Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Emerging Markets: Desync!

- Rapid declines in inflation rates, high nominal interest rates and low currency volatility have paved the way for lower rates for emerging markets;

- We favour local debt in Brazil and Mexico over Eastern European countries with slower disinflation process;

- The de-synchronization of the emerging markets’ monetary policies also reinforces the value of diversification.

Market review: The Fed is right

- Jobs and surveys justify Fed tightening;

- US 10-Yr note yield rises above 4 %;

- Credit spreads resist despite upward pressure on CDS indices;

- European equities dip as yields shoot higher.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the Week: Equity and credit valuations;

- Theme: Emerging markets: desynchronization!

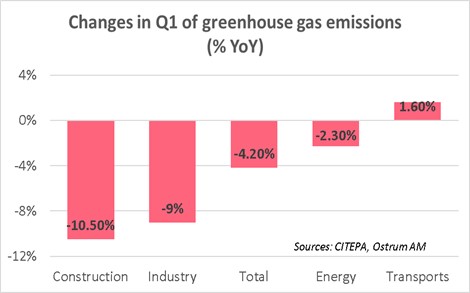

Chart of the week

In the first quarter of 2023, greenhouse gas emissions fell by 4.2% over one year and those of CO2, the best covered by the CITEPA barometer, by 4.9%.

We are approaching the pace required to achieve the European “Fit for 55” objective. But part of the declines can be explained by cyclical factors, while emissions from transport remain on the rise.

Figure of the week

It took fully 15 years for US 2-Yr note yield to rise back to 5%.

MyStratWeekly : Market views and strategy

MyStratWeekly – July 11th 2023