Latin America is extremely well positioned to benefit from the (near) end of the Fed's tightening cycle.

The Strategist viewpoint

The (near) end of the Fed's monetary tightening cycle is an important catalyst for emerging markets, particularly in Latin America.

Positive and attractive real interest rates.

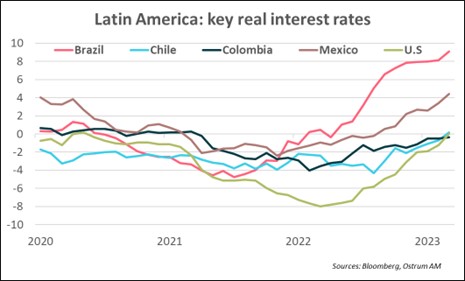

Currencies in Latin America are set to benefit from positive real rates, as shown in the following chart.

Improving growth prospects

The rise in commodity prices has served as a cushion for economic activity in a context of aggressive rate hikes, allowing Latin America to record growth of 4% in 2022. In 2023, growth is expected to slow to 1.6%, but decelerate less than expected in Q1. That said, inflation, especially core inflation, remains high, which favors vigilant positioning on policies from central banks. Dollar weakness and the China recovery (driven by consumption) are catalysts for higher commodity prices, which should benefit the region's producing and exporting countries.

Economic orthodoxy achieved

The overall region has strengthened its economic orthodoxy (the exception being Argentina). Central banks in the region are proving to be credible by pursuing inflation targeted monetary policies, limiting current account deficits and repositioning public debt in domestic currencies (vs USD). International reserves are also solid. Today, Latin America is well equipped to cope with external shocks.

Reduced political risk

Reduced political risk has served to improve investor sentiment, particularly in regard to Brazil, Colombia and Chile. Today, international investors are signaling they are more comfortable with political risks in these three countries compared to a few months ago.

The Portfolio Manager viewpoint

In our opinion, local rates in Brazil and Mexico offer the most attractive investment opportunities considering the context of high real / nominal yields and upcoming rate cut cycles.

The end in rate hike cycle(s)

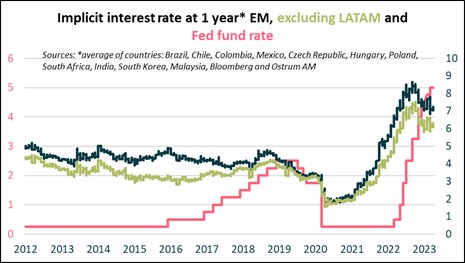

In Brazil, after raising key interest rates from to 2% to 13.75% (March 2021 - September 2022), the central bank is expected to lower its rates as early as Q3 2023. In Mexico, after a 7.25% increase since June 2021, the monetary tightening cycle is coming to an end (terminal rate close to 11.50%) and rate cuts are expected from 2024. Rate hikes in Brazil & Mexico were the most aggressive in the EM universe, as shown in the chart below.

Disinflation is underway

In Brazil, headline inflation is below 5%, after peaking at 12% in June 2022. In Mexico, the process of disinflation is emerging with inflation falling below 7%, after a peak at 8.7% in September 2022. Brazilian and Mexican real rates are in positive territory and among the highest in emerging markets.

LATAM currencies have appreciated vs the USD

We expect the Mexican peso and the Brazilian real to benefit from positive real rates, investment flows (at a historical high level in Mexico), strong external accounts and the return of foreign investors to local debt markets. It is worth noting that foreign holdings of Brazilian and Mexican local bonds are at historically low levels.

Idiosyncratic risks are priced into local yield curves

In Brazil, we identify the main risk as uncertainty about the tax trajectory and the cap on spending. In Mexico, we identify no specific risks in the run-up to the 2024 presidential election.

Focus on Latin America

Download the insightOstrum Asset Management

Asset management company regulated by AMF under n° GP-18000014 – Limited company with a share capital of 50 938 997 €. Trade register n°525 192 753 Paris – VAT: FR 93 525 192 753 – Registered Office: 43, avenue Pierre Mendès-France, 75013 Paris – www.ostrum.com

This document is intended for professional, in accordance with MIFID. It may not be used for any purpose other than that for which it was conceived and may not be copied, distributed or communicated to third parties, in part or in whole, without the prior written authorization of Ostrum Asset Management.

None of the information contained in this document should be interpreted as having any contractual value. This document is produced purely for the purposes of providing indicative information. This document consists of a presentation created and prepared by Ostrum Asset Management based on sources it considers to be reliable.

Ostrum Asset Management reserves the right to modify the information presented in this document at any time without notice, which under no circumstances constitutes a commitment from Ostrum Asset Management.

The analyses and opinions referenced herein represent the subjective views of the author(s) as referenced, are as of the date shown and are subject to change without prior notice. There can be no assurance that developments will transpire as may be forecasted in this material. This simulation was carried out for indicative purposes, on the basis of hypothetical investments, and does not constitute a contractual agreement from the part of Ostrum Asset Management.

Ostrum Asset Management will not be held responsible for any decision taken or not taken on the basis of the information contained in this document, nor in the use that a third party might make of the information. Figures mentioned refer to previous years. Past performance does not guarantee future results. Any reference to a ranking, a rating, a label or an award provides no guarantee for future performance and is not constant over time. Reference to a ranking and/or an award does not indicate the future performance of the UCITS/AIF or the fund manager.

Under Ostrum Asset Management’s social responsibility policy, and in accordance with the treaties signed by the French government, the funds directly managed by Ostrum Asset Management do not invest in any company that manufactures, sells or stocks anti-personnel mines and cluster bombs.

Natixis Investment Managers

This material has been provided for information purposes only to investment service providers or other Professional Clients, Qualified or Institutional Investors and, when required by local regulation, only at their written request. This material must not be used with Retail Investors.

To obtain a summary of investor rights in the official language of your jurisdiction, please consult the legal documentation section of the website (im.natixis.com/intl/intl-fund-documents)

In the E.U.: Provided by Natixis Investment Managers International or one of its branch offices listed below. Natixis Investment Managers International is a portfolio management company authorized by the Autorité des Marchés Financiers (French Financial Markets Authority - AMF) under no. GP 90-009, and a public limited company (société anonyme) registered in the Paris Trade and Companies Register under no. 329 450 738. Registered office: 43 avenue Pierre Mendès France, 75013 Paris. Italy: Natixis Investment Managers International Succursale Italiana, Registered office: Via San Clemente 1, 20122 Milan, Italy. Netherlands: Natixis Investment Managers International, Nederlands (Registration number 000050438298). Registered office: Stadsplateau 7, 3521AZ Utrecht, the Netherlands. Spain: Natixis Investment Managers International S.A., Sucursal en España, Serrano n°90, 6th Floor, 28006 Madrid, Spain. Sweden: Natixis Investment Managers International, Nordics Filial (Registration number 516412-8372- Swedish Companies Registration Office). Registered office: Covendrum Stockholm City AB, Kungsgatan 9, 111 43 Stockholm, Box 2376, 103 18 Stockholm, Sweden. Or,

Provided by Natixis Investment Managers S.A. or one of its branch offices listed below. Natixis Investment Managers S.A. is a Luxembourg management company that is authorized by the Commission de Surveillance du Secteur Financier and is incorporated under Luxembourg laws and registered under n. B 115843. Registered office of Natixis Investment Managers S.A.: 2, rue Jean Monnet, L-2180 Luxembourg, Grand Duchy of Luxembourg. Germany: Natixis Investment Managers S.A., Zweigniederlassung Deutschland (Registration number: HRB 88541). Registered office: Senckenberganlage 21, 60325 Frankfurt am Main. Belgium: Natixis Investment Managers S.A., Belgian Branch, Gare Maritime, Rue Picard 7, Bte 100, 1000 Bruxelles, Belgium.

In Switzerland: Provided for information purposes only by Natixis Investment Managers, Switzerland Sàrl, Rue du Vieux Collège 10, 1204 Geneva, Switzerland or its representative office in Zurich, Schweizergasse 6, 8001 Zürich.

In the British Isles: Provided by Natixis Investment Managers UK Limited which is authorised and regulated by the UK Financial Conduct Authority (register no. 190258) - registered office: Natixis Investment Managers UK Limited, One Carter Lane, London, EC4V 5ER. When permitted, the distribution of this material is intended to be made to persons as described as follows: in the United Kingdom: this material is intended to be communicated to and/or directed at investment professionals and professional investors only; in Ireland: this material is intended to be communicated to and/or directed at professional investors only; in Guernsey: this material is intended to be communicated to and/or directed at only financial services providers which hold a license from the Guernsey Financial Services Commission; in Jersey: this material is intended to be communicated to and/or directed at professional investors only; in the Isle of Man: this material is intended to be communicated to and/or directed at only financial services providers which hold a license from the Isle of Man Financial Services Authority or insurers authorised under section 8 of the Insurance Act 2008.

In the DIFC: Provided in and from the DIFC financial district by Natixis Investment Managers Middle East (DIFC Branch) which is regulated by the DFSA. Related financial products or services are only available to persons who have sufficient financial experience and understanding to participate in financial markets within the DIFC, and qualify as Professional Clients or Market Counterparties as defined by the DFSA. No other Person should act upon this material. Registered office: Unit L10-02, Level 10 ,ICD Brookfield Place, DIFC, PO Box 506752, Dubai, United Arab Emirates

In Japan: Provided by Natixis Investment Managers Japan Co., Ltd. Registration No.: Director-General of the Kanto Local Financial Bureau (kinsho) No.425. Content of Business: The Company conducts investment management business, investment advisory and agency business and Type II Financial Instruments Business as a Financial Instruments Business Operator.

In Taiwan: Provided by Natixis Investment Managers Securities Investment Consulting (Taipei) Co., Ltd., a Securities Investment Consulting Enterprise regulated by the Financial Supervisory Commission of the R.O.C. Registered address: 34F., No. 68, Sec. 5, Zhongxiao East Road, Xinyi Dist., Taipei City 11065, Taiwan (R.O.C.), license number 2020 FSC SICE No. 025, Tel. +886 2 8789 2788.

In Singapore: Provided by Natixis Investment Managers Singapore Limited (NIM Singapore) having office at 5 Shenton Way, #22-05/06, UIC Building, Singapore 068808 (Company Registration No. 199801044D) to distributors and qualified investors for information purpose only. NIM Singapore is regulated by the Monetary Authority of Singapore under a Capital Markets Services Licence to conduct fund management activities and is an exempt financial adviser. Mirova Division is part of NIM Singapore and is not a separate legal entity. Business Name Registration No. of Mirova: 53431077W.This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Provided by Natixis Investment Managers Hong Kong Limited to professional investors for information purpose only.

In Australia: Provided by Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) and is intended for the general information of financial advisers and wholesale clients only.

In New Zealand: This document is intended for the general information of New Zealand wholesale investors only and does not constitute financial advice. This is not a regulated offer for the purposes of the Financial Markets Conduct Act 2013 (FMCA) and is only available to New Zealand investors who have certified that they meet the requirements in the FMCA for wholesale investors. Natixis Investment Managers Australia Pty Limited is not a registered financial service provider in New Zealand.

In Colombia: Provided by Natixis Investment Managers International Oficina de Representación (Colombia) to professional clients for informational purposes only as permitted under Decree 2555 of 2010. Any products, services or investments referred to herein are rendered exclusively outside of Colombia. This material does not constitute a public offering in Colombia and is addressed to less than 100 specifically identified investors.

In Latin America: Provided by Natixis Investment Managers International.

In Uruguay: Provided by Natixis Investment Managers Uruguay S.A., a duly registered investment advisor, authorised and supervised by the Central Bank of Uruguay. Office: San Lucar 1491, Montevideo, Uruguay, CP 11500. The sale or offer of any units of a fund qualifies as a private placement pursuant to section 2 of Uruguayan law 18,627.

In Mexico: Provided by Natixis IM Mexico, S. de R.L. de C.V., which is not a regulated financial entity, securities intermediary, or an investment manager in terms of the Mexican Securities Market Law (Ley del Mercado de Valores) and is not registered with the Comisión Nacional Bancaria y de Valores (CNBV) or any other Mexican authority. Any products, services or investments referred to herein that require authorization or license are rendered exclusively outside of Mexico. While shares of certain ETFs may be listed in the Sistema Internacional de Cotizaciones (SIC), such listing does not represent a public offering of securities in Mexico, and therefore the accuracy of this information has not been confirmed by the CNBV. Natixis Investment Managers is an entity organized under the laws of France and is not authorized by or registered with the CNBV or any other Mexican authority. Any reference contained herein to “Investment Managers” is made to Natixis Investment Managers and/or any of its investment management subsidiaries, which are also not authorized by or registered with the CNBV or any other Mexican authority.

In Brazil: Provided to a specific identified investment professional for information purposes only by Natixis Investment Managers International. This communication cannot be distributed other than to the identified addressee. Further, this communication should not be construed as a public offer of any securities or any related financial instruments.

Natixis Investment Managers International is a portfolio management company authorized by the Autorité des Marchés Financiers (French Financial Markets Authority - AMF) under no. GP 90-009, and a public limited company (société anonyme) registered in the Paris Trade and Companies Register under no. 329 450 738. Registered office: 43 avenue Pierre Mendès France, 75013 Paris.

The above referenced entities are business development units of Natixis Investment Managers, the holding company of a diverse line-up of specialised investment management and distribution entities worldwide. The investment management subsidiaries of Natixis Investment Managers conduct any regulated activities only in and from the jurisdictions in which they are licensed or authorized. Their services and the products they manage are not available to all investors in all jurisdictions. It is the responsibility of each investment service provider to ensure that the offering or sale of fund shares or third-party investment services to its clients complies with the relevant national law.

The provision of this material and/or reference to specific securities, sectors, or markets within this material does not constitute investment advice, or a recommendation or an offer to buy or to sell any security, or an offer of any regulated financial activity. Investors should consider the investment objectives, risks and expenses of any investment carefully before investing. The analyses, opinions, and certain of the investment themes and processes referenced herein represent the views of the portfolio manager(s) as of the date indicated. These, as well as the portfolio holdings and characteristics shown, are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material. The analyses and opinions expressed by external third parties are independent and does not necessarily reflect those of Natixis Investment Managers. Past performance information presented is not indicative of future performance.

Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy, or completeness of such information. This material may not be distributed, published, or reproduced, in whole or in part.

All amounts shown are expressed in USD unless otherwise indicated.

Natixis Investment Managers may decide to terminate its marketing arrangements for this product in accordance with the relevant legislation