How insurers can gain an edge by combining tailored servicing and active investment.

The insurance sector has needs that are considerably different from most other investors and this requires a specialist approach.

“We’ve focused primarily on this market for 30 years and understand that a generic investment approach is not suitable for insurers’ evolving needs,” says Philippe Setbon, chief executive of Ostrum Asset Management (Ostrum AM), an affiliate of Natixis Investment Managers.

So What Do Insurers Need?

The absolute minimum requirement, he says, is active strategies which are tailored to closely match insurers’ liability cashflows and growth expectations. Given miniscule investment yields and rising business costs, insurers expect even more expertise at even lower fees. To get this, they need asset managers with scale.

Further, most want ESG1 to be embedded in their assets, whatever the sector, strategy or geography. Smaller insurers, in particular, seek help in designing their ESG approach and policies.

That’s quite an ask. But it still leaves an important gap which must be filled. That is a way of identifying unmet needs and linking these needs to investment strategies. That link can be provided by specialist servicing, analysis and advice. “Only by combining servicing and investments in an insightful way, can the true needs of insurers be identified and met,” says Setbon.

A Challenging Time For Insurers

Let’s recap where insurers are today.

A decade on from the financial crisis and its legacy weighs heavily. Regulation, in particular, has become more pervasive and more complex. This is particularly true in Europe, but other regions have adopted similar regulations which aim to ensure insurers are adequately capitalised and pose a reduced risk to financial systems.

Fast-evolving regulation – such as FRPS2 in France, IFRS3 and SFDR4 – combined with rising investor demands, has increased the need for digitalisation, effective data management, embroiling insurers in expensive, multi-year efforts to upgrade their IT capabilities.

Regulation has also been one of the catalysts for the revolution in ESG investing, in many cases requiring a reappraisal of portfolios.

Other catalysts include client pressure and rising societal expectations around ESG. Not least, central bank policies have forced down interest rates and changed the nature of risk versus return. In the search for yield, insurers are investing in riskier assets such as income-producing equities. This not only puts capital at risk, but runs headlong into regulation, which imposes higher capital charges on such investments.

The many challenges have put considerable pressure on insurers’ P&Ls and business models. To be relevant to the insurance industry, asset managers have to anticipate and respond directly to these challenges.

Active Investment, Executed at Scale

Asset managers must be able to offer key investment capabilities such as active management for both equities and bonds, fundamental and quantitative research, and an integrated ESG strategy. Active management has historically been associated with equities, but low yields demand that an active approach is also applied to bonds, the staple of insurance portfolios.

There are many ways to optimise a bond portfolio, including active strategies, which target a desired level of income. These strategies aim to achieve consistent yields by prioritising the minimisation of losses in the portfolio. To do this, all credit risks in the portfolio must be continuously monitored and dynamically managed. Similarly, asset-liability matching (ALM) strategies must employ a more dynamic approach than in the past. ALM can no longer rely on a passive approach harvesting yields and carry strategies.

Active management done well improves risk versus return, but it also entails deep research and therefore comes at a cost. This cost should be offset by savings elsewhere in the value chain in order to keep asset management fees to insurers under control. “It’s essential to have a low cost of production. To be clear, this is very different from low-cost asset management.” says Setbon.

A low cost of production comes through applying scale and know-how to streamline and mutualise processes. This is only possible if an asset manager has considerable resources: through Ostrum AM’s 2020 merger with the investment management arm of La Banque

Postale, one of France’s largest financial companies, it now manages assets of some €440 billion and employs nearly 400 people. Ostrum AM has expanded its product range, in particular strengthening its ALM strategies for insurers across Europe and, increasingly, in Asia.

“Size allows us to offer lower transaction costs and achieve competitive pricing while still maintaining the range and quality of strategies to suit all types of insurers,” says Setbon.

A Technology Platform That Adds Value

A powerful technology platform is key to streamlining not only costs, but also the services provided to insurers. The Ostrum AM technology platform includes a wide range of investment tools and services, ranging from middle office, risk management and compliance services, to reporting tools to support investment decision-making.

It is entirely see-through, so insurers can view their portfolios in summary format or in detail – including their investments in real assets, where digitalized data is often lacking. Insurers gain access to financial performance, accounting performance, regulatory data and even updates to ESG scores in the portfolio. The platform is connected to support functions, to process and analyse data, facilitating reporting to boards, regulators and clients.

With all the information in one place, analysis can be produced to identify current and future needs that have not been addressed fully, or at all.

The Missing Piece of the Jigsaw

A powerful technology platform allied to a human solutions team is the missing piece of the jigsaw in many asset management offerings aimed at insurers.

“An experienced, well-staffed and dedicated insurance team can help more precisely determine an insurer’s strategic objectives,” says Gaëlle Malléjac, chief investment officer for Insurance and ALM Solutions at Ostrum AM. “This team has the experience to produce bespoke analysis and solutions for insurers’ ALM and asset allocation, hedging needs, regulatory constraints and more besides.”

The insurance solutions team can scope the optimal fixed income and equity investment universe to meet the established objectives and examine the potential value-add of non-traditional investments. The team can plot the potential trajectory of the allocation towards its target. It can also analyse potential flows and how these flows will be impacted by various market scenarios.

The desired outcome can be scoped in many different ways, including by book yield, solvency and other ratios, capital gains and losses, cashflows, and more. “It completely depends on which metrics are important to a particular insurer; our approach is completely tailor-made,” adds Malléjac.

How Insurers Can Stay Ahead of the ESG Curve

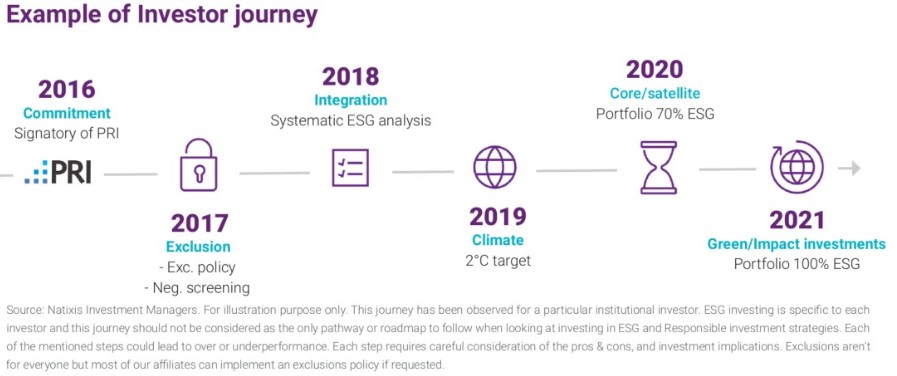

The linkage between performance and servicing can add value to non-financial performance too. Through close partnership and dialogue between Ostrum AM and a large insurance client over a long period, it became clear that the insurer wanted to keep ahead of market expectations about ESG and to embark on an ESG journey.

Recognising that the insurer could not implement ESG across its investments in a single step, Ostrum AM guided it along a multi-year journey, which is still ongoing today.

The insurer’s first step, some five years ago, was a commitment to the United Nations Principles of Responsible Investment (PRI5). The insurer was advised how to apply exclusion policies and, later, the integration of ESG analysis across the portfolio. It then made a deep commitment to meet the 2°C climate target.

With an ESG framework now clearly articulated, the step to a portfolio with 100% ESG-compliant assets was not as huge as making it in one go. The insurer has now made a number of green impact investments and future phases are being worked on.

Can Bond Portfolios Integrate ESG6?

The insurer above is not alone. Most insurers are somewhere along this journey, even if some are at an earlier stage. “ESG is now strategic. We speak literally every day about ESG with insurers and their needs all differ,” says Malléjac. ESG approaches are maturing fast, with many insurers establishing quantitative targets for ESG strategies and implementing reporting to match.

“As an asset manager, you need sizeable resources for this,” says Malléjac. “It’s not an add-on activity, it’s absolutely core.”

The resources required are higher still if, like Ostrum AM, €420 billion out of a total of €440 billion of the assets managed are bonds. Ostrum AM has built a dedicated ESG team and has developed a proprietary approach to ESG investing for fixed income, including in government bonds, investment grade bonds and high yield.

“We live in a debt-based world where debt increases year after year,” argues Malléjac. “As shareholder or bondholder, if we don’t engage issuers we will never make the ESG transition.” Ostrum AM’s ESG approach embraces active dialogue with issuers to put pressure on investee companies to act faster and more forcefully. The rationale is that engagement can be more productive than simple exclusion.

In 2020, Ostrum AM conducted more than 600 meetings and conference calls with companies on financial and extra-financial topics, and engaged with 53 companies specifically on ESG. “Our clients want ESG-compliant portfolios; we support them in defining objectives and implementing them in their investment strategy”, adds Malléjac.

Multi-Dimensional Solutions for a Multi-Faceted Sector

The certainties of the past are disappearing from the insurance sector. Asset managers can no longer apply a one-dimensional approach by simply offering insurers a variety of assets.

A multi-dimensional approach which takes into account insurers’ specific aims, and helps them integrate regulatory, financial, accounting and extra-financial factors is now essential. Setbon says: “More than ever, insurers seek partnerships with asset managers who can provide a holistic view of their needs and offer investments that respond precisely and positively to these needs.”

Eventually, the insurance sector will concentrate in the years ahead and insurers will seek business partnerships internationally. They will need partners to accompany them in this growth phase.

1ESG: Environmental, Social and Governance

2Fond de retraite professionnelle supplémentaire

3International financial reporting standards

4Sustainable Finance Disclosure Regulation

5PRI assigns one of six performance bands (from E to A+) for each applicable module. A+ is the highest score possible whereas E is the lowest. Please read more about UNPRI assessment methodology: https://www.unpri.org/signatories/about-pri-assessment. Ostrum AM was one of the first French asset managers to sign the PRI in 2008. For more information: www.unpri.org. References to a ranking, prize and/or rating are not indicative of the future results of the funds or of the management company.

6“ESG integration refers to the inclusion of ESG issues in investment analysis and decisions. Approach to ESG integration varies based on the strategies. ESG integration does not necessarily imply that investment vehicles also seek to generate a positive ESG impact”

Ostrum Asset Management

An affiliate of Natixis Investment Managers.

French Public Limited liability company with board of Directors.

Share capital €48 518 602.

Regulated by the Autorité des Marchés Financiers (AMF) under no. GP 18000014.

RCS Paris n° 525 192 753.

43 avenue Pierre Mendès France 75013 Paris, France.

www.ostrum.com

Natixis Investment Managers

Natixis Investment Managers is a subsidiary of Natixis.

Portfolio management company - French Public Limited liability company

RCS Paris n°453 952 681

Registered Office: 43, Avenue Pierre Mendes France – 75013 – Paris.

www.im.natixis.com

This communication is for information only and is intended for investment service providers or other Professional Clients. The analyses and opinions referenced herein represent the subjective views of the author as referenced unless stated otherwise and are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material.