Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Access to finance of enterprises in the Eurozone and investment

- The bi-annual ECB survey on access to finance of Euro area enterprises reveals a significant gap between corporate financing needs and their availability – the highest since the sovereign debt crisis;

- Corporate financing conditions have deteriorated sharply;

- Faced with sharp increases in interest rates, companies are reducing their demand for loans, which will weigh on investment;

- Continued unprecedented monetary tightening by the ECB creates uncertainty about the scale of the adjustment.

Market review: A resilient US economy

- Markets are almost in line with the Fed’s rate guidance;

- US GDP growth revised up to 2% in 1Q 2023;

- T-note burst past 3.80%, Bunds held under 2.50%;

- Equities end the first half of 2023 on a positive note.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the Week: Resilience of the U.S. Economy;

- Access to finance of enterprises in the Eurozone and investment.

Chart of the week

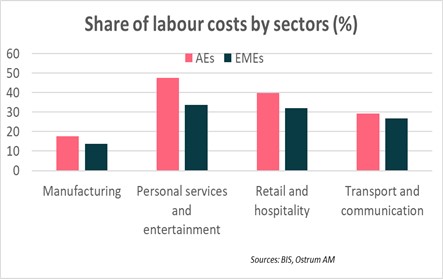

Central banks in developed countries are particularly sensitive to the risk of a price-wage spiral.

Developed economies are in fact dominated by the service sector where wage costs represent between 30% and 45% of costs depending on the sector. The manufacturing sector is more capital-intensive and the share of wages is lower by 3% to 14% depending on the sector considered.

In emerging countries, the share of wages is much lower.

Figure of the week

The annual growth of the M2 monetary aggregate in the euro area. It is the lowest growth on record.

MyStratWeekly : Market views and strategy

MyStratWeekly – July 4th 2023