Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: US credit cards: higher card delinquencies but no stress for now

- The rise in delinquencies and a contraction in credit card lending in the first quarter is notable;

- Credit card delinquencies are highest among households whose credit card balances are close to the limit;

- Delinquencies outside credit cards remain muted;

- Credit standards on credit card loans have been tightened by banks;

- Credit card losses remain very low at large banks, as smaller institutions bear the brunt of the deterioration.

Market review: Nvidia, a distraction from the bigger picture?

- Nvidia leads tech higher but equities hit by higher rates;

- Fed minutes show some FOMC participants policy Is not restrictive enough;

- Stronger US PMI spark bond selloff, with Bund yields above 2.60%;

- Sovereign and credit spreads remain stable.

Axel Botte's podcast

- Topic of the week: Market news and economic conditions;

- Theme: US equities at the crossroads?

Chart of the week

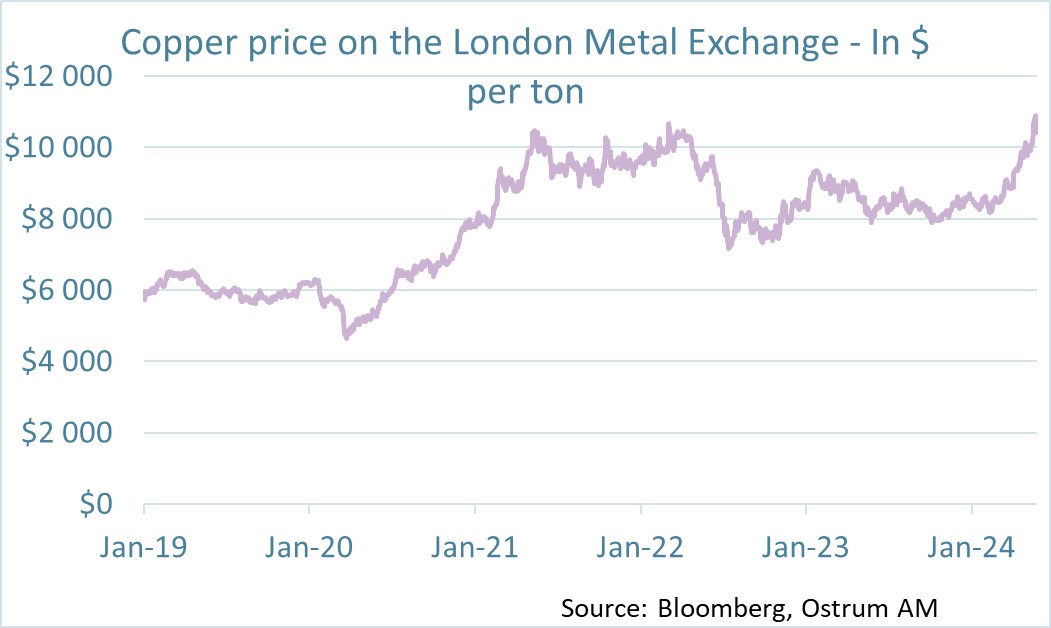

The price of copper is at an all-time high. A ton of metal is trading at more than $10,400.

The energy transition metal par excellence is facing both high demand and recurring production problems, especially as the productivity of the deposits has been decreasing for several years.

Figure of the week

1.8-billiondollars. This represents global investment spending in clean energy last year. Investment rose 17% from a year prior.

Source: Bloomberg

MyStratWeekly : Market views and strategy

MyStratWeekly – May 28th 2024