Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- Île-de-France Mobilités (IDFM), transportation services in the Paris region, has launched a €1bn European green bond with a 20-year maturity, attracting exceptional interest with demand exceeding €6bn. This bond complies with the EU Green Bond Standard, effective since December 2024. IDFM is actively committed to sustainable mobility, with significant projects such as the modernization of electric trains and the goal of having a fully clean bus fleet by 2029. Transparency is crucial, with reports issued every three years and verification conducted by KPMG. IDFM also plans to expand its fleet of electric bicycles to 40,000 by 2026 and to incorporate biomethane into its buses. Each project is rigorously selected to maximize its environmental impact. By positioning itself as a leader in the transition to sustainable transportation, IDFM sends a clear message: innovation and commitment to the environment are essential for building a sustainable future in Île-de-France.

- The European Union Green Bonds Standard (EU GBS) represent a new standard to harmonize the green bonds market. It provides a framework to help issuers align their green bond projects with activities recognized by the European taxonomy. Since the beginning of 2025, Île-de-France Mobilités and A2A (utility company in Italy) have been the first entities to align their green bond issues with this new standard. A2A has issued the first green bond in the new format of the European Union worth €500M with a maturity of 10 years. The funds raised will be fully invested in activities that fully comply with the European taxonomy.

- Motability Operations issued, in January 2025, a new 12-year social bond in euros to finance vehicles and other transportation systems adapted to disabled people. Since 2021, the group only issued bonds through its “social” framework. The British brand has been operating for over 45 years and currently serves around 700,000 people.

Figure of the month

$70T

By 2050, water scarcity could jeopardize $70T of global GDP

Chart of the month

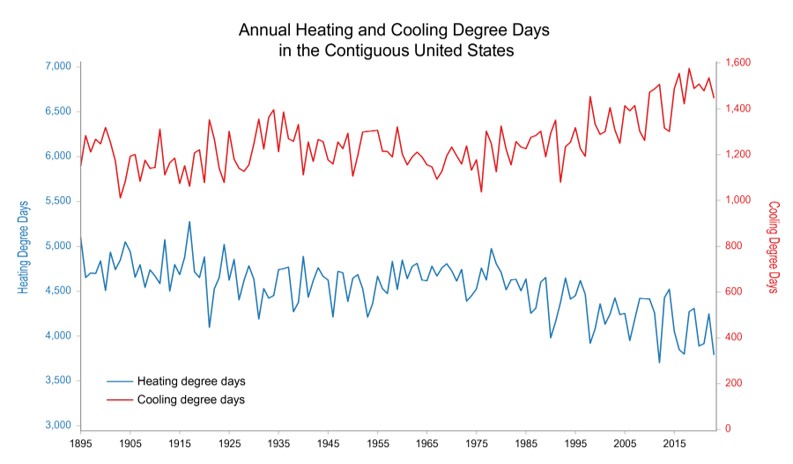

Number of cooling and heating degree days in the United States

Since 1990, the use of air conditioning in the United States has surged primarily due to climate change and consumption habits. This rising energy demand creates a vicious cycle with widespread consequences, impacting sectors such as agriculture, construction, electrical infrastructure, data centers, tourism, and fashion.

Without adjustments, productivity losses related to global warming could reach $500 billion by 2050, according to a study by the Arsht-Rockefeller Foundation.

Source: Market sources, January 2025