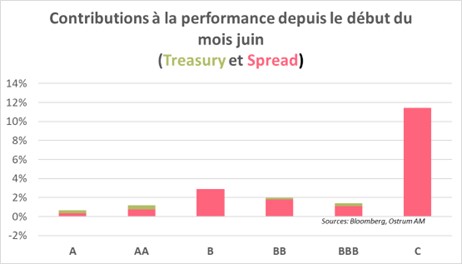

June was marked by outperformance of ‘high yield’ EM countries and in particular the ‘C’ rated segment compared to investment grade counterparts, as shown in the chart below.

Strategist viewpoint

June was marked by outperformance of ‘high yield’ EM countries and in particular the ‘C’ rated segment compared to investment grade counterparts, as shown in the chart below.

The ‘C’ rated rally was fueled by three key drivers:

- The hope of a return to structural reforms in countries like Nigeria, Argentina, Egypt and Turkey;

- Debt restructuring negotiations under the new G20 framework. Zambia, for example, finally struck a deal to restructure its US $6.3 bn debt;

- A strong push from multilateral and private creditors to have nature conservation and climate considerations embedded into emerging sovereign debt. As an illustration, on 9 May Ecuador concluded the world's largest $1.6 bn “debt for nature” deal to protect the Galapagos Islands.

Looking forward, a main catalyst for EM external sovereign debt performance is the Fed's monetary policy, which is now close to the end of its cycle. In addition, doubts could persist about the willingness of some countries to return to economic orthodoxy. Nevertheless, the conditions are in place and supportive for sustainable and inclusive growth. However, as always, ‘C’ rated countries will need to redouble their efforts to convince investors of their commitment, allowing for more spread tightening.

Portfolio Manager viewpoint

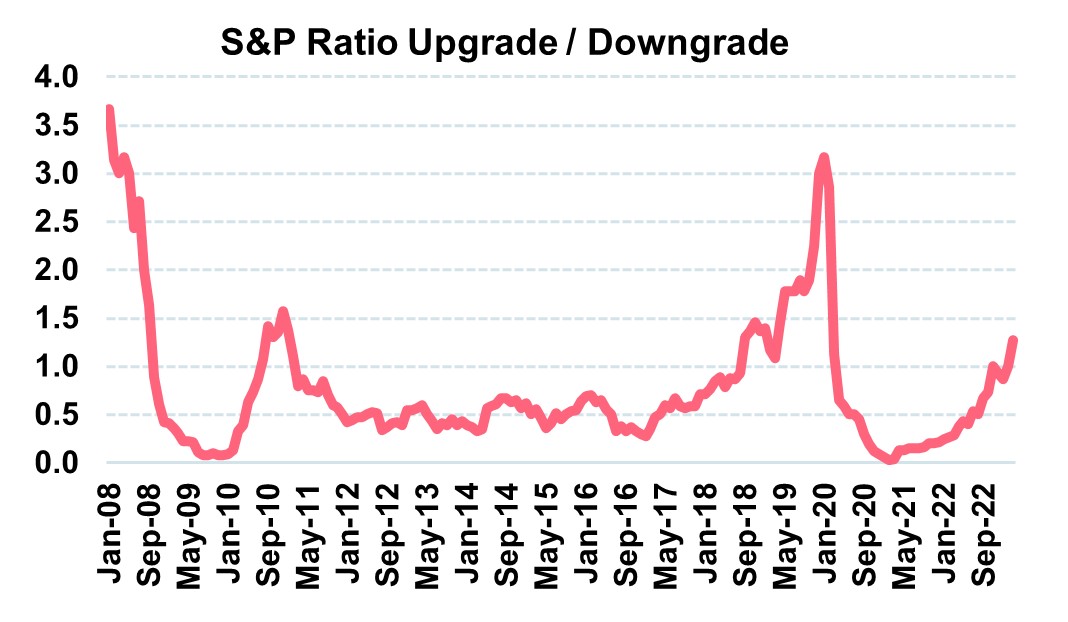

The economic fundamentals of many EM countries have been challenged for the past 2 decades. Average EM sovereign ratings were negatively impacted by the 2008 crisis. Starting in 2017, ratings improved but were halted by COVID 19 which completely reversed the improving trend. The reopening of EM economies has repositioned the market for an uptrend is ratings supported by growth.

What is notable is that the trend for improved ratings emerged during the Fed’s tightening cycle. As we near the end of its hike cycle the trend for improved rates could be even more robust.

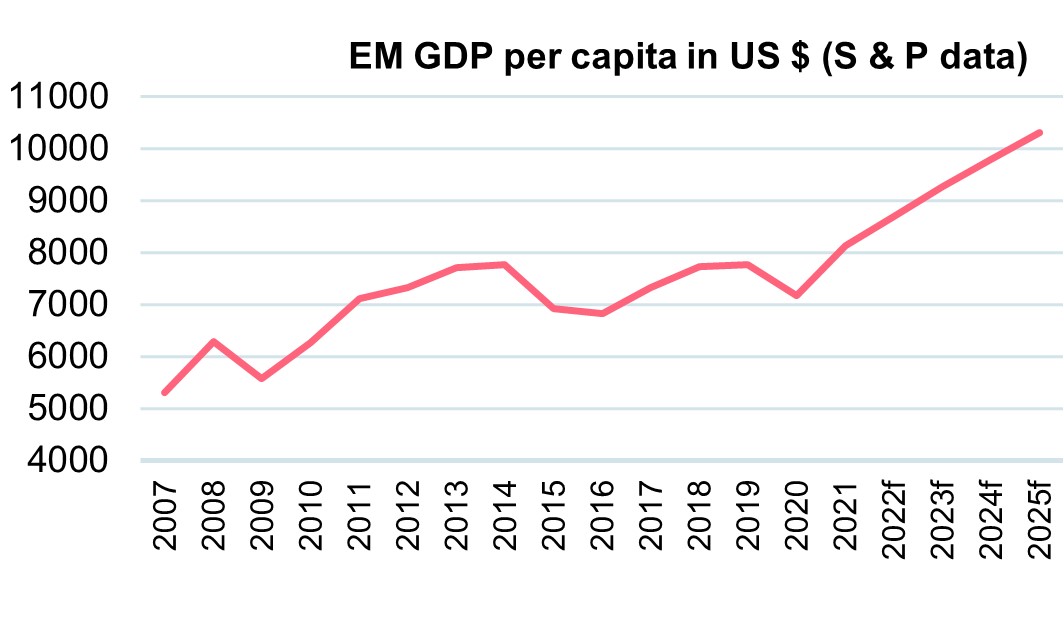

The improving average GDP per capita of the 75 emerging countries in our investment universe reflects this trend to a higher rating profile. Average growth in EMs since late 2021 bodes well for the asset class. A big plus is also the impulsion for inclusive and climate sensitive development which has become a prerequisite for EM countries to develop sustainable growth over the longer term.

Momentum in EMD: (re) structuring, (re) rating and climate related!

Download the insight