Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Where does the divergence in business surveys in the Eurozone come from?

- In normal times, business surveys provide consistent signals about the dynamics of economic activity;

- For the past few months, surveys have been diverging. According to S&P Global, the economic situation in France seems deteriorated, while according to INSEE, the Banque de France, and the EC, economic activity is close to its long-term average;

- This divergence mainly stems from the sample size. INSEE surveys 15 times more companies than S&P Global, and the Banque de France surveys 8 times more;

- It is even more problematic that the current context is characterized by a strong heterogeneity in sectoral dynamics;

- It’s essential to have a large sample in order to fully understand the overall dynamics of economic activity;

- In this context, the results of the S&P Global survey should be put into perspective.

Market review: ECB: A First Rate Cut and Then What?

- ECB will cut rates by 25 bp this week but inflation is creeping higher;

- Treasury auctions faced with poor demand, US curve bear steepens;

- JGB yields top 1%;

- Sovereign and credit spreads remain stable.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the week: Market news and economic conditions;

- Theme: Where does the divergence in business surveys in the euro area come from?

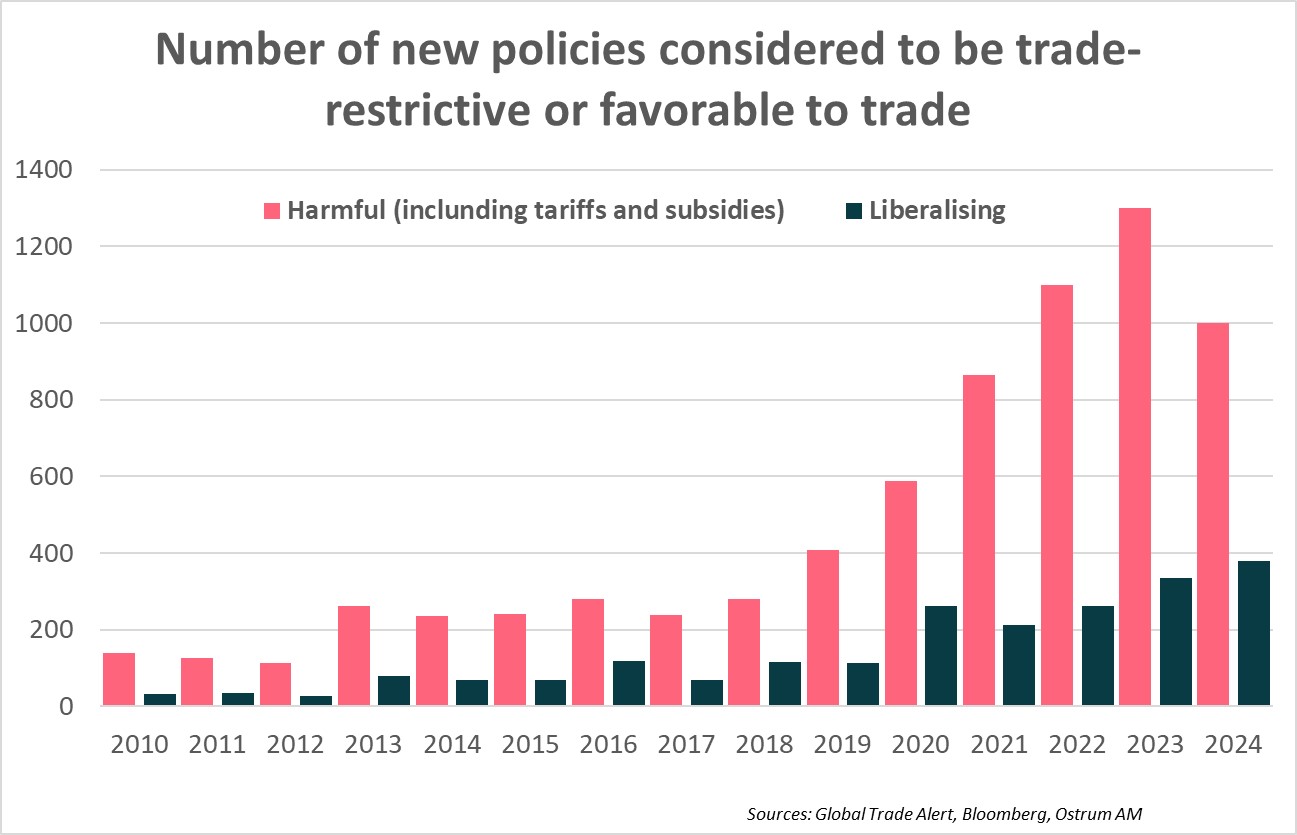

Chart of the week

The number of new policies considered restrictive to global trade reached a record in 2023 (1,300). The year 2024 started off with a bang, notably with the decision of the Biden administration to increase tariffs on certain Chinese products, including a 100% tax on electric cars, to which China responded.

The European Union's response, following its investigation into Chinese subsidies, is expected to be more measured. The trade war is intensifying, with the risk of weighing on global growth.

Figure of the week

The IMF has revised upward its growth prospects for China to 5% in 2024, up from 4.6% previously, due to strong growth in the first quarter and new government support measures. This corresponds to the growth target set by the government.

Source: IMF

MyStratWeekly : Market views and strategy

MyStratWeekly – June 4th 2024