- Resilience of Euro zone peripheral spreads;

- Credit is resilient.

Axel Botte's podcast

- Topic of the week : US Markets and Inflation;

- Theme : The Labor Hoarding phenomenon in the United States.

Chart of the week

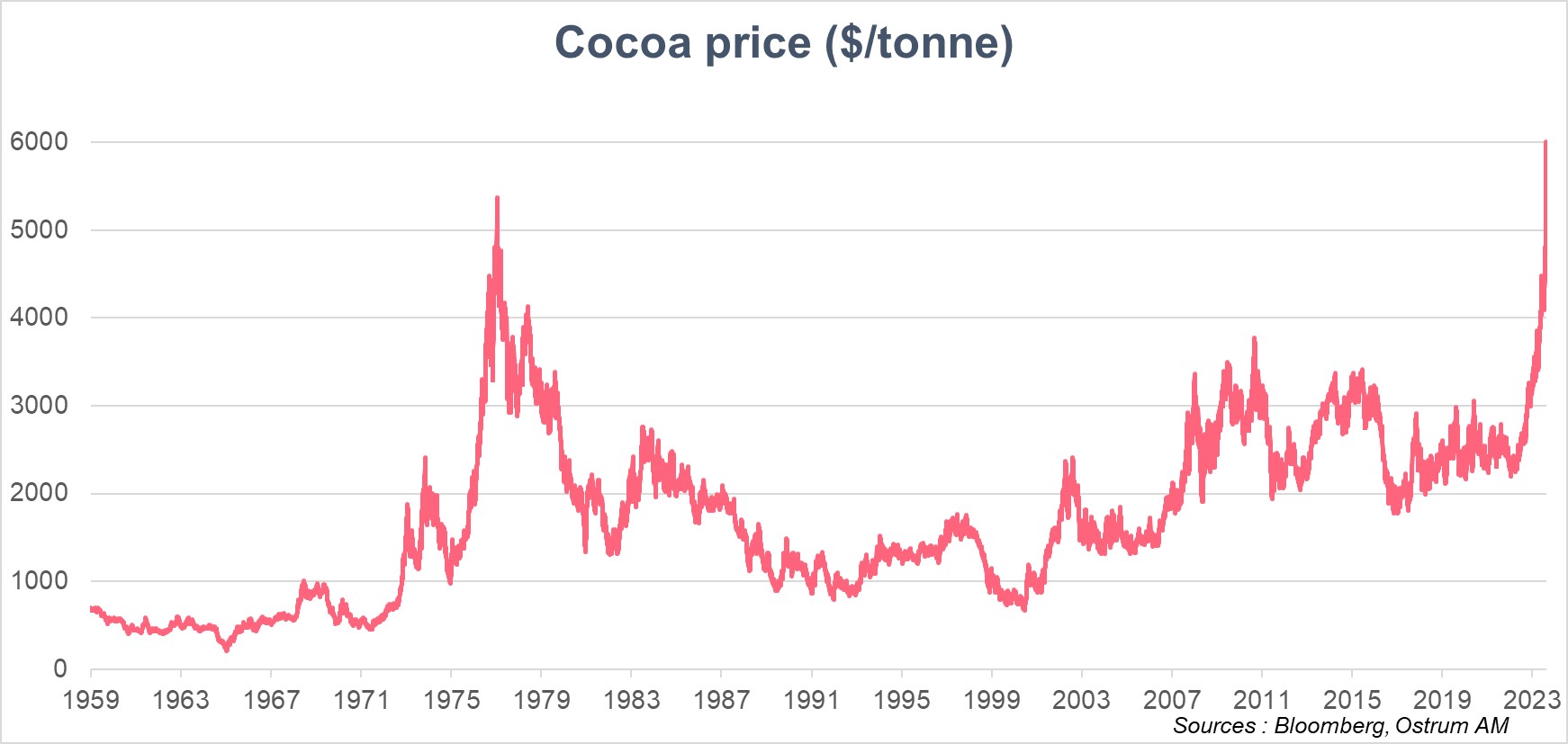

The price of cocoa in New York literally soared from last summer to reach a historic high of $6,000 per tonne on February 13, compared to $3,000 at the start of June 2023. This surge is linked to poor climatic conditions in Ghana and Ivory Coast, main cocoa producers (nearly 70% of world production).

After being affected by a disease linked to flooding, the cocoa pods suffered from the drought following the passage of El Niño. This increase in prices has also been amplified by speculators who force cocoa producers to cover their short positions. This spectacular increase in the price of cocoa should result in an increase in the selling price of chocolate.

Figure of the week

In 2023, the United States became the world's leading exporter of liquefied natural gas, ahead of Australia and Qatar. Exports were 91.2 million tons, mainly destined for the Netherlands, the United Kingdom and France.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – February 20th 2024