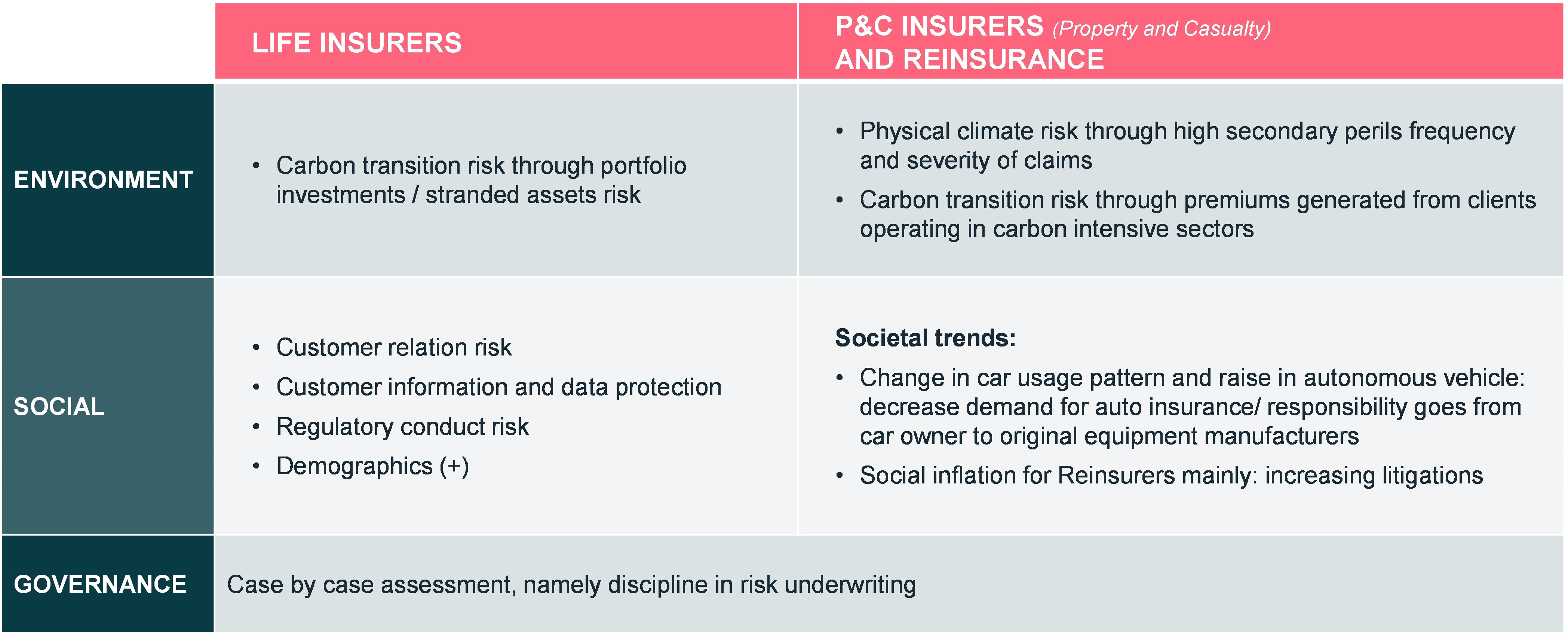

The insurance industry is highly affected by climate change. ESG has become a more global challenge for shareholders, customers, employees, suppliers and communities. Consequently, insurers must consider environmental, social and governance risks and opportunities within their strategies, as insurers and investors. Although they are primarily affected by environmental issues – physical and transition risks – they are also impacted by societal transformation and governance issues. Insurers need to adapt and innovate to remain competitive. This is a key concern, currently and for coming years.

Key takeaways

The most relevant non-financial factor for the insurance industry, both in terms of scale and impact timing, is the environment, in particular the physical risk for non-life insurers. The increase in insured losses from natural disasters poses risks to industry earnings and potentially to its capital. Climate transition risk is increasing but also providing opportunities, chiefly due to stakeholders’ influence, including regulators pushing for the insurance industry to participate in sustainable finance initiatives, such as investing in and insuring green projects. Alternatively, climate transition may become a risk for the industry, particularly in cases where insurers end up holding stranded assets in their investment portfolios, or they underwrite projects which may become significantly riskier, given the global shift towards energy transition.

Social and governance issues, while meaningful, are not homogeneous key drivers at the industry level. They may pose risk on a case-by-case basis however, at which point they may develop into major controversies.

In this report we assess the insurance sector sensitivity to each of the environment (E), social (S) and governance (G) factors, and how they translate into risks or opportunities for companies and, finally, how companies are adapting.

1. Environmental risks: physical and transition risk and opportunities

Physical risks

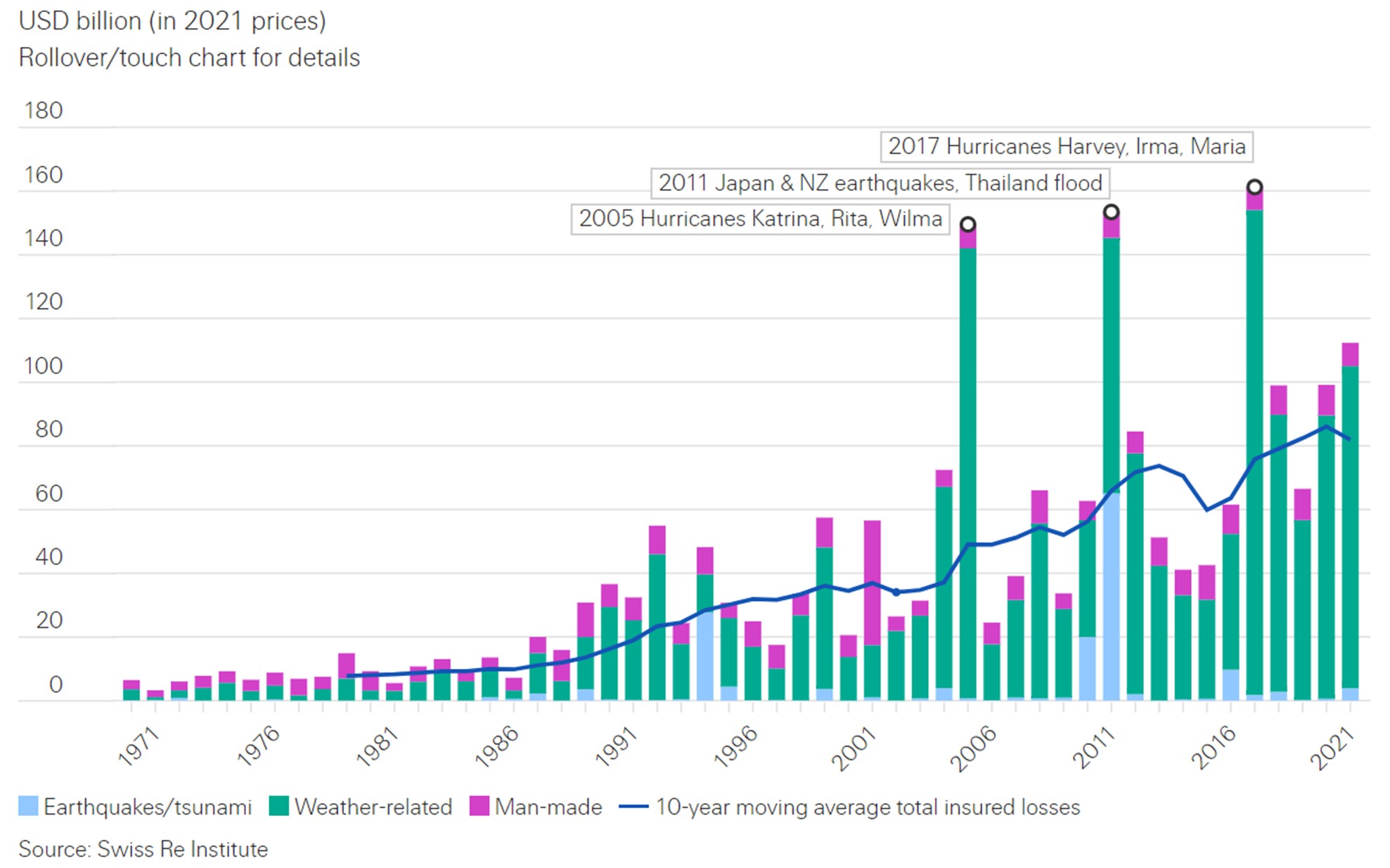

First of all, insurers face increased frequency and severity of claims driven by climate change. Given the nature of their business models, property & casualty (P&C) insurers and reinsurers are exposed to physical risks, as there is a link between climate change/global warming and the frequency of natural catastrophes. For example, a small rise in average temperatures significantly increases the probability of extreme events.

Natural catastrophe losses - frequency and severity of claims - are expected to continue to outpace global GDP growth, given the increase in wealth, urbanization and climate change. According to Swiss Re, 2021 saw the fourth highest natural catastrophe losses since 1970 [USD 105bn] of which half resulted from secondary risks.

Extreme events in 2021 included:

- Europe: severe thunderstorms / hail and tornadoes in June (Germany, Belgium, the Netherlands, Czech Republic and Switzerland)

- Severe flooding in China’s Henan province

- Record temperatures: peaks at +50°C in British Columbia and California, resulting in wildfires in California.

Higher frequency and severity of claims have consequences for P&C insurers and reinsurers. To maintain underwriting discipline, non-life insurers need to significantly increase premiums. But can they?

According to Moody’s annual CFO inquiry for reinsurers, 70% of companies consider climate change when assessing the risks they are willing to underwrite (+), but only 35% are willing or able to adapt prices (-).

The ACPR (insurance and reinsurance prudential supervisory authority) shows that the insurance sector would have to increase premiums by 3% annually for 30 years in order to cope with expected claim increases related to secondary risks, over the period to 2050. This is a whole different ball game compared to the current price increase cycle, which is simply a reaction to the most recent catastrophic events.

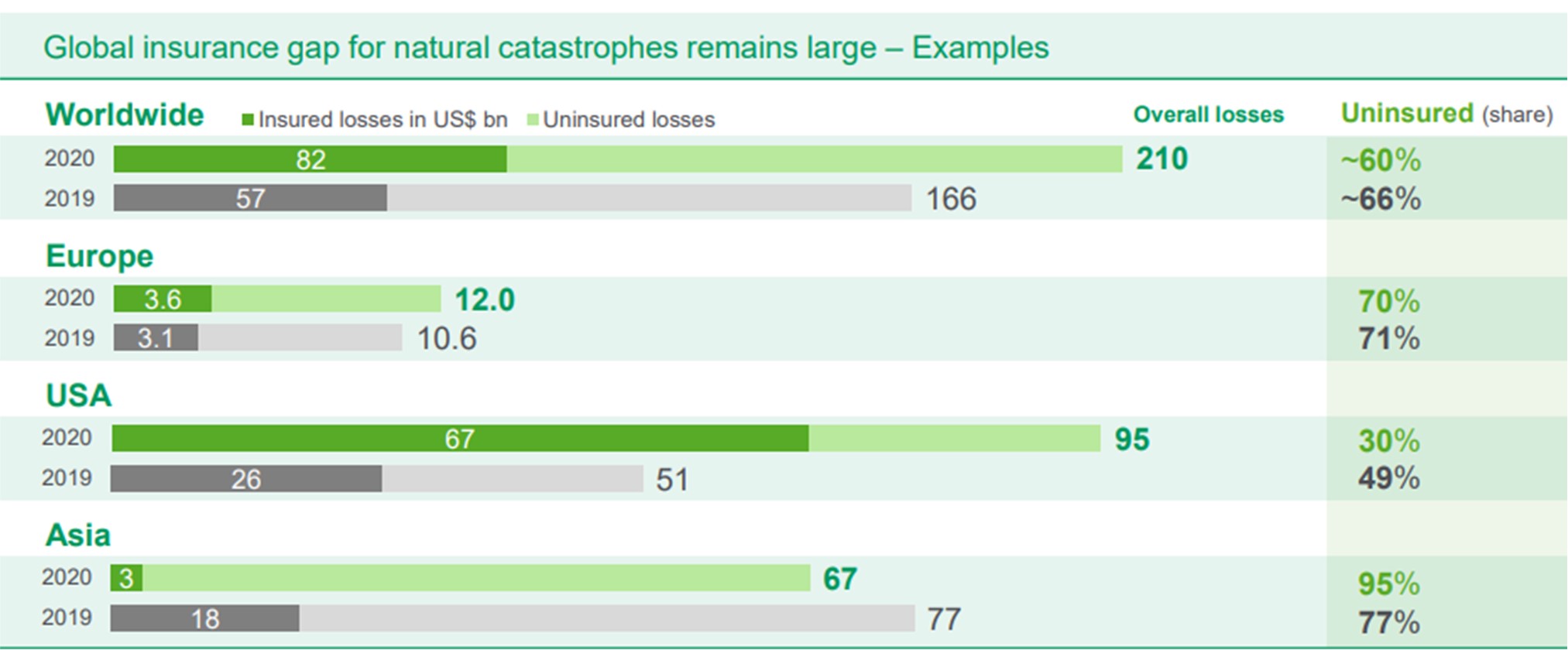

The reinsurance industry in particular may see potential growth in the natural catastrophe business, if it is adequately priced. But the most likely effect in the short term, is the risk of the insurance gap widening (negative social implications) as insurers simply withdraw coverage.

Source : Munich Re, December 2021

Physical risks also have business implications for P&C insurers and reinsurers. As certain risks become uneconomically insurable for the pure private segment, insurers and reinsurers will enter into partnerships with governments to ensure that insurance cover is still affordable. Public-private partnerships aim to share risks and responsibilities, in the event of high natural catastrophe exposure, pandemics, large scale cyber events, etc. It is necessary for policymakers to understand and appreciate the value insurance can bring, in order to achieve win-win partnerships. This is not always the case however, particularly in emerging countries.

Instead of exiting, certain reinsurers would look to offer holistic solutions, such as structuring risk transfer solutions for their clients, some of them favouring energy transition. Business model shifts from risk underwriters to risk assessment and risk prevention (advisory fees) for clients.

Transition risks & opportunities

Transitioning to low carbon economies generates both risks and opportunities for the insurance industry.

Insurers have a pivotal role in supporting the transition towards low carbon, through their dual role as:

- Risk underwriters: P&C and reinsurers enable companies to undertake (or not) new projects

- Investors: the case of life insurers, given the long duration of their liabilities and high asset leverage.

Transition risks

This is the risk of owning assets which ultimately become stranded, especially in a scenario of delayed or disorderly transition towards low carbon economies.

Insurers’ exposure to carbon-intensive industries is estimated at 13% of invested assets (lower than 19% for global banks). This is explained by the fact that insurers’ investment assets are dominated by sovereign bonds, while corporate bonds (subject to transition risk) represent the second-largest weighting in the asset mix. Life insurers naturally tend to have higher exposure, and US insurers more than their European peers.

Transition opportunities

Opportunities are based on increased commitments from the financial services sector (including insurance) to support global decarbonisation.

Insurers can act on financed emissions (asset side) and on insured emissions (liability side).

Insurers can increase pressure on carbon-intensive sectors and companies without credible carbon transition strategies, by influencing their access

to capital, via responsible investment guidelines. Insurers can also influence the development of new projects by deciding whether to provide risk coverage/risk transfer solutions or not, via responsible underwriting guidelines.

An example of best practices would be an insurer which announces no longer insuring an electricity & gas company because it does not meet the insurer’s own coal exit goals.

We pay close attention to communication content and implications and we are also wary of greenwashing. For example, one insurance company announced that it no longer insures upstream oil & gas activities, which may be seen positively by all stakeholders, given the energy transition path. However, we deemed this announcement irrelevant, in the context of the company, given its marginal involvement in oil & gas projects.

2. Social risks

While a broad variety of social issues exist, we focus on the three subjects which seem important to us for P&C insurers, reinsurers and life insurers:

1/ societal trends in auto insurance

2/ societal trends: social inflation risk

3/ mis-selling risk

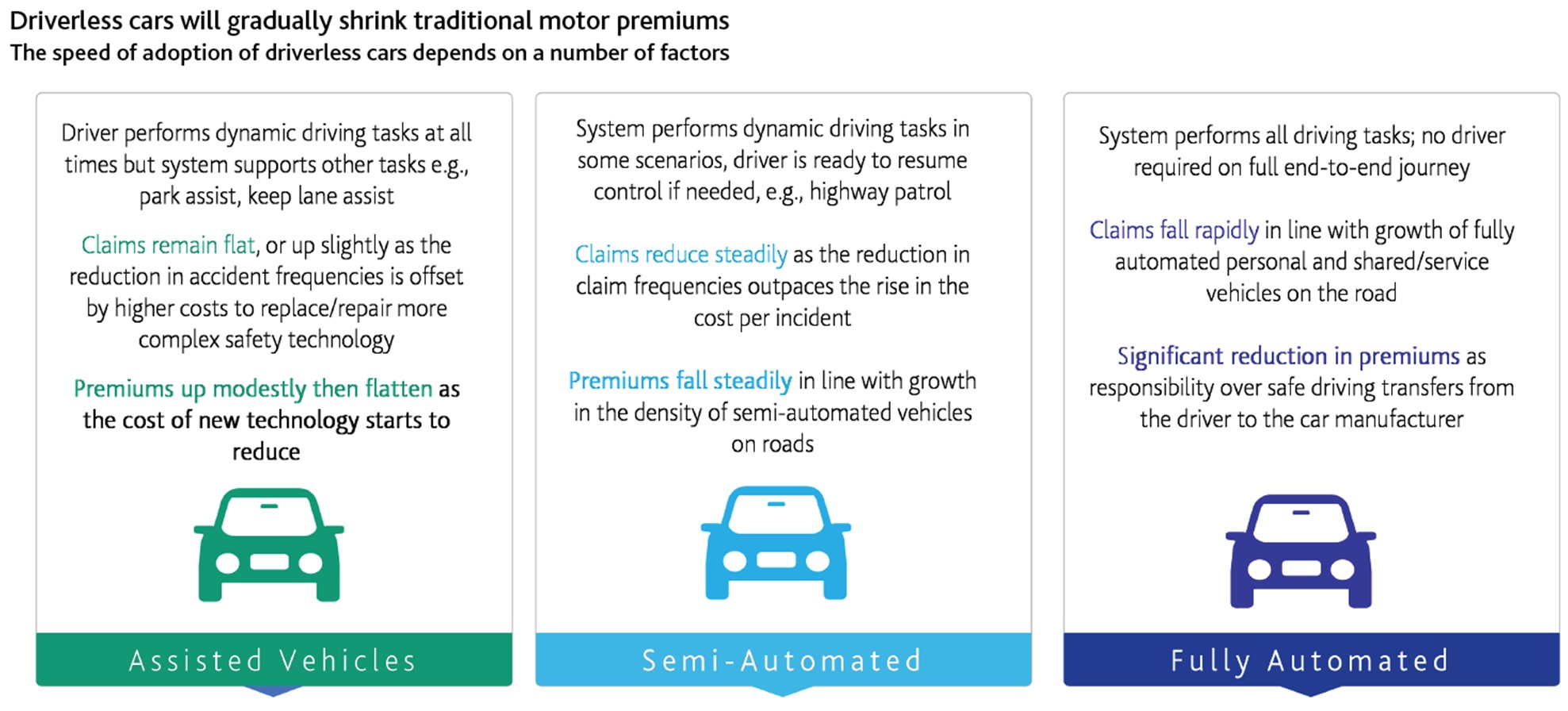

Change in car usage and autonomous vehicles

The development of autonomous vehicles is a very long-term trend. Over time, technology will reduce the frequency of accidents, decreasing the demand for traditional motor insurance and therefore reducing claims and premiums. Some 90% of road accidents are attributable to human error (source: Moody’s November 2021 publication entitled Innovation critical for insurers as technology threatens their traditional earnings). Technology is already reducing the frequency of road accidents. This trend will accelerate with semi-autonomous and eventually fully autonomous vehicles.

Fully autonomous vehicles will disrupt the market even more, shifting the responsibility for road safety from the car driver to the original equipment manufacturers.

In return, we expect a switch from traditional retail motor insurance - declining demand - towards more liability insurance for original equipment manufacturers and therefore increasing demand. Insurers’ risk profiles will therefore be negatively impacted as they will be exposed to potentially greater risks (lower probability of occurrence, but higher losses when they do occur).

However, this is a mid to long-term trend. According to Moody’s, a majority of cars in the US could be autonomous by 2045, rising to almost 100% by 2055. This factor accounts for the long timeframe.

In the car sector, we are also seeing a change in customer patterns, with a shift from owning to using a car. There is growing demand for leasing, mobility solutions, car subscriptions etc.

Cars will continue to be insured. Alternatively, insurance cover could be sold to individuals for any vehicle they use, to adapt to vehicle-sharing trends. In any case, insurance costs will ultimately continue to be supported by end-users.

Source : Moody's, novembre 2021

Social inflation, mainly for reinsurers (increasing litigations)

Reinsurers face rising claims in their liability & casualty businesses because of the increase in litigations, lawsuits and verdict amounts. This factor is referred to as social inflation.

Diverse trends and drivers account for the rise in social inflation. Swiss Re Institute published extensive research entitled US litigation funding and social inflation in December 2021, which included the following key takeaways:

- Tort insurance case filings in state courts are trending upwards

- All types of legal actions are concerned, including claims for personal injuries (accident, medical claims etc.), class actions (product liability mass tort), commercial litigations etc.

- Trust in institutions has eroded over the last decade. Attitudes towards large corporations remain negative. Millennials particularly are more skeptical of corporate ethics and are more likely to sue.

- Jury attitudes have turned more plaintiff-friendly.

- Rising inequality is an additional reason to sue and explains why more verdicts are in favor of plaintiffs.

- Rising third-party litigation finance, particularly in the US, is also contributing to more case filings. Investors such as hedge funds and family offices finance legal action against companies, in return for a percentage of successful claims. USD 17bn investments were made into litigation funding globally in 2020, half of which was in the US.

To put these issues into context and provide some numbers, liability costs in the US are the world’s highest. In 2016, the costs and compensation paid in the tort system amounted to USD 429 billion, or 2.3% of US gross domestic product, according to Swiss Re (source: Swiss Re, US litigation funding and social inflation, December 2021).

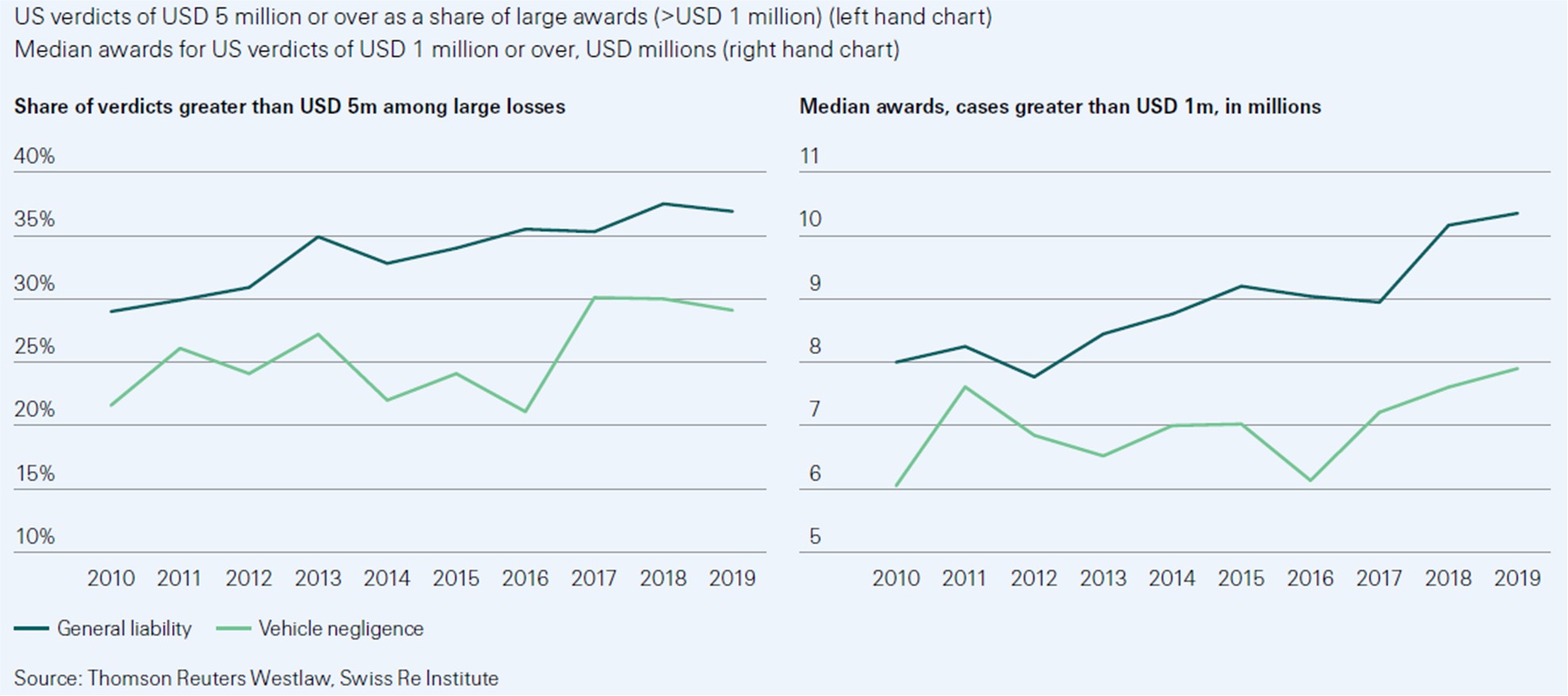

The level of significant verdicts is increasing - US case study

Source : Swiss Re Institute, décembre 2021

What are the consequences for reinsurance companies?

Reinsurance companies, like Swiss Re, are exposed to the rising costs of legal liabilities with the increase in claims. Failing to factor-in or price these risks adequately leads to high combined ratios and business restructuring.

Higher claims are also driving insurance premiums up. In 2020, director & officers (D&O) and umbrella rates soared by 15.8% and 22.6% respectively, while general liability and medical professional liability increased by 7.3% and 8.8%

(source: Swiss Re Institute). Higher premiums can reduce the availability of liability cover and therefore increase the protection gap. Consequently, insurance will be less affordable and companies will be more vulnerable.

However, we also question the ability of insurance companies to continue to raise premiums at this pace, keeping up with the trend in rising verdicts and lawsuits. This is why some reinsurers are also restructuring/reducing their liabilities business, which is also contributing to widening the protection gap.

Many other items incurring litigation risk

We will focus on customer data and mis-selling risk, although these are not the only risks incurred.

Customer data

This is a risk especially for life insurers - impacting P&C insurers less - which possess large amounts of customer information, exposing them to data breach risk. At the same time, cyber risk is also offering new business opportunities, as risk underwriters. This type of risk is difficult to cover however.

Mis-selling risk

Mis-selling risk is incurred not only among insurance products, but also in ancillary businesses like asset management. We previously mentioned litigations, and insurers can also be subject to lawsuits.

As an example, we can refer to an insurer which is in the headlines regarding potential mis-selling in its asset management business in the US. The investigations may result in a fine, which may have a significant impact on its financial results.

3. Governance risks and opportunities

Regarding governance, we conduct a case-by-case assessment, focusing chiefly on risk underwriting discipline.

Risks

- Risk practices: sound underwriting discipline is crucial

- Financial transparency risk, including organizational and business complexity

- Quality and timeliness of financial reporting

- Management credibility and track record

- Conflict of interest risk

- IT systems governance. Cybersecurity and data protection. Data management is critical, particularly for life insurers, as any breach could lead to litigation, fines and a loss of clients and revenues

- Litigation and wrong-doing risks in the event of inadequate checks and balances, mis-selling, or regulation breaches (financial crime). This could lead to financial costs (fines), loss of revenues (in case the franchise is impacted) etc.

Opportunities

Good governance, including sound underwriting discipline, is the minimum we look for among insurance companies, as this factor represents the core of an insurance company’s business.

4. Insurers' roles in financing energy transition: how do insurance companies adapt to transition and physical risks and business opportunities ?

Given their position in the economy, insurers not only have a role to play in financing the low-carbon economy, but also in the process. They also need to protect their own businesses and hopefully seize new business opportunities for the best performers.

As asset owners, insurers display their own commitments to supporting the transition towards net zero.

- A global coalition of 450 leading financial institutions across 45 countries and managing +USD 130tn assets committed to the goal of science-based net zero financed/insured emissions by 2050, at the UN’s COP26 climate summit in Glasgow in November 2021.

- The UN-convened Net Zero Asset Owner Alliance brings together 49 insurers and pension funds representing $7 trillion. These companies are committed to decarbonizing their investment portfolios by 2050.

- 8 global leading insurers and founding members of the Net Zero Insurance Alliance have committed to transitioning their underwriting portfolios – the risks they already insure – to net zero greenhouse gas (GHG) emissions by 2050.

Significantly, the largest insurers have already set exclusion policies for coal and certain fossil-fuel related sectors. An increasing number of insurers have also committed to halting the provision of new insurance policies to carbon-intensive industries, such as the energy sector. This is a game changer in our opinion, which will accelerate transition, but will also potentially increase transition risk for the most fragile companies. As referred to previously, over the longer term, we expect an increasingly large number of companies to struggle to find risk transfer solutions, which may later jeopardize their ability to stay in business.

Looking at the business risk incurred by insurance and reinsurance companies, we see two different strategies.

On the one hand, many insurance companies are telling us that they are taking into account higher expected insured losses, associated with climate change-induced physical risks, and are adapting by increasing the premium rates they charge for natural disasters. While this is certainly true for the short term – we are currently midway through a price-hike cycle, as a result of the most recent natural disasters related to secondary perils – we doubt the whole industry’s willingness and ability to reprice for climate change risk over the very long term, given the role of insurance as a commoditized product.

On the other hand, reinsurance companies – which are by definition highly familiar with natural catastrophe losses – are adopting a different approach. These companies describe how they are simply reducing their exposure to the physical risks associated with global warming. The major players acknowledge that future higher losses may not be adequately priced-in. As long as they feel this pricing imbalance persists, they are simply withdrawing from this market segment and focusing on their core business instead, which comprises large-scale natural disasters, such as earthquakes, hurricanes and typhoons. This factor simply increases what we call the protection gap, especially in emerging markets, where the take-up of insurance and reinsurance is below average. As a result, this issue, which is initially considered an environmental problem within the ESG factors, is becoming an even bigger social problem, when the consequences of rising climate risk leave human beings in distress.

However, the transition towards low-carbon economies also provides opportunities for insurers and reinsurers. First and foremost, demand for property and casualty insurance will increase as the transition towards the low-carbon, economy requires risk transfer and risk mitigation solutions. This will provide the opportunity for the largest, best-in-class, insurance companies to increase their market share relative to peers if they are able to insure the future solutions.

Conclusion

With growing stakeholder awareness of environmental issues, we think that insurers on top of environmental subjects will be in a better position to defend and develop their franchise, as they boast a stronger ESG reputation and image.

To analyse insurers from an ESG perspective, in-depth knowledge of the sector and each business model is crucial. Analysis requires experience and extensive resources. At Ostrum AM, the credit research team is one of the largest in Europe, with 23 credit analysts across 3 continents, including 2 analysts specialised in sustainable bonds, covering 1,200 issuers worldwide.

Unique to our credit research approach is that environmental (E), social (S) and governance (G) issues are integrated at all stages of our analysis. These factors may affect the sector or the company’s business model and may therefore have a material impact on financial conditions today or in the future.

Analysts have a duty to systematically identify any environmental or social factors, which may be relevant for the company, and roll them up into the bigger picture of the industry or business model assessment, and also assess their implication. We have also developed a proprietary methodology to analyse green, social and sustainable bonds. This approach, taking insurers’ sector-dedicated resources and ESG factors into account, provides an edge in analysing insurers and supports portfolio managers in their investment decisions.

Written in March 2022

486 Ko