Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: An overview of the FX market

- The evolution of the dollar will depend on the risk of recession, inflation, the crisis of regional banks and the debt ceiling;

- The euro seems vulnerable to an economic downturn, as well as a strong long positioning;

- The weak yen gives Japan a competitive advantage;

- The yuan should weaken to support Chinese exporters;

- The real and the Mexican peso offer attractive carry;

- Positive real rates should be the market mover for the FX market in this second part of the year.

Market review: Fed: status quo called into question?

- Markets fully price a 25-bp Fed hike in July;

- T-note yields hovering about 3.80%;

- Profit-taking on equities expect for US Tech;

- Stable credit spreads, sharp tightening in high yield.

Axel Botte's and Zouhoure Bousbih's podcast

- Review of the week;

- An overview of the foreign exchange market.

Chart of the week

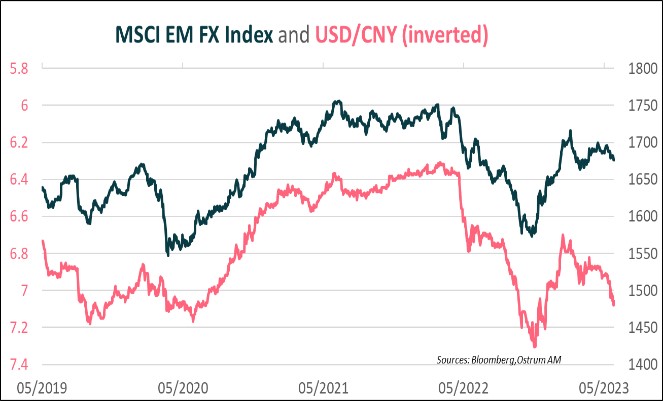

The Chinese yuan has massively underperformed the MSCI EM Currency Index.

Since May, the dollar has strengthened sharply in the wake of rising US nominal interest rates.

However, the Chinese authorities seem to tolerate the recent depreciation of the yuan against the dollar if it remains gradual and orderly.

The weakness of the yuan also supports exporters who are suffering from the contraction in manufacturing activity at the global level and the weakness of the yen.

Figure of the week

For the 1st time, the Earth's average surface temperature is likely to exceed pre-industrial temperatures by 1.5 degrees for at least one year before 2027.

MyStratWeekly : Market views and strategy

MyStratWeekly – May 30th 2023Podcast slides (in French only)

Download the podcast slides (in French only)