Quarterly publication / January 2026

Analyses and data as of 14/01/2026

Marketing communication for professional investors in accordance with MIFID II

MARKETS OVERVIEW

SO FAR, SO GOOD IN THE MARKET

The United States' military intervention to extradite Nicolas Maduro marks a new phase in the Cold War between China, which imports 5% of its crude oil from Venezuela, and the United States, which seeks to limit Chinese influence in the southern part of the continent. Iran, Ukraine, Greenland, and even Nigeria present potential theaters for confrontations. The increasingly tense geopolitical situation contrasts with the performance of risky assets.

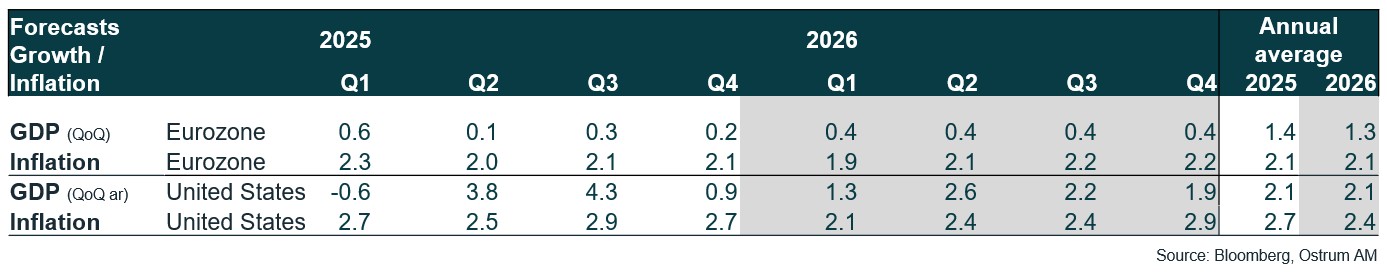

Economically, growth in the United States remains driven by investments in AI and consumption from the wealthiest households. However, the labor market indicates a continuous deterioration since spring. In the Eurozone, a recovery is becoming clearer in Germany, where the industry benefits from more robust orders and a decrease in energy prices. China remains committed to a policy of reducing overcapacity in an effort to lessen deflationary pressures.

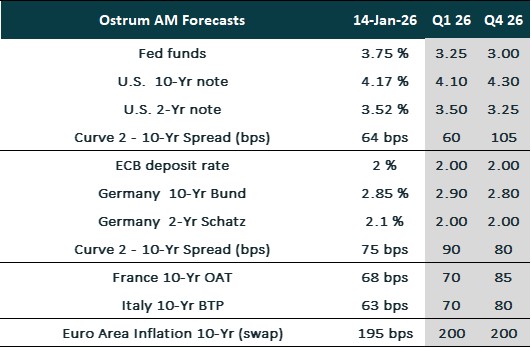

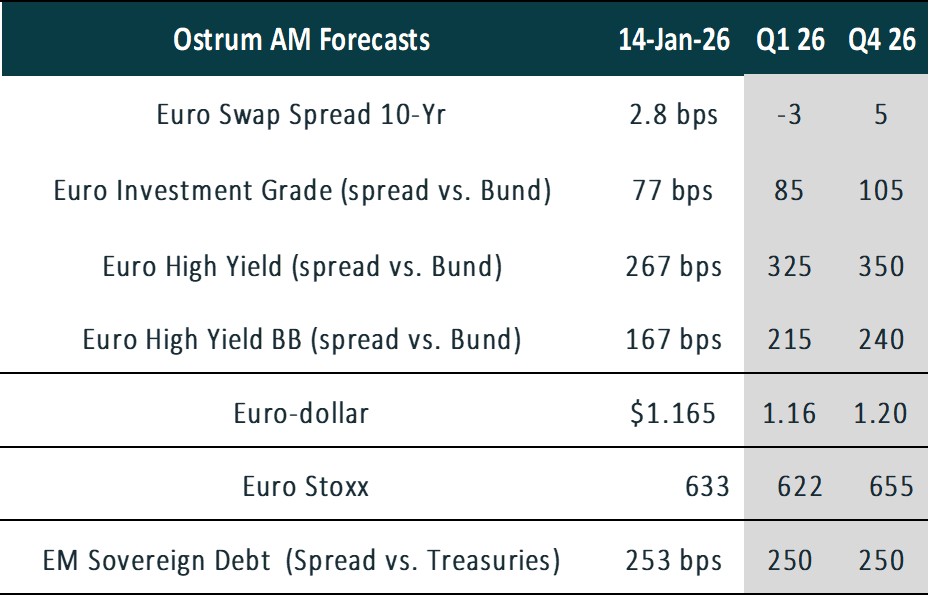

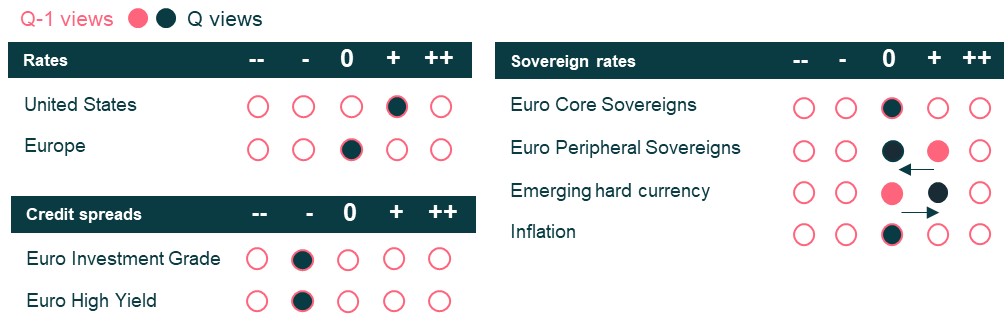

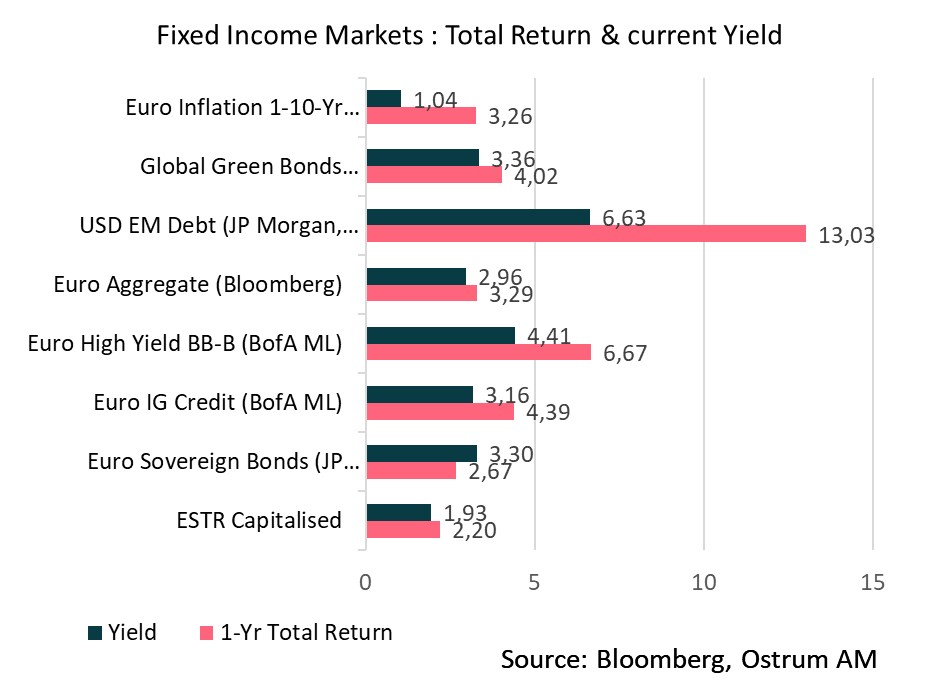

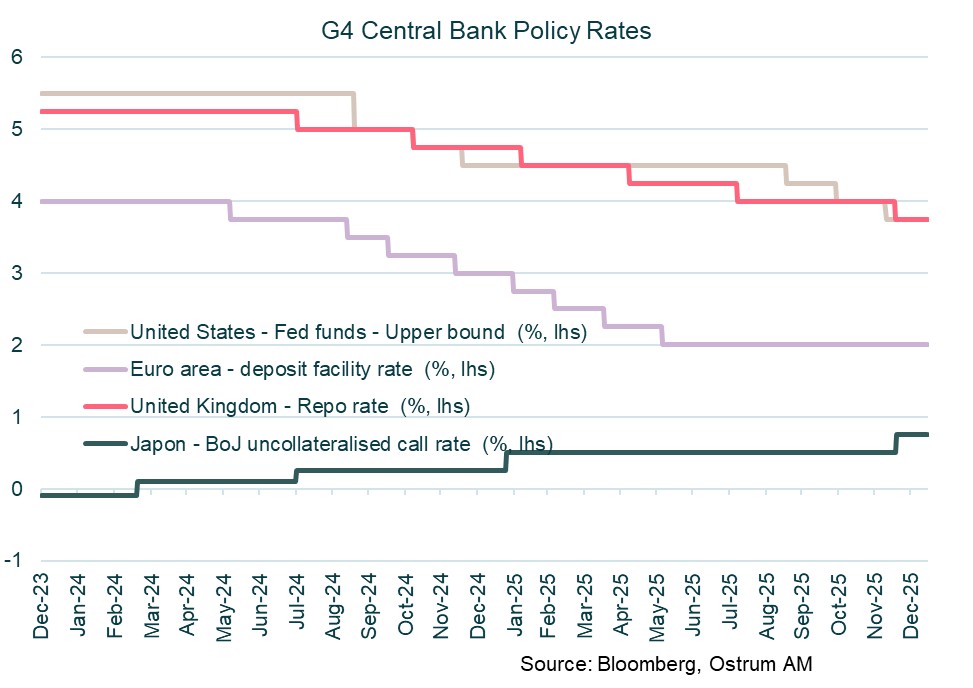

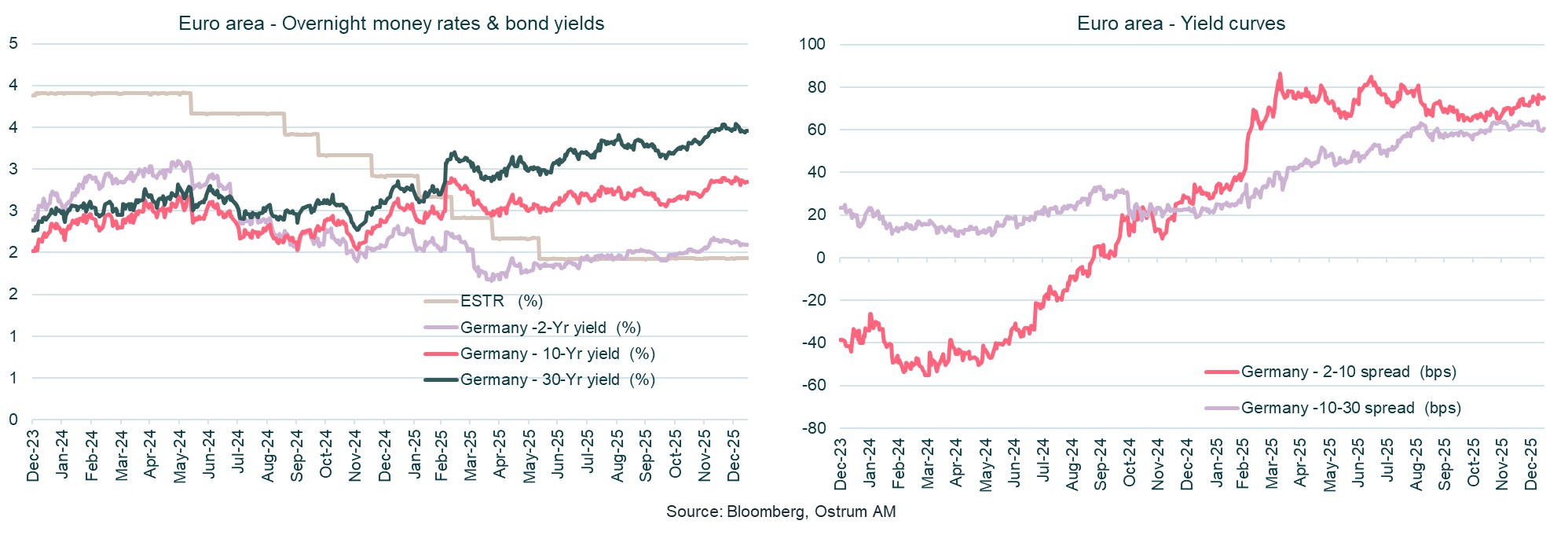

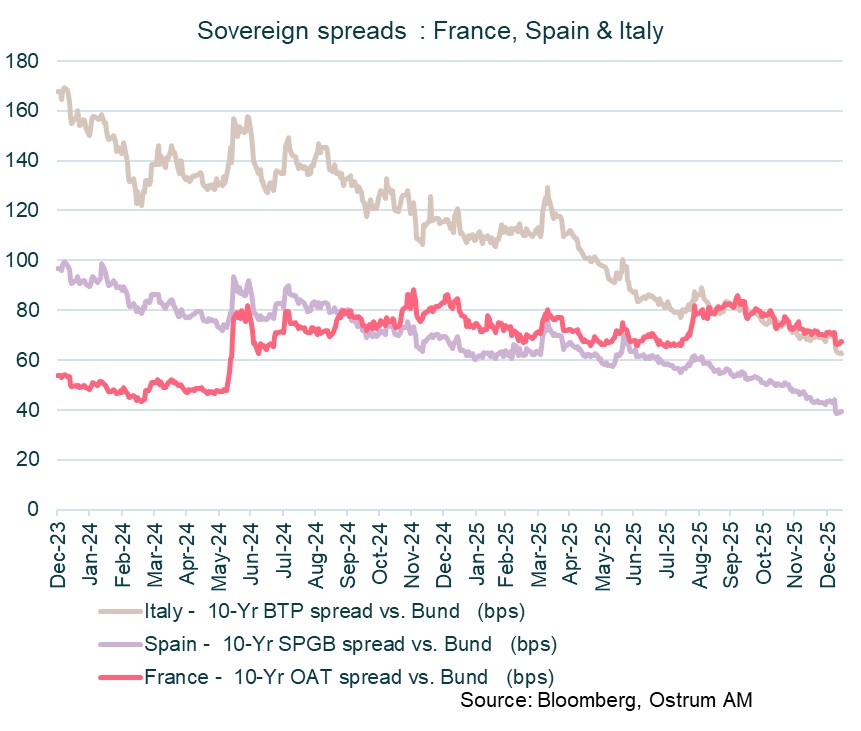

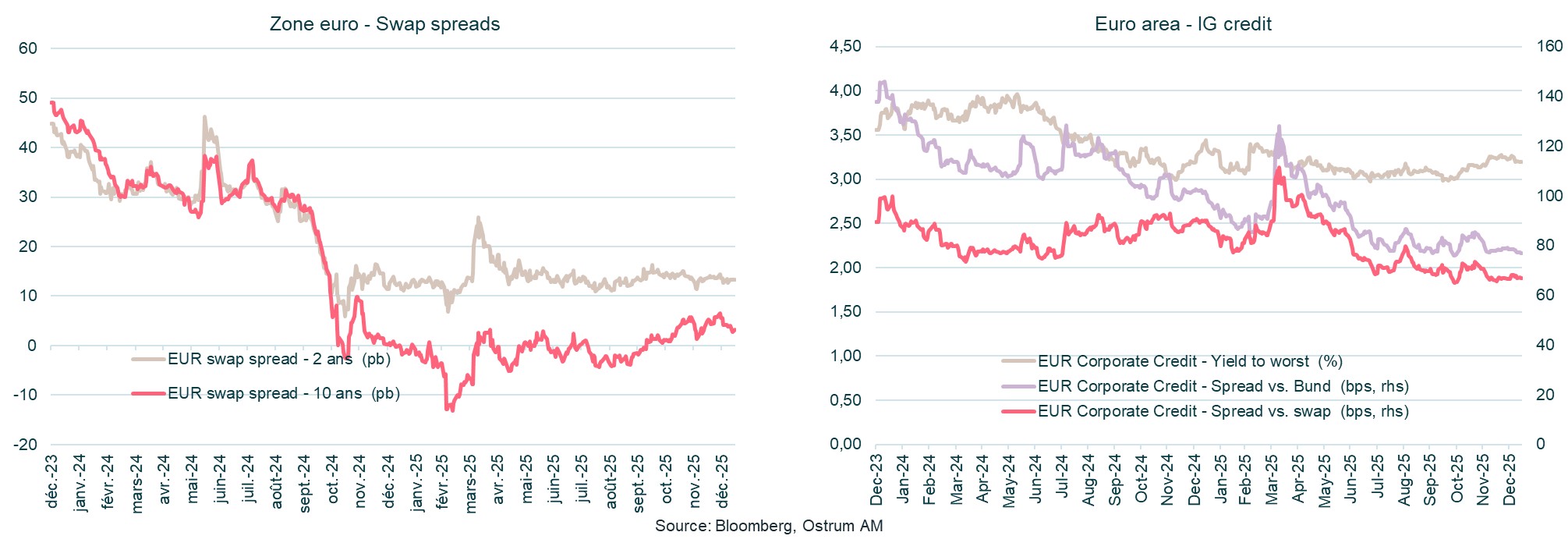

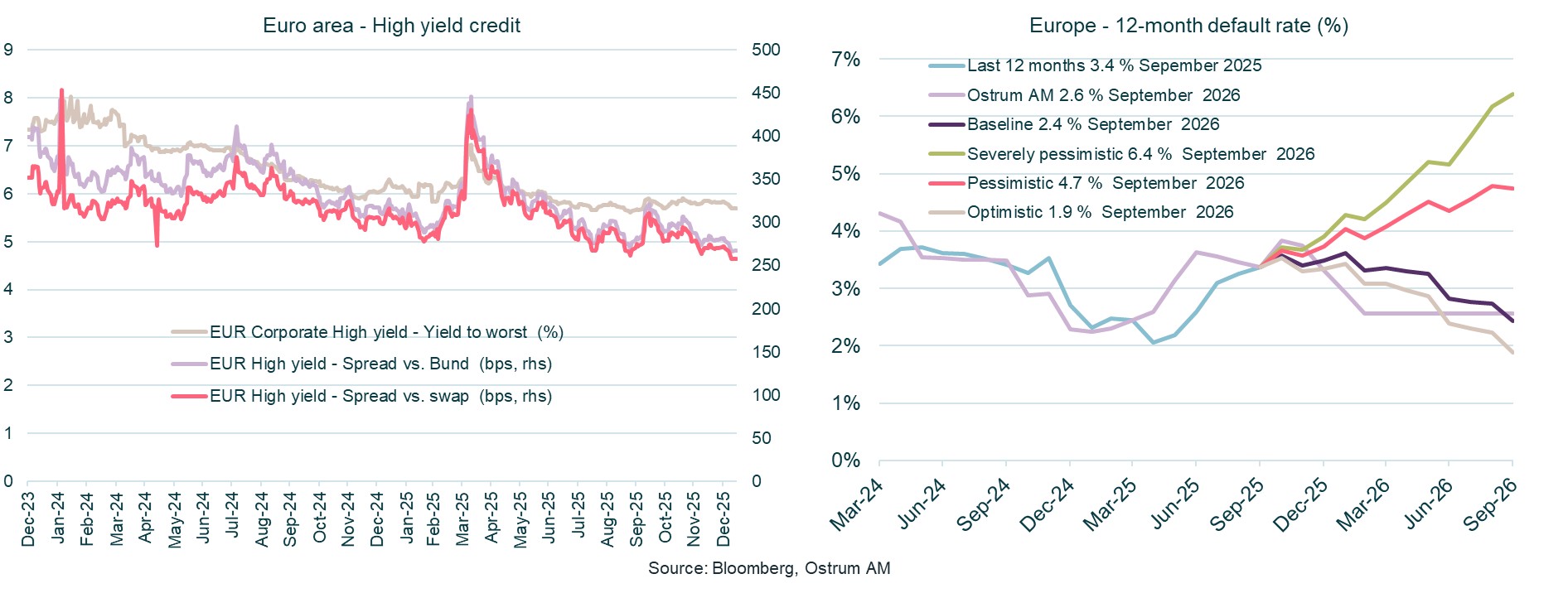

Regarding central banks, the Fed is expected to continue easing, although the succession of Powell may slow the adjustment of rates. Persistent tensions in the money markets now necessitate monthly purchases of T-bills amounting to $40 billion. The ECB is likely to maintain the status quo unless there is a major shock. In contrast, the Bank of Japan and the RBA seem inclined to raise their rates at a measured pace. In this context, 10-year rates are expected to fluctuate around current levels by the end of March. Appetite for sovereign debt appears intact. Despite the absence of a budget, the spread of the OAT has returned to its tightest levels since summer. Credit remains supported by low volatility and the strong financial health of companies. The reduced default rate continues to support high yield bonds despite stretched valuations. Stocks remain well-oriented, thanks to improved profit outlooks.

KEY INDICATORS

3 MONTH OUTLOOK ON BOND MARKETS

FIXED INCOME RETURNS & PERFORMANCES

GROWTH & INFLATION

GROWTH

- The activity data in the United States appears to indicate strong growth despite the stagnation in employment. Investment in Artificial Intelligence and consumption by affluent households are compensating for the evident difficulties in most sectors of the economy.

- The Eurozone is experiencing a gradual recovery, according to surveys. Germany is expected to show a better fourth quarter.

- The Chinese economy is slowing down, with lackluster domestic demand. The reduction of industrial capacity is continuing.

INFLATION

- In the United States, inflation is slowing down, especially since rental data will not be updated until April 2026. However, American households' inflation expectations remain relatively high.

- In the Eurozone, inflation was at 2% in December but is expected to decrease significantly in the first quarter, primarily due to falling energy prices.

- In China, inflation continued to rise in December to 0.8%, driven by an increase in food prices.

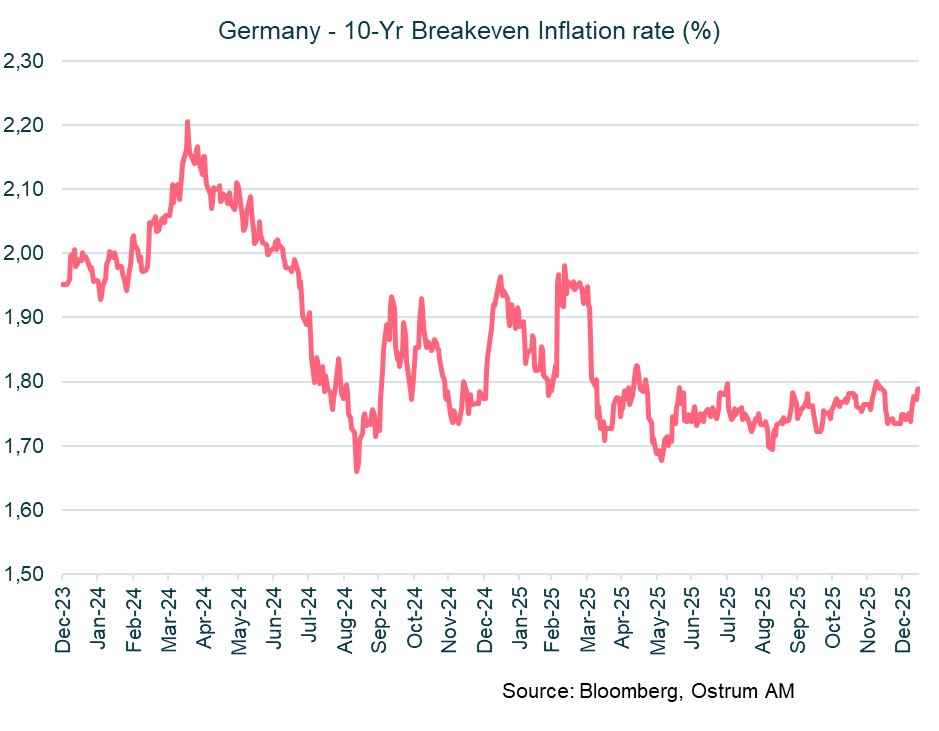

Eurozone inflation: Inflation expectations remain anchored around the 2% target.

CENTRAL BANKS RATES

MONETARY POLICIES

DIVERGENCE BETWEEN THE FED AND THE ECB

The Fed, becoming more divided, is facing increased pressure from the White House

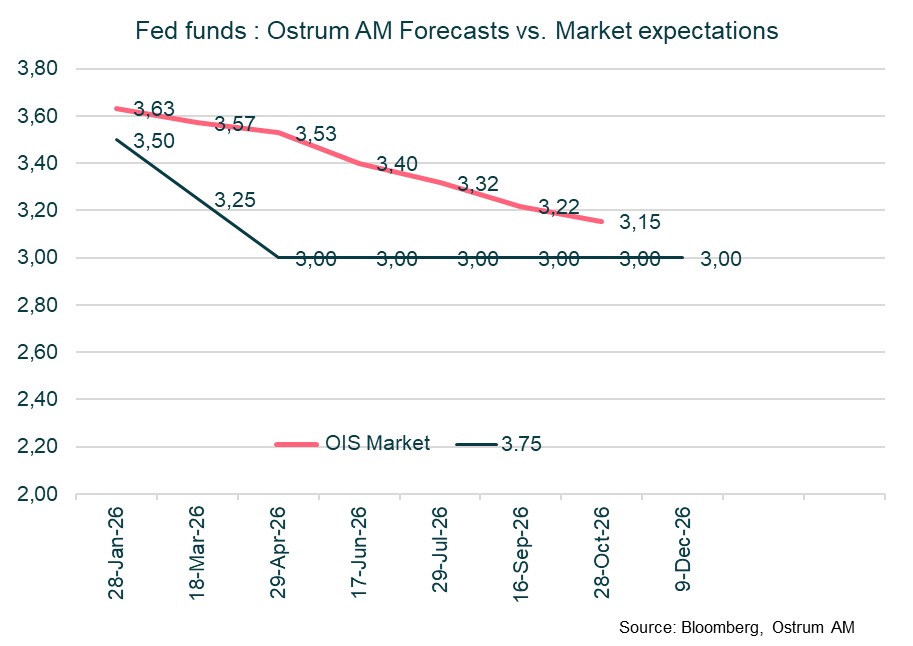

On December 10, the Fed implemented its third consecutive rate cut of 25 basis points, bringing the federal funds rate into the range of [3.50% – 3.75%]. This decision was motivated by heightened downside risks to employment. Inflation risks remain oriented upward, but the impact of tariffs is considered to be temporary. Significant divisions have emerged within the FOMC, with two voting members preferring the status quo and a third advocating for a 50 basis point cut (Stephen Miran). After halting its balance sheet reduction since December 1, the Fed decided to purchase $40 billion per month in short-term securities (primarily T-Bills) starting December 12, in order to maintain ample levels of bank reserves and limit tensions in the money market. At the same time, pressures from the Trump administration on the independence of the Fed are intensifying. Given the ongoing deterioration in the labor market and significant risks in the housing market, we anticipate three rate cuts in 2026. The timing of the first rate cut is more uncertain due to the mixed employment report for January, which indicated a decrease in the unemployment rate to 4.4% in December.

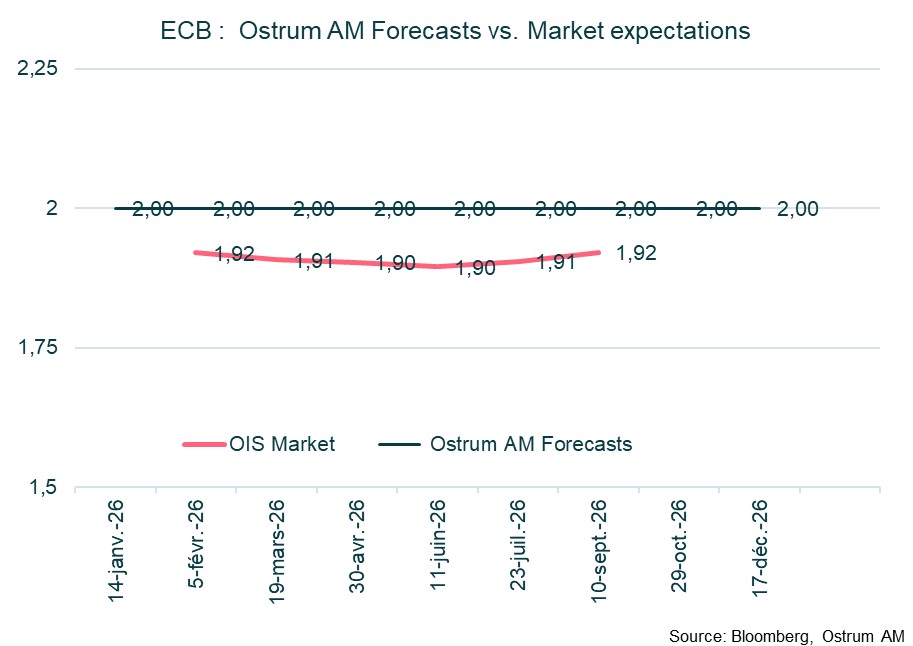

Extended status quo of the ECB

For the fourth consecutive time, the ECB kept its rates unchanged during the meeting on December 18, deeming itself to be in a comfortable position given the resilience of growth and inflation expected to remain close to 2% in the medium term. Growth prospects were revised upward, along with inflation expectations, particularly underlying inflation, due to a slower-than-expected deceleration in wages. The threshold is high for a potential final rate cut (shock to growth). The ECB is also continuing to reduce the size of its balance sheet through the non-reinvestment of maturing assets. It is expected to maintain the status quo until the end of 2026.

INTEREST RATES INDICATORS

EURO SOVEREIGN BONDS

- U.S. Rates: The Fed may continue to cut rates though the outlook for easing is now more uncertain. The end of quantitative tightening (QT) and the resumption of T-bill purchases are mitigating upside risks on long-term bonds.

- European Rates: The ECB is expected to maintain the status quo at 2% until 2026. The 10-year Bund is projected to reach 2.90% by the end of Q1.

- Sovereign Spreads: Short-term political risks in France are easing, but they are expected to resurface later in the year. The trend of tightening BTP spreads (Italian bonds) is also likely to moderate after a very strong start of year.

- Mixed performance across maturities: In 2025, shorter maturities (1-3 years) showed relatively strong returns across most countries, with Austria and Italy leading at 2.30% and 2.71%, respectively. Longer maturity bonds (10 years and over) suffered, displaying negative returns for countries like Germany and Austria.

- Italy’s outperformance: Italy's sovereign bonds delivered the best overall performance in the Euro area for both 2025 (3.21%) and Q4 2025 (0.92%), particularly in the mid-term maturities. This robust performance may reflect improved investor sentiment towards Italy’s economic fundamentals.

- Greece’s notable gains: Greece demonstrated resilience with a total return of 2.12% for the year and 0.63% in Q4, outperforming many of its Eurozone peers.

- Weakness at the long-end of the curve: The long-end of the curve (10 years and over) exhibited significant losses across various countries, such as Germany (-8.72%) and Belgium (-5.72%) for the full year.

EMERGING BONDS

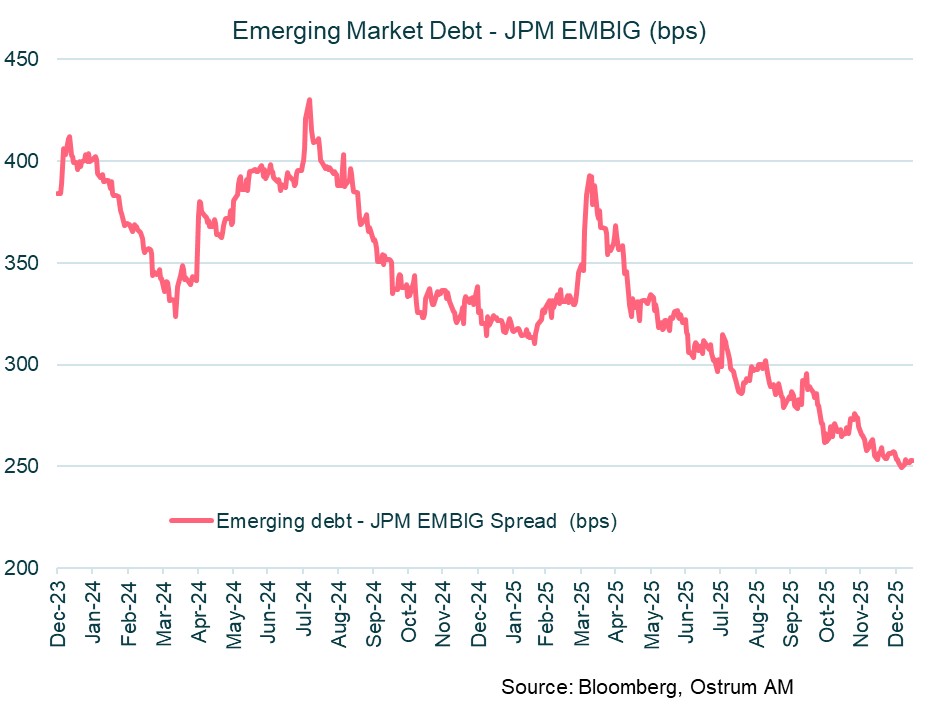

Emerging market spreads are likely to remain tight in the short term, thanks in part to the Fed's easing measures.

Solid overall returns for emerging market bonds

- Solid overall returns for emerging market bonds: The JP Morgan EMBI Global Diversified Index (EMBIG) achieved a total return of 3.29% over the last quarter and a notable 14.3% in 2025. This consistent performance signifies a robust appetite for emerging market bonds as investors seek higher yields compared to developed markets, particularly in a favorable economic backdrop.

- Next GEM strategy shines: The "Next GEM" segment (new generation of emerging markets, often out of the biggest EM countries like China, India and Brazil) outperformed other categories with a strong total return of 7.17% in the past quarter and an impressive 20.16% last year. Many High Yield issuers have fared exceptionally well last year.

- Best/Worst performers in Q4: Argentina, Venezuela and smaller Latam countries outperformed significantly in Q4. In contrast, GCC issuers (Gulf Cooperation Council) and other oil-producing countries fared poorly. Senegal bonds fell on political instability.

- Narrowing credit spreads indicate improved sentiment: The EMBIG saw a significant spread tightening of 11 basis points over the last quarter and 72 bps for the full year. This reduction in spreads reflects improved sentiment toward emerging market debt, which can be attributed to heightened investor confidence amid stabilizing economic conditions and positive outlooks for several emitting countries.

CREDIT INDICATORS

EURO INVESTMENT GRADE CREDIT

Investment-grade credit spreads have tightened significantly, though a gradual widening is likely to occur.

- Overall index and sector performance in Q4: The ICE BofA ML Euro Corporate Index reported a modest return of 0.25% in Q4, reflecting a slowdown in momentum compared to earlier in the year. Key sectors like autos (0.66%) and retail (0.46%) performed decently last quarter, but several sectors, including leisure (-0.02%) and media (-0.39%), faced losses.

- Strong performance from financial sector: The financial sector led the total returns within the corporate index, achieving an impressive overall return of 3.53% in 2025 and continued outperformance in Q4. Notably, subordinated financial instruments saw significant gains, with a total return of 4.63% in 2025 and 0.56% in the last quarter.

- Mixed results across corporate sectors: Performance varied widely among different corporate sectors. While the auto group posted a solid return of 3.79%, sectors like healthcare (1.86%) and media (1.83%) underperformed significantly last year, reflecting industry-specific challenges.

- Subordinated debt outperformance: Subordinated debt consistently delivered higher returns compared to their senior counterparts across various sectors. For example, subordinated insurance returned 0.49% in Q4 while senior insurance only reached 0.11%. This trend indicates appetite among investors for higher-risk, higher-return opportunities within the corporate bond market.

EURO HIGH YIELD CREDIT

Valuations in the high yield segment are expected to normalize over the year. However, the default rate remains contained and below the historical average.

Robust Overall Performance

- Robust overall performance: The ICE BofA ML Euro High Yield Index achieved a strong total return of 5.15% in 2025 and 0.52% in Q4, reflecting favorable market conditions for high-yield bonds.

- Fallen angels stand out: Among the different categories, Euro Fallen Angel High Yield bonds outperformed with an impressive return of 7.03% for the year and 1.35% in Q4. This suggests that investors are capitalizing on the recovery potential of bonds that have recently been downgraded to junk status.

- Mixed returns within financial and non-financial sectors: The financial high yield category lagged significantly behind other segments, posting a return of only 3.87% in 2025, with a negative return of -0.15% in Q4. In contrast, the Euro Non-Financial High Yield segment performed exceedingly well with total returns of 5.28% and 0.60% respectively.

- Shorter maturities offer stability: The 2-4 Year Euro High Yield segment delivered a quarterly return of 0.22%, which is solid yet lower than the 4-6 Year Euro High Yield category at 0.64%. This trend suggests that while shorter-duration high-yield bonds provide relative stability, investors are still rewarded for taking on slightly longer maturities.

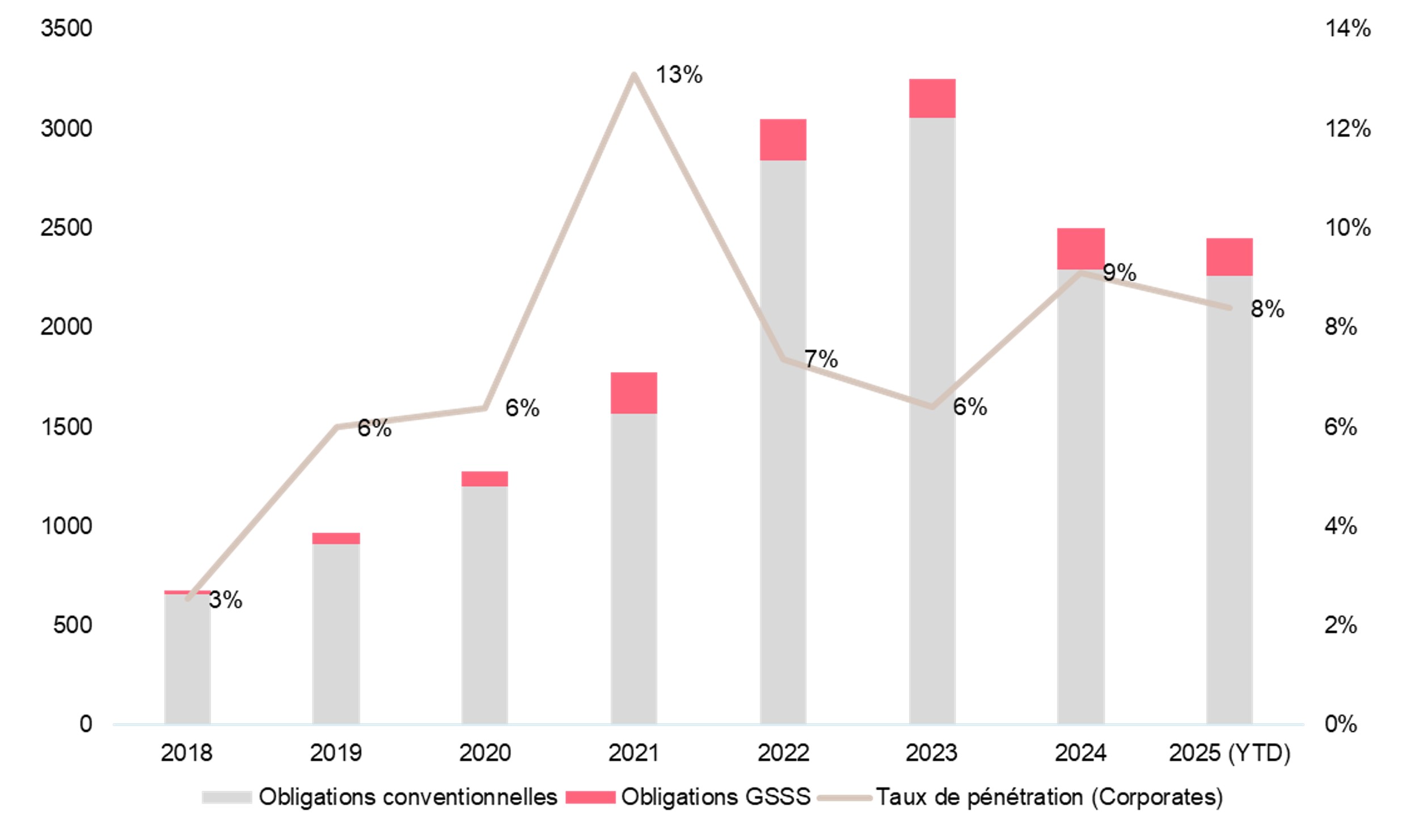

FOCUS ON SUSTAINABLE BONDS

QUARTERLY GRAPH

Evolution of the sustainable bond penetration rate (Europe)

Evolution of the penetration rate of sustainable bonds between 2018 and the estimated end of 2025, for the Corporate sectors (excluding governments and assimilated), in the European zone.

- COP 30, the United Nations global climate conference, took place last month in Brazil, with the main objective of accelerating the implementation of the Paris Agreement. The discussions resulted in a consensus text that strengthens cooperation and financing for vulnerable countries while emphasizing a just transition. However, the lack of clear binding commitments on phasing out fossil fuels led many observers to conclude that the outcome was useful but insufficiently ambitious.

- The European Central Bank (ECB) has imposed an unprecedented fine of €187,650 on the Spanish bank Abanca for shortcomings in its management of climate change-related risks. This is the first sanction of this kind, highlighting the ECB's commitment to enhancing supervision of banking practices related to climate risks.

- The Sustainability-Linked Bonds (SLBs) asset class is struggling to convince sustainable issuers. In the third quarter, only €0.68 bn were issued in Europe, representing a 77% decline compared to 2024. In the first nine months of 2025, Italian companies, with €5.5 bn, significantly dominated the market, while French companies issued €2.2 bn.

- Climate Transition Bonds (CTBs), are bonds intended to finance the gradual reduction of emissions from carbon-intensive issuers. They are defined and governed mainly by ICMA (International Capital Markets Association) through the Climate Transition Finance Handbook and the Green Bond Principles. Their credibility relies on a measurable transition pathway aligned with the Paris Agreement, rather than the immediate "green" nature of the financed projects.

- Green bond issuance from European REITs has been particularly active in recent weeks. Two new issuers, Klépierre and Warehouses de Pauw, entered the market with their first green bonds, both of which were well received by investors. Proceeds are mainly allocated to highly energy-efficient buildings, supporting the decarbonization of the real estate sector.

2026 OUTLOOK

Prepared on December 1, 2025

MACROECONOMIC OUTLOOK

After more than three decades of ‘great moderation,’ markets are entering a new phase where global economic balances are being redrawn. At the same time, new structural drivers are emerging: The rise of artificial intelligence, whose economic impact now extends beyond the technology sector alone, and monetary innovation, which is reshaping the framework for economic actors, most notably central banks.

The combination of these developments raises a key question for 2026: we are in a transitional phase, or is this the beginning of a real economic and financial regime breakdown?

In the US, Donald Trump's return to the White House has significantly increased economic uncertainty in the United States, weighing on growth and employment, with the notable exception of the artificial intelligence sector. AI is expected to contribute nearly half of US growth in 2025, at the cost of a marked crowding-out effect on the rest of the economy: concentration of funding, pressure on energy costs and a general slowdown in non-technology activity.

This two-speed growth is expected to persist in 2026, remaining below its potential of 2%. The risk of an AI-related bubble bursting and the deterioration in consumer credit quality are the main downside factors. Inflation is nevertheless expected to moderate from the spring onwards, while unemployment will continue to rise.

However, the US Supreme Court's expected ruling in the first quarter on the legality of tariffs could change the trajectory of global trade: a forced de-escalation would pave the way for a rebound in trade.

- In the Eurozone, the economic recovery is gaining momentum, driven in particular by investment plans in Germany, which will run a public deficit of more than 3% of GDP for the foreseeable future. This stimulus will partially offset the expected consolidation in France, enabling European growth to remain above 1%, thanks in particular to Spain. Inflation is expected to remain slightly above 2% due to a still tight labour market and residual wage pressures.

- In China, the economy remains at a crossroads: weak domestic demand, industrial refocusing on advanced technologies, a contraction in the property market and increased deflationary pressures.

- On the monetary front, Jerome Powell will step down in May. The reshuffling of the Fed's Board of Governors should favour a more accommodative stance, with the Fed funds rate expected to be around 3%.

- In the Eurozone, the ECB is expected to maintain its deposit rate at 2% while continuing its quantitative tightening. If inflation persists, a rate hike could be considered in the fourth quarter.

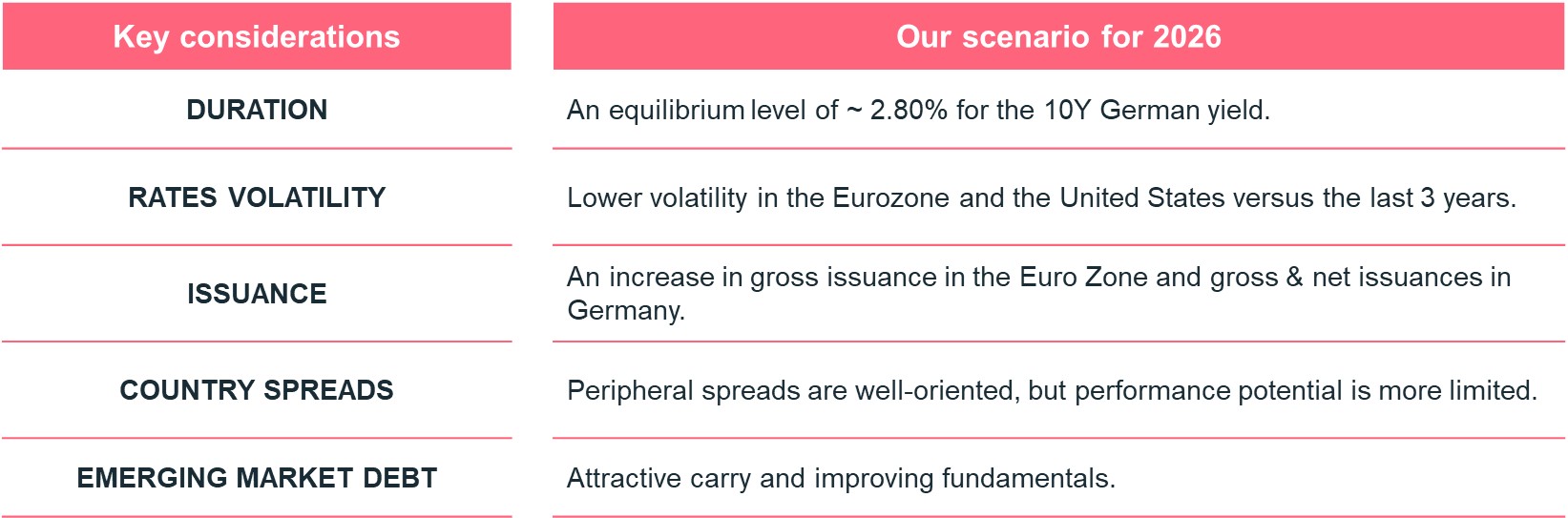

2026 FIXED INCOME OUTLOOK

An asymmetric environment between Europe, the United States and Emerging markets:

- Decline in volatility of euro rates;

- Peripheral spreads continue to perform well but with limited potential for performance;

- US rate environment remains volatile and uncertain.

- In Europe, German 10-year bond yields are expected to evolve in a context of reduced volatility in 2026, with bullish and bearish factors offsetting each other.

- The ECB's monetary status quo will help anchor the short end of the curve, automatically benefiting 10-year bonds via the associated slope and carry/roll-down.

- However, upward pressure will remain, linked to the increase in gross and net issuance in Germany, as well as the effects of the Dutch pension fund reform, which will mainly affect long maturities. Investors' growing disinterest in very long maturities should accentuate this trend. After a steepening of around 40 basis points on the 10-30 year segment since the beginning of 2025, a further rise of around 20 basis points is expected in 2026.

- In the United States, the outlook for long-term interest rates remains more uncertain. The Fed's monetary policy appears less transparent than that of the ECB. Persistent inflation could slow the cycle of rate cuts..

- According to Ostrum AM, France's spread should remain around 80 bp, reflecting a more fragile fiscal and political situation.

- In an environment that remains supportive for risk assets, emerging markets are benefiting from a favourable growth differential compared to developed countries, and from a steady improvement in their sovereign ratings.

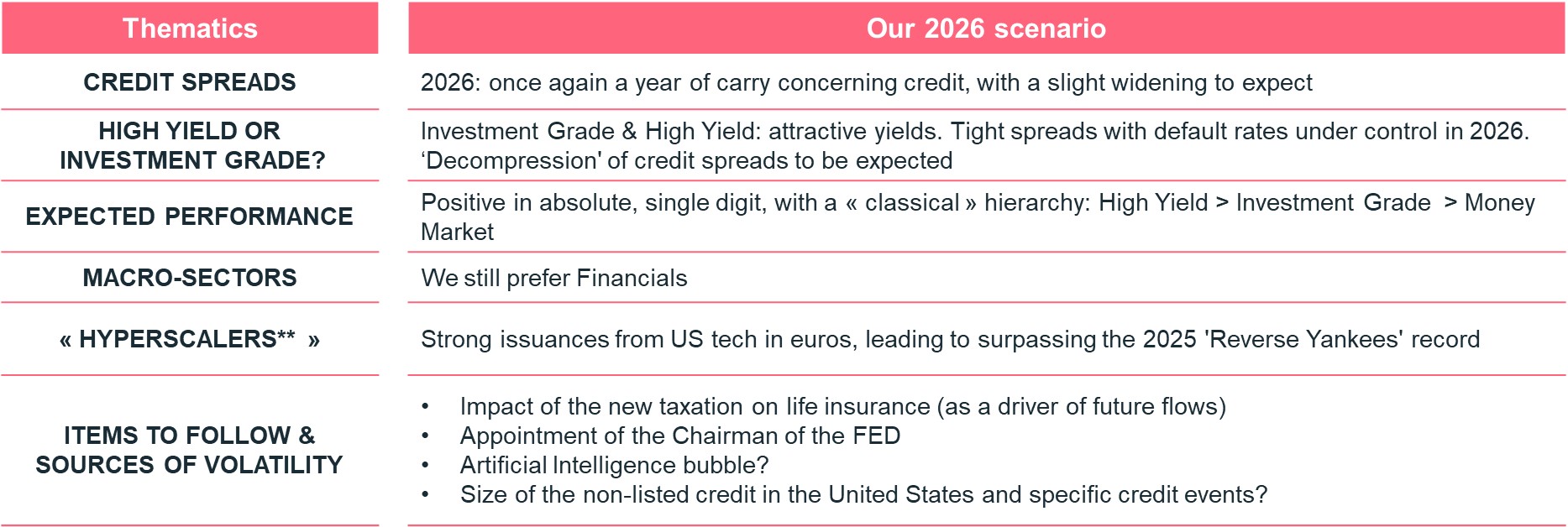

2026 CREDIT OUTLOOK

Market still supportive:

- 2026: Carry, again;

- Peripheral spreads continue to perform well but with limited potential for performance;

- Risk management not to be underestimated.

- On the Credit market, 2026 should closely resemble 2025. Current fundamentals support credit, which will be a preferred bond asset for next year according to Ostrum AM: moderate growth in Europe, inflation close to the ECB's target, stable credit quality, controlled leverage and contained default rates. Philippe Berthelot believes credit bonds offer attractive yields, even if spreads appear less generous than in the past. In addition, monetary stimulus should ease over the course of the year.

- Reverse Yankee* issuances are expected to reach a new record in 2026, driven in particular by the massive investment needs of hyperscalers** in Artificial Intelligene. At the same time, the size and opacity of the unlisted credit market, particularly in the United States, remain sources of uncertainty and volatility.

- However, upward pressure will remain, linked to the increase in gross and net issuance in Germany, as well as the effects of the Dutch pension fund reform, which will mainly affect long maturities. Investors' growing disinterest in very long maturities should accentuate this trend. After a steepening of around 40 basis points on the 10-30 year segment since the beginning of 2025, a further rise of around 20 basis points is expected in 2026.

- Ostrum AM maintains a preference for bank debt, whose slightly higher spreads could once again offer a more robust relative performance than that of non-financial issuers.

*Reverse Yankees: a strategy of borrowing in euros rather than dollars for a US company.

**Hyperscalers: large scale data centres specialising in providing large amounts of computing power and storage capacity to organisations and individuals around the world.

DASHBOARD - OSTRUM AM VIEWS

MACROECONOMIC OUTLOOK • EUROZONE AND UNITED STATES

MARKET VIEWS