Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Green Hydrogen, the new “zero-carbon” commodity ?

- Geopolitical developments and the desire to move away from fossil fuels have rekindled interest in green hydrogen. It is a key element in decarbonizing heavy industries that are difficult to electrify;

- Despite this enthusiasm, investments in hydrogen account for only 0.6% of global energy investments, reflecting high production and deployment costs resulting in low demand;

- China has rapidly increased the capacity of its electrolyzers and could become the global leader in hydrogen. Renewable hydrogen also presents an opportunity for fossil fuel-producing countries, but challenges related to water resources, crucial in hydrogen production, could limit their ambitions.

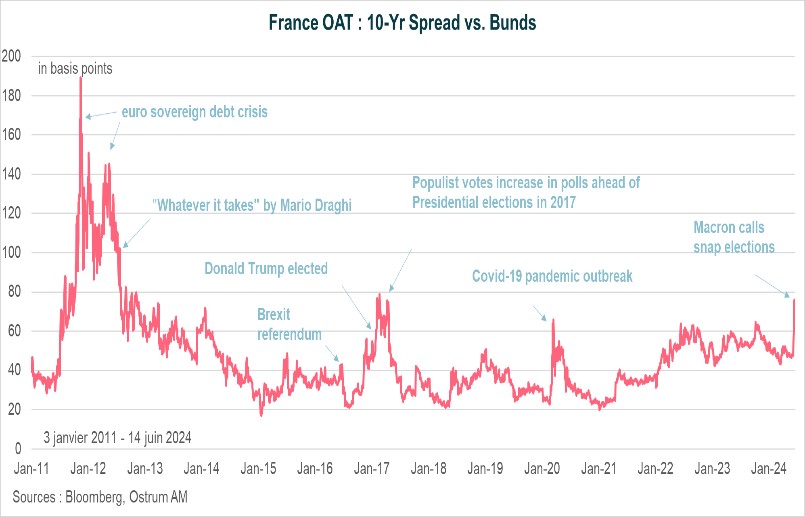

Market review: French political risk derails markets

- Political risk in France: OAT spreads at 77 bps and CAC 40 down 6 % last week underperform significantly;

- FOMC held rates unchanged, as inflation shows signs of moderating;

- Swap spreads rise, decompression in credit markets;

- The gap between VIX and VSTOXX implied volatility indices highlight the European political risk.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week: Market news, FOMC and French markets;

- Theme: Green Hydrogen, the new “zero-carbon” commodity ?

Chart of the week

The spread of the OAT is around 80 basis points. This level recalls the situation that prevailed at the time of fears of a EU exit with the rise of extremists during the 2017 presidential campaign, against the international backdrop of Brexit or the election of Donald Trump.

At the beginning of the 2010s, the sovereign debt crisis and the ensuing banking crisis had caused the spread to skyrocket to 190 basis points before dropping to 140 basis points in 2012, until the famous "whatever it takes" speech by Mario Draghi.

Figure of the week

This is the performance of the French CAC 40 index since the start of the year. The benchmark equity index has erased all year-to-date gains since President Macron called snap elections.

Source: Bloomberg

MyStratWeekly : Market views and strategy

MyStratWeekly – June 18th 2024