Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Aline Goupil-Raguénès’ podcast:

- Review of the week – Financial markets, the return of tariffs;

- Theme – German growth recovery projected for 2026, fueled by public investment.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Rebound of German growth starting in 2026 driven by public investment

- After years of chronic underinvestment, in a context of increased geopolitical uncertainty, Germany adopted key measures in 2025 aimed at significantly increasing its investments;

- The reform of the debt brake, the infrastructure fund, and the Germany Fund, designed to mobilize private investment, will result in a significant increase in investment starting in 2026;

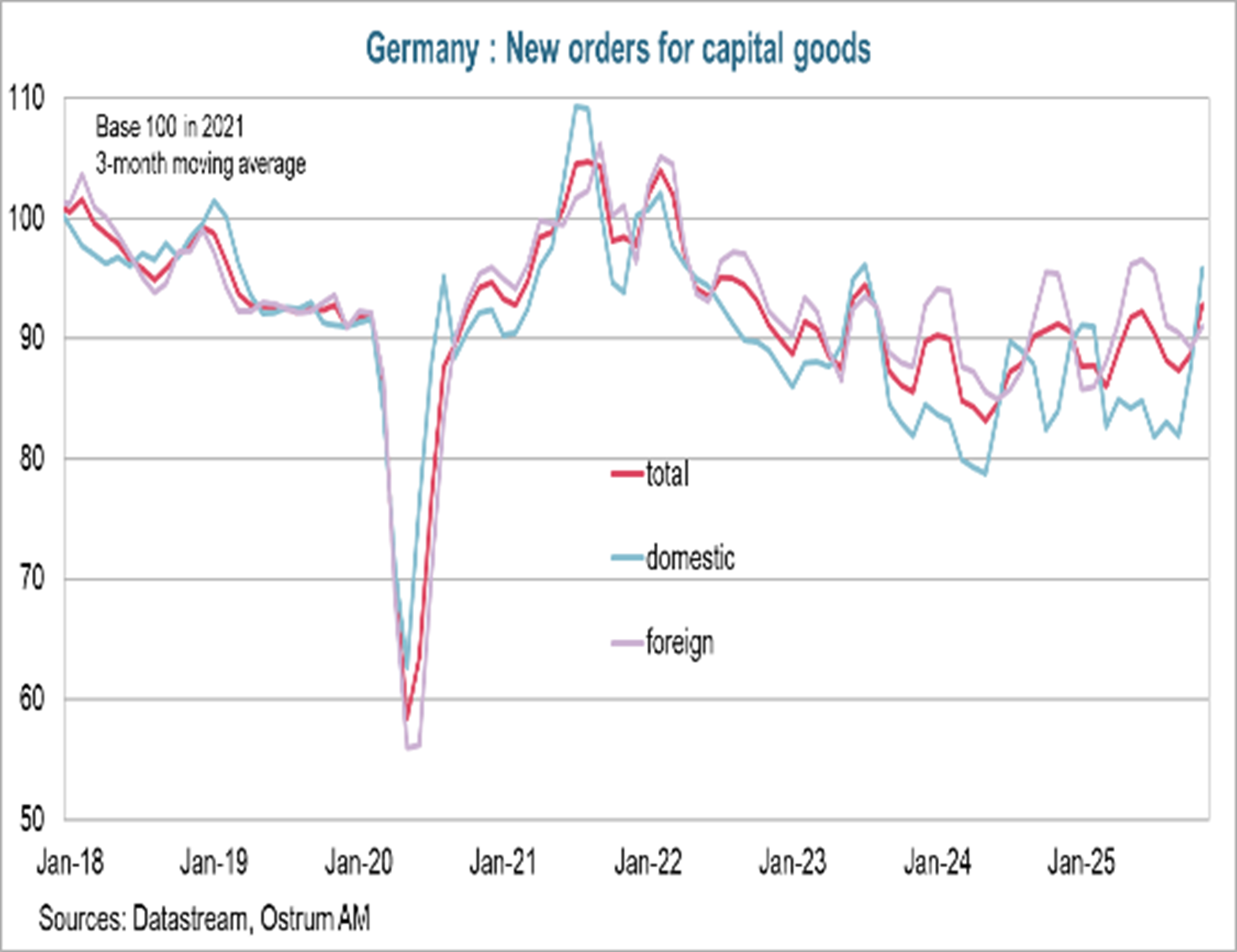

- While the impact is expected to be limited in 2025, the first signs of recovery have emerged through the strong increase in new orders for domestic capital goods;

- For the recovery of growth to be sustainable, structural reforms must be adopted to mitigate the impact of the rapid aging of the population, ensure a short approval period for investment projects and reduce bureaucracy. The key regional elections in September could hinder their adoption.

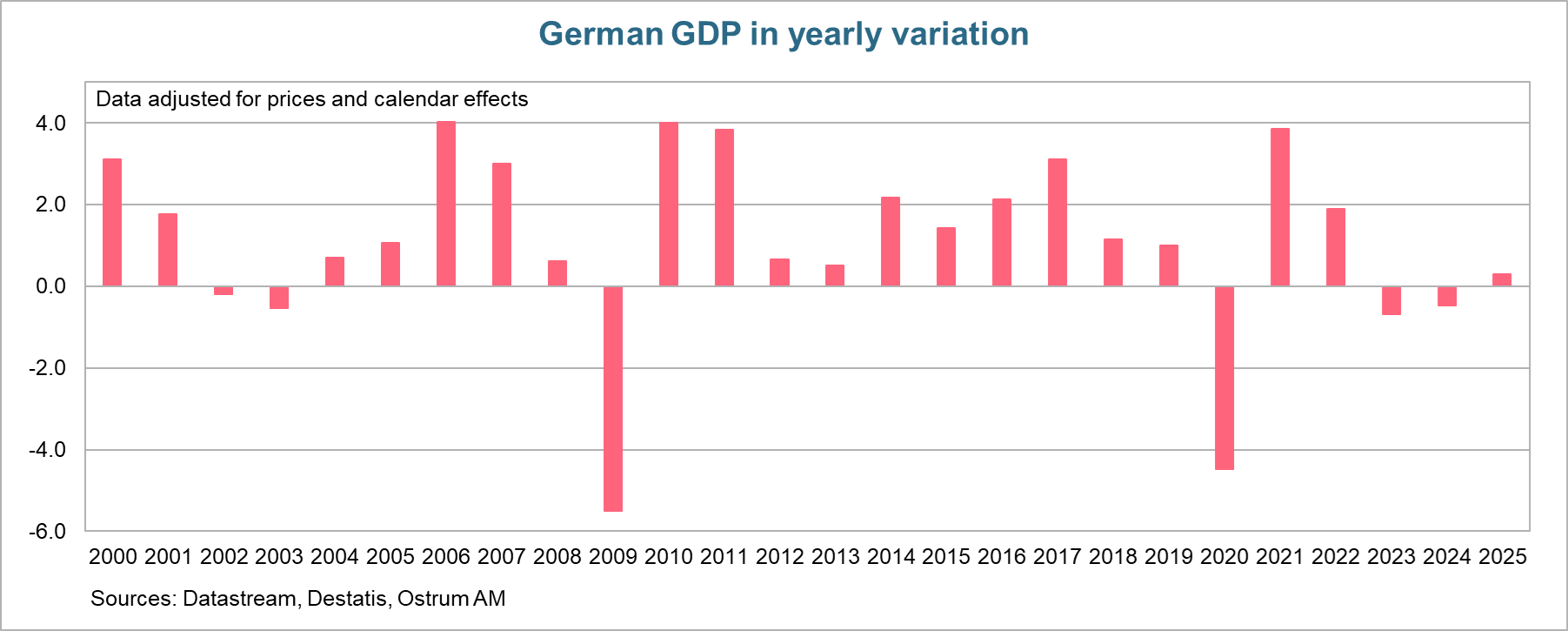

Stabilization of growth in 2025 after two years of recession

The German economy has been heavily affected by its past dependence on Russian energy and the energy shock following the conflict triggered by Russia in Ukraine. It has also suffered from the contraction of global trade, to which its economy is more sensitive than the rest of the Eurozone, with reduced exports to China. Additionally, the economy across the Rhine is facing increased competition from China in key sectors, notably in the automotive industry. These factors resulted in two consecutive years of recession in 2023 and 2024 (-0.7% and -0.5% respectively).

In 2025, according to initial estimates from the German statistical institute Destatis, the German economy remained virtually stable. Growth averaged 0.2% over the year 2025 and 0.3% when adjusted for calendar effects. The growth in 2025 was driven by domestic demand, particularly household consumption (+1.4% compared to 2024) and public spending (+1.5%), especially in the healthcare sector. Investment, on the other hand, slightly declined (-0.5%) in both machinery and equipment as well as in construction. External trade had a negative contribution due to a decrease in exports (-0.3%) and a sharp increase in imports (+3.6%). Exports were affected by rising trade tensions since Donald Trump's return to the White House, the appreciation of the euro and stronger competition from China.

Starting in 2026, growth will benefit from the "budgetary bazooka"

After years of chronic underinvestment, Germany's investment needs are enormous in infrastructure, digital technology, and defense, especially given the pressures exerted by Donald Trump on NATO and the increasingly uncertain geopolitical context. The German government announced key measures on March 19, 2025.

The Reform of the Debt Brake

The debt brake rule, enshrined in the constitution, limits new borrowing by the federal government. Before the reform, new borrowing was limited to 0.35% of GDP and forbidden for the Länder. With the reform, military spending exceeding 1% of GDP is exempt from the debt brake and the Länder are allowed to take out new loans up to 0.35% of GDP. This reform aims to significantly increase investment in defense, with an expected amount of 500 billion euros.

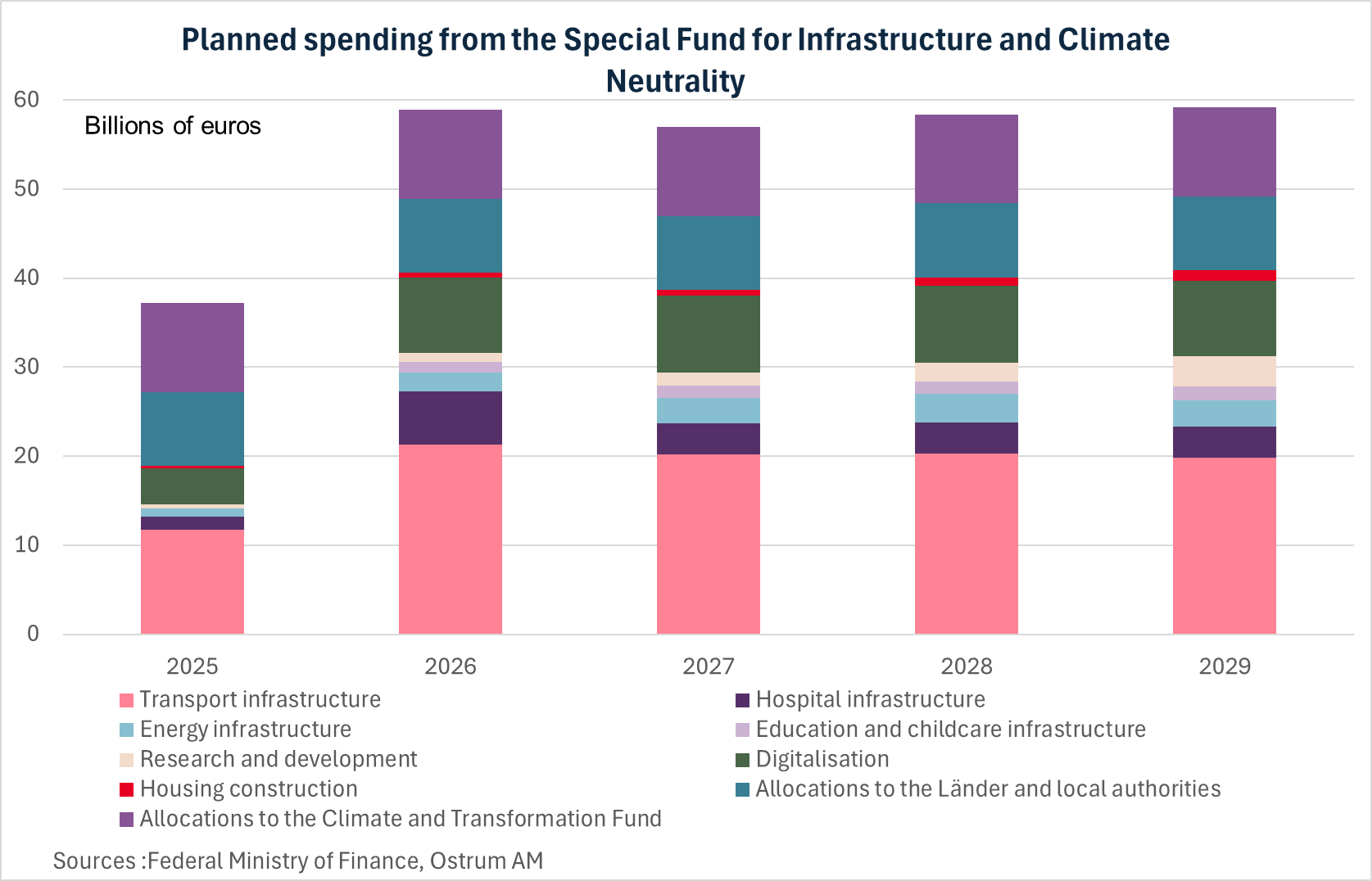

A 500 Billion Euro Infrastructure Fund

Germany has the lowest public investment rate among G7 countries in the OECD, which results in poor-quality infrastructure and contributes to reduced growth. In response, the government announced the creation of a special fund for infrastructure and climate neutrality amounting to 500 billion euros (11% of GDP) over a period of 12 years. Of this amount, 100 billion euros are allocated to the Länder and 100 billion euros will contribute to the climate and transformation fund. This fund is off-budget and not subject to the debt brake; it complements the federal budget (central budget). Investments will primarily focus on transportation infrastructure (rail networks, trains, renovation of bridges and tunnels...), followed by digital infrastructure (broadband expansion and digitization of administration), as well as healthcare, energy, and educational infrastructure, research and development, and housing construction.

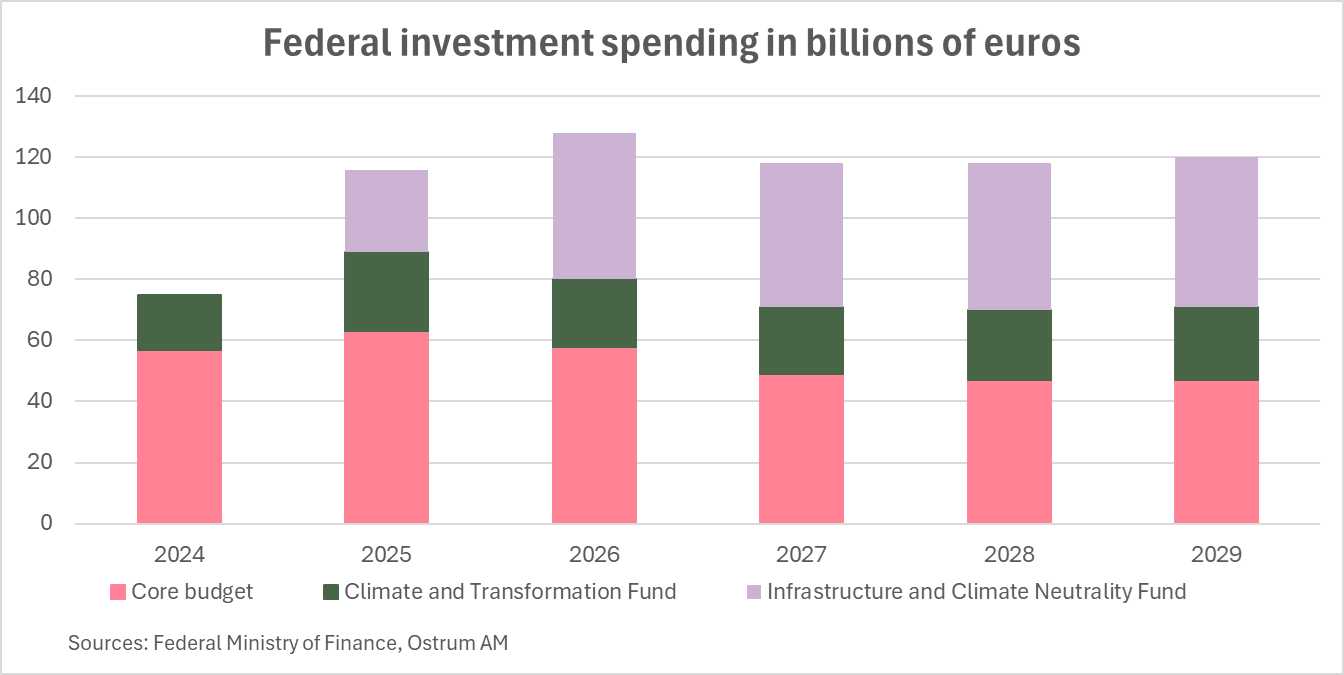

Significant Increase in Public Investment

The federal government is planning a substantial increase in investments starting in 2025, with a projected rise of 55% compared to 2024, reaching 115 billion euros. Investment levels are expected to remain high at least until 2029, with an estimated 120 billion euros in 2026. The special infrastructure fund will contribute between 37 and 58 billion euros, respectively in 2025 and 2026. The first economic plan for the special fund was adopted in October 2025 and took effect retroactively from January 1, 2025.

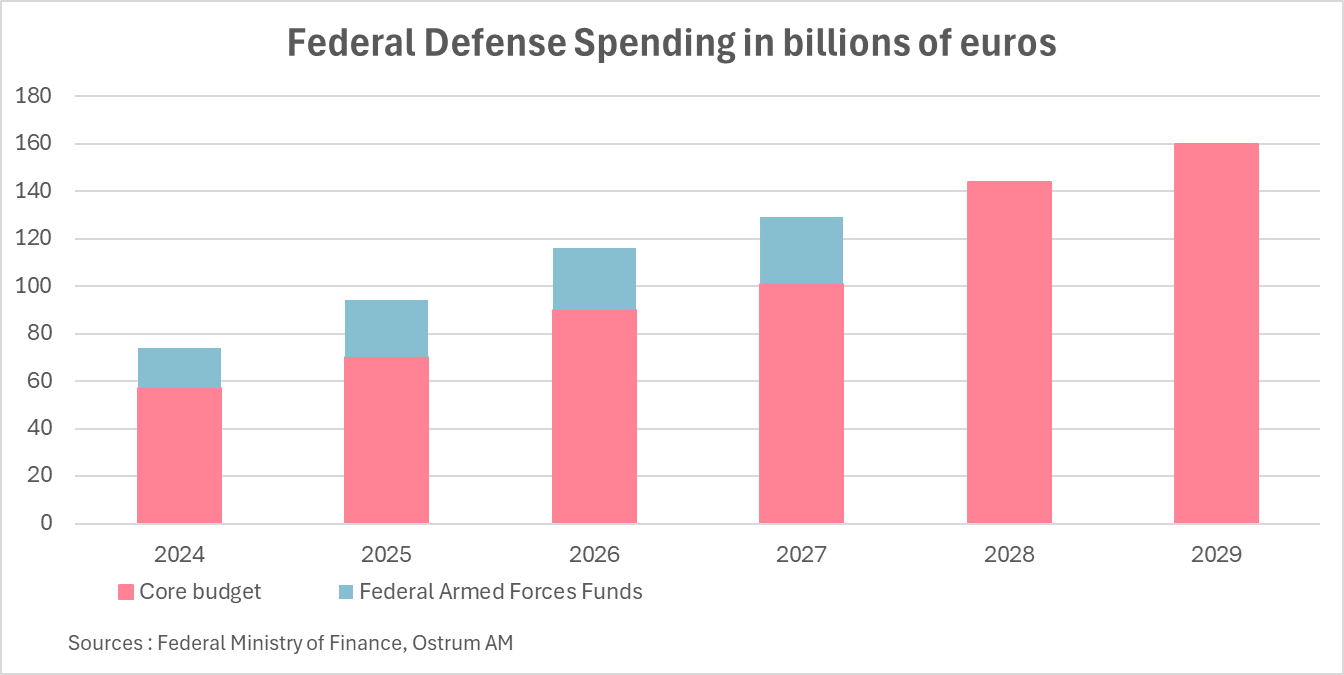

The government is also set to significantly increase military spending, primarily through the federal budget but also via the federal armed forces fund. Military expenditures are expected to reach the new NATO goal of 3.5% of GDP by 2029, well ahead of the target date of 2035.

"Growth Booster"

The government has created incentives for private investment. Companies can depreciate up to 30% of the amounts invested in capital goods in 2025, 2026, and 2027 (compared to 10 to 20% previously). Starting in 2028, corporate tax will gradually decrease from 15% to 10% by 2032. The government has also implemented subsidies for the purchase of electric vehicles for companies (75% depreciation in the first year, 10% in the second year, and 5% in the following two years).

Fund to Mobilize Private Investment

On December 18, the government announced a fund aimed at mobilizing private investment. The key sectors targeted include industry (including defense and critical minerals), SMEs, venture capital and energy infrastructure. The federal government is providing public funds and guarantees amounting to approximately 30 billion euros to mobilize private investments totaling 130 billion euros. This fund, called the Germany Fund, is managed and implemented by the public development bank KfW.

Significant Increase in Debt

Given years of fiscal caution in Germany, these measures resemble a "whatever it takes" moment to finance massive investments in defense and infrastructure. The federal budget will contribute significantly and will be complemented by the infrastructure fund, the climate and transformation fund, and the military armed forces fund. As a result, the federal deficit is expected to increase significantly, fluctuating between 3.5% and 4% of GDP between 2026 and 2029, compared to 1.5% in 2024.

To finance these investments, new borrowing is expected to increase by nearly 850 billion euros between 2025 and 2029, of which 400 billion euros will be allocated to defense. Interest costs are anticipated to double, reaching 62 billion euros. The federal deficit is expected to increase by 50% between 2024 and 2029.

According to preliminary figures from Destatis, the budget deficit narrowed in 2025 to 2.4% of GDP, down from 2.7% in 2024. This is related to the Länder and the social security fund. In contrast, the federal deficit increased from 60.9 billion euros to 65.1 billion euros in 2025, and public spending exceeded the 50% of GDP threshold (50.3%) for the first time since the pandemic. In addition, the special fund for infrastructure and climate neutrality borrowed 12.8 billion euros in October and 18.8 billion euros in November, in line with the target of 37.2 billion euros set for 2025.

Signs of Recovery

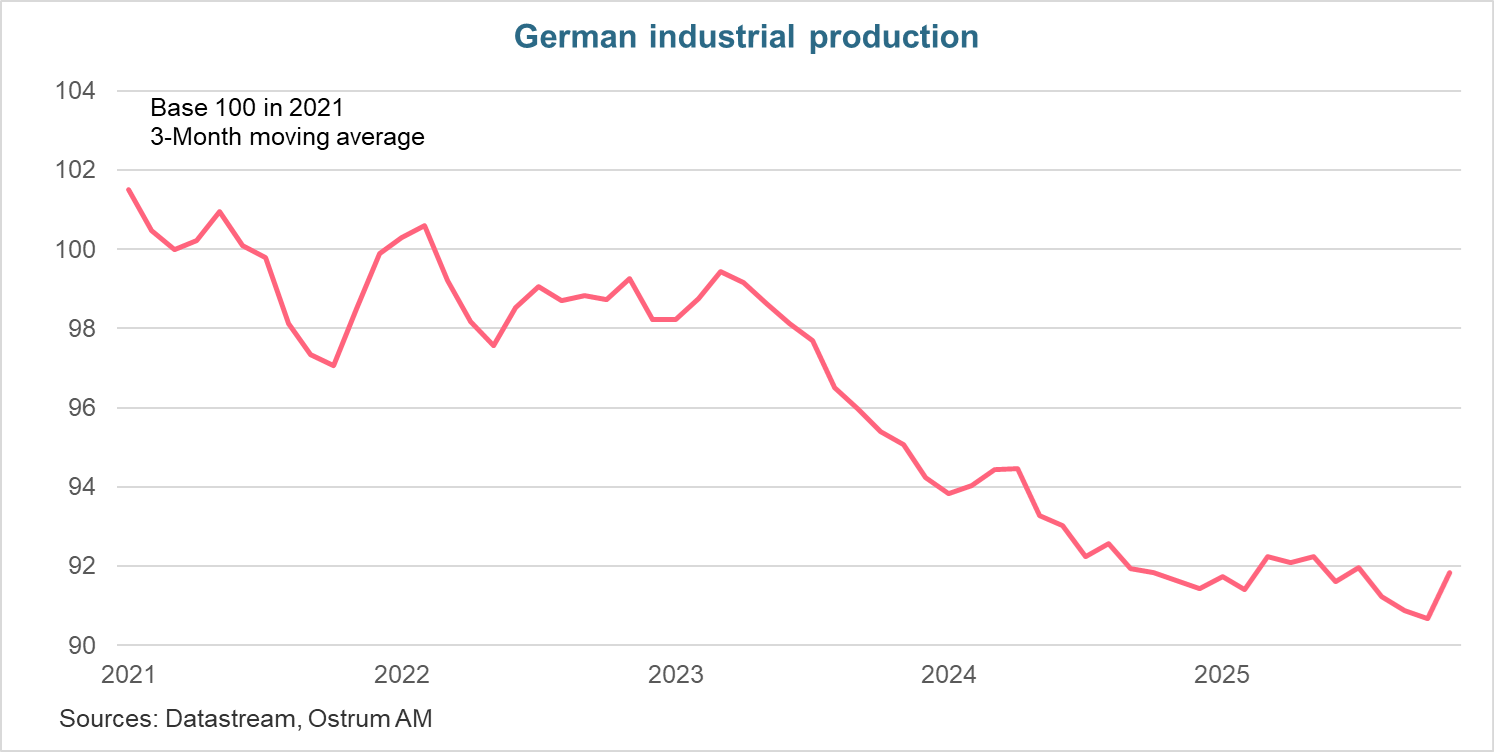

Recent data is very encouraging. In the fourth quarter, Destatis estimates growth at 0.2%. This compares to 0% in Q3, a figure that may be subject to revision. New orders in the industrial sector increased significantly in November (+5.6%). New orders for capital goods have rebounded for the past two months, primarily driven by domestic capital goods orders (+22.9% and 9.6%), which have reached their highest point since July 2023 based on 3-month moving average data. Orders for other transportation equipment, which include aircraft, ships, trains, and military vehicles, have also increased significantly. This is expected to lead to further improvements in industrial production, which rose by 0.8% in November, following increases of 2% and 1.1%. While the short-term momentum is improving, the industrial production index remains well below the levels that prevailed in 2021, prior to the energy shock. The production index was 91.8 in November, significantly lower than the average of 100 in 2021.

Conclusion

The year 2026 will be marked by the recovery of growth in Germany, driven by massive investments in infrastructure and defense. The government announced on December 18 an additional 50 billion euros in military spending. Growth is expected to be at least 1% in 2026, following a period of near stagnation in 2025 and two years of recession. For this growth to be sustainable, structural reforms must also be adopted. Germany is the G7 country where the aging population will be the most rapid, which will weigh on its potential growth and public finances. A pension reform could help mitigate the financial impact. The government must also take measures to ensure a short approval period for investment projects and reduce bureaucracy to promote a recovery in private investment, which has been sluggish. However, the approach of key regional elections in September may hinder the adoption of the necessary reforms to ensure sustainable growth in Germany.

Aline Goupil-Raguénès

Chart of the week

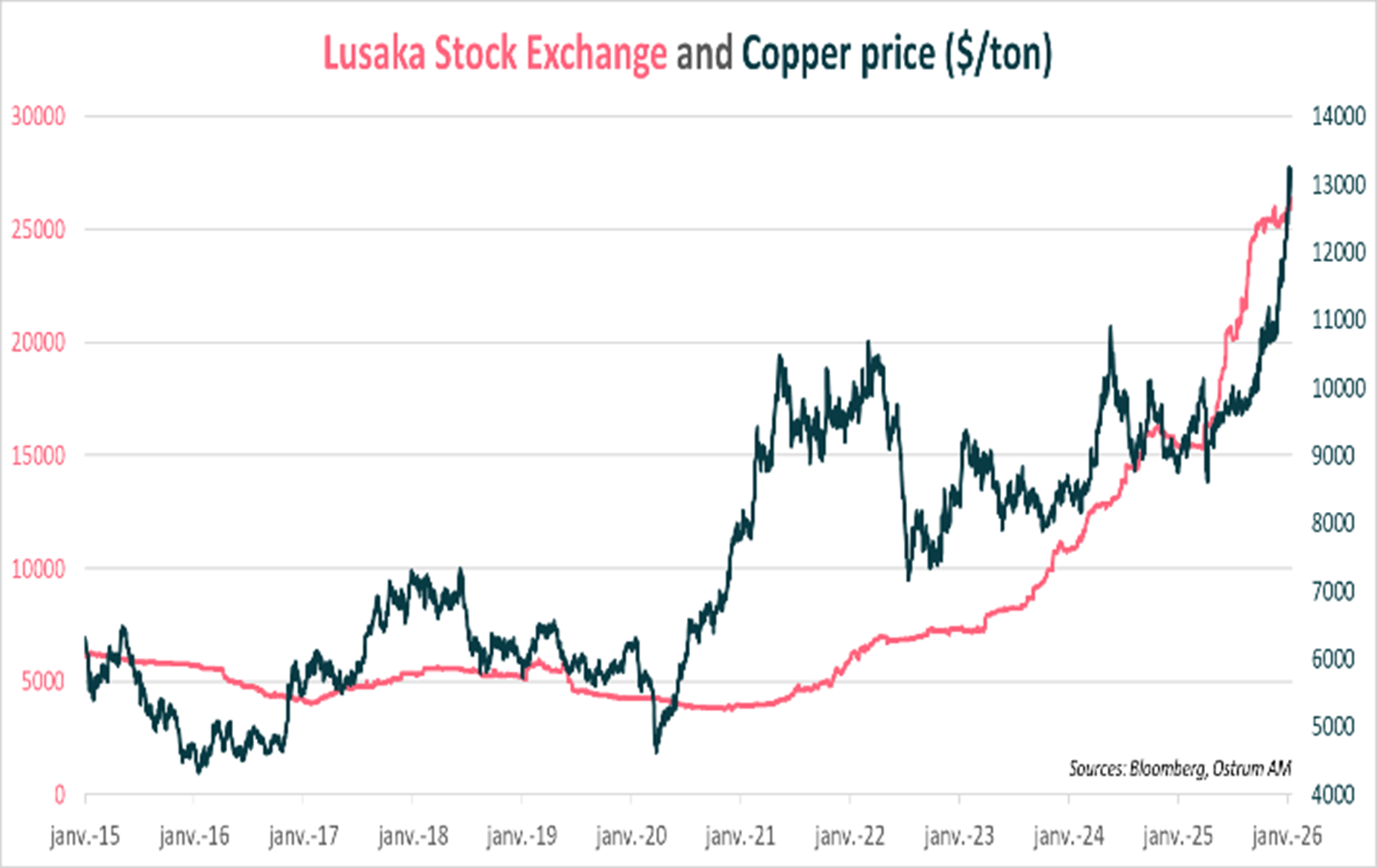

The Lusaka Stock Exchange in Zambia has posted the second-best year-to-date performance (17%), supported by the rapid rise in copper prices to over $13,000 per ton. Its currency, the Kwacha, also registered the best performance against the dollar, up by more than 11%. Zambia is the world's second-largest copper producer, after the Democratic Republic of Congo. Following a long debt restructuring process backed by an IMF program, the country's fiscal outlook has significantly improved, thanks to a rise of over 40% in the price of the red metal last year. The mining sector accounts for more than a quarter of its budget revenues and 70% of its export earnings. Consequently, the government has requested a new IMF program this year, focused not on fiscal consolidation but rather on inclusive growth and energy resilience. Zambia's credit profile is improving significantly.

Figure of the week

95

The ECB estimates that trade frictions within the single market, particularly related to differing regulations between countries or anti-competitive national practices, are equivalent to customs duties of 67% in the trade of goods and 95% in that of services.

Market review:

- United States: Producer prices rekindle inflation fears;

- Precious Metals: Silver skyrockets by 27% in 2026;

- Equities: Rotation from technology to small-cap stocks in the U.S;

- Fixed Income: The Bund and T-note remain trendless, while JGBs are under pressure near 2.20%.

The Gold-Equity Barbell Strategy

The rally in equities and credit continues, with precious metals appearing to factor in geopolitical risks. As demonstrated throughout 2025, the multitude of international crises does not seem to hinder the advancement of financial markets.

Asian stocks, particularly in South Korea (Kospi), are soaring amid weakness in the yen and won, while rates and credit spreads remain narrow despite significant issuance. Precious and industrial metals are reaching new historical highs. The rise in gold and silver represents the only tangible sign of political risk aversion, with both implied and realized volatility remaining notably low.

In the U.S., inflation data are mixed, bolstering the narrative for a pause in monetary policy in January. The producer price index has rekindled fears of inflation resurgence, with distribution margins rebounding at the expense of consumers. Electricity prices (+6.7%) have become a political issue in the run-up to the midterm elections, highlighting one of the negative externalities associated with AI development. Nonetheless, the Consumer Price Index (CPI) for January is expected to dip below 2.5%. While labor market conditions remain challenging, there is no dramatic deterioration, with both hiring and layoffs remaining low. In the Eurozone, Germany is posting meager growth of 0.2% in 2025, but the current industrial upturn predicts a rebound in 2026.

In the rates markets, crude oil volatility linked to the Iranian situation fuels short-term inflation expectations. The anticipated Fed rate cut for January has faded. The T-note continues to fluctuate within a narrow range of 4.10% to 4.20% ahead of the Martin Luther King Jr. long weekend. Volatility in rates is similarly subdued in Europe, with the Bund trading around 2.85% before upcoming 15-30 year issuances this week. Receiving flows in long maturities are tightening swap spreads, while sovereign spreads easily absorb January syndications. The OAT is trading below 70 basis points despite the lack of concrete progress on the budget. In Japan, the promised budget stimulus following the snap elections is putting pressure on rates, with the 10-year JGB nearing 2.20%. Japanese authorities are signaling the risk of intervention in the yen (currently at 158 against the dollar), but markets remain skeptical, as the Bank of Japan would act unilaterally with limited chances of success. Market participants appear to prefer gold and even silver, with prices soaring beyond $90 an ounce.

Credit markets remain stable, with the average investment-grade spread slightly tightening to 66 basis points over swaps since the beginning of the year. Covered bonds are trading at even tighter spreads of 22 basis points. The high-yield segment is the standout performer, buoyed by rising equity markets. Implied volatility of 15-16% keeps CDS indices insulated (XOVER at 240 basis points). Equity markets are poised for growth in 2026, with Japanese and Korean indices benefiting from currency weakness—Kospi has risen 14%, while Nikkei has gained 7%. In the U.S., sectoral and thematic rotations are underway, with major tech stocks pulling back while the Russell 2000 rallies by 7%. The performance of the Magnificent Seven has remained flat since late October. The AI narrative remains intact in light of TSMC's results, which saw revenues increase by 30% in 2025.

Axel Botte

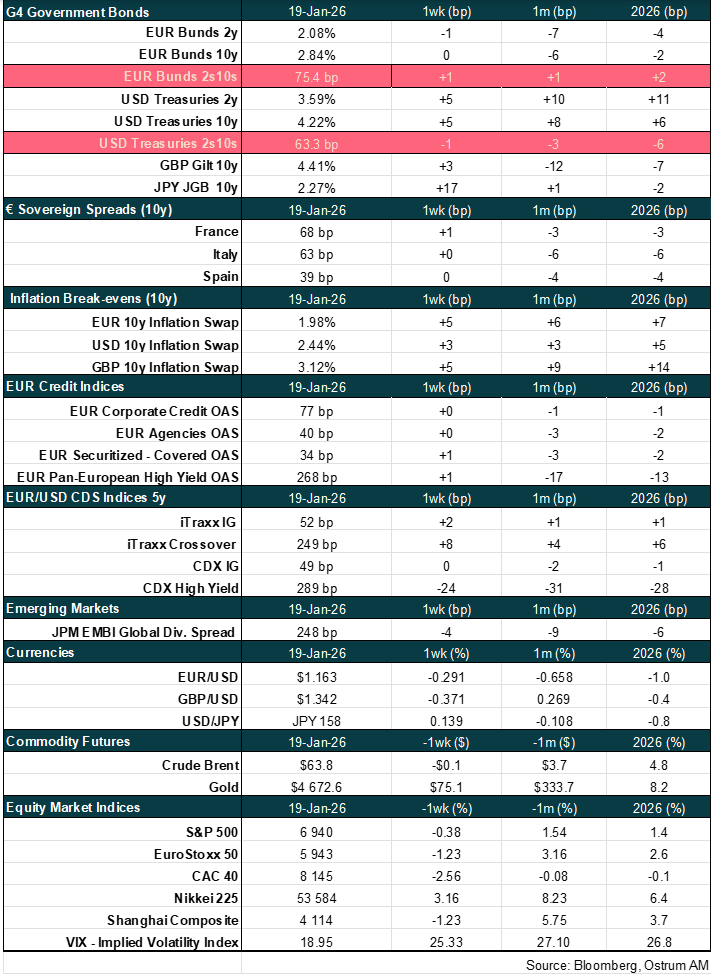

Main market indicators