Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The risk of a “Donald Truss” moment

- The global economy has long been driven by U.S. domestic demand. The U.S. administration claims it wants to reduce America's external imbalances by imposing prohibitive tariffs. Europe and China are also taking measures to stimulate their domestic demand. China does not intend to negotiate;

- Trump's advisors believe that the dollar's status as a reserve currency has become a burden, resulting in an overvaluation of the dollar. Steven Miran aims to make the rest of the world pay for the security and reliability provided by the U.S. currency;

- The U.S. government is reportedly seeking to force foreign creditors to accept a restructuring of U.S. debt converted into a 100-year loan. This is the purpose of the Mar-a-Lago accord mentioned by Steven Miran. The resulting decline of the dollar would also serve as a means to correct the trade balance;

- However, the U.S. economy is very sensitive to financial markets. Tampering with the credibility of the United States and its credit risk is extremely dangerous. Markets have understood this well, and a significant credit risk premium is now embedded in U.S. long-term rates;

- The risk of debt restructuring, and a sharp depreciation of the dollar raises the specter of a collapse in the Treasury market, reminiscent of the British episode during the brief government of Liz Truss.

Market review: On hold

- The 90-day tariff pause triggers a historic rebound in U.S. indices;

- However, escalation continues with China;

- Rates: the 10-year T-note experiences its worst week since 1982 (+55 bps), with the Bund acting as a safe haven;

- Massive outflows from high yield and leveraged loan mutual funds.

Axel Botte’s podcast:

- Review of the week – A rebound following the suspension of tariffs over 10%;

- Theme – The risk of a Donald “Truss” moment.

Chart of the week

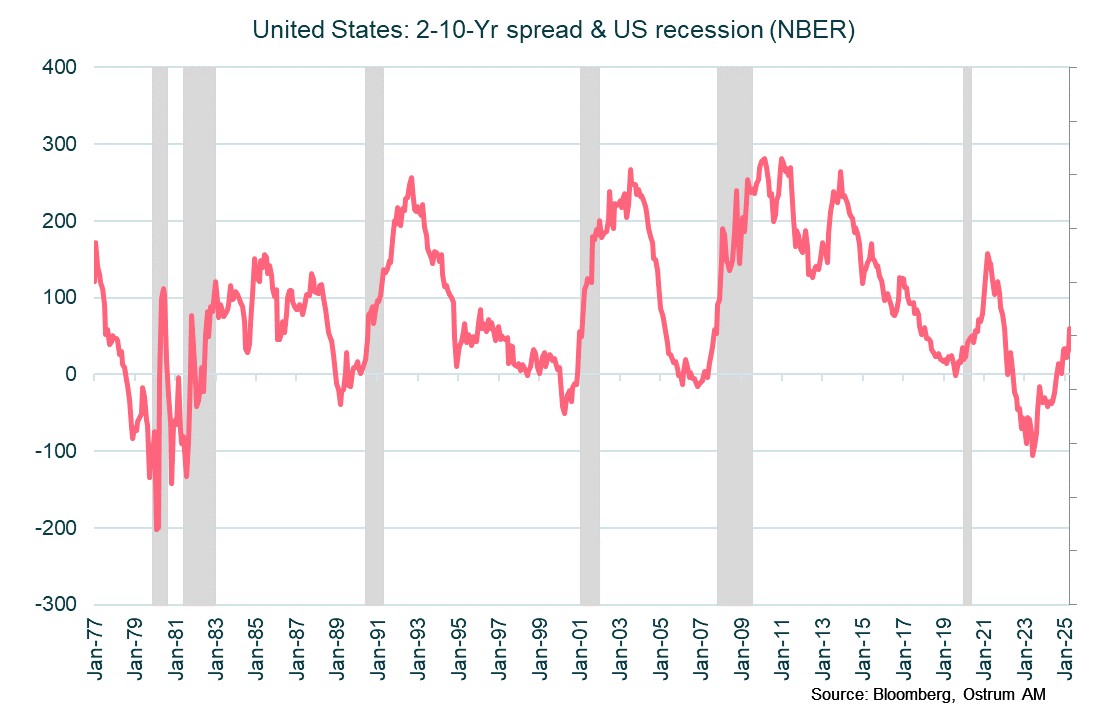

The term structure of interest rates is a time-tested indicator of economic conditions. An inversion in the 2-10-Yr yield spread often foreshadows downturn. Conversely, as the economic enters recessions, market participants anticipate rate cuts from the Fed which results in steepening.

In extreme market conditions, investors may sell long-dated bonds to cover for losses elsewhere and park cash in shorter-dated bills.

The sharp yield curve steepening must thus be monitored closely.

Figure of the week

-9.5

This is the percentage decline in the broad DXY dollar index from its January 13 high. The dollar has fallen to 3-year lows.

MyStratWeekly : Market views and strategy

MyStratWeekly – April 15th 2025