Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The CIO letter

So far, so good (in the markets)

The military intervention of the United States to extradite Nicolas Maduro marks a new phase in the Cold War between China, which imports 5% of its crude oil from Venezuela, and the United States, which seeks to limit Chinese influence in the southern part of the continent. Iran, Ukraine, Greenland, and even Nigeria present potential theaters for confrontations. The increasingly tense geopolitical situation contrasts with the performance of risky assets.

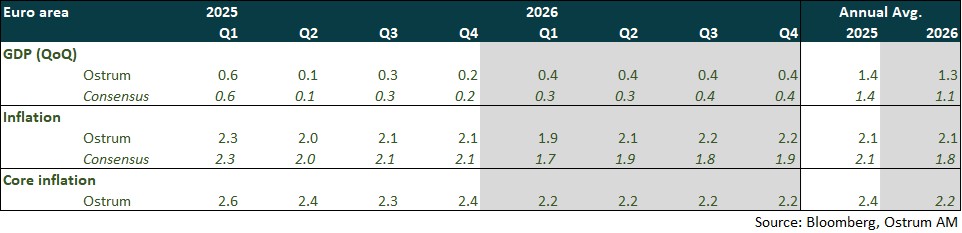

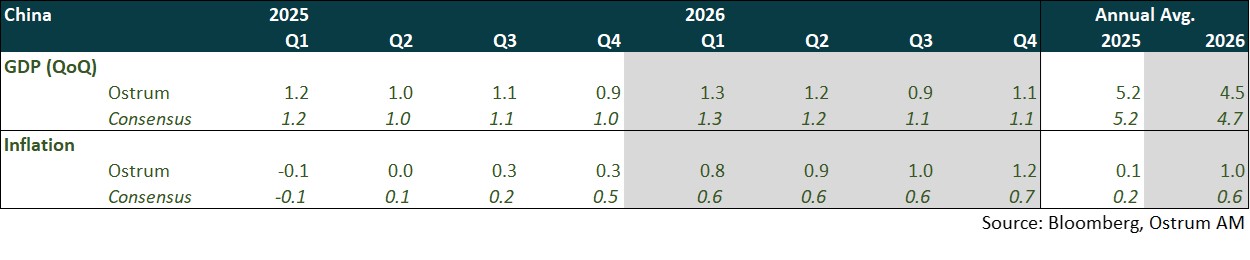

Economically, growth in the United States remains driven by investments in AI and consumption from the wealthiest households. However, the labor market indicates a continuous deterioration since spring. In the Eurozone, a recovery is becoming clearer in Germany, where the industry benefits from more robust orders and a decrease in energy prices. China remains committed to a policy of reducing overcapacity in an effort to lessen deflationary pressures.

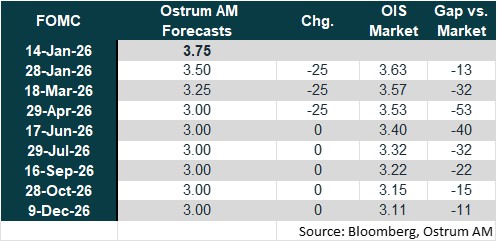

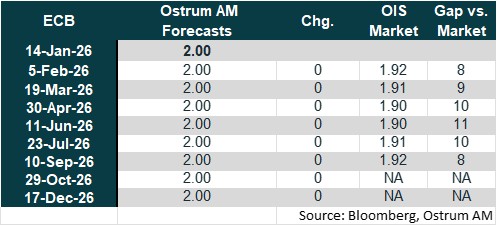

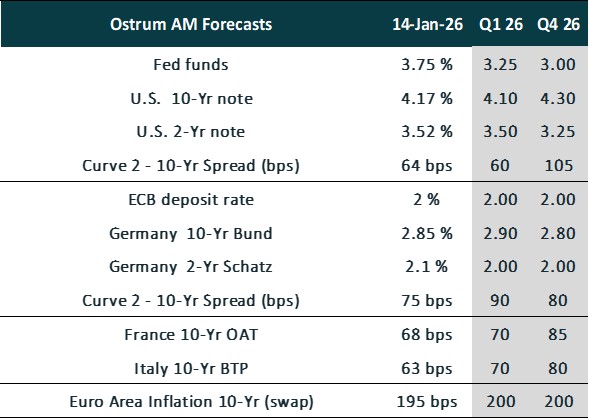

Regarding central banks, the Fed is expected to continue easing, although the succession of Powell may slow the adjustment of rates. Persistent tensions in the money markets now necessitate monthly purchases of T-bills amounting to $40 billion. The ECB is likely to maintain the status quo unless there is a major shock. In contrast, the Bank of Japan and the RBA seem inclined to raise their rates at a measured pace. In this context, 10-year rates are expected to fluctuate around current levels by the end of March. Appetite for sovereign debt appears intact. Despite the absence of a budget, the spread of the OAT has returned to its tightest levels since summer. Credit remains supported by low volatility and the strong financial health of companies. The reduced default rate continues to support high yield bonds despite stretched valuations. Stocks remain well-oriented, thanks to improved profit outlooks.

Economic Views

THREE THEMES FOR THE MARKETS

-

Growth

The activity data in the United States appears to indicate strong growth despite the stagnation in employment. Investment in AI and consumption by affluent households are compensating for the evident difficulties in most sectors of the economy. The Eurozone is experiencing a gradual recovery, according to surveys. Germany is expected to show a better fourth quarter. The Chinese economy is slowing down, with lackluster domestic demand. The reduction of industrial capacity is continuing.

-

Inflation

In the United States, inflation is slowing down, especially since rental data will not be updated until April 2026. However, American households' inflation expectations remain relatively high. In the Eurozone, inflation was at 2% in December but is expected to decrease significantly in the first quarter, primarily due to falling energy prices. In China, inflation continued to rise in December to 0.8%, driven by an increase in food prices.

-

Monetary policy

The Fed lowered its rates by 25 basis points in December and is purchasing $40 billion in T-bills each month. The Fed's policy stance is expected to remain accommodative due to challenges in the labor market. The ECB is likely to maintain the status quo at 2% until the end of 2026, confident in achieving the medium-term inflation target of 2%. The PBOC will maintain an accommodative bias throughout 2026 through its reserve requirement ratios and its main interest rate.

ECONOMY: UNITED STATES

Surprising growth in contrast to the deterioration of the labor market; downside risks pertain to private credit and stock valuations.

- Growth: The GDP forecast for 2025 has been revised upwards following Q3, but doubts remain about the consistency of employment, consumption, and external trade data in particular.

- Demand: The confidence shock and tariff impact will continue to weigh on household confidence and investment in structures, particularly in the first half of 2026. The credit quality of households is deteriorating, but an increase in transfers to households could support consumption starting in April. The trade balance, however, seems to be improving. Residential investment will contract further this year. Productive investment will remain primarily driven by AI (data centers, software, and R&D).

- Labor Market: Employment is showing modest increases. The unemployment rate is expected to remain above 4.5% in 2026 despite weak participation. Job openings are trending downward, including in previously dynamic sectors regarding job creation.

- Fiscal Policy: The risk of a government shutdown will return by the end of January. Transfers to households are likely in 2026 ahead of the midterm elections.

- Inflation: The moderation in oil prices and the reduction in rental inflation will contribute to slowing price increases. However, the inertia in services (healthcare, auto insurance) will keep inflation above target in 2026.

ECONOMY: EURO AREA

The December surveys align with our scenario of a strengthening growth in the Eurozone in 2026, driven by Germany (infrastructure plan and military spending) and still robust growth in the peripheral countries. In France, growth will be very moderate due to the persistence of political and budgetary uncertainty.

- Domestic demand: Consumption is expected to be slightly stronger due to gains in purchasing power (albeit more moderate) and an unemployment rate that is likely to remain low. Investment will be better oriented with the implementation of infrastructure and defense plans in Germany (the sharp increase in German orders for capital goods over two months is a positive signal), the rise in military spending in Europe, and the disbursements from NextGeneration EU, mainly intended for peripheral countries, which will conclude at the end of 2026. In France, political uncertainty will continue to hinder growth (wait-and-see attitude).

- External demand: Foreign trade is expected to have only a minor contribution to growth, with increased competition from China for German products.

- Fiscal policy: Germany, after years of fiscal prudence, is set to significantly increase its spending on infrastructure and defense. France still does not have a budget. Budget consolidation is expected to be very limited due to the divided National Assembly, which restricts the government's ability to act. The approach of the presidential elections will make compromises even more difficult.

- Inflation: Inflation is expected to remain close to the ECB's target of 2%. Inflation in services is likely to moderate only gradually due to a slow adjustment of wages to inflation.

ECONOMY: CHINA

Manufacturing PMI surveys rebounded at the end of the year, but domestic demand remains weak. Investment is expected to strengthen, supported by fiscal policy coordinated with monetary policy.

- Net exports: Despite US tariffs, foreign trade was resilient in 2025, as evidenced by the record trade surplus of 1.19 trillion dollars, reflecting the upgrading of Chinese products. Exports are expected to remain a driver of Chinese growth in 2026.

- Consumption: The new consumer subsidy plan for the replacement of household appliances should help to boost consumption. The gradual appreciation of the yuan against the dollar also supports a rebalancing of the economic model towards consumption.

- Investment: The goal of technological self-sufficiency implies an acceleration of investment in AI-related fields, where China aims to become the world leader. The "anti-involution" policy should rapidly improve the margins of private companies.

- Inflation: Core inflation is expected to continue rising, driven by consumption. This is the main focus of the Chinese authorities.

- Monetary Policy: The PBoC (People's Bank of China) is reluctant to lower its interest rates to avoid "pushing on a string." However, liquidity injections and monetary expansion will remain coordinated with fiscal policy.

Monetary Policy

Divergence between the Fed and the ECB

- The Fed, becoming more divided, is facing increased pressure from the White House.

On December 10, the Fed implemented its third consecutive rate cut of 25 basis points, bringing the federal funds rate into the range of [3.50% – 3.75%]. This decision was motivated by heightened downside risks to employment. Inflation risks remain oriented upward, but the impact of tariffs is considered to be temporary. Significant divisions have emerged within the FOMC, with two voting members preferring the status quo and a third advocating for a 50 basis point cut (Stephen Miran). After halting its balance sheet reduction since December 1, the Fed decided to purchase $40 billion per month in short-term securities (primarily T-Bills) starting December 12, in order to maintain ample levels of bank reserves and limit tensions in the money market. At the same time, pressures from the Trump administration on the independence of the Fed are intensifying. Given the ongoing deterioration in the labor market and significant risks in the housing market, we anticipate three rate cuts in 2026. The timing of the first rate cut is more uncertain due to the mixed employment report for January, which indicated a decrease in the unemployment rate to 4.4% in December.

- Extended status quo of the ECB

For the fourth consecutive time, the ECB kept its rates unchanged during the meeting on December 18, deeming itself to be in a comfortable position given the resilience of growth and inflation expected to remain close to 2% in the medium term. Growth prospects were revised upward, along with inflation expectations, particularly underlying inflation, due to a slower-than-expected deceleration in wages. The threshold is high for a potential final rate cut (shock to growth). The ECB is also continuing to reduce the size of its balance sheet through the non-reinvestment of maturing assets. It is expected to maintain the status quo until the end of 2026.

Market views

- U.S. Rates: The Fed may continue to cut rates though the outlook for easing is now more uncertain, The end of quantitative tightening (QT) and the resumption of T-bill purchases are mitigating upside risks on long-term bonds.

- European Rates: The ECB is expected to maintain the status quo at 2% until 2026. The 10-year Bund is projected to reach 2.90% by the end of Q1.

- Sovereign Spreads: Short-term political risks in France are easing, but they are expected to resurface later in the year. The trend of tightening BTP spreads is also likely to moderate after a very strong start of year.

- Eurozone Inflation: Inflation expectations remain anchored around the 2% target.

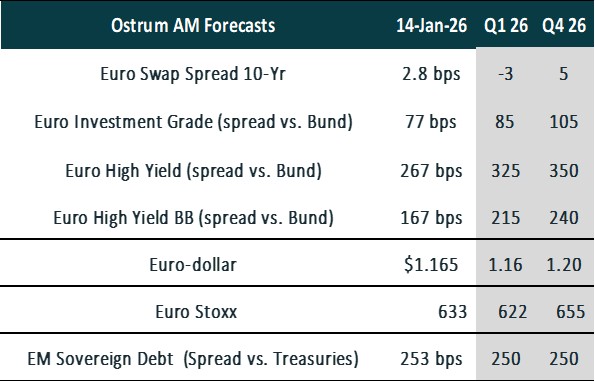

- Euro Credit: Investment-grade credit spreads have tightened significantly, though a gradual widening is likely to occur.

- Euro High yield: Valuations in the high yield segment are expected to normalize over the year. However, the default rate remains contained and below the historical average.

- Exchange Rates: The Fed's easing and the ECB's status quo are likely to contribute to an increase in the euro towards $1.20.

- European Equities: Following a year of stagnant growth, earnings growth is projected to reach 9%. Valuation multiples may approach 17x by year-end.

- Emerging Debt: Emerging market spreads are likely to remain tight in the short term, thanks in part to the Fed's easing measures.