Quarterly publication / July 2025

Analysis finalised on 08/07/2025 ; data as of 30/06/2025

Document for professional investors in accordance with MIF II.

MARKETS OVERVIEW

MARKETS CUTTING THROUGH THE POLITICAL HAZE

The contrast is striking between, on one hand, the low financial volatility and the strong rebound in risk assets, and on the other hand, Donald Trump's chaotic economic policy, geopolitical tensions, and significant signs of cyclical downturn in the U.S.The U.S. economy is experiencing an unprecedented uncertainty shock. Domestic demand appears paralyzed by tariff policy instability and fiscal concerns. The housing sector is grappling with shortages of materials and detrimental immigration policies. The declining labor force participation rate, which masks the underlying rise in the unemployment rate, is troubling.

In the Eurozone, Germany's gradual recovery is offsetting the political hesitations in France following the failure of pension reform. The rollout of the infrastructure investment plan in the second half of the year is expected to bolster this renewed optimism. The growth gap between the U.S. and Europe is narrowing. In China, technological innovation remains at the core of industrial policy, with improvements in consumer spending occurring faster than anticipated, despite an economy still marked by deflationary risks.

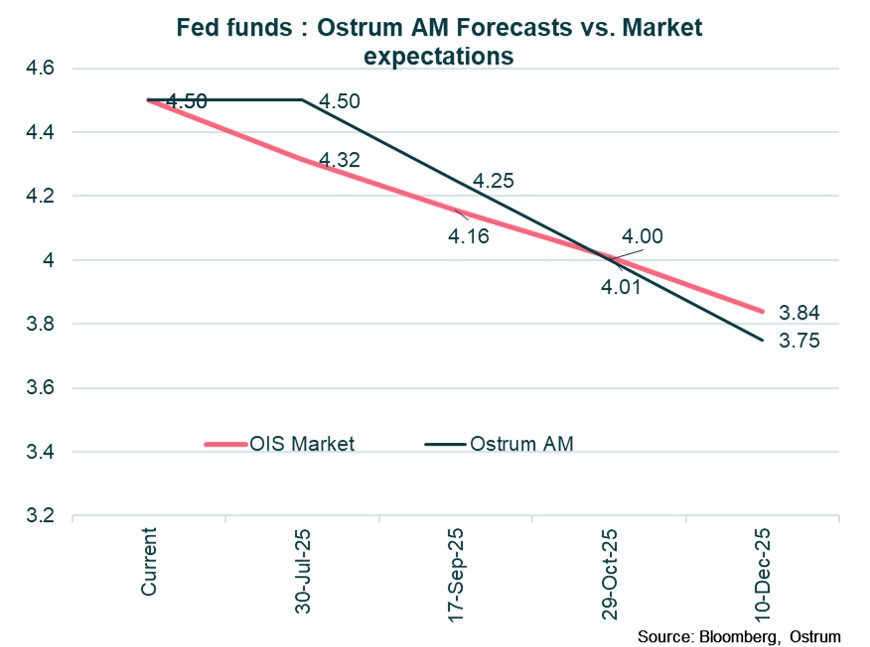

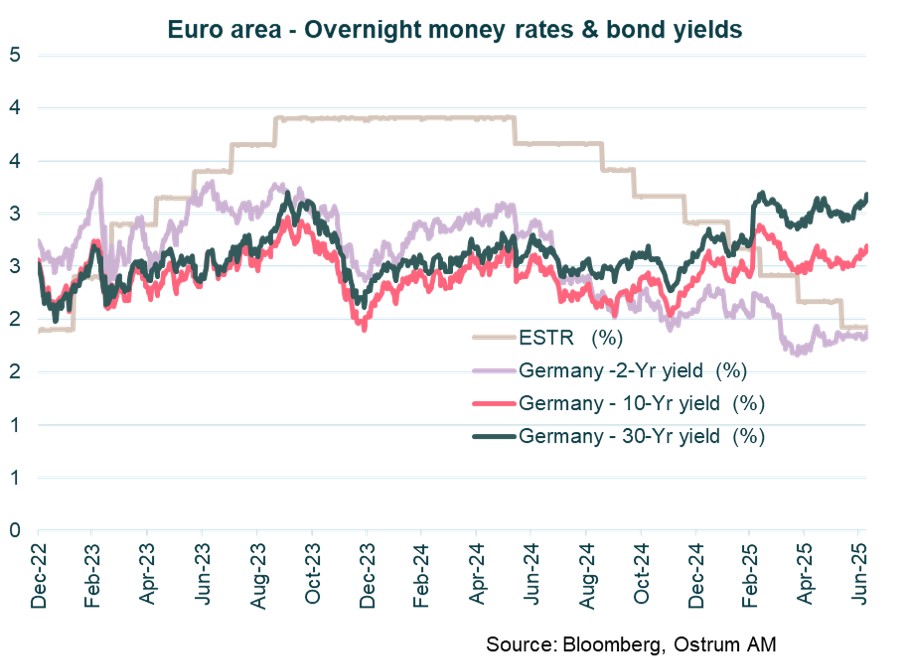

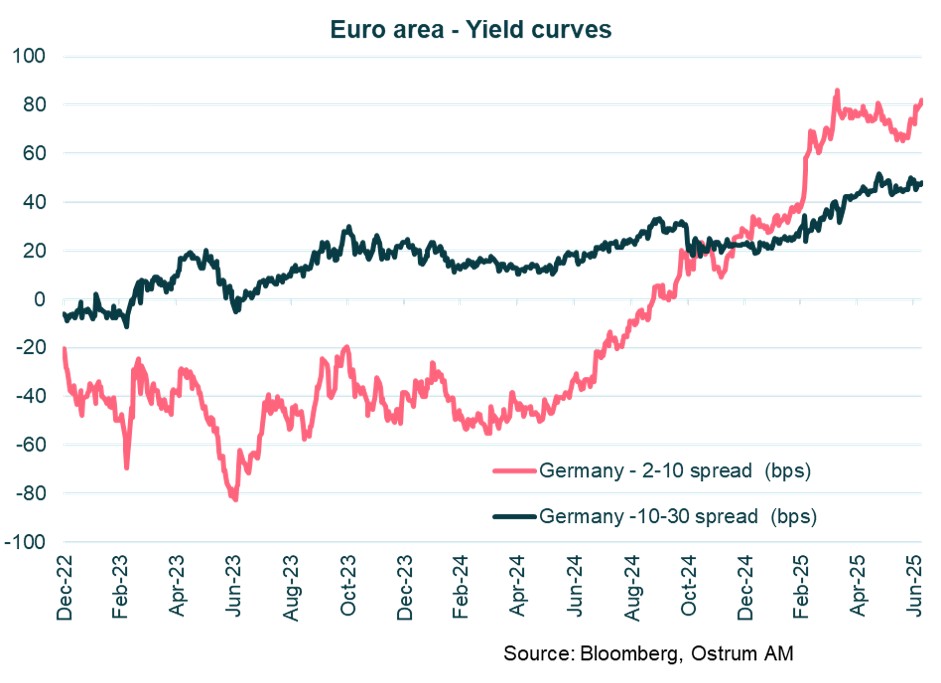

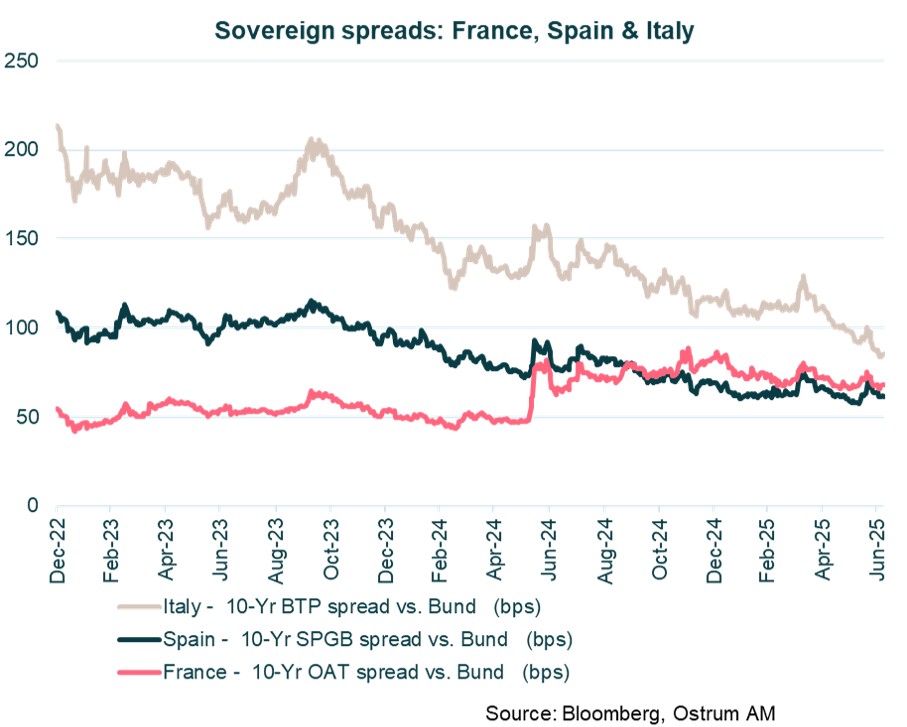

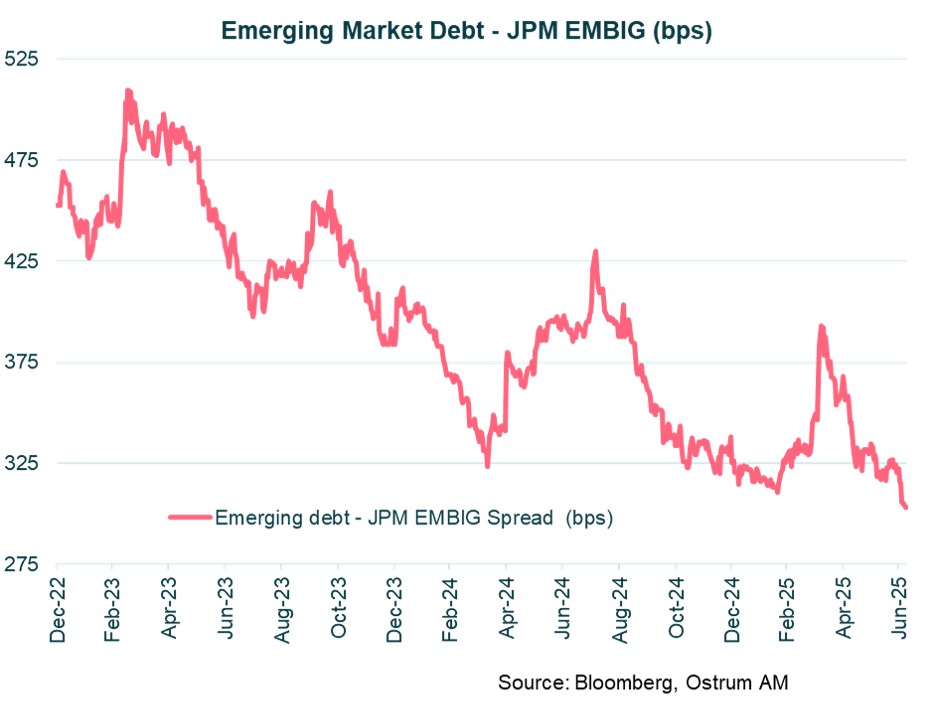

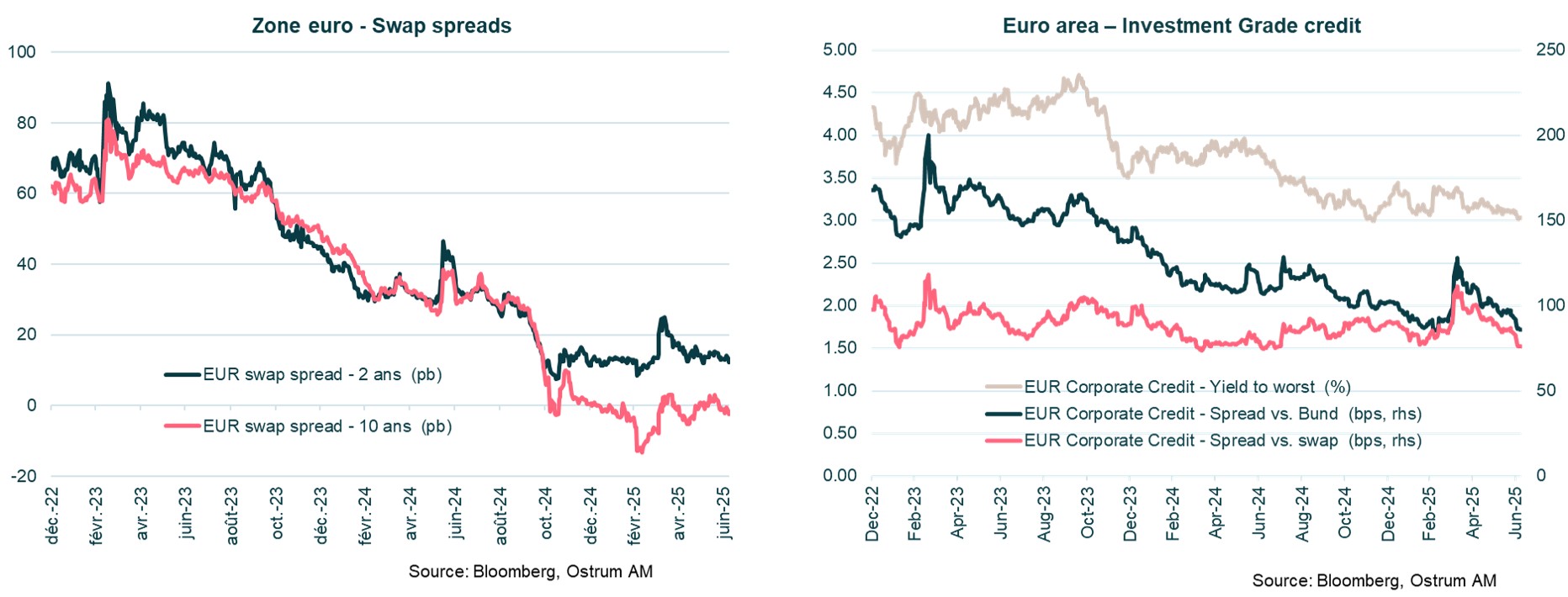

The Fed's policy is likely to soon reflect the weakening labor market. The tariff shock undermines demand and is therefore not expected to lead to a lasting surge in inflation. Waller and Bowman have mentioned a possible rate cut as early as July, despite a highly divided FOMC. The ECB will closely monitor the euro as inflation has returned to 2%. A final rate cut appears probable. In this context, the steepening of global yield curves reflects monetary easing and budget deficits. The convergence of peripheral debts toward higher-rated debts remains a prevailing trend. The tightening of credit may have gone too far, while the resurgence of primary issuance in the high-yield market is slowing the momentum. The “Magnificent Seven" remain unshakeable, propelling the S&P to record levels, but Wall Street's outperformance is inextricably linked to the weakness of the dollar.

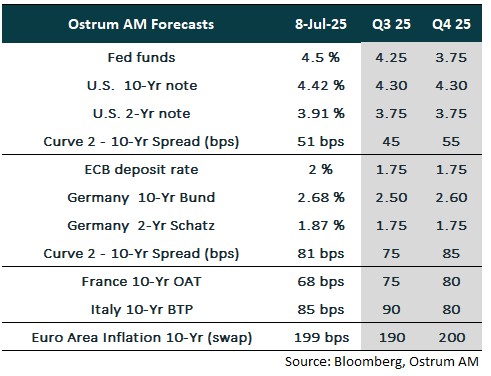

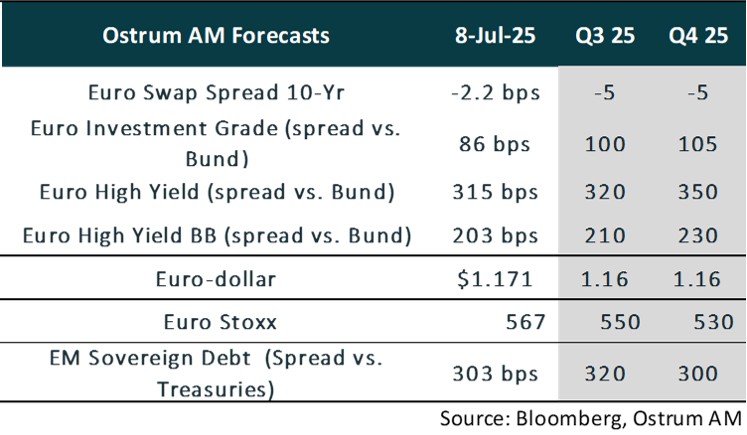

KEY INDICATORS

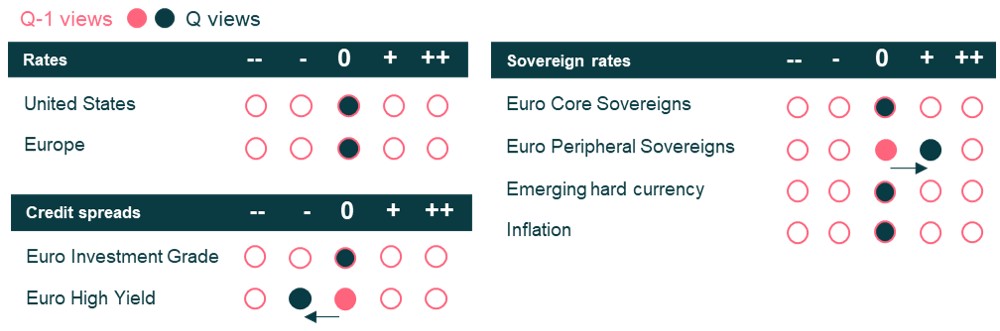

3 MONTH OUTLOOK ON BOND MARKETS

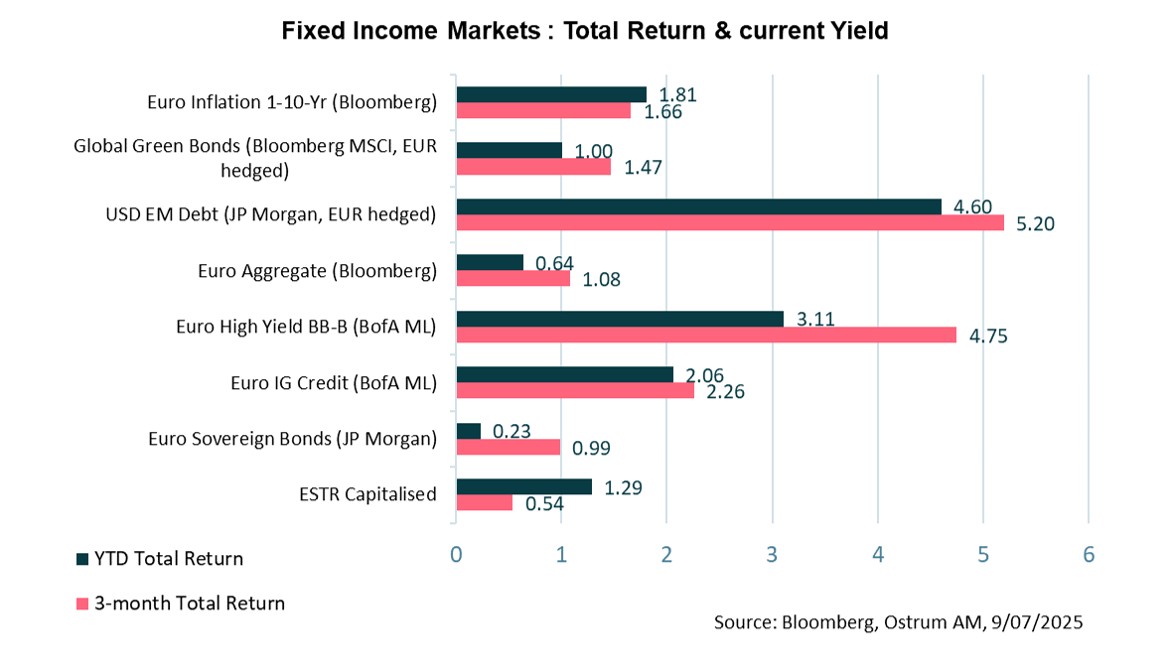

FIXED INCOME RETURNS & PERFORMANCES

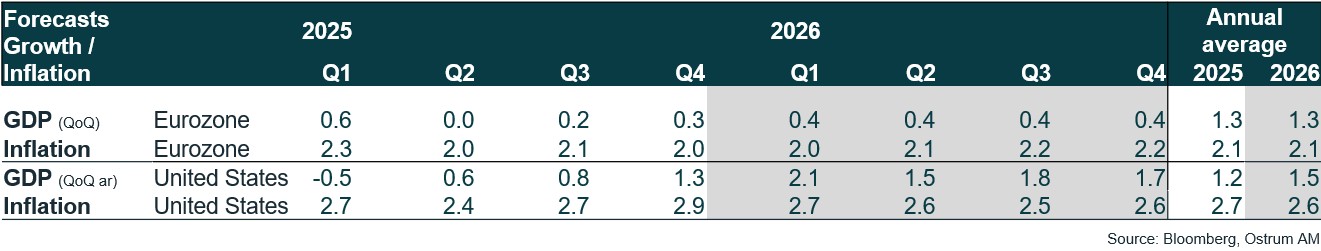

GROWTH & INFLATION

GROWTH

- In the United States, Q1 GDP has been revised down to -0.5% GDP, attributed to a revision of consumption to 0.5% GDP (compared to 1.2%). The June employment report shows very few hires outside of the healthcare and government sectors. The decline in the unemployment rate to 4.1% is linked to a decrease in the number of migrants in the labor force.

- In the Eurozone, after an expected correction in GDP in Q2, growth should begin to benefit gradually from Germany's very ambitious fiscal policy.

- In China, the rebound in retail sales in May to 6.4% YoY indicates economic resilience boosted by fiscal and monetary support.

INFLATION

- In the U.S. inflation measure preferred by the Fed, the PCE index, slightly increased in May to 2.3% YoY. The core PCE index also rose by 2.7% YoY in May compared to 2.6% YoY in April.

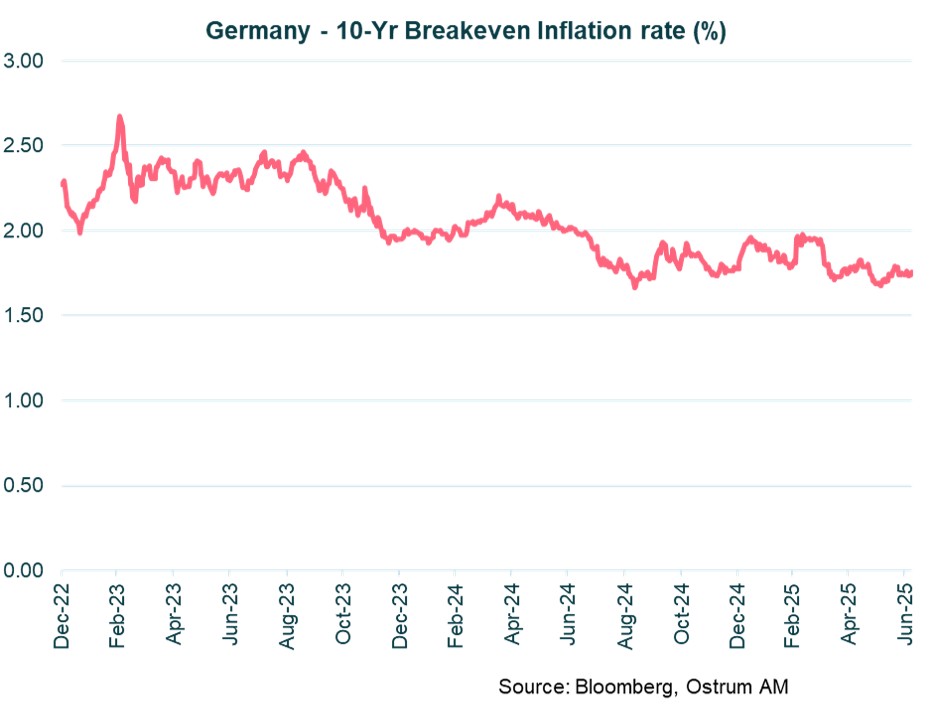

- In the Eurozone, after reaching 1.9% in May, inflation hit the ECB's target of 2% in June. The point of concern remains the inflation in services, which increased to 3.3% YoY and remains high. The appreciation of the euro and the decrease in energy prices should help keep inflation close to the target.

In China, inflation remained at -0.1% in May, reflecting weak domestic consumption.

Eurozone inflation: Inflation expectations remain anchored around the 2% target.

CENTRAL BANKS RATES

MONETARY POLICIES

CENTRAL BANKS ARE PLUNGED INTO THE UNCERTAINTY OF TRUMP’S POLICIES

The Fed should lower its rates starting in September.

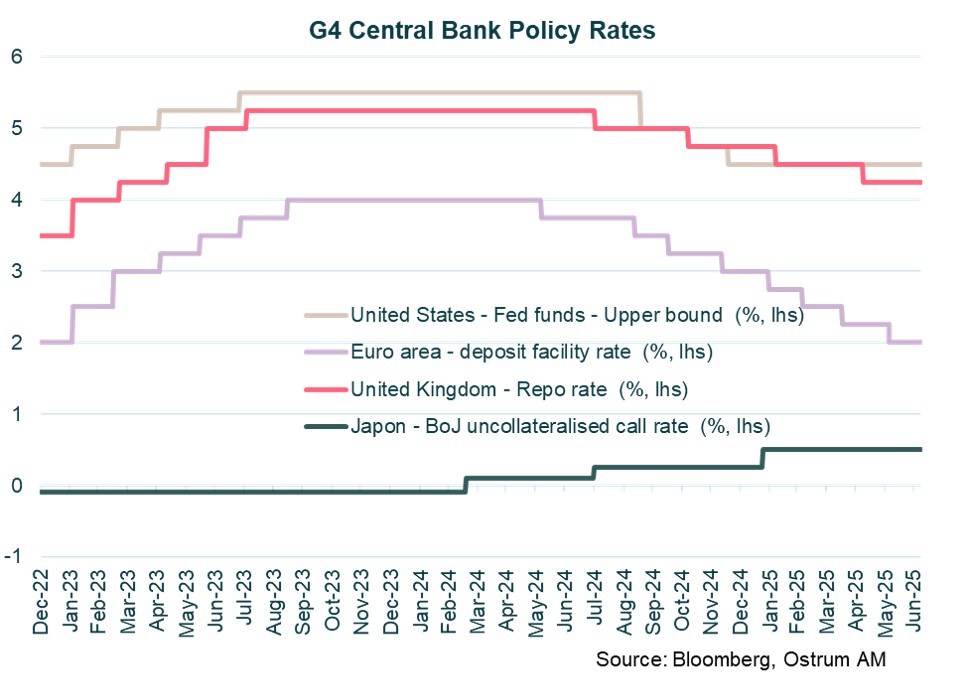

On June 18, the Fed kept its rates unchanged for the fourth consecutive time, believing it was well-positioned to wait for more visibility on the impact of the policies implemented by the White House. The central bank finds itself in an uncomfortable position: the rising uncertainty related to Donald Trump's policies increases the risk of higher unemployment as well as that of stronger inflation. The median forecasts from the Fed’s monetary policy committee members indicate two rate cuts of 25 basis points this year. The votes are highly divided: 7 out of 19 members wish to maintain rates unchanged for the remainder of the year (up from 4 in March) while 10 others believe that 2 to 3 rate cuts are appropriate. We believe that rates should remain unchanged in July and that the Fed should cut them three times starting in September due to the deterioration in the labor market. Price pressures are expected to be less significant than anticipated by the Fed.

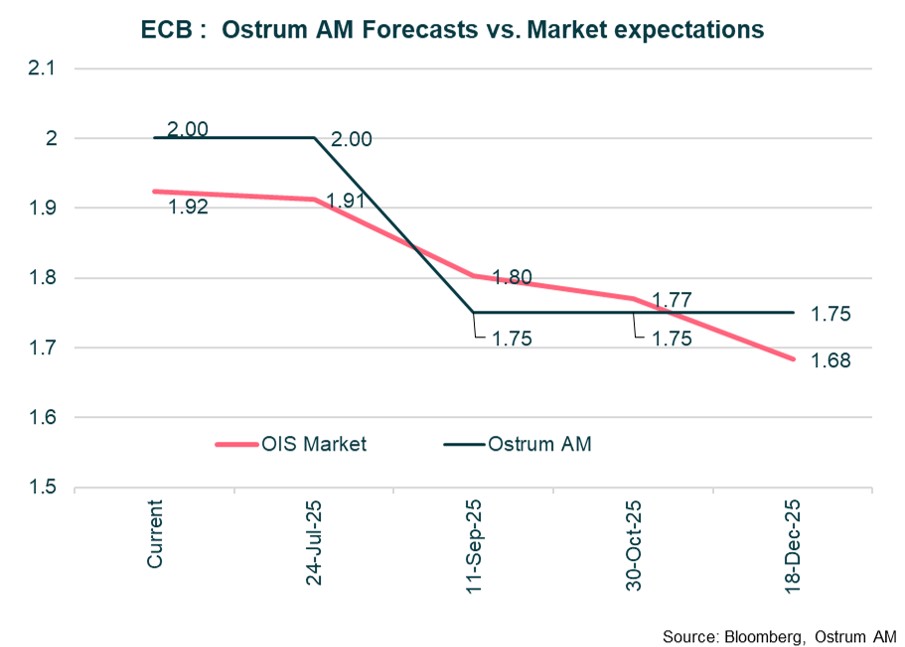

A final rate cut by the ECB in September

At the meeting on June 5, the ECB implemented its 8th rate cut, bringing the deposit rate to 2%. The ECB emphasized that the significant reduction in inflation outlook for 2026 (1.6% down from 1.9%) is related to the appreciation of the euro and the decline in oil prices, and is expected to be temporary, as inflation is anticipated to return to 2% by 2027. The ECB is therefore confident in achieving the 2% target in the medium term and believes that the monetary policy cycle is nearing its end. However, the door remains open for further monetary easing given that the ECB continues to view the risks to growth as skewed to the downside due to high uncertainty, particularly regarding trade. We anticipate another rate cut of 25 basis points by the ECB in September. It could lower rates further in the event of a much sharper slowdown in growth due to the trade war or a stronger appreciation of the euro, which would weigh more heavily on inflation and growth through exports.

INTEREST RATES INDICATORS

EURO SOVEREIGN BONDS

- U.S. Rates: The Federal Reserve is expected to respond to the deterioration in employment; however, the impact on long-term rates is likely to be limited given the budgetary risk.

- European Rates: The European Central Bank (ECB) is anticipated to lower its rate to 1.75%. The 10-year Bund reflects a more ambitious fiscal policy in Germany and benefits from reallocations from the dollar to the euro.

Sovereign SpreadsThe convergence of peripheral spreads towards core countries is expected to accelerate, with spreads on BTPs and OATs projected at 80 basis points.

- Overall Positive Returns: The Euro Area sovereign bonds exhibited a total return of 1.86% across all maturities in Q2 2025, reflecting a generally favorable environment for European government bonds during this period.

- Strong Performance in Italy: Italy's bonds showed particularly robust returns with 5.15% for the 10-year+ maturity segment and an overall return of 2.94%. This suggests positive market sentiment towards Italian sovereign debt amid improving economic indicators.

- Greece Leading Longer Maturities: Greece exhibited the highest returns in the longer maturity categories, with a remarkable 3.58% for the 10-year+ segment. This could indicate a recovery in confidence in Greek bonds, reflecting a stronger economic outlook.

- Consistent Returns Across Key Countries: Major economies like France (2.18% for 7-10 years) and Belgium (1.99% for 7-10 years) posted solid returns, demonstrating stability and investor confidence in these markets despite varying yields among different maturity ranges.

EMERGING BONDS

Emerging market spreads have erased the tensions seen in early April and are expected to remain close to their lows for the year.

High Yield outperformance YTD

- Consistent Total Returns: The JP Morgan EMBI Global Diversified achieved a Year-to-Date (YTD) return of 5.64%, indicating strong performance in emerging market bonds. The 2Q 2025 return of 3.32% reflects solid quarterly growth, showcasing resilience in this asset class despite potential macroeconomic challenges.

- High Yield Outperformance: The high yield segment continues to show strength with a YTD return of 6.34%, highlighting robust investor interest in riskier assets. The quarterly performance of 4.54% underscores the attractiveness of high yield amid a search for yield.

- Spread Movements Reflecting Market Sentiment: The EMBIG saw a slight tightening in spreads of -3 basis points (bps) YTD, which indicates a generally positive investor sentiment towards emerging market bonds. However, the Next GEM segment experienced significant widening of 252 bps YTD, pointing to increased caution and differentiated risk perceptions among emerging markets.

- Mixed Spread Changes by Maturity: Spread changes varied significantly across different maturities, with the 1-3 Year segment tightening by 1 bp, showcasing relative stability in that category despite earlier volatility. In contrast, the longer 5-7 Year segment tightened spreads by 30 bps, reflecting a more favorable outlook for mid-term bonds, while the 10 Yr+ category saw a minor spread tightening of -2 bps, indicating lingering investor caution in longer-duration bonds.

CREDIT INDICATORS

EURO INVESTMENT GRADE CREDIT

Investment-grade credit spreads have tightened significantly, with a modest widening likely.

- Overall Positive Corporate Returns: The ICE BofA ML Euro Corporate Index recorded a total return of 1.84% for 2025, reflecting a generally favorable environment for corporate bonds, with a slightly lower return of 1.69% in Q2 2025, indicating stable but cautious market conditions.

- Strong Financial Sector Performance: The financial sector outperformed other categories, with subordinated financial bonds yielding a robust return of 2.55% YTD. This indicates strong investor confidence in financial institutions, potentially driven by favorable economic trends and regulatory stability.

- Mixed Results Across Industries: The industrials sector lagged with a return of just 1.59%, while sectors like banking (2.34%) and insurance (2.04%) showed stronger returns. This discrepancy highlights varying levels of investor confidence across different industries, with financial services leading the pack.

- Underperformance in Leisure and Healthcare: The leisure (0.91%) and healthcare (1.14%) sectors showed notably lower returns compared to other sectors, suggesting potential challenges or market hesitance specific to these industries, which may be impacted by current economic conditions and consumer sentiment.

EURO HIGH YIELD CREDIT

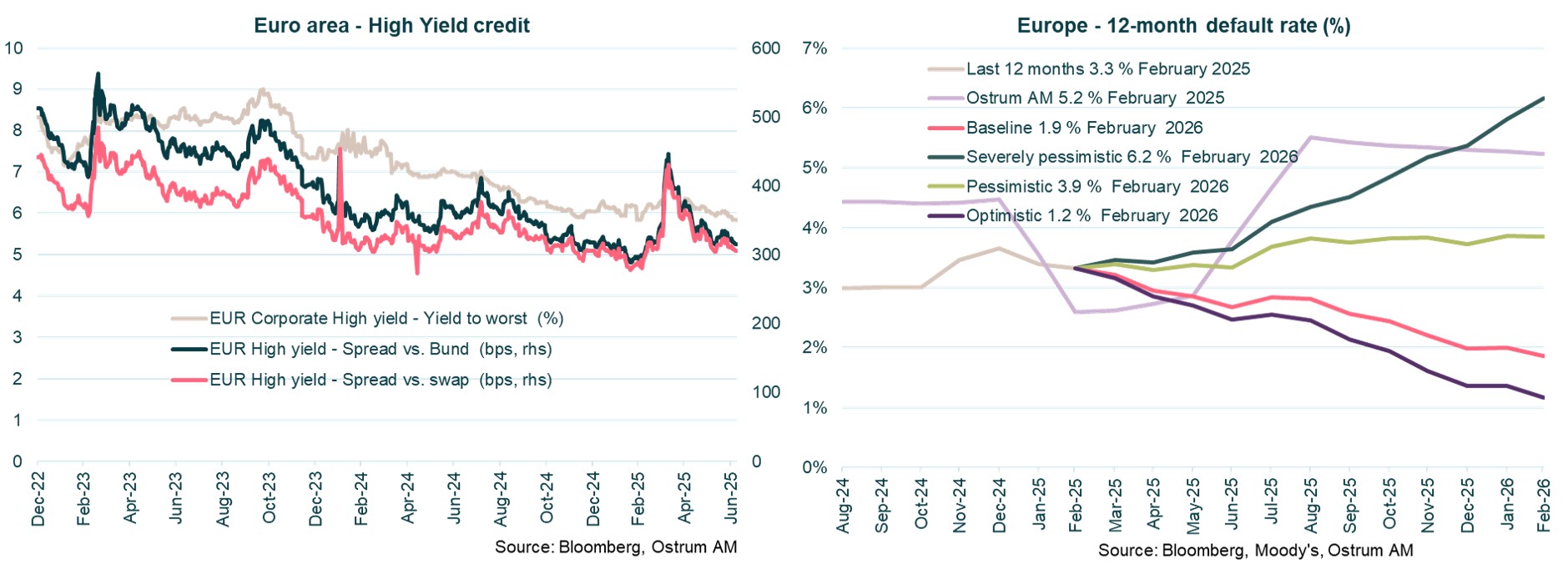

Valuations in the high-yield sector are expected to normalize over the year, with the default rate remaining below the historical average.

Solid overall performance of the High Yield market so far in 2025

- Solid Overall Performance So Far in 2025: The ICE BofA ML Euro High Yield Index achieved a total return of 2.75% for 2025,with a slightly lower return of 2.09% in Q2 2025. This indicates a stable high-yield market, reflecting continued investor interest despite potential economic uncertainties.

- Strong Returns in Financial High Yield: The Euro Financial High Yield segment led the index with a noteworthy return of 3.00% YTD, suggesting that financial issuers are experiencing strong demand and confidence from investors, likely buoyed by favorable economic conditions.

- Fallen Angels Outperforming: The Euro Fallen Angel High Yield category, which includes bonds that have been downgraded to high yield status, delivered the highest return at 3.59%. This indicates that investors are finding value in these previously investment-grade bonds, possibly due to improving fundamentals or attractive yields.

- Variation in Maturity Segments: The 2-4 Year Euro High Yield segment yielded 2.90%, outperforming longer maturities like the 4-6 Year Euro High Yield, which returned 2.47%. This suggests a preference for shorter maturities in the current market environment, potentially reflecting investor caution regarding future interest rate movements and economic conditions.

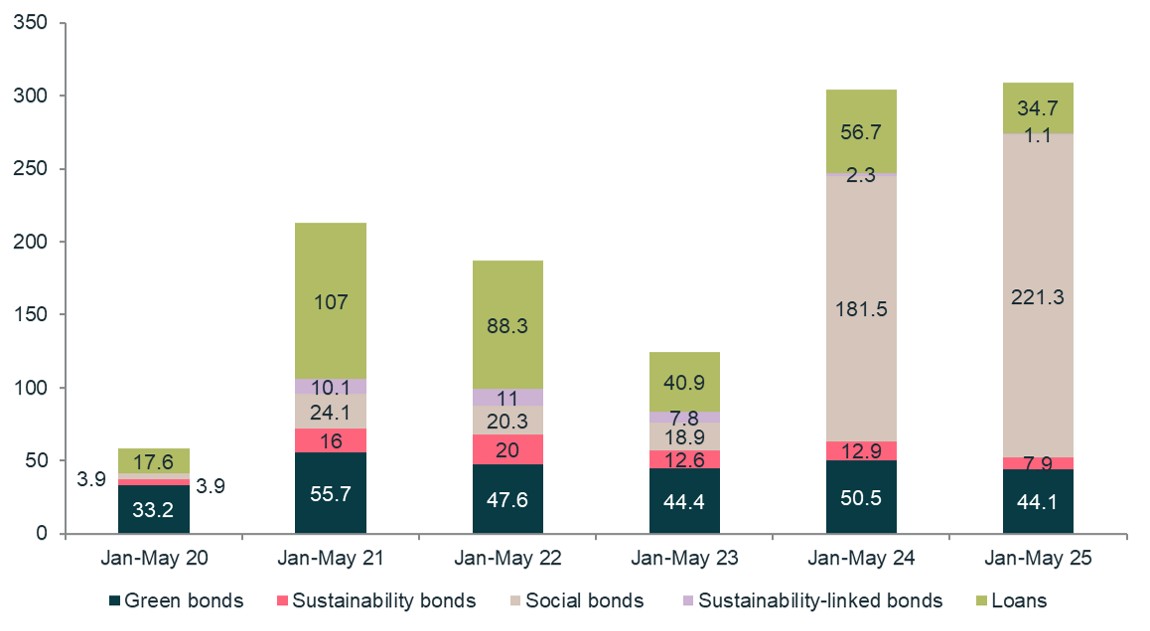

FOCUS ON SUSTAINABLE BONDS

QUARTERLY GRAPH

Sustainable debt issuance – United States

Contrary to popular belief, ESG debt sales in the US reached a record high in 2025. While corporate bond issuance fell by 46% (due to trade tensions and anti-ESG positions), social bonds from the government agency Ginnie Mae saw significant increases.

- In June 2025, the Community of Madrid issued its first green bond aligned with the European Union Green Bond Standards,with a huge interest from investors: a final book order that has reached a record of €68bn. Since 2017, the issuer has issued €8bn of sustainability bonds and €5 billion of green bonds, totaling more than €11bn in sustainable bonds issuances. It is currently one of the most committed SSA (Sovereigns, Supranationals, and Agencies) issuers in Europe in this market.

- In May, the Spanish company Iberdrola issued for the first time a green bond aligned with European standards on green bonds (or EU GBS). This issuance was an important success, attracting about €3.7bn of demand (5 times the offer), thus allowing the group to issue at 3.5%, an interesting greenium for its financing strategy.

- In April, EDF came back to the sustainable bond market with a new triple-tranche green bond, financing both the existing nuclear assets (about 79% of the group's energy mix and renewable energy generation assets (including hydroelectric, which is worth about 8% of the energy mix). This duality allows, not only to contribute to the group’s overall investments for the energy transition, but also to satisfy investors who sometimes have specific policies on nuclear issues.

- The European Investment Bank (EIB) issued, at the beginning of April 2025, its first climate-aligned bond (CAB) aligned with the European Union’s Green Bonds Standards. First entity to issue a green bond in 2007, the EIB has continuously improved its sustainable bonds frameworks to align them with the most stringent market standards. The main purpose of this new issue will be to finance projects related to climate change mitigation, mainly in Europe but also in South America, Africa and Asia.

DASHBOARD - OSTRUM AM VIEWS

MACROECONOMIC OUTLOOK • EUROZONE AND UNITED STATES

MARKET VIEWS