2025 was an excellent year for equity markets across all geographic regions. Total return performances (with net dividends reinvested) of the world’s major markets (United States, EMU, Europe, Japan, China) rose by an average of 20% throughout the year. Such performance had not been seen for some time, particularly in the euro area.

2026 should remain supportive for equity markets, albeit with some persistent risk factors. Diversification and selectivity will remain key investment principles in 2026.

European Equities: expected upside of around 8%

- Constructive but measured outlook for 2026: The anticipated improvement in euro area macroeconomic conditions, supported by lower interest rates and more expansionary fiscal policies, should drive a rebound in earnings, with profit growth estimated at around 8%, particularly in cyclical sectors.

- Valuations under scrutiny amid contrasted scenarios: After strong market gains despite subdued earnings in recent years, valuation sustainability remains a key issue. Our central scenario targets market upside of around 8%, supported by a cautious investment approach focused on the delivery of earnings expectations.

Asian Equities in 2026: same story… but different

- After an exceptional 2025, Asia ex-Japan enters 2026 with higher valuations, making further performance increasingly dependent on earnings growth, selectivity and disciplined risk management, as previously crowded consensus trades become more fragile.

- In a more demanding market environment, performance should focus on earnings quality and margin expansion, with a preference for companies structurally exposed to artificial intelligence, supported by strong balance sheets and visible earnings upgrades.

Global Equities: supportive environment with elevated risks

- Momentum dominance: In 2025, the Momentum factor continued to outperform significantly, with historically low turnover, reflecting strong investor confidence in established market trends.

- Navigating uncertainty in 2026: While the market environment may remain supportive in the short term, historical parallels point to greater return dispersion and a higher likelihood of meaningful corrections over the medium term, calling for a selective approach and careful risk management.

Through the insights of three of our experts, we will explore how to capture diversification opportunities beyond U.S. markets - particularly in Europe and Asia - and how we assess the key risks shaping 2026.

European Equities in 2026: “8% Growth Expected”

2025 proved to be particularly favorable for global equity markets, with performances that further fuelled already strong interest among international investors. According to the data collected, the main stock market indices recorded an average and broadly homogeneous increase of 20% over the year, a phenomenon that had not been observed for several years. In the United States, this rise followed a year of strong gains in 2024, at around 25% (in dollars and with net dividends reinvested), compared in particular with 10% for the euro area. Since the lows of September/October 2022, the advances—once again very broadly shared—have been close to 100%.

It should nevertheless be noted that, beneath these seemingly similar performances, a number of disparities remain. In the United States, earnings growth benefited both from economic expansion and from the depreciation of the dollar, whereas in most international markets the rise was driven primarily by multiple expansion, reflecting investors’ growing appetite for risk assets.

Similarly, an analysis of sector and thematic performances highlights notable differences across markets. Taking the United States and the euro area as examples, 2025 was characterized by marked differences between the U.S. and European equities. We note, for example, marked divergences in the performance of major sub-segments such as growth and value, which have shown opposite relative performances on either side of the Atlantic. Telecommunications stocks performed well in the United States, while delivering disappointing returns in Europe. Conversely, the financial sector thrived in the euro area but underperformed in the U.S. market. This heterogeneity reflects very different underlying dynamics across the main equity markets, despite an overall optimistic backdrop.

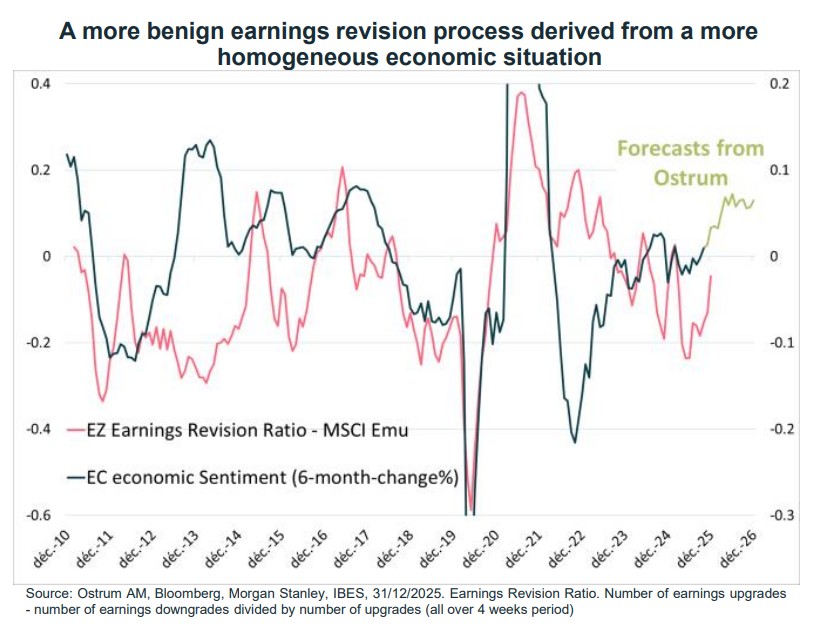

The outlook for European equities in 2026 appears encouraging, with a growing consensus around an improvement in macroeconomic indicators. Conditions in the euro area should be supported by the delayed effects of interest rate cuts as well as by generally expansionary public budgets. These factors are expected to translate into a positive inflection in earnings forecasts, particularly in cyclical sectors, which have been under significant pressure in recent months. We expect profit growth of 8% in 2026, a marked improvement compared with the 1% recorded in each of the past three years.

Nevertheless, it should be noted that analysts’ consensus is forecasting earnings growth of around 15% in the euro area for 2026, projections that appear to reflect an excess of optimism.

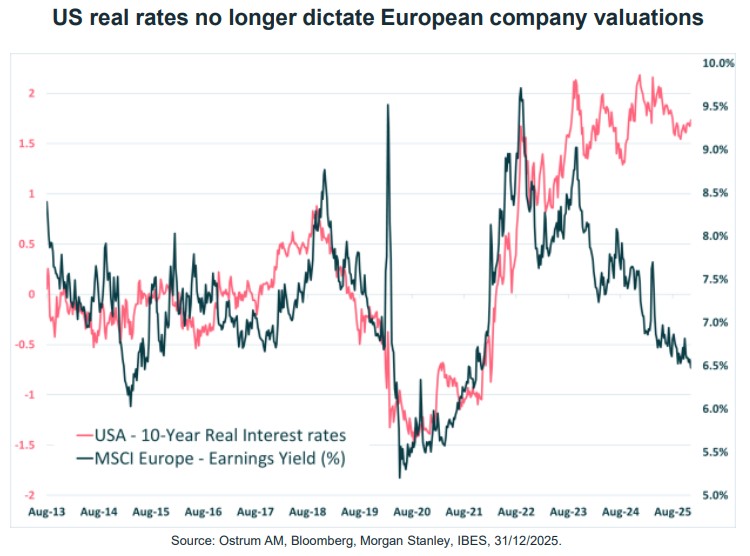

A crucial element of our current expectations relates to asset valuations. Over the past three years, euro area markets have recorded an overall appreciation of 90%, despite a marked stagnation in profits. This situation raises questions about the sustainability of current valuation levels, particularly when considering the growing divergence between real interest rates in the United States and the expected level of equity returns in the euro area.

European Equity Market Scenarios for 2026

Despite this uncertainty, our central scenario assumes market gains of around 8%, broadly in line with earnings growth. This scenario rests on the assumption that valuation multiples remain stable. The start of 2026 should remain well oriented, supported by sustained appetite for the asset class. Volatility could increase during the first half of the year to 20%, compared to the currently very low level of 15%.

Our downside scenario would result in a 15% decline, reflecting a more destabilized global economy than anticipated, driven by challenges to the existing world order. Our upside scenario, which would imply potential gains of 20%, would reflect a stronger economic response to the expected decline in U.S. interest rates and to broadly supportive fiscal policies across the main developed economies.

At the beginning of the year, during which we expect a phase of consolidation, we are adopting a defensive approach, for example by emphasizing investments that enhance shareholder returns. At the same time, close attention will need to be paid to developments in valuation multiples, whose resilience will depend on the achievement of earnings expectations.

Asia Equities in 2026: “Same, But Different!”

A popular Thai catchphrase that resonates across Asia may well encapsulate this year's playbook: 'Asia ex-Japan delivered a vintage year in 2025, leaving many to wonder if it can be repeated in 2026’.

At Ostrum, we believe that the fundamental investable question for 2026 is not, 'Will Asian equities go up?' but rather, 'Will investors continue to play last year’s winners as if they are still in the same early life cycle stage?' We believe the answer lies in recognizing that valuations have reflated and that investment themes are now more precise. In this context, investors should shift their focus from top-line growth to solid margin expansion and overall profitability.

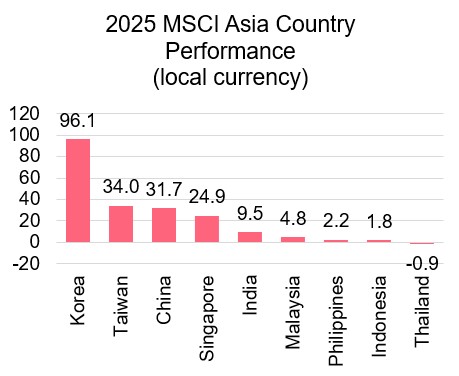

There is a risk that the winners of 2025 may have become crowded trades. Our view is that the next leg of equity market performance will be more earnings-led, with a significantly higher premium placed on breadth, selectivity, and risk control. The MSCI Asia ex Japan index gained 33% in 2025, outperforming the MSCI World by 11.4 bp.

Perhaps more interesting is how this happened. According to a recent Goldman Sach’s report, the MSCI Asia Pacific ex Japan index returns were powered by 12% earnings growth and a 13% valuation expansion with modest FX tailwinds of 2% versus the US dollar.

Dispersion was extreme: Korea (+96%) versus Thailand (-0.9%) and India (+9.5%) which created a wide gap within an index that looked “one way” in aggregate.

Source: MSCI as at 31/12/2025.

In China, the PBOC's record liquidity injections helped drive the 2025 equity rally despite weak real sector fundamentals. The "anti-involution" campaign aimed at reducing destructive price competition and improving corporate margins helped the MSCI China index gain almost 32%. China continues to transition with "new growth engines" as its economy shifts from property-led investment to consumption, technology, and global expansion. China's pragmatic focus on integrating Artificial Intelligence across every sector of its economy, utilizing low-cost, open source models, stands a higher chance of yielding productivity gains. As a result, we expect the economy to emerge as a real winner. Key policy priorities also include the 15th Five-Year Plan emphasizing innovation, green transition, and domestic consumption.

South Korea was among the standout performers in 2025, driven by its leverage to the global semiconductor and AI supply chains. Equity momentum re accelerated in line with global semiconductor sales, while valuations remained more reasonable than in other North Asian technology markets. Taiwan delivered strong absolute returns but lagged S. Korea on a relative basis.

Performance was increasingly constrained by valuation expansion and heavy index concentration in a small number of mega cap technology names, leaving the market vulnerable to any moderation in Artificial Intelligence enthusiasm going forward.

In contrast, India suffered its worst relative performance in thirty years against Global Emerging Markets, despite posting a +9.6% gain. Market-implied expectations for India have been modest, which can be attributed to lower GDP growth expectations, earnings downgrades, rupee weakness, sustained foreign divestment, and peak equity supply. However, we remain constructive on India due to its long-term structural growth drivers, including demographics, digitalization, and domestic demand potential.

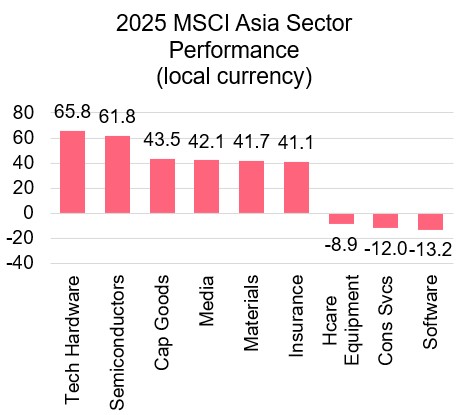

In 2025, the Artificial Intelligence and semis complex did much of the work for portfolios: high operating leverage to a global cycle, a clear narrative, and persistent upgrades. Sector leadership was highly concentrated with Tech Hardware (+66%) and Semiconductors (+62%) serving as the defining driver while Software & Services (-13%) lagged — creating an unusually wide internal spread. Similarly, Media within Communications gained +42%, while Consumer Services such as ecommerce, online travel and education fell (-12%).

Source: MSCI as at 31/12/2025.

In 2026, while the thematic drivers from 2025 persist, the bar is now much higher, and portfolios require a tighter leash. Factors such as higher base effects, increased scrutiny of end-demand, and greater sensitivity to policy and geopolitics are at play. Volatility can quickly punish crowded exposures.

We believe that our Growth at a Reasonable Price philosophy, which invests across the corporate life cycle, provides much-needed diversification, allowing us to focus on companies that are delivering sustainable value creation or transitioning from lower to higher levels of value creation. As it stands, we plan to maintain exposure to structural AI beneficiaries while funding this with under-owned domestic demand and balance-sheet compounders, rather than simply rotating into lower-quality cyclicals that lack pricing power and are trading at high market-implied expectations. We are also wary of policy-dependent trades as there is no evidence that there will be a conversion into shareholder value.

We expect the market to be less forgiving of stories without revisions and therefore believe that positioning should be tied to observable signposts, such as EPS upgrade cycles, capex orders, and consumer recovery indicators.

Global Equities in 2026: “A promising yet high-risk environment”

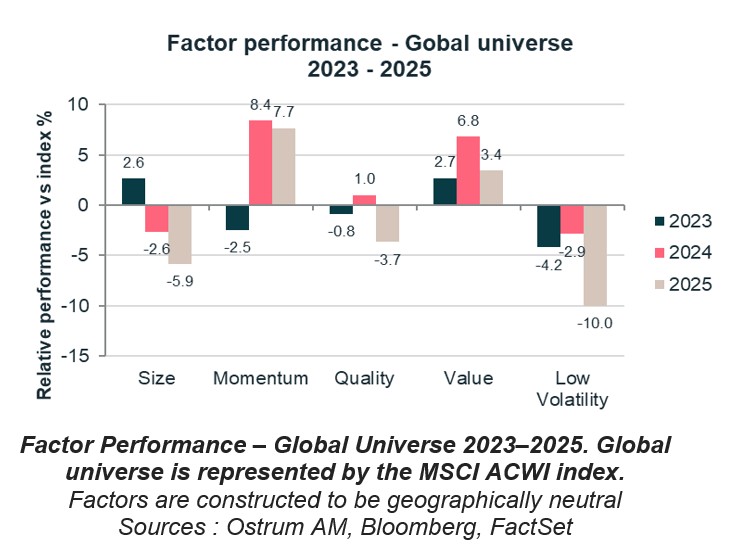

2025 ended by largely extending the major trends observed in 2024. From a factor perspective, the global market presents a similar picture, marked by the continued outperformance of specific themes and significant dispersion.

First, 2025 once again confirmed the overwhelming dominance of the Momentum factor, which delivered a relative performance of +8.4% globally. This trend, already very pronounced in 2024 (+7.7%), contrasts with the ongoing relative underperformance of Low Volatility and Size factors, which have fallen to historically low levels relative to the market since the pandemic.

Notably, this Momentum dominance occurred in an environment of exceptionally low rotation among factors. Despite heightened volatility at the start of 2025 (1-month volatility of the MSCI ACWI reached 37% in April, the highest level recorded since Covid), the overall Momentum turnover—typically elevated—reached its lowest level in 20 years, i.e. two standard deviations below its historical average. In other words, the advance of winning segments (semiconductors, European banks and defence, and mining stocks) unfolded in a largely uninterrupted manner.

Where we stand: a sense of “déjà vu”

To better understand the current market environment, the conventional approach is to examine valuation multiples. They send a uniform signal: the US market has returned to levels seen at the peak of the dot com bubble, while the rest of the world (MSCI ACWI ex US) is trading at the 90th percentile over the past 30 years.

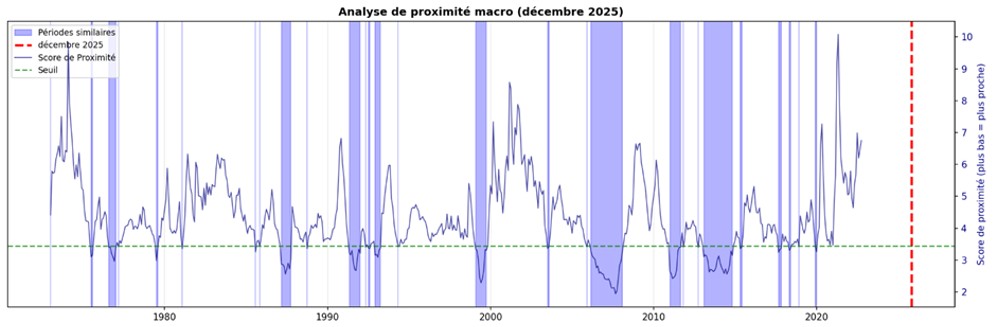

It is therefore appropriate to adopt a complementary approach, stepping away from valuation metrics to assess market conditions. To this end, we have developed a “macroeconomic proximity score”, calculated monthly since 1970. This indicator compares a broad range of variables (yield curves, commodities, diffusion indices, volatility, correlations, factor performance, etc.) at the end of December 2025 with each historical monthly configuration.

After excluding the two most recent years to guaranty the consistency of the analysis, it appears that among the periods best describing the current context, the closest are 1999 (mainly from May to August) and 2007 (mainly from March to October).

Analyse de proximité (décembre 2025)

Sources : Ostrum AM, Bloomberg, FactSet, FRED

Interpreting this resemblance is crucial. Both periods—late 1999 and much of 2007—were supportive market environments over the short term. However, they are both final stages of major bull markets, immediately preceding the severe corrections of 2000–2002 and 2008. This represents a complex configuration for investors, in which short-term gains must be weighed against a higher probability of increased volatility over the medium term.

The convergence of these two analyses leads to a central thesis for the year ahead. On the one hand, the market dynamics of 2025, dominated by strong and persistent Momentum, reflect investor confidence in established trends. On the other hand, the strong historical similarity with the pre crisis periods of 1999 and 2007 serves as a significant warning. While the current environment may remain supportive in the short term, it contains the seeds of future instability.

Market outlooks are often reduced to a single point estimate for the coming year: “the US market should rise by x%”, or “the CAC 40 will surpass 9,000 by yearend”. Unfortunately, such exercises completely ignore the stochastic nature of markets. Beyond the mean expectation, it is the distribution of potential future paths that must be considered in order to extract meaningful insights. Today, we are operating in an environment that remains supportive in the short term, but whose historical parallels point to increased dispersion of future returns and a significantly higher than normal probability of sharp corrections over the medium term. Risk analysis and selectivity will therefore be critical in approaching 2026, a year that could mark a meaningful break from recent trends.

Conclusion

In 2026, Ostrum AM’s central scenario anticipates a continued rise in U.S. markets of around +10%, supported by current momentum, although risks are expected to increase, particularly over the medium term. This outlook justifies a higher volatility premium, with the realized volatility of the U.S. S&P expected to average around 20% over the year. Such an environment could eventually trigger significant sector rotation, favouring the most defensive stocks that have been under pressure so far. Diversification and selectivity will remain key in 2026.

In Europe, our base case for 2026 anticipates a positive performance for European equity markets of around +8%, driven by earnings momentum and a broadly unchanged valuation environment, despite volatility that could reach 20%. In the near term, we keep a prudent stance, with a defensive bias toward stocks offering attractive shareholder returns and close attention to the consistency between earnings expectations and valuation levels.

After an exceptional year in 2025, Asia ex-Japan enters 2026 in a more mature and demanding environment. Performance concentration and rising valuations call for a renewed focus on fundamentals rather than a simple extension of past trends. In this context, selectivity, diversification, and investment discipline become essential.

With 27 billion euros in equity assets and over 40 years of experience, Ostrum AM has the experience, strategies and expertise to support investors in their equity management. Our team of analyst-portfolio managers, portfolio managers, allocators, and Solutions experts is backed by more than 50 research specialists, allowing us to analyze equity market opportunities more effectively and identify the right solutions for each investor.