Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: QT reduction to be Fed’s first move

- At the same time as rate increases, the Fed is piloting the reduction of its balance sheet by reinvesting only part of the proceeds from its portfolio made up of Treasuries and MBS;

- Given the difficult budgetary discussions and the risk of congestion in the Treasuries market, the Fed should reduce the portfolio maturities by half;

- The liquidity thus freed would reduce the risk of tensions on the repo market and all the financial plumbing linked to the financing of the US federal deficit;

- The QT cutback will be the first easing measure before interest rate cuts begin in May at the earliest.

Market review: As good as it gets?

- US growth revised to 3.2% in 4Q 2023;

- Euro Stoxx 50 as an alternative to the Magnificent 7?

- Bund yields hot briefly 2.50%;

- The credit rally is slowing.

Axel Botte's podcast

- Topic of the week: Eurozone equities, volatility and credit;

- Theme: QT as the Fed’s first decision

Chart of the week

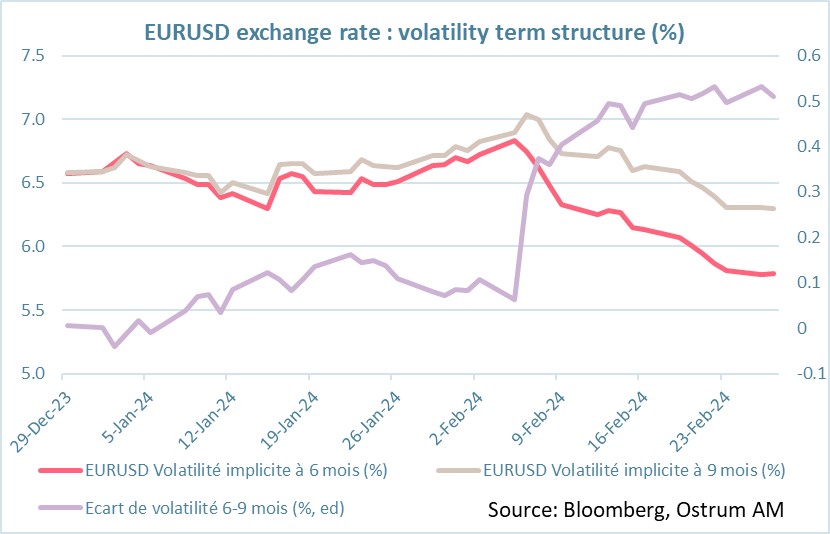

The US presidential election will undoubtedly be a major event at the end of the year, especially since the clear-cut positions of Donald Trump, the likely Republican candidate, may generate high volatility across financial markets.

The foreign exchange market already seems to be factoring in greater volatility after the November 5 election. The slope of the implied volatility of the euro-dollar exchange rate over the 6 to 9 month horizon therefore has moved up significatly.

Figure of the week

This is the fertility rate in South Korea, the lowest in the World.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – March 5th 2024