Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: G4 FX: Something‘s got to give

- The dollar remains the cornerstone of financial markets and a source of stability despite twin deficits and upcoming election deadlines;

- The yen remains significantly undervalued, burdened by very negative carry trades and an ongoing expansionary monetary policy that limits interventions in the foreign exchange market;

- The renminbi is facing external pressures through European and American tariff policies as well as weak domestic demand, which forces the PBoC to ease its policy. The specter of the 2015 summer devaluation resurfaces;

- Political risk weighs on the euro, reminiscent of previous crises. The ECB has the means to limit contagion risks, but the single currency will remain under pressure.

Market review: A precarious calm in the markets

- AFT conducts its auctions, relaxation in sovereign spreads;

- Surveys decline under the weight of the French political situation;

- Mixed publications in the United States and China;

- European stocks rebound by 2% for the week.

Axel Botte's podcast

- Topic of the week: Market news, OAT auction, US real estate market;

- Theme: G4 FX: Something‘s got to give.

Chart of the week

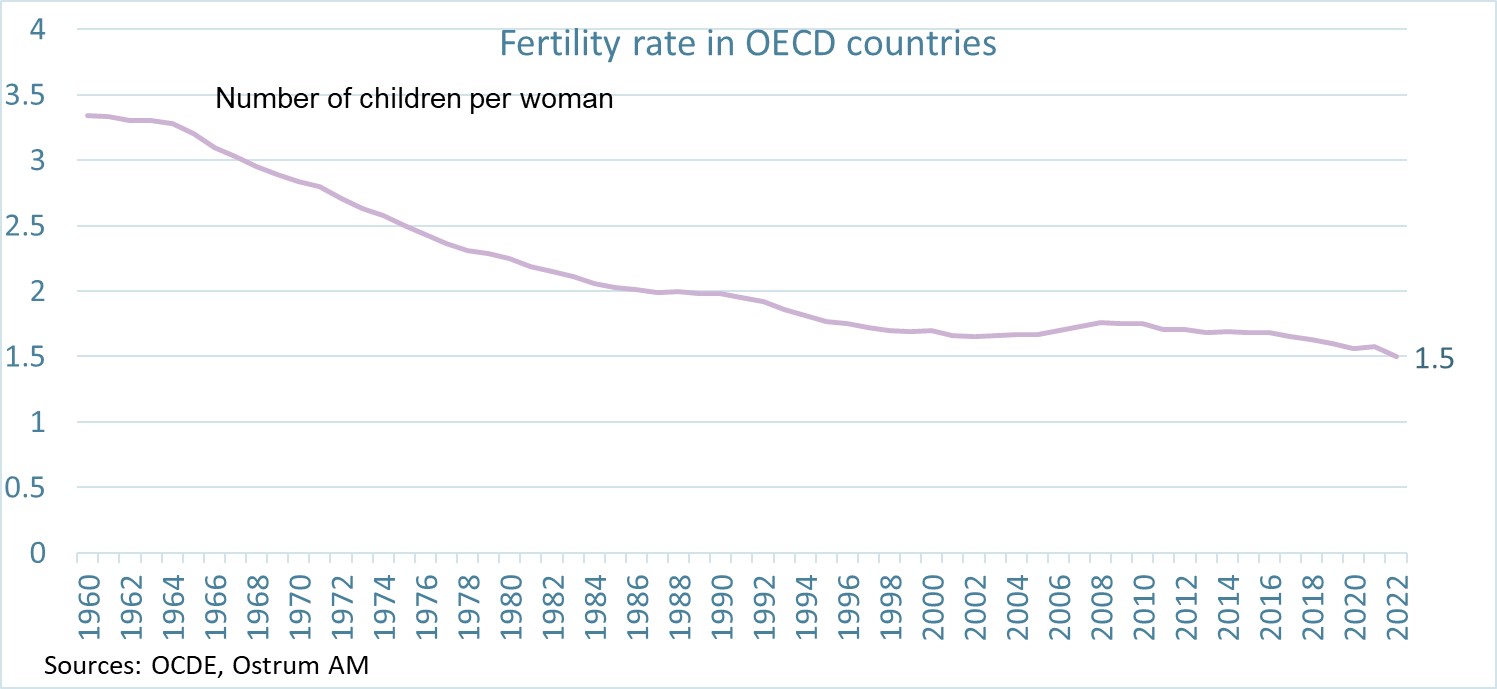

According to a new OECD report, the fertility rate in developed countries has halved since 1960, dropping from 3.3 children per woman to just 1.5 in 2022. This rate has even fallen to 1.2 in Spain and Italy, and to 0.7 in Korea. This reflects, in particular, the fact that the average age for women to have a child has increased (from 28.5 years in 2000 to 30.9 in 2022) and that the number of childless women has risen.

The fertility rate is thus well below the population replacement level of 2.1. This poses a risk of demographic decline, resulting in a decrease in the working-age population and an aging population that could make it even more challenging for governments to finance retirement systems, healthcare services and services for the elderly.

Figure of the week

This is the amount borrowed by the French Treasury in billions of euros at nominal and inflation-linked bond sales last week. This is the high-end of the indicated range by the AFT, which signals strong investor demand.

Source: Bloomberg

MyStratWeekly : Market views and strategy

MyStratWeekly – June 25th 2024