Given the diversification of the market in terms of issuers and securities, a rigorous analysis is imperative. Because greenwashing is an ambush.

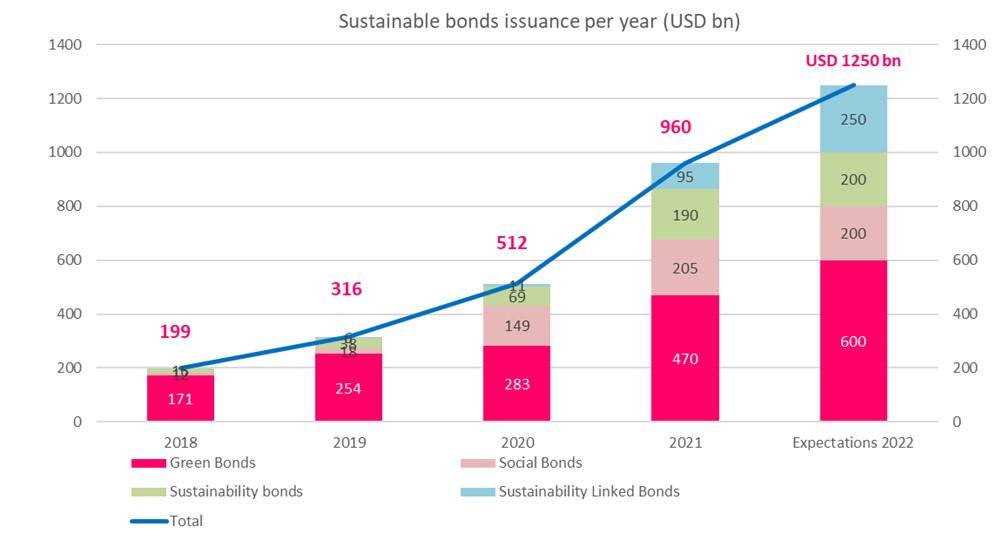

Sustainable Finance has undergone unprecedented growth since the Paris Agreement was signed on 12 December 2015. Climate change has become a priority for all economic agents. In this environment, the international bond markets have emerged as an effective tool for meeting the considerable financing needs required to achieve the objectives of the Agreement. Furthermore, the health crisis underscored the need for financing specifically targeting social projects. The sustainable bond market is growing increasingly varied as new tools are added (see glossary). It recorded robust growth in 2021, with nearly $960 billion in new issues. This much higher than expected 80% year-on-year increase can be attributed to two phenomena: first, persistently strong momentum in the green bond segment, with green bonds making up half of total issues last year; and second, development of new instruments such as Sustainability Linked Bonds (SLBs) and social bonds.

Green bonds: a market-driving role…

With issue volumes up nearly 66% year-on-year, green bonds have continued to play a market-driving role. Companies are still the top issuers of green projects, supported by internal policies aimed at reducing their carbon emissions and improving their energy efficiency. The sovereign debt market is still highly dynamic, though. New governments, such as Italy and Spain, have been able to refinance their debt, for example. The UK saw close to £100 billion in demand for its inaugural issue. Another underlying factor of market growth: Sustainability Linked Bonds. Expectations have been high for this market since their creation in 2020, and they were fully met in 2021! The amount of this new type of issue has in fact grown tenfold to nearly $100 billion. New issuers, predominantly in the High Yield category, have jumped on the opportunity to refinance their debt using this new instrument.

Europe boosts social bonds

Lastly, the social bond segment accounted for close to 20% of total sustainable issues in 2021. Supranational issuers and government agencies were especially active in this segment. By refinancing its SURE (Support to mitigate Unemployment Risks in an Emergency) programme, the European Union (EU) became the No.1 issuer of social bonds totalling more than €50 billion. Unlike the green bond segment, just 12% of social bond transactions are carried out by private-sector firms. This highlights the problems encountered by companies in identifying social projects.

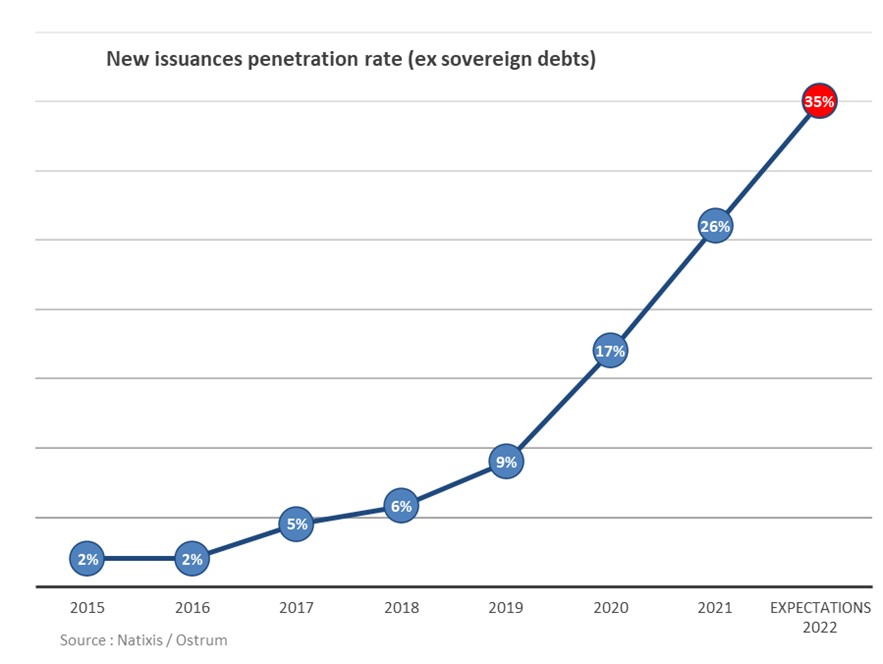

In 2022, the global sustainable bond market is expected to hit a new record of more than $1,200 billion in new issues. Our forecasts call for continued momentum in all bond classes, with issuers sticking to their commitment to combat climate change and overcome certain social challenges. As a result, we should see another rise in the penetration rate of sustainable issues in 2022 compared to the primary market as a whole (see charts), meaning one-third of new issues should be sustainable.

Persistent momentum in sustainable issues

The market will be stimulated by multiple factors. First of all, green bonds should continue to be the primary market driver, with issue volumes of around $600 billion, i.e. market share of close to 50%. This trend is supported by several factors. The first is the ongoing development of sustainable development regulations and establishment of standards in Europe. In addition, government support, in the form of environmental policies, will fuel the momentum. Government green issues have proved highly successful with investors in recent years, and new governments are expected to enter the market, such as Austria or Greece. The market may even see innovations. For example, France plans to issue* its first inflation-linked green bond this year. More diversification can be expected in credit debt, particularly for sectors still holding issue potential, such as real estate, automotive and retail. Green investment projects are clearly identified in these sectors.

Europe’s green bond programmes

Next, let’s not forget that the EU is working to reduce its greenhouse gas emissions by at least 55% by 2030 and to achieve carbon neutrality by 2050, which will make it a dominant player in the market. In order to achieve this energy transition, the EU has implemented a stimulus plan, financed in part by a €250 billion green bond issue programme over the 2021-2026 period. In 2022, the EU is expected to issue between €45 billion and €60 billion in green bonds.

We also estimate some $250 billion in Sustainability Linked Bonds will be issued in 2022, making up nearly 20% of total supply. These instruments, which allow issuers to associate their financing with social or climate-related objectives, are highly sought-after by companies unable to issue green or social bonds due to the nature of their business. This trend will keep going strong in 2022. Some issuers in sensitive sectors, embarking on a net zero trajectory, may even be tempted to use this instrument. Finally, these sustainable bonds also meet the expectations of the growing number of investors to set transition objectives. The sustainable bond market is an excellent way to help them achieve their Paris Agreement commitments as well as other specific commitments, such as the Net Zero Asset Owner Alliance, which encourages the transition of investment portfolios to carbon neutrality by 2050. Moreover, environmental and social impact themes boast strong leverage for aligning corporate ESG and CSR strategy. The implementation of the SFDR (Sustainable Finance Disclosure Regulation) is also worth noting. Its purpose? To improve transparency on sustainable investment and sustainability-related risks. The SFDR will give a major boost to the market as well.

Be careful with bond picking

In light of the skyrocketing growth of the sustainable bond market and rapid diversification of instruments, it is important to watch out for fads and reputation risk. Although a set of principles was defined by the Capital Market Association (ICMA), responsible for supervising SB issues, a sustainable bond can be issued without meeting any specific regulatory requirements. For that reason, investors need to be especially rigorous in their analysis of this new type of debt.

While it is certainly positive to have a more diversified investment universe to structure portfolios, caution is the watchword with bond selection. Ostrum AM has established an analysis process dedicated to this new type of debt, based on non-financial criteria, with a particular focus on the quality of governance or social practices of issuers. For sensitive sectors, the implementation of sector policies is critical and is an integral part of the investment process.

SLB framework neededWith green issues, it is very important to make sure the issue is consistent with the issuer’s climate strategy. However, an analysis of the instrument itself is just as important as an analysis of the issuer. It is necessary to assess the materiality and impacts of the projects being financed, to ensure the proper allocation of funds, and obtain quality reports for impact measurement purposes.

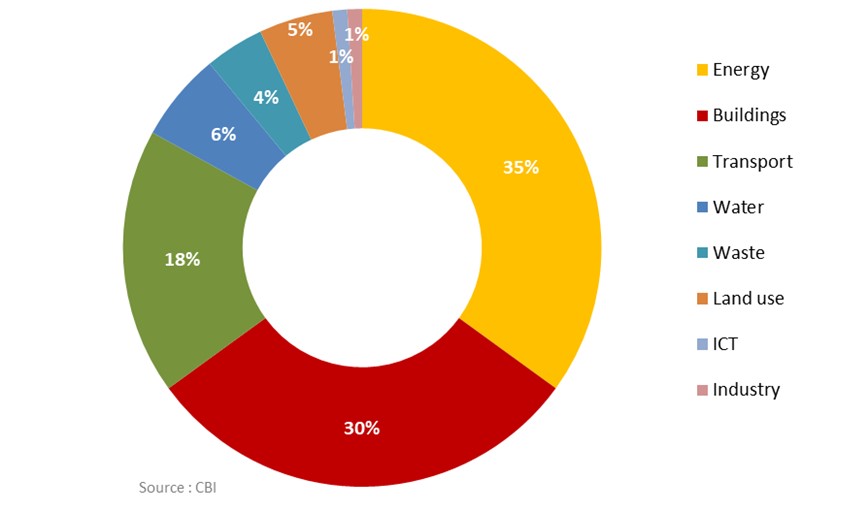

Our investment process notably includes specific themes such as natural capital preservation. In reality, the projects currently available in connection with this theme, such as ecosystem protection and restoration, and forest/farmland protection, are still too few and far between. The energy and construction sectors are responsible for the lion’s share of green issues (see chart).

Furthermore, the spectacular rise of Sustainability Linked Bonds makes it even more important to define a robust investment framework for this new instrument because, unlike green and social bonds, capital raised from Sustainability Linked Bonds goes directly into the company’s general funds and provides the issuer with a practical tool for engagement in its transition process. Although these new instruments have been subject to the application of the ICMA’s Sustainability Linked Bond Principles since 2020, investors need to look beyond the issuer’s commitments. After all, criticisms are converging on these new instruments and the risks of disappointment are very real. Before investing, it is important to assess the issuer’s sustainability strategy, the credibility of the Key Performance Indicators (KPIs) provided, and make sure the issuer has set high enough ambitions in terms of sustainable performance targets going above and beyond “business as usual”. It is also necessary to assess the structuring and characteristics of the financing operation. We have found that certain characteristics of previously issued bonds have not always been very consistent, pointing to a credibility problem! For example, these products call for the bond coupon to increase if the non-financial target is not achieved. The fact is that, for some high yield issuers, this increase was similar to that of IG issuers. In such cases, the sensitivity of high yield issuers to low coupons remains limited. Lastly, as these instruments do not serve to finance specific projects, the disclosure of information on KPIs and verification of target ambition levels is especially critical.

Adopting a comprehensive approach

Investors have jumped at the opportunity to invest in green bonds for the last few years, with the aim of incorporating anti-global warming strategies in their investment portfolios. In addition to the environment, socio-economic aspects also need to be taken into account. The energy transition must be equitable for all members of society.

The transition to a resilient, low-carbon economy calls for a holistic and inclusive approach. In other words, a fair transition. This approach guarantees not only the integration of social best practices in the deployment of green investments, but also the inclusion of workers and communities operating in carbon-intensive industries. This can apply to all sectors of the economy. For example, protection of individuals and prevention of negative impacts on jobs need to be key areas of focus. Addressing all issues associated with climate change, transition strategies and their social implications makes for better risk assessment, and thus offers a major benefit. This comprehensive, balanced approach also makes it easier to identify investment opportunities associated with the most deserving companies and projects.

Ostrum AM firmly believes that this is a source of value creation over the long term. Our sustainable bond investment process has been strengthened with the creation of a proprietary Fair Transition indicator, which supplements our existing non-financial and impact analysis capabilities, focusing in particular on sustainable management of resources and local development.

The key to investing in sustainable bonds is to simultaneously target projects associated with the ecological transition and aimed at mitigating problems facing society. By incorporating socioeconomic impacts, investors can select assets offering sustainable returns, while meeting commitments in line with their own CSR policy.

Source: Revue Banque April 2022