Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The CIO letter

Solid Growth despite signs of weakness in the labor market

The intense geopolitical sequence at the start of 2026 (Venezuela, Greenland, Iran) has somewhat dissipated. A U.S. military intervention in Iran nonetheless seems inevitable should negotiations on the nuclear issue fail. Market attention has also turned to the Fed, with the appointment of Kevin Warsh as Jerome Powell’s successor. Often portrayed as a hawk, Warsh is expected to push ahead with the monetary loosening cycle that was halted in January. Meanwhile, the massive investment announced by AI giants roils U.S. equity and private credit markets, particularly in the software sector.

As regards the economic backdrop, U.S. growth—described as “solid” by the Fed—appears rather fragile given the persistent weakness in the labor market (though payrolls beat expectations in January). In the euro area, public spending in Germany is starting to feed into the recovery. China’s slowdown persists. External demand remains the sole growth driver, reflecting a reduction in production overhang and lackluster consumer spending.

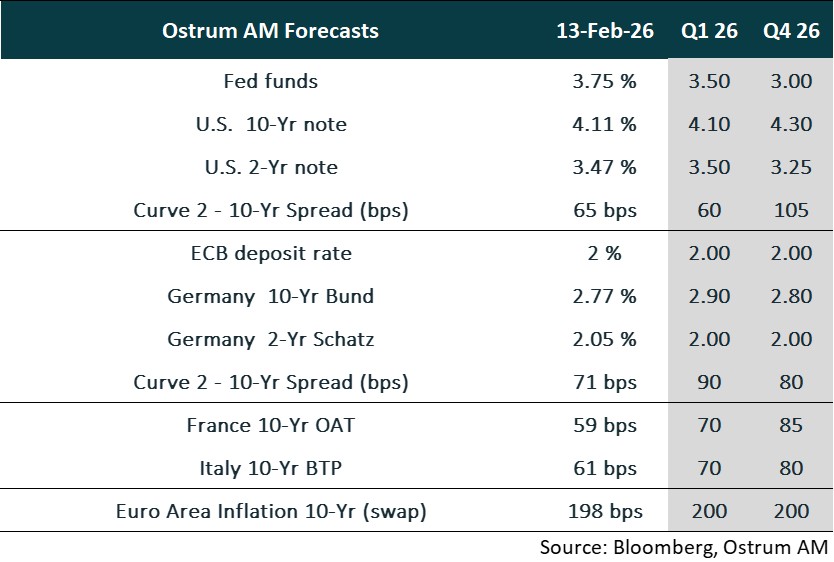

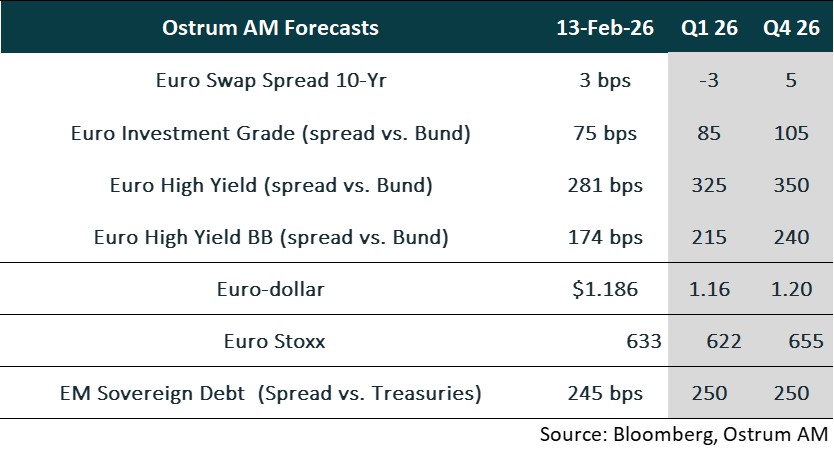

On the markets, the T-note is expected to hover around 4.10% at the end of Q1 before a flattening of the curve in the second half of the year as the Fed eases toward 3%. In the euro area, the Bund seems to be around its equilibrium level of roughly 2.80%. Swap spreads are stable. After a solid start to the year, sovereign spreads are likely to widen again as the 2027 elections approach in major markets (France, Italy). Euro-area corporate credit spreads (around 65 bp over swaps) are tightening, with the market having to absorb reverse Yankee issuance, particularly from U.S. tech companies. Against this backdrop, European equities have started the year well, with earnings seen rising about 9% in 2026 and valuations holding near 17x. In addition, dollar weakness is a boon for emerging market debt. Spreads hover 250 bps vs. Treasuries.

Economic Views

THREE THEMES FOR THE MARKETS

-

Growth

US economic data indicate growth described as “solid” despite a labor market that has stagnated since the spring. AI investment and consumption by higher-income households are offsetting the evident difficulties across most sectors of the economy. The euro area is experiencing a gradual recovery, confirmed by a positive surprise in Q4 growth. Germany is recovering. The Chinese economy continues to slow on the back of weak domestic demand. The reduction of industrial capacity remains underway.

-

Inflation

In the United States, inflation is easing gradually (2,4 % in January) but is expected to remain above the target in 2026. Producer prices point to persistent underlying pressures. In the euro area, inflation stands at 1.7% in January, helped by energy prices. However, wages are likely to contribute to a modest re-acceleration in inflation over the year. In China, inflation slowed to 0.2% in January due to last year’s base effect and lower energy prices. At the same time, producer price deflation is moderating (–1.2%y), driven by higher metal prices and the anti‑involution policy.

-

Monetary policy

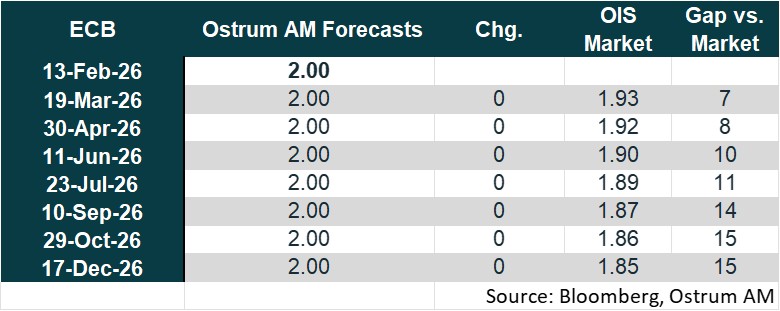

The Fed left policy unchanged in January. The easing cycle is expected to resume in March given labor-market weakness, with Kevin Warsh succeeding Jerome Powell in May and continuing the monetary easing path. The ECB is projected to hold the policy rate at 2% through the end of 2026, confident of hitting its 2% inflation target on a medium-term horizon. The PBOC may postpone its rate cuts to the second quarter, awaiting additional data to assess the state of the Chinese economy.

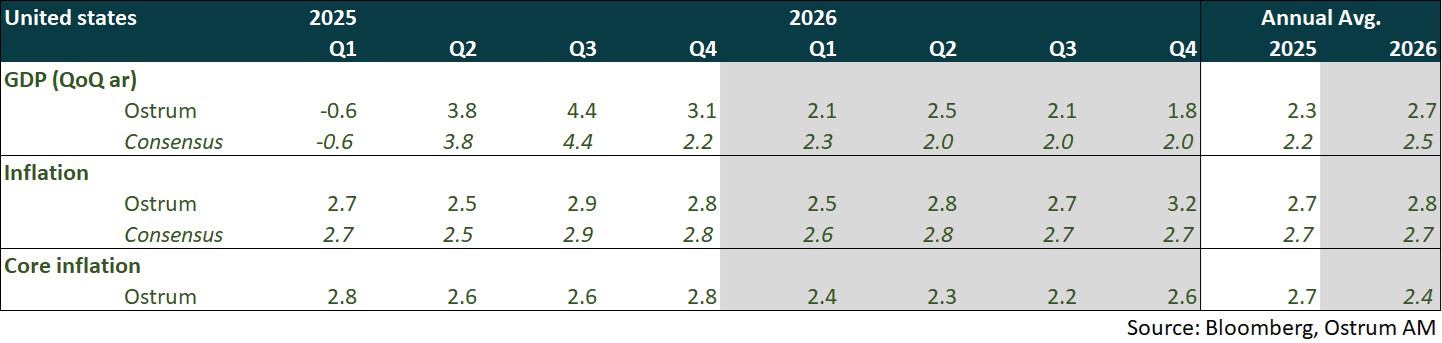

ECONOMY: UNITED STATES

Growth about 2% despite deterioration in the labor market; downside risks could stem from private credit and equity valuations.

- Growth: Activity is judged solid by the Fed. Growth finished the year on a positive note with an improvement in the external balance.

- Demand: The sustained demand masks significant disparities between AI-related sectors and the rest of the economy, as well as between the top-income decile and the rest of the population. Household credit quality appears to be deteriorating, but higher transfers could boost consumption from Q2. The trade balance is expected to normalize. Housing investment will continue to contract in 2026. Productive investment is mainly driven by AI.

- Labor Market: Hiring is slowing and job openings are plunging. The unemployment rate is expected to rise in 2026 despite weak labor force growth and participation (due to constrained immigration). Employment prospects for graduates have become increasingly challenging.

- Fiscal Policy: There should not be another shutdown despite the ICE/DHS financing issue. Transfers to households will increase in 2026.

- Inflation: Service price inertia (healthcare, auto insurance) will keep inflation above target in 2026, though rents should contribute to disinflation.

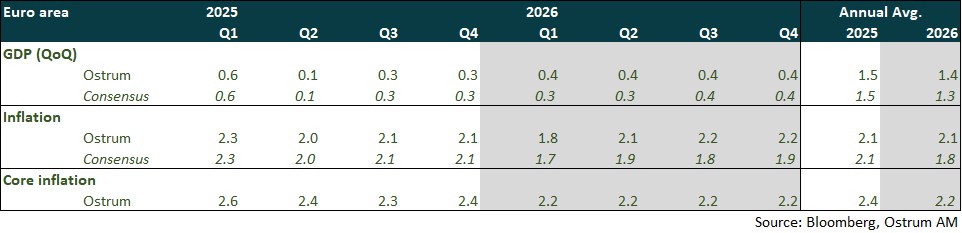

ECONOMY: EURO AREA

Growth came in better than expected in Q4 2025. Surveys and available data validate our scenario of stronger euro area growth in 2026, led by Germany.

- Domestic demand: Growth was better than expected in Q4, driven by domestic demand. Consumption is set to benefit in 2026 from gains in purchasing power (though more modest) and a still-low unemployment rate. The sharp rise in new orders for domestic capital goods in Germany points to stronger investment linked to the implementation of infrastructure and defense plans in Germany. Added to this will be higher military spending in Europe and the NextGenerationEU disbursements.

- External demand: Foreign trade is expected to have only a minor contribution to growth, with increased competition from China for German products.

- Fiscal policy: Germany, after years of fiscal prudence, will significantly increase its spending on infrastructure and defense. In France, the 2026 Budget was finally voted with compromises resulting in a very limited consolidation (the public deficit should be around 5% of GDP) and remaining among the highest in the euro area. The approach of the 2027 presidential election will make compromises even more difficult.

- Inflation: Inflation is temporarily below the 2% threshold at the start of the year due to the negative contribution from energy prices. It should subsequently rise again slightly above the ECB’s target because of a slow adjustment of wages to inflation, which will continue to weigh on service prices.

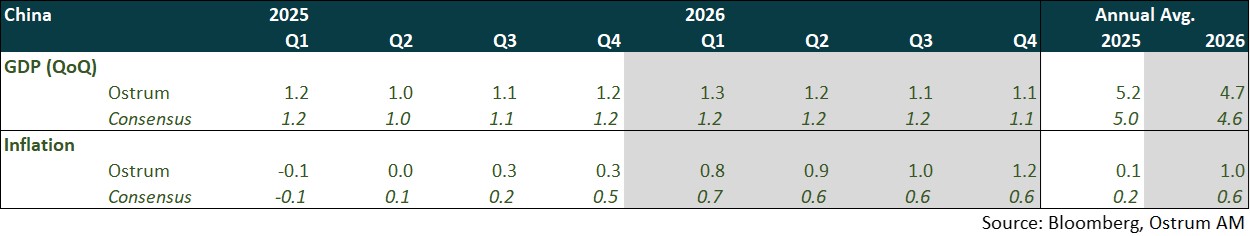

ECONOMY: CHINA

Growth in 2025 reached the 5% target, but the beginning of 2026 is rather mixed. Exports remain robust, contrasting with weak domestic demand, particularly in investment. Xi Jinping’s call to make the yuan a reserve currency should support its appreciation against the dollar.

- Net exports: Growth reached its target thanks to resilient exports, whose contribution (one-third) hit its highest level since 1997. Easing trade tensions (Canada, United Kingdom, Germany(?)) and the move upmarket of exports encouraged by the 15th Plenum (AI, batteries, electric vehicles) should support momentum in 2026.

- Consumption: Consumption shows encouraging signs, as evidenced by the resilience of the RatingDog survey in services. However, limited visibility in the labor market and the real estate crisis remain major obstacles to a broader recovery.

- Investment: Investment posted its first decline last year. Despite the RMB 200 bn plan—about 2% of GDP—to support equipment investment, this was not enough to offset the drop in real estate investment. A new RMB 96 bn plan should provide additional support. However, the amount appears insufficient and may need to be increased. The main challenge for policymakers is to revive private investment, the key source of employment.

- Inflation: Inflation ended 2025 at 0.1%, and core inflation stabilized at 1.2%, the highest in two years. This is positive, as price dynamics have not deteriorated.

- Monetary Policy: The PBOC may postpone rate cuts while waiting for more economic data to gauge the state of the economy.

Monetary Policy

The Fed and the ECB in a Wait-and-See Attitude

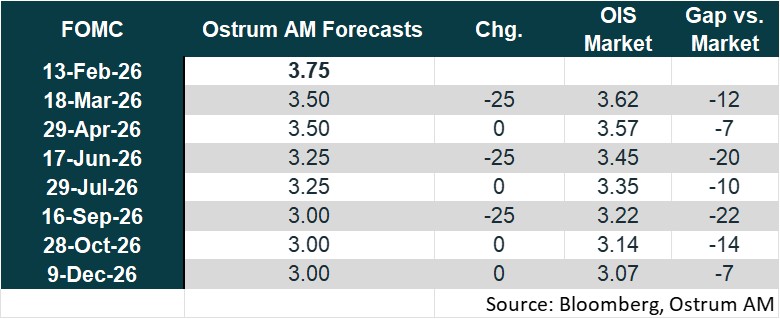

- A short pause in the Fed’s monetary easing

After having cut rates three times, the Fed decided to leave them unchanged at the January 28 meeting. According to the Fed statement, this decision was driven by activity deemed solid and signs of stabilization in the unemployment rate amid still somewhat elevated inflation. Two members voted for a 25 basis point rate cut. The Fed continues to buy $40 billion per month in short-term securities (essentially T-bills) to maintain ample bank reserves and limit tensions in the money market. Given the expected ongoing deterioration in the labor market and risks to the housing market, we anticipate three rate cuts in 2026, the first expected in March. Kevin Warsh will succeed Jerome Powell at the end of May if his nomination is confirmed by the Senate. He will thus continue the Fed’s monetary policy easing.

- Extended status quo of the ECB

For the fifth consecutive time, the ECB left its rates unchanged at the February 5 meeting, continuing to assess monetary policy as being in “a good place” given the resilience of growth and inflation expected to remain close to the 2% target in the medium term. During the question-and-answer session, Christine Lagarde did not express concern about the impact of the euro’s appreciation on inflation, with the euro/dollar exchange rate near the average observed since the euro was introduced. The bar is high for a possible final rate cut (growth shock). The ECB is also continuing to unwind the size of its balance sheet through its non-reinvestment of maturing securities. It is expected to keep policy unchanged until the end of 2026.

Market views

- U.S. Rates: The Fed may continue to cut rates though easing and the timing of cuts is now more uncertain, The end of quantitative tightening (QT) and the resumption of T-bill purchases are mitigating upside risks on long-term bonds.

- European Rates: The ECB is expected to maintain the status quo at 2% until 2026. The 10-year Bund is projected to reach 2.80% by the end of the year.

- Sovereign Spreads: Short-term political risks in France are easing, but they are expected to resurface later in the year. The trend of tightening BTP spreads is also likely to moderate after a very strong start of year.

- Eurozone Inflation: Inflation expectations remain anchored around the 2% target.

- Euro Credit: Investment-grade credit spreads have tightened significantly, though a gradual widening is likely to occur.

- Euro High yield: Valuations in the high yield segment are expected to normalize over the year. However, the default rate remains contained and below the historical average.

- Exchange Rates: The Fed's easing and the ECB's status quo are likely to contribute to an increase in the euro towards $1.20.

- European Equities: Following a year of stagnant growth, earnings growth is projected to reach 9%. Valuation multiples may approach 17x by year-end.

- Emerging Debt: Emerging market spreads are likely to remain tight in the short term, thanks in part to the Fed's easing measures.