Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Topic of the week: China-US: critical metals as a new battle line

- The trade war between China and the United States is a race for technological and military hegemony;

- Americans restrict tech exports to China, which retaliates by limiting exports of rare metals;

- This situation is reminiscent of the Japanese crisis of 2010 which caused a surge in the price of rare earths;

- This is arguably a new front line in the Sino-US trade war.

Market review: Disinflation, 60/40’s best friend

- US headline inflation dips to 3% in June;

- The T-note (3.80%) erases the tension observed after us employment;

- Sharp upward acceleration on equities;

- The credit carried by the hopes of monetary relief.

Axel Botte's podcast

- Topic of the Week:

- Theme:

Chart of the week

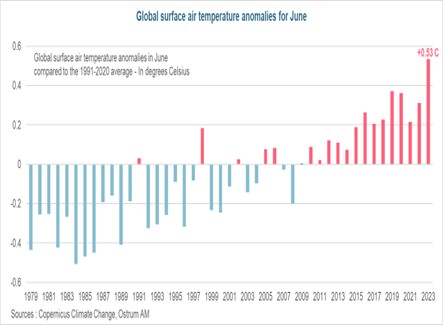

We had the hottest June on record. This graph indeed shows an acceleration of the temperature drift in the air at the surface of the globe in June 2023.

The anomaly or deviation from the average observed between 1991 and 2020 is of an unprecedented magnitude of more than half a degree Celsius. It far exceeds the previous record of June 2019. Hottest temperature have been recorded in Europe and in particular in Ireland, the United Kingdom, Belgium and the Netherlands. They were significatly warmer in France and in parts of Canada, the United States, Mexico, Asia and Australia.

The trend rise in temperatures continued at the beginning of July with a historic high on July 3.

Figure of the week

$ 38 billion : this represents total inflows into European bond ETFs in the first half of 2023 as investors grab higher yields.

MyStratWeekly : Market views and strategy

MyStratWeekly – July 17th 2023