Quarterly publication / January 2025

Analysis finalised on 17/01/2025 ; data as of 31/12/2024

Document for professional investors in accordance with MIF II.

MARKETS OVERVIEW

THE ELEPHANT IN THE ROOM

Donald Trump will assume office on January 20, and his influence over financial markets is set to amplify, as his rhetoric appears increasingly unchecked. The Trump administration's overt political interference with allied nations, including Canada, Germany, and the United Kingdom, along with its controversial statements regarding Panama and Greenland, represents a new source of risk. German elections are scheduled for February, Justin Trudeau has resigned, and Keir Starmer faces significant challenges.

Paradoxically, uncertainty surrounding the effects of international tensions and the anticipated increase in tariffs has bolstered American consumption and accelerated Chinese exports to the U.S. as the year draws to a close. The bilateral trade surplus for China has reached record highs, while the eurozone grapples with Germany entering recession for a second consecutive year. In France, the Bayrou government is already easing its budget consolidation efforts. China anticipates improvement as it awaits Trump's initial decisions, although the significant rise in crude oil prices poses an additional risk.

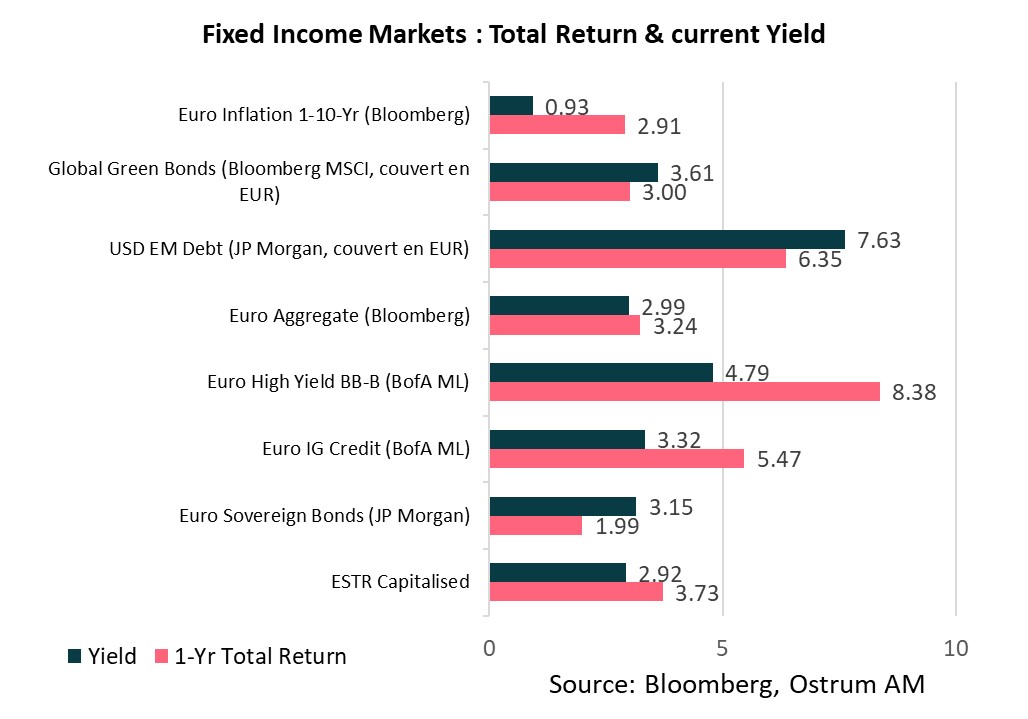

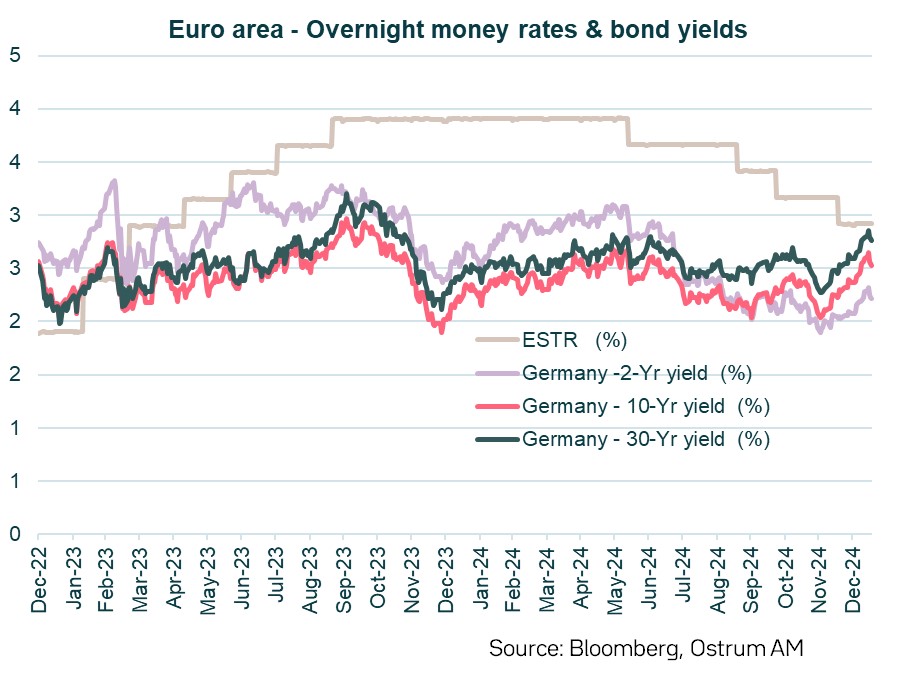

Long-term interest rates have risen sharply since the beginning of the year. Current levels are attractive, given that central banks—except for the Bank of Japan—continue to lower rates. Despite a heavy primary market in January, credit remains a safe haven, less sensitive to macroeconomic data and political tensions than interest rates and equities.

Stock markets are likely to be buffeted by political volatility and uncertainty from the Federal Reserve. Initial reports from American banks are reassuring, but valuations leave little room for error among major players. European equities receive some support from the weakness of the euro.

KEY INDICATORS

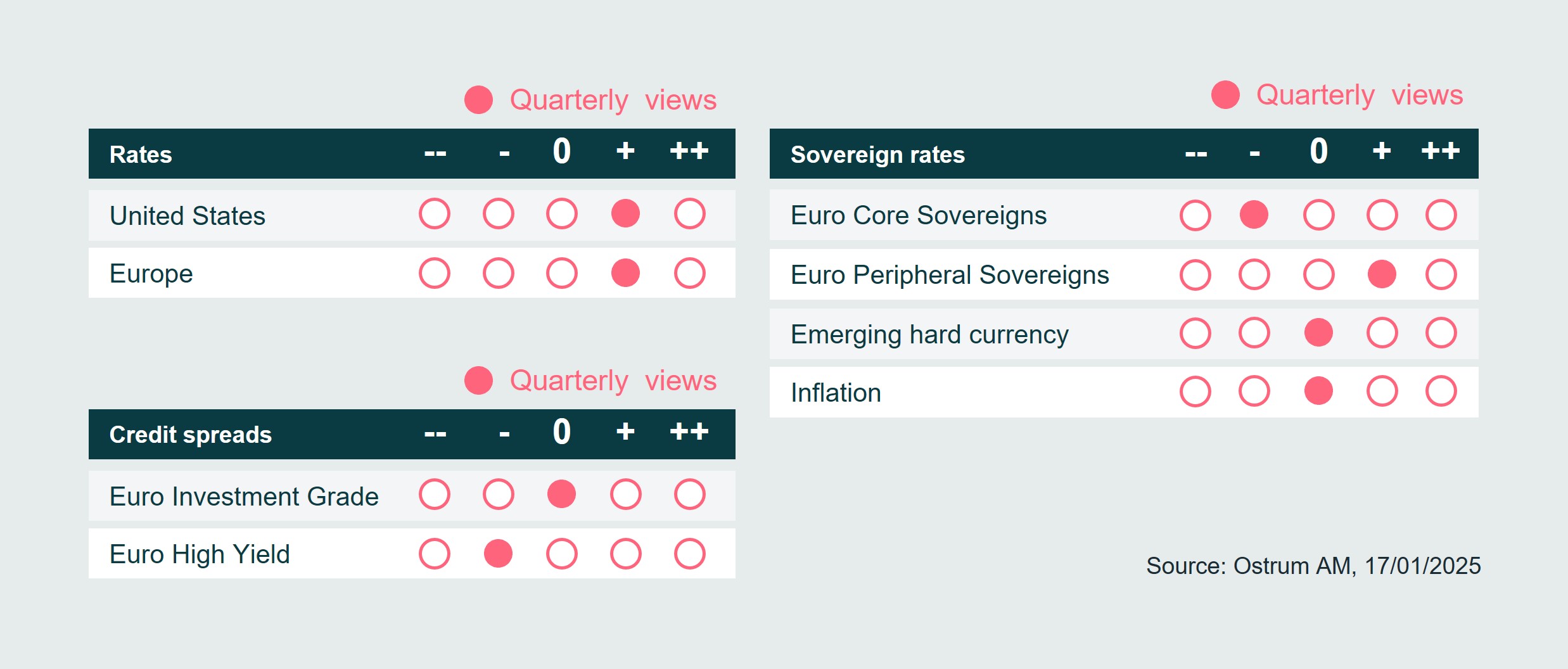

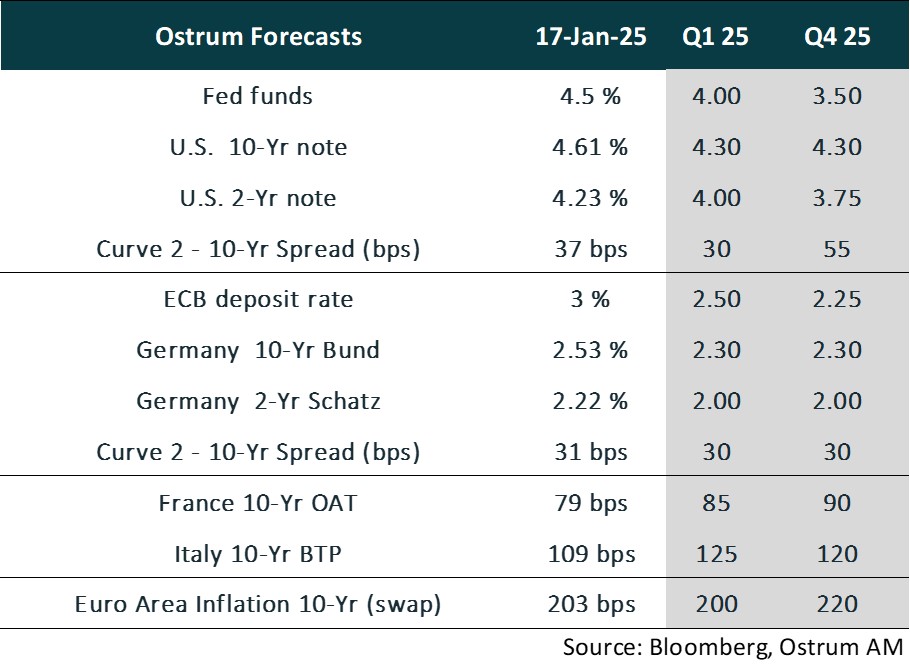

3 MONTH OUTLOOK ON BOND MARKETS

FIXED INCOME RETURNS & PERFORMANCES

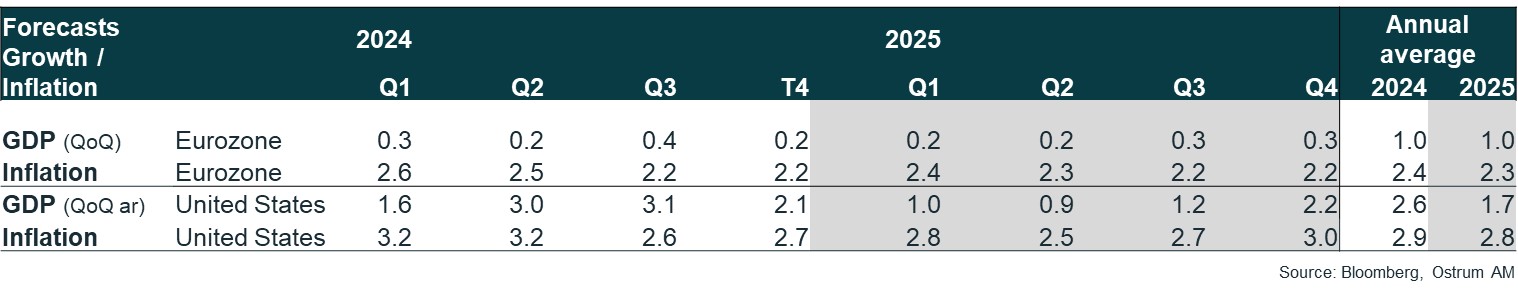

GROWTH & INFLATION

GROWTH

- Growth continued to exceed potential in the fourth quarter, with consumers likely having anticipated the impact of tariffs, while employment remained robust.

- In the euro area, uncertainty surrounding growth is pronounced, with Germany facing a second consecutive year of recession in 2024. Surveys indicate a deterioration in France, driven by political instability.

- In China, activity is buoyed by exports, and the real estate sector is stabilizing. However, domestic demand remains fragile, awaiting a fiscal support plan.

INFLATION

- Global disinflation will face significant challenges from tariffs and a resurgence in energy prices.

- In the United States, inflation rose to 2.9% in December, while core inflation moderated to 3.2%. The long-term impact of tariffs remains uncertain.

- In the euro area, inflation climbed to 2.4% in December, driven by adverse base effects on energy prices, with core inflation remaining stable at around 2.7% since spring.

Meanwhile, inflation in China remains nearly nonexistent.

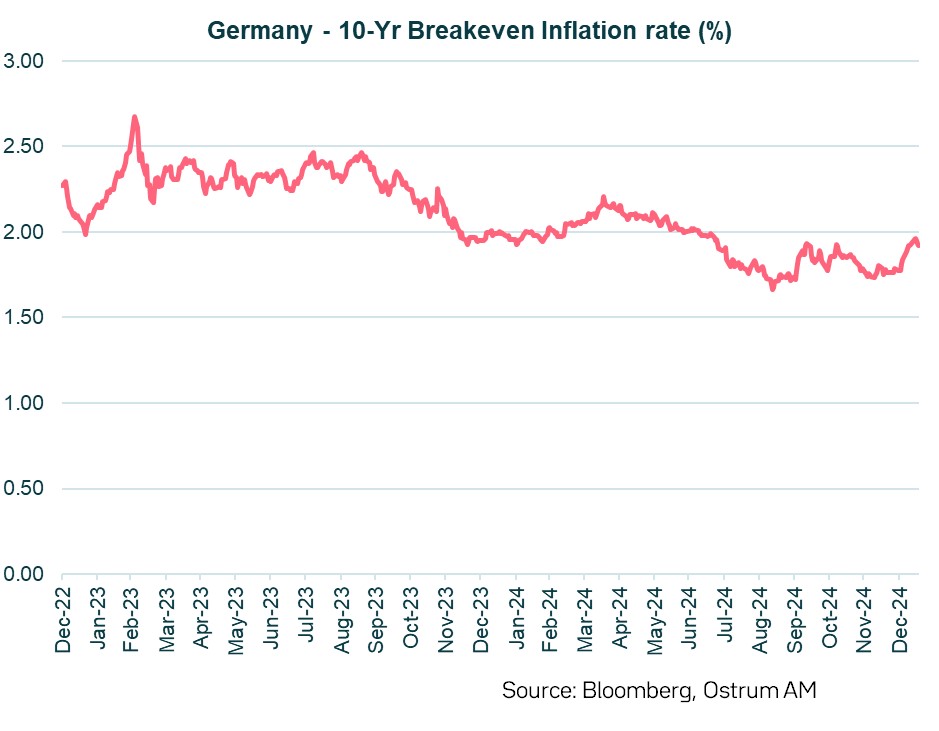

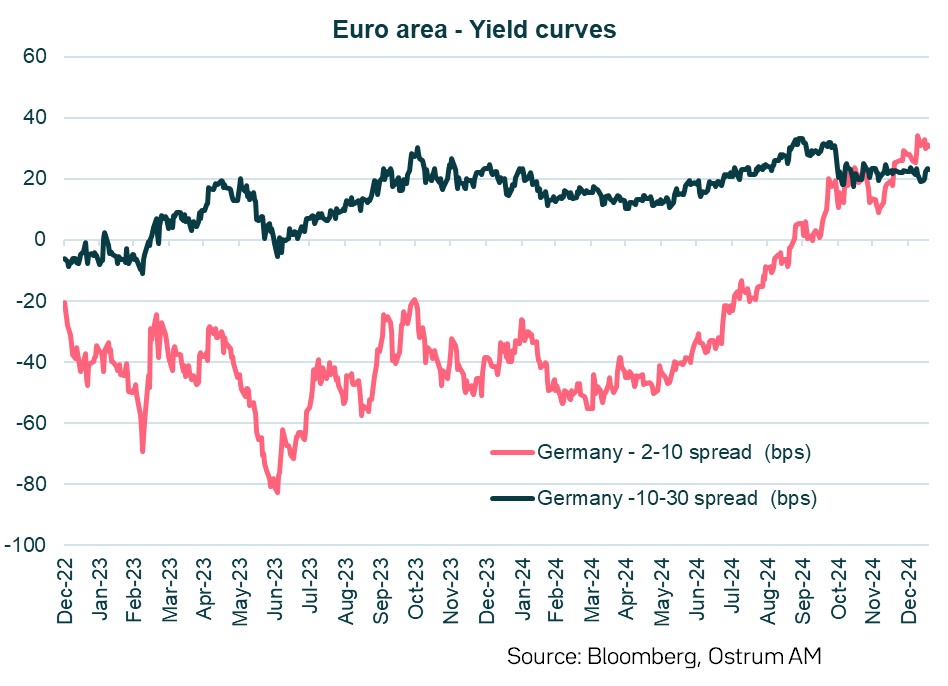

Eurozone inflation: Long-term inflation expectations appear well anchored, but the anticipated steepening of the yield curve will result in a rise in breakeven inflation rates.

CENTRAL BANKS RATES

MONETARY POLICIES

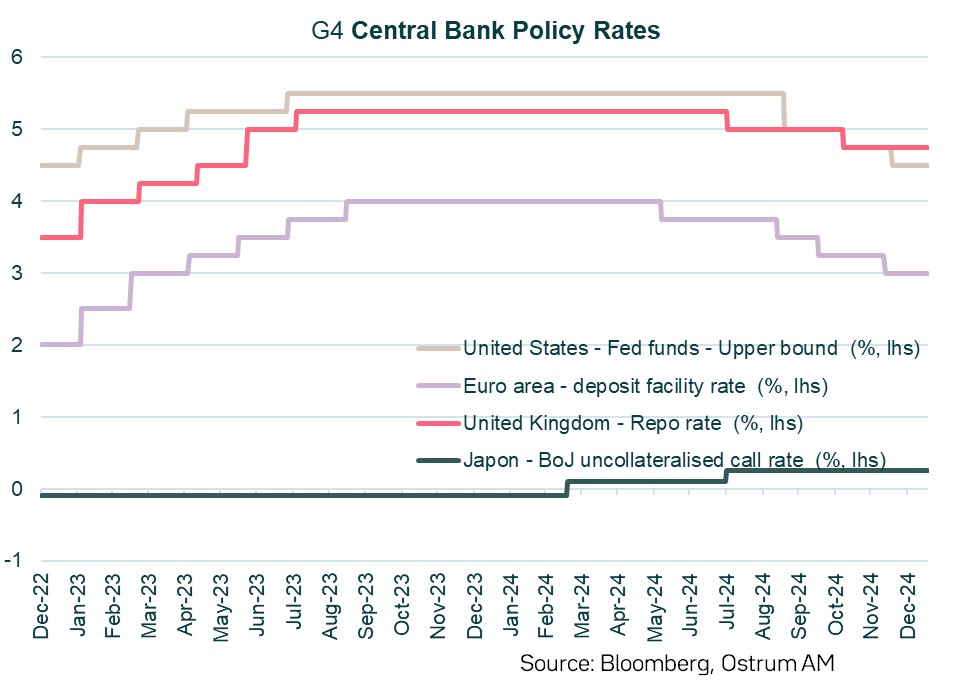

MONETARY POLICIES ARE APPROACHING THE THRESHOLD OF NEUTRALITY

The Fed will focus more on its maximum employment objective

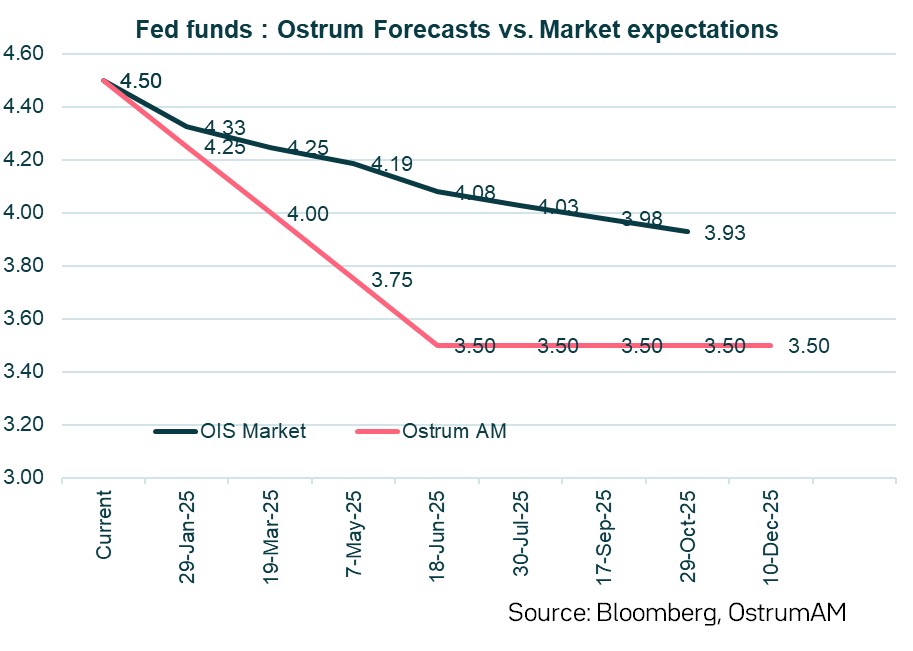

The Fed lowered its rates by 25 basis points during the meeting on December 18, bringing the federal funds rate to the range of [4.25% - 4.50%], totaling a reduction of 100 basis points since September. FOMC members revised down the expected number of rate cuts for 2025 to 2, compared to the previously anticipated 4, due to an upward revision of inflation expectations.

We maintain our forecast of 4 rate cuts in 2025 for two reasons. The first is the expected slowdown in growth, which should lead the Fed to place more emphasis on its maximum employment objective. The second concerns the ongoing tensions in banking liquidity, which supports the case for monetary easing.

Furthermore, the central bank will likely end its balance sheet reduction before March 2025. With Donald Trump arriving at the White House, it will need to firmly resist any attempts to challenge its independence in order to preserve its credibility.

The ECB keeps the door open for further rate cuts

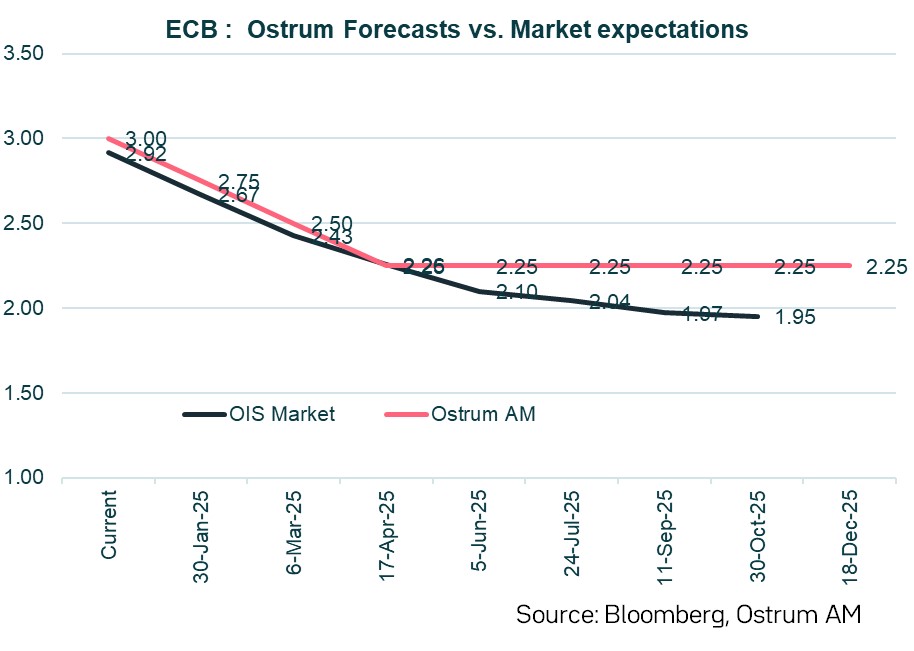

The ECB carried out its fourth rate cut of 25 basis points on December 12, bringing the deposit rate down to 3%. Growth forecasts have been revised downwards (1.1% in 2025, 1.4% in 2026, and 1.3% in 2027), as have inflation forecasts for 2025 (2.1% in 2025, 1.9% in 2026, and 2.1% in 2027).

The ECB has kept the door open for further rate cuts to ensure that monetary policy is no longer restrictive and allows for a sustainable stabilization of inflation at the 2% target. We anticipate three rate cuts in 2025, bringing the deposit rate down to 2.25% by April.

The reduction in the size of the balance sheet will simultaneously accelerate, as the ECB has not been reinvesting the proceeds from the Pandemic Emergency Purchase Programme (PEPP) since January.

INTEREST RATES INDICATORS

SOVEREIGN BONDS

- U.S. Rates: The Federal Funds rate is expected to converge towards the neutral rate, which will be raised to 3.50%. Budgetary risks will keep the 10-year Treasury yield around 4.30%.

- European Rates: The neutral rate is estimated by most ECB members to be between 1.25% and 3%. The Bund is projected to hover around 2.30% by year-end, (persistent accommodative bias followed by a potential steepening).

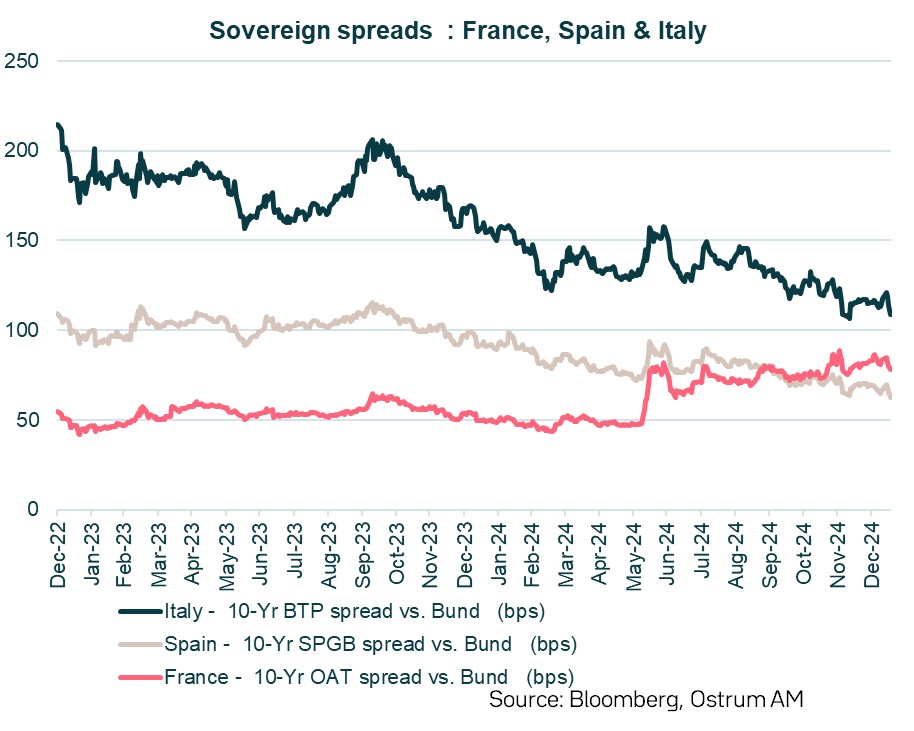

Sovereign Spreads: Risk premiums will continue to incorporate the likely downgrade of France's credit risk and the risk of dissolution. The BTP-Bund spread remains supported by an improvement in the deficit outlook for 2025.

- Stark contrast between short-term and long-term bonds: While shorter maturities (1-3 years) show positive returns, with Austria at 0.54% and Spain at 0.76%, longer maturities (7-10 years and 10+ years) are predominantly in negative territory.

- Country performance variability: Italy stands out with a consistent positive return across all maturity segments, particularly strong in the 3-5 year (0.54%) and 10+ year (0.63%) categories. Countries like Belgium (-1.25%) and France (-1.99%) struggled, particularly in the longer maturities(10+ year)

- Mixed results in the eurozone: The Eurozone aggregate (EU) shows a slight overall decline of -0.10%, reflecting the mixed performance across member states. While some countries like Greece (0.31%) and Spain (0.31%) posted positive returns, others, particularly in Northern Europe, faced declines in longer maturities, which may indicate a broader trend of investor caution regarding longer-dated debt.

Stability in shorter maturities: The shorter maturity segments (1-3 years) across most countries remained stable, with positive returns indicating that investors are favoring safer, shorter-duration investments in the current economic environment.

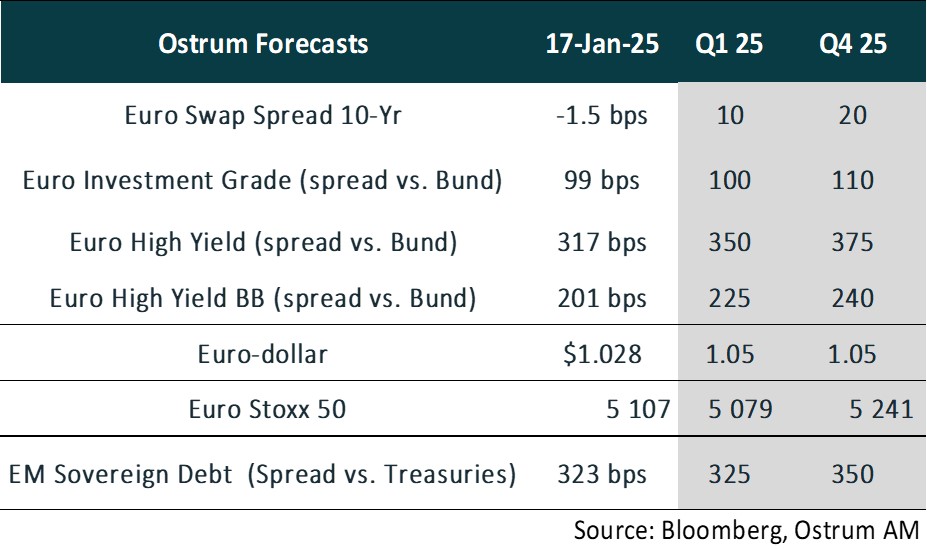

EMERGING BONDS

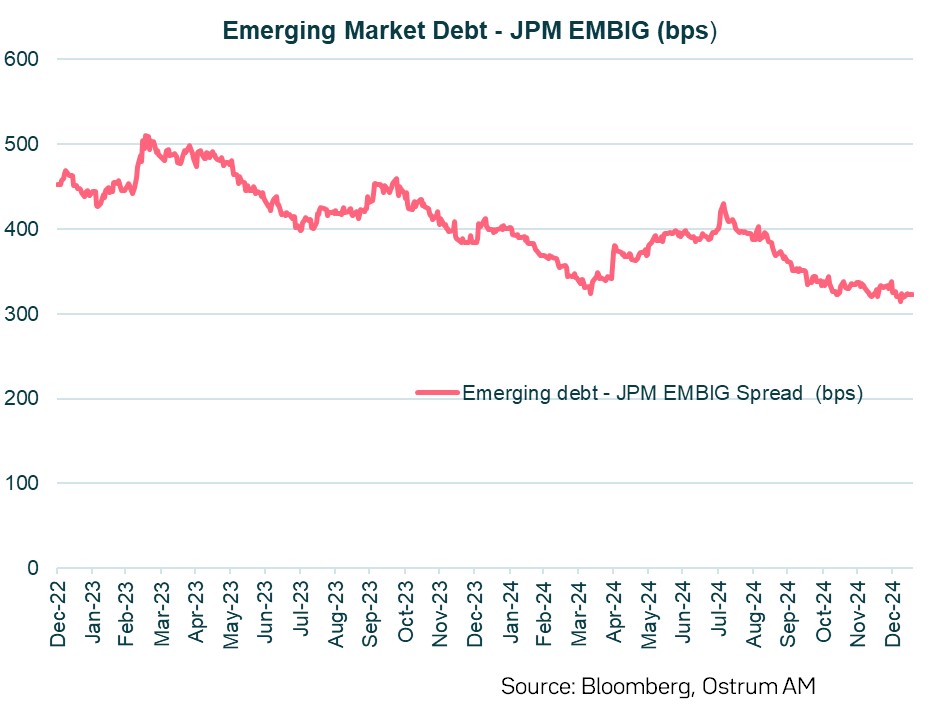

The Federal Reserve's actions should lead to stability at the end of the year. A further tightening in 2025 will be possible

Divergence in High Yield and Investment Grade bonds

- Overall Negative Returns: The majority of emerging market bonds posted negative total returns by the end of December 2024, with the EMBIG Diversified Index showing a return of -1.94%. This reflects a challenging environment for fixed-income investments amid rising interest rates and economic uncertainties.

- Divergence in High Yield and Investment Grade bonds: While high-grade bonds experienced a notable decline of -4.59%, high-yield bonds managed a modest positive return of 0.67%. This divergence suggests that investors may be seeking higher returns in riskier assets, despite the overall negative sentiment in the market.

- Latin America Under Pressure: Latin American bonds faced significant headwinds, with countries like Brazil (-5.87%) and Chile (-5.15%) showing substantial losses. In contrast, Argentina posted an exceptional return of 33.61%, due to unique market conditions.

- Regional Spread Changes: The spreads have generally tightened, as indicated by the quarterly spread changes across various regions. For example, Africa experienced a notable spread reduction of 119 basis points, while Asia's spreads narrowed by 63 basis points.

CREDIT INDICATORS

EURO INVESTMENT GRADE CREDIT

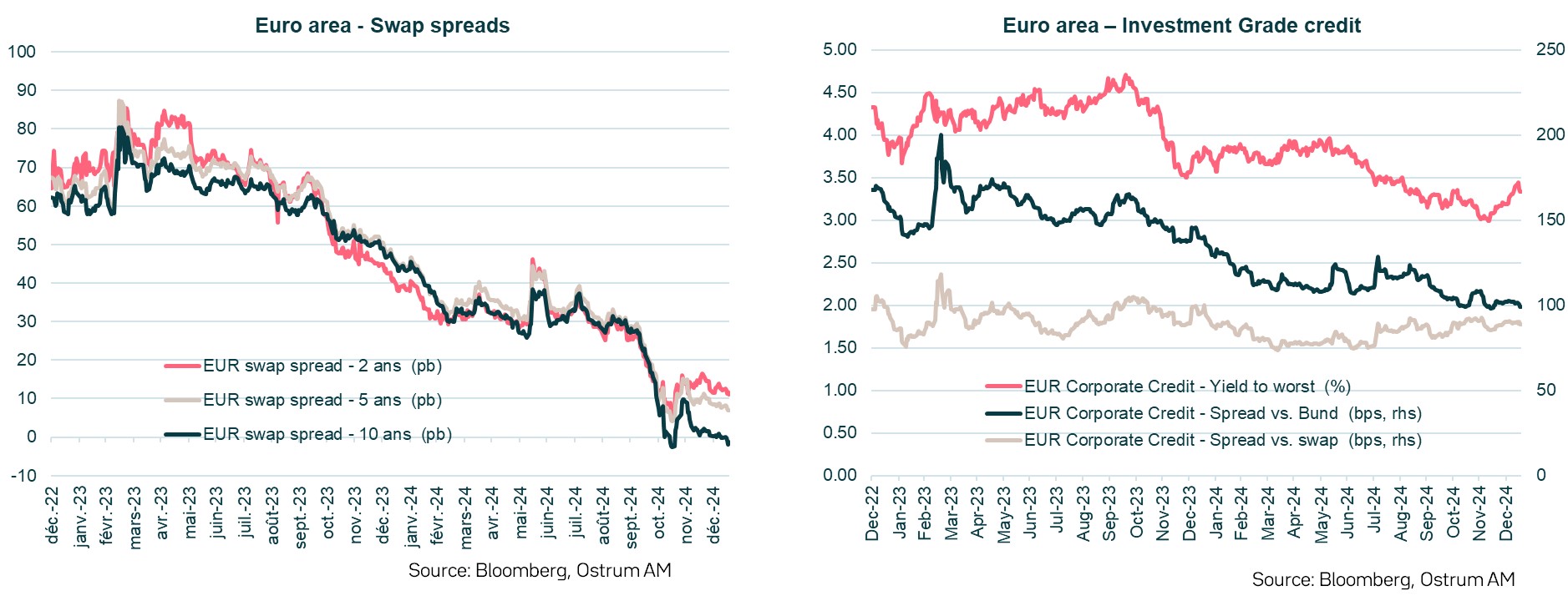

Investment Grade credit spreads are nearing their fair value levels, although the premium for high-yield bonds proving insufficient despite a default rate that remains below average. Market participants are still awaiting a compression in spreads.

- Overall Positive Performance: The ICE BofA ML Euro Corporate Index shows a solid year-to-date return of 4.67%. However, the performance in Q4 2024 is more subdued at 0.81%, indicating profit-taking as the year concludes.

- Sector Variability in Returns: Different sectors demonstrate significant variability in performance. The Financial Subordinated & Lower Tier-2 Index (EBSL) and the Financial Junior Subordinated & Tier-1 Index (EBSS) have notably high returns of 6.81% and 8.78%. In contrast, sectors such as Industrials (EJ00) and Consumer Goods (EJCS) lag with returns of 4.34% and 3.64%.

- Yield and Spread Analysis: The Yield to Worst (YTW) and Option-Adjusted Spread (OAS) metrics provide insights into the risk-return profiles of different indices. At year-end 2024, the Subordinated Financial Index (EBSU) has a high YTW of 4.32% and an OAS of 145 basis points, reflecting a higher risk premium compared to the Unsubordinated Financial Index (EBXS) with a YTW of 3.18% and an OAS of 98 basis points.

- Stable Utility and Real Estate Indices: The Real Estate Index (EJRE) stands out with a strong return of 8.70% YTD and an OAS of 125 basis points, highlighting the sector’s recovery. Similarly, the Utility Index (EK00) shows stability with a return of 4.08%.

EURO HIGH YIELD CREDIT

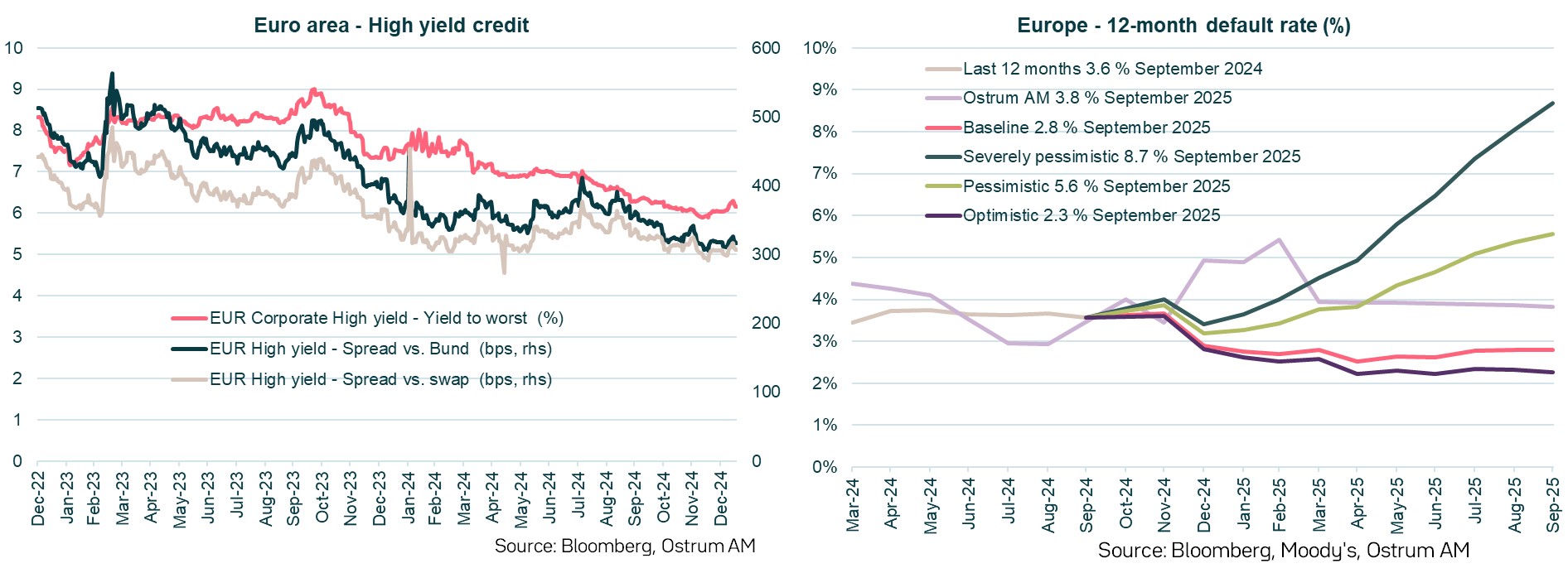

The default rate is lower than its historical average, but valuation levels are tensed.

Strong Year-to-Date Performance

- Strong Year-to-Date Performance: The Euro High Yield indices have shown robust performance in 2024, with the ICE BofA BB-B Euro High Yield Constrained Index (HEC4) returning 8.46% YTD. This indicates a combination of favorable economic conditions and investor demand for higher returns.

- Positive Q4 Returns: Most sub-indices continued to show positive returns. For example, the ICE BofA Euro High Yield Index (HE00) delivered a return of 1.77% in Q4.

- Spreads and Risk Assessment: The Option-Adjusted Spreads (OAS) for various indices trade near multi-year lows. The ICE BofAML Euro Financial High Yield Index (HEB0) has the lowest OAS at 224 basis points at year-end while non-financial high yield index (HNE0) at 325 basis points.

- Sector-Specific Insights: The performance of specific indices reveals interesting sector dynamics. For instance, the ICE BofAML Euro Financial High Yield Constrained Index (HEBC) outperformed many others with a YTD return of 9.40%. Conversely, the ICE BofAML Euro Fallen Angel High Yield Index (HEFA) lagged with a return of only 5.69%, which could point to challenges faced by downgraded issuers in the current market environment.

FOCUS ON SUSTAINABLE BONDS

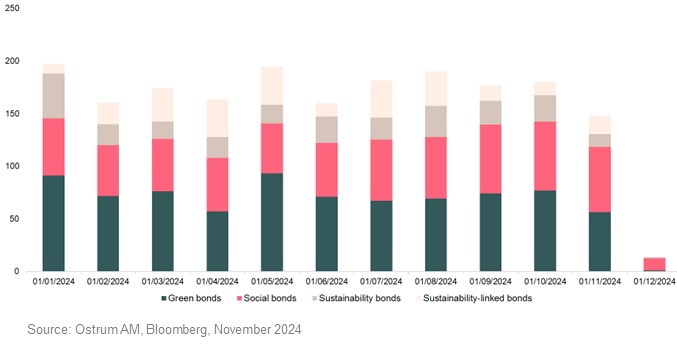

QUARTERLY GRAPH

Sustainable debt issuance year-to-date

Sustainable issuances in 2024 are expected to set new records, surpassing those of 2021. A linear distribution of issuances is observed, and the gap between social and green bonds is narrowing, indicating a growing harmonization between these two types of financing.

- The transport sector accounts for approximately 15% of global greenhouse gas (GHG) emissions, prompting companies to take action to reduce their environmental impact. In this context, IHO, a German manufacturer of parts for machinery and vehicles, offers solutions for the transition to a low-carbon economy. This year, the company issued a Sustainability-linked bond with the goal of reducing its GHG emissions by 75% for scopes 1 and 2, and by 25% for scope 3 by 2030.

- Deutsche Bank announced that it has raised €500 million through its first social bond, the proceeds of which are intended to support the bank's sustainable asset portfolio. This portfolio finances sectors such as affordable housing and access to essential services for the elderly or vulnerable individuals.

- Local authorities (regions, departments, municipalities) play a key role in sustainable development by financing projects. At the end of November 2024, the Walloon region launched its second social bond to finance education, employment, affordable housing, and access to essential services.

- BPCE launched its first social bond with a profit-sharing coupon in partnership with Natixis CIB, amounting to €400 million for the benefit of the Robert-Debré Institute for Child Brain Health. This amount will be allocated to finance ESG projects and assets in the healthcare sector, directly impacting the well-being of children and their families. In total, the Robert-Debré Institute for Child Brain Health will receive €2.79 million in donations over a 10-year period.

- Saur stands out as a pioneer in the water sector with the issuance of a blue bond (€500 million), reinforcing its status as a leader in sustainable finance supporting the water transition. This unique initiative highlights Saur's strong commitment to the preservation of natural resources.

DASHBOARD - OSTRUM AM VIEWS

MACROECONOMIC OUTLOOK • EUROZONE AND UNITED STATES

MARKET VIEWS

Fixed Income Compass - January 2025

Download the full PDF