Every month, find out all about the sustainable market bonds news in our newsletter

« MySustainableCorner ».

This month in a nutshell

- Agence France Trésor announces that it has successfully launched the fourth French green sovereign bond, with a maturity of 25 years, the green OAT 3.00% 25 June 2049, at an issue rate of 3.201% for an amount of €8 billion. This brings the outstanding amount of green OAT (French 10-year bond) issued to date to ~70 billion euros. The order book reached 98 billion euros, which underlines a high demand.

- In November, EDF launched its first nuclear green bond (€1 billion, maturity 3.5 years) to restructure the costs associated with upgrading or improving nuclear reactions to bring them in line with the criteria defined by the EU taxonomy.

- On January 8, 2024, the Ministry of Ecological Transition and Territorial Cohesion published the new Greenfin label standard, entered into force on January 23, 2024. Aligned with the European taxonomy, this new framework now includes nuclear energies in its eligible activities.

- In January 2024, the Green Bond Principles (GBP) celebrated their 10th anniversary. They aim to help issuers finance environmental-friendly and sustainable projects that promote a zero-emission economy and protect the environment. GBP-aligned issues provide transparent green references.

- The Institute of Sustainable Finance (IFD) has published its second report* on the integration of climate issues into Corporate Governance. This report makes 10 recommendations to strengthen companies’ governance of energy and ecological transition.

* In French: https://institutdelafinancedurable.com/app/uploads/2024/01/IFD_Gouvernance-de-la-transition-climat-dans-les-entreprises_VF.pdf

Figure of the month

New milestone reached for the sustainable bond market: $4,000 billion in outstanding issues worldwide.

Source: Environmental Finance Data, February 2024

Chart of the month

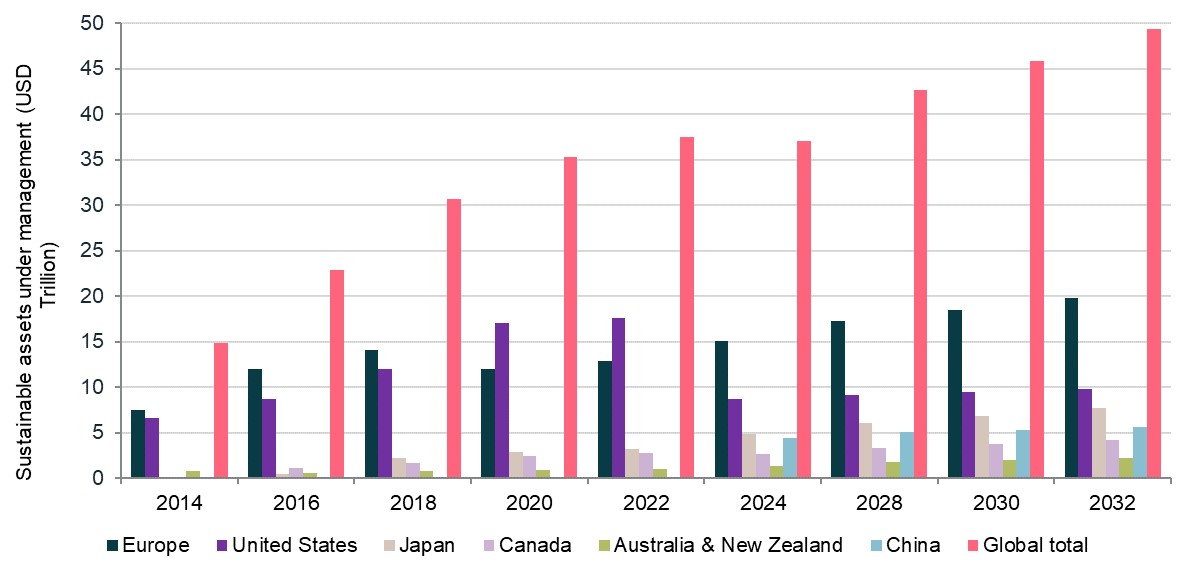

Amount of assets under management invested in sustainable assets by country and at a global level

Source: Ostrum AGSI Alliance, November 2023.

Sustainable Assets include the following sustainable investment strategies: ESG integration, norms-based screening, negative/exclusionary screening, sustainability themed investing, positive/best-in-class screening, impact/community investing, corporate engagement and shareholder action