Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

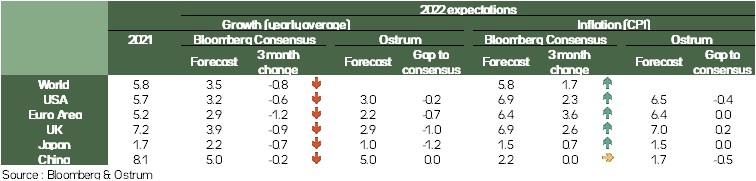

Growth vs. inflation

Inflation in both the United States and Europe continues to surprise on the rise and signs of sustainability are accumulating: expectations of inflation are up, inflationary pressures that are spreading over many sectors and especially pressures on wages. If the story is easier to tell about the United States than about the Eurozone, the trend is also emerging even if, as usual, the trend is delayed and attenuated.

Central banks are therefore obliged to react in particular so that expectations do not become too high. The Fed and the ECB have hardened the tone significantly and are accelerating the monetary tightening with, as a corollary, a rise in the yield curve and a strong rebound in volatility. The problem is that with current inflation levels, a return to 2%, the target of the Fed and the ECB, would require even greater policy rate hikes than the market expects (for the moment, the expected real rates remain negative over several years, which is not enough to really fight against inflation). Such a tightening would most likely lead to a recession.

This is the central banks dilemma: growth versus inflation. It is now unlikely that they will be able to control inflation without having to implement a policy that leads to a recession.

The Ukrainian tragedy adds to this dilemma by weighing on growth and adding to inflationary pressures. The key variable here is the duration of the conflict which unfortunately drags on and thus exacerbates the impact on economic variables. Not to mention the human tragedy.

Two scenarios then emerge. The first, if we are to believe the rhetoric of the central banks, with inflation returning to the target, but in this case high policy rates and most likely a recession. The second, with central banks becoming more complacent when growth falls too much; in this case the rate hikes anticipated by the market would be excessive, a recession could be avoided but inflation would stabilize at a level well above 2%.

Rather, on the second scenario, central banks have shown their risk aversion to growth.

Economic views

Three themes for the markets

-

Monetary policy

The very sharp acceleration of the monetary tightening was necessary in view of inflation. The impact on growth remains as economies falter. The risk of “too fast too strong” after too much procrastination is certain. This can lead to a downward reconsideration of the tightening.

-

Inflation

The red thread for over a year for markets that have continued to be surprised by the upside. Signs of impact on growth are multiplying and we are passing the point where inflation becomes recessive and therefore deflationary. The main issue in Europe is the possible emergence of a price/wage loop that would continue the pressures.

-

Growth

The headwinds are multiplying. Inflationary shock that negatively impacts the disposable income of households, the monetary tightening, the impact of the war in Ukraine that unfortunately lasts, but also the lockdown in China. The slowdown is inevitable, the risk of recession is growing rapidly.

Key macroeconomic signposts

The global economy is experiencing four types of shocks at the beginning of 2022.

- The first is energy. The graph at the bottom right for France indicates that an energy shock is generally associated with a period of strong slowdown in activity or even a recession. The price of energy is higher now when you take into account electricity and gas prices. For the US, the rise in the price of oil in constant dollars is less marked than for Europe. The reduced parity of the euro is penalizing.

- A shock of uncertainty mainly in Europe. The invasion of Ukraine by Russia blurs the horizon, thus risking inducing economic actors to postpone spending and/or investment decisions.

- The combination of the two is very detrimental for Europe since its supply of fossil fuels is dependent on Russia.

- It must therefore face a very high energy price and a change in its supplies with a risk of rationing. Germany is experiencing this. After the decline in GDP in Q4 2021, IFO is also suggesting a decline in Q1 2022. The weak German economy in the midst of reconstruction will weigh on the economic situation and the pace of activity in the Eurozone.

- The third shock is the sharp slowdown in the Chinese economy. The pandemic is crippling the Middle Kingdom economy. The impulse effect on the global economy will be very limited and production processes will be penalized.

The global economy is experiencing four types of shocks at the beginning of 2022.

Key macroeconomic signposts

- The fourth shock is monetary. Central banks are facing a very high inflation rate. In March, it was 7.5% in the Eurozone and 8.5% in the US. Central banks cannot accept this.

- However, the situation is not comparable in the US and the Eurozone.

- In the Eurozone, inflation is mainly associated with the price of energy (and to some extent with food prices). Tensions within the internal economy are not very great. The 7.5% of inflation is divided into 5.5% on energy and food and 2% on goods and services (underlying index). By hardening the tone, the ECB takes the risk of weighing on domestic activity but without noticeable effects on energy prices.

- In the USA, the picture is reversed. Inflation is closely linked to internal tensions, including high wage increases (which is not seen in Europe). The Fed can very quickly harden the tone to change the pace of underlying inflation. They’re going to do that.

- The central bankers' problem is that of a trade-off between a risk of persistent inflation with a price-wage loop (US example) and a risk of recession. Experience shows that it is very damaging to have persistent inflation. This is why the Fed will intervene harshly even if it creates a strong risk of recession. In the Eurozone, the ECB wants to limit the risk of inflation expectations forming over time at the risk of creating persistence. That is why it will harden the tone very quickly even if it is not on the same scale as across the Atlantic.

In the Eurozone, inflation is mainly associated with the price of energy (and to some extent with food prices).

Budgetary policy

The return of political risk

- "Build back better" again ?

The acceleration of US inflation is undermining J. Biden’s popularity rating, which has fallen in recent months, even though the unemployment rate has gradually receded. Almost two-thirds of Americans disapprove of his management of the economy. His mistake was not to get the Congress to adopt the ”Build Back Better”, his vast plan of social reforms. His two predecessors saw their parties lose control of the House, and J. Biden could suffer the same fate.

- Budgetary fragility of France

The high indebtedness of the country, which had been hidden until now, could accentuate the upward tensions on French interest rates in the event of Le Pen’s victory. Indeed, public debt has risen from 97% in 2019 to 115% of GDP in 2020, linked to the pandemic. However, compared with the other Member States, its primary deficit was -1.7% of GDP, compared with -0.8% for Spain and -0.2% for Belgium. The other countries were in surplus. The interest rate differential with Germany could diverge (Italy bis?) reflecting the loss of investor confidence. The apparent debt rate would rise, increasing debt servicing, the public deficit and the level of debt over GDP.

- Towards a pooling of debt (details)

To finance the investments necessary for EU’s independence on Russian energy and the strengthening of European defense capabilities, the European Union can reallocate some funds of Next Generation EU (€220 billions) and has the structural funds (€350 billions). However, this will not be enough. According to Mario Draghi, 1,500 to 2,000 billion euros are needed to finance these investments. Discussions are under way for a new massive European joint financing.

Monetary policy

The Fed roars, the ECB is expected at the turn and the PBoC remains zen

- The Fed becomes more vocal

In the face of accelerating US inflation, the Fed has raised its voice. Minutes confirmed more aggressive Fed fund rate hikes (50bps) as early as the next FOMC on May 4th. The reduction of its balance sheet will begin in May. The wage-price loop is racing and the Fed does not want to take the risk that it will settle permanently. The Fed does not want to lose face with inflation, but only 6 FOMC remain to act. Towards 5% Fed fund rates, as Larry Summers mentioned?

- The ECB is expected at the turn

After several meetings which had surprised the market with a more restrictive speech than expected, the ECB, during its meeting of April 14, was much more cautious. Admittedly, the end of QE is confirmed for Q3 and rate hikes to return to 0% are very likely. But with an economy that seems to be suffering more and more, the ECB's room for maneuver is shrinking despite the level of inflation. The volume of rate increases expected by the market seems excessive to us, particularly over next year when rates are expected by the market to be around 1.1/2%.

- A growing Fed/PBoC divergence

The interest rate differential between the United States and China quickly narrowed, with a negative 10-year interest rate differential on 11 April for the first time since 2010. The latter should continue to expand and risk generating outflows of capital putting under pressure local rates and the Chinese currency.

Strategic views

Bump or long-term trend

Synthetic market views: Uncertainties and Momentum

Inflationary pressures and the central banks that are driving their message have led to rates that, on the long end, have exceeded our year-end target. Is this a new trend with rates permanently on the rise? In the short term, momentum remains strong, but we think that this is more of a temporary episode, growth prospects should help lower rates towards our targets.

At the same time, the lack of visibility maintaining volatility in markets and risky assets tend to suffer, we are very cautious in the short term on credit and equities.

Allocation recommendations: The Trend is Our Friend

We remain underweight on nominal rates as all the conditions are in place in the short term for the trend to continue with in particular an overweight in inflation where we feel market expectations are insufficient. We remain underweight on credit with HY in particular expected to suffer. Finally, on equities, if we remain confident in the medium term, a correction is possible in the shorter term.

Inflationary pressures and the central banks that are driving their message have led to rates that, on the long end, have exceeded our year-end target.

Asset classes

G4 rates

- The Federal Reserve has pre-announced its balance sheet reduction from May and is waving the risk of 50bp hikes. Inflation and growth argue for a short position in Treasuries.

- The ECB confirms a hawkish policy stance in response to inflation despite a likely cyclical downturn ahead. Still, April maturities may be supportive of bond markets.

- The BoE will continue to tighten its monetary policy, as the Gilt follows the global bond rout. In Japan, neutrality is still warranted given YCC support from the BoJ around the upper limit of 0.25%.

Other sovereigns

- French spreads reflect uncertainty about the outcome of the presidential elections with an asymmetric risk profile in the event of Le Pen's victory. This encourages us to underweight the OAT.

- Italy's debt widened beyond 165 bps as risk aversion picked up in April. Reduced ECB purchases should fuel volatility.

- Duration positioning remains short in the G10 universe given the hawkish turn of the Central Banks. In Australia, the short position is less pronounced, as the RBA may react less strongly than the market expects.

Inflation

- Inflation (8.5% in March) remains very high in the United States. The Fed's monetary tightening should nevertheless weigh on inflation breakevens. We opt for neutrality.

- Euro area inflation is at an historic high of 7.5% in March. The ECB is concerned about inflation. Demand for inflation-linked bonds remains well oriented, due to the high carry until May.

- In the United Kingdom, upside surprises on prices followed one another to the benefit of linker holders. However, the markets already seem to price in high inflation over the medium term. Neutrality prevails.

Credit

- IG spreads are likely to continue to widen in the near term, given higher risk aversion and fears of an economic slowdown. Flows will provide short-term support, but the APP runs out in June.

- The primary market reopened with high new issue premiums. However, there is a risk of decompression as risk-free yields rise.

- Sentiment deteriorated in high yield markets, despite the default rate still at an all-time low. The shutdown of the primary market for 6 weeks implies a risk of supply congestion in the months to come.

Stock market

- Economic growth presents downside risks given the war in Ukraine. Annual EPS growth is limited to 0/+2%. Lack of visibility is an obstacle to performance.

- Inflationary pressures (logistics, raw materials, recruitment) may impact profit margins. The low visibility should benefit the quality factor.

- We remain cautious in the short term, targeting a decline towards 3,750 on the Euro Stoxx 50. The evolution of the war and monetary tightening will dictate investor sentiment.

Emerging

- The EMBIGD spread should move in a range of 390-440 bps. We remain cautious, as the decline in the spread observed is linked to the exit of Russia and Belarus from the index.

- The two catalysts for the asset class, namely the state of global growth and accommodative financial conditions, are fading.

- Countries that have macroeconomic discipline and that are net exporters of commodities should hold up better.