Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Zouhoure Bousbih’s podcast:

- Review of the week – Financial markets;

- Theme – Venezuela's Debt Restructuring: An Overly Optimistic Outlook.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Venezuela's Debt Restructuring: Premature Optimism

- The capture of President Nicolás Maduro by U.S. armed forces has rekindled hopes for a restructuring of Venezuela's debt, which has been in default since 2017.

- In our view, this optimism is premature, as four key obstacles remain:

- Venezuela's repayment capacity is severely limited. Its dilapidated oil industry requires massive investment and significant time to return to a production level of 4 million barrels per day.

- Washington's demands for indefinite control over Venezuelan oil are undermining the current Vice President, thereby increasing the risk of political instability.

- Financial sanctions imposed by the U.S. Treasury and oil embargo remain in place.

- A widely dispersed creditor base makes coordination, which is essential for restructuring, extremely difficult.

- Rather, any Venezuelan debt restructuring under the D. Trump administration is poised to be both masterful and unprecedented.

First Obstacle: Venezuela's Severely Limited Repayment Capacity

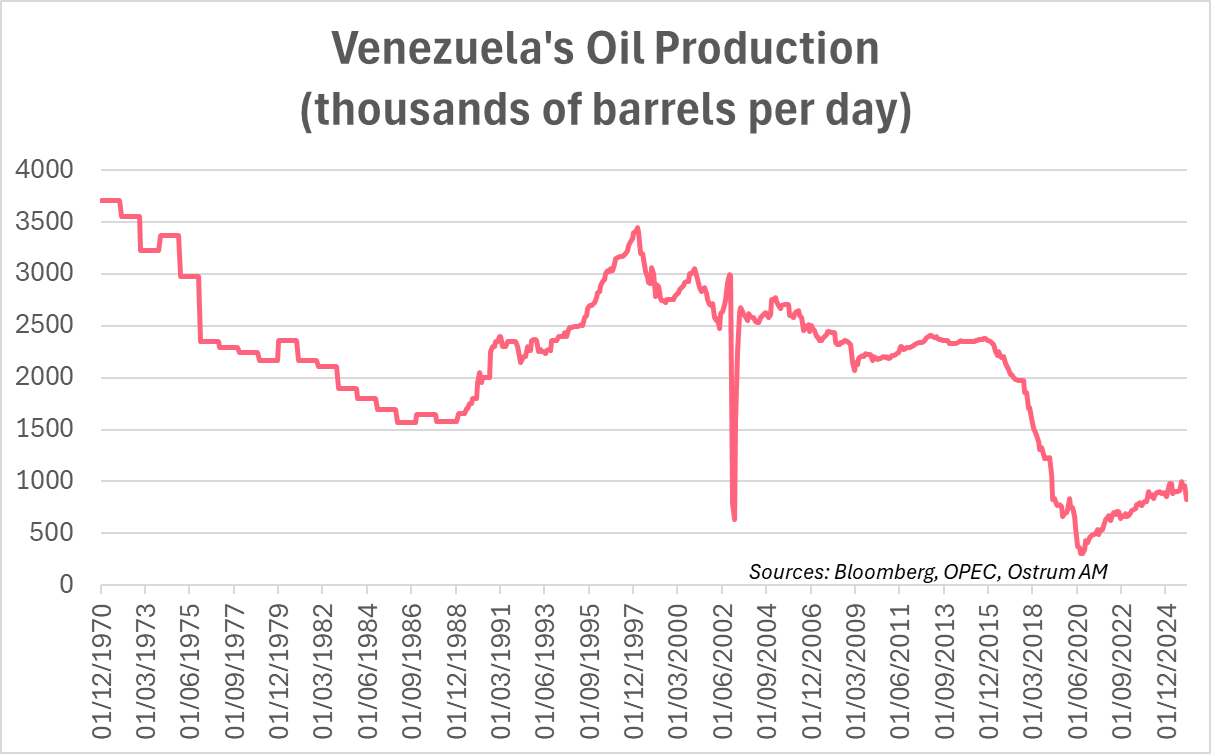

Despite holding the world's largest proven oil reserves of 300 billion barrels, Venezuela's crude production has plummeted to historic lows of 830,000 barrels per day—a far cry from the nearly 4 million barrels per day produced in the 1970s.

Venezuela's oil industry, once the pillar of the country's economy, is now in a state of ruin, crippled by embargoes.

This sharp deterioration of the oil industry has had dire repercussions for Venezuela's economic and financial situation, as oil revenues once accounted for 50% of fiscal revenue, 25% of GDP, and 95% of foreign exchange earnings. As a result, Venezuela has endured staggering hyperinflation, an 80% collapse in its GDP between 2013 and 2020, and a 99% loss of its foreign exchange reserves since 2014. After years of U.S. financial sanctions and economic crises, Venezuela declared a partial default on its debt at the end of 2017.

According to estimates, over $100 billion would be needed to rebuild the country's energy infrastructure and restart significant oil production. It will therefore take many years and massive foreign investment before a return to the production levels of the 1970s can be contemplated. Venezuela's repayment capacity is thus highly constrained.

Second Obstacle: Political Risk Persists

The D. Trump administration is pressuring major U.S. oil companies to swiftly resume Venezuelan oil production. However, these companies are reluctant to invest due to the high level of political uncertainty.

Indeed, the White House's latest demands—which include U.S. purchases of 30 to 50 million barrels and indefinite control over Venezuelan crude to prevent its sale to U.S. adversaries like China and Russia—threaten to undermine the current Vice President, Delcy Rodriguez. She could be accused of complicity in the ousting of President N. Maduro.

Diosdado Cabello, a former comrade-in-arms of Hugo Chavez and leader of the Chavista militias, has already launched protests, threatening the country's political stability. D. Trump has, in turn, issued threats against Cabello. This lack of political clarity is deterring U.S. oil majors. Furthermore, a U.S. ground military intervention would risk plunging the country into chaos.

Third Obstacle: Sanctions

Despite the fall of N. Maduro, U.S. financial sanctions remain in place, representing one of the two primary obstacles to a debt restructuring, alongside political risk.

Restrictions from the U.S. Treasury are still in effect, prohibiting the trading of Venezuelan bonds and thereby blocking the country's access to capital markets. Furthermore, the 2019 U.S. embargo on Venezuelan oil remains active. The United States had also sanctioned the state-owned oil company, PDVSA, freezing $7 billion of its assets on U.S. soil and preventing it from receiving payments for its oil exports to the United States.

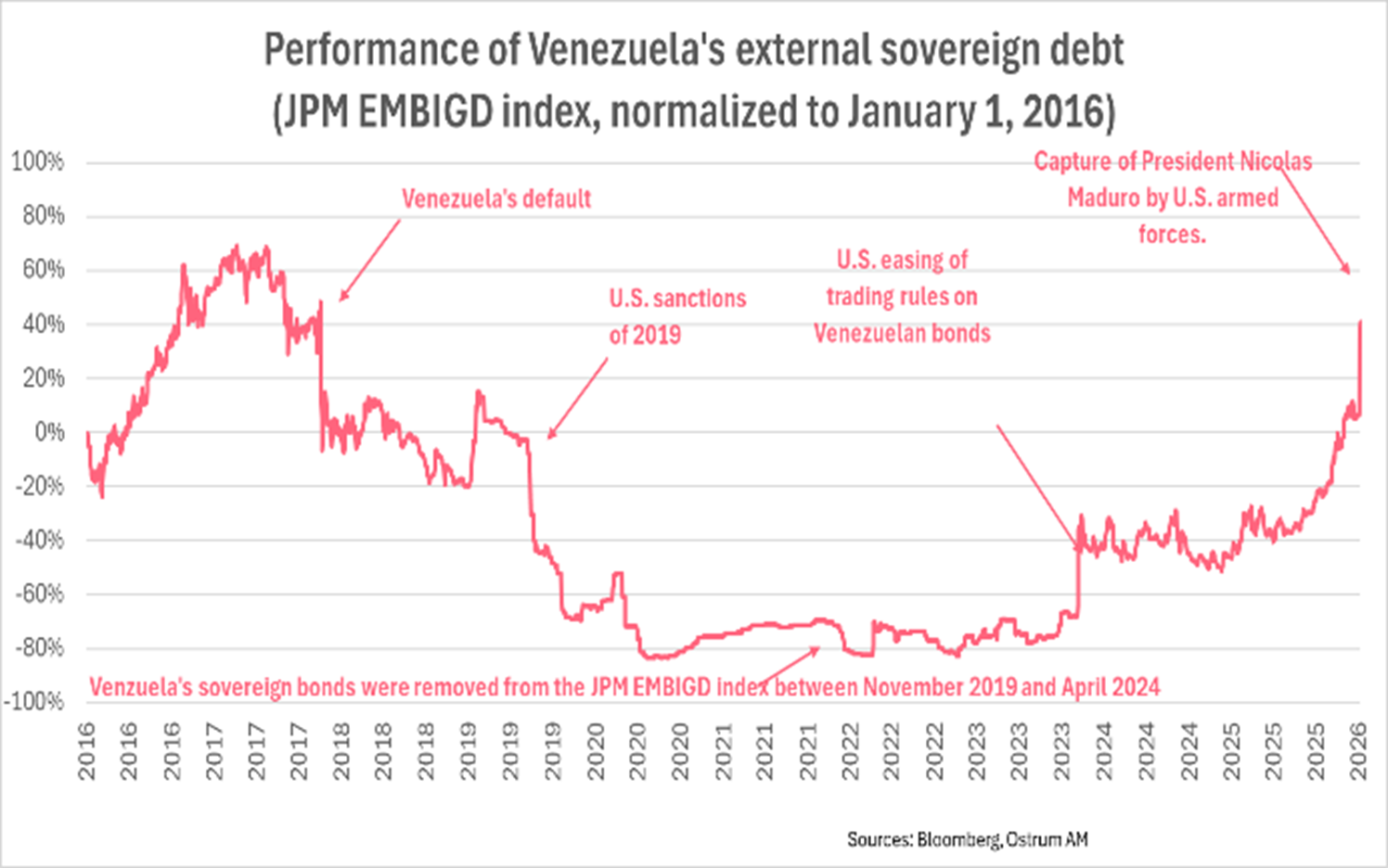

Since D. Trump took office in 2025, Venezuelan sovereign bond prices have surged, reflecting speculation of a regime change in Venezuela.

Prices for Venezuelan dollar-denominated sovereign bonds have returned to their pre-default levels in anticipation of a debt restructuring following President N. Maduro's downfall.

The J.P. Morgan EMBIGD index on Venezuelan USD sovereign debt has increased by over 40% since January 1, 2016, and the index-eligible sovereign bonds have gained 11% since the 2017 default. This optimism from private creditors appears premature as long as U.S. financial sanctions have not been fully lifted.

Fourth Obstacle: The Complexity and Opacity of Venezuela's Debt

Since Venezuela's partial default in 2017, accrued interest and court-ordered judgments have been added to the unpaid principal, further inflating the country's debt and making it difficult to estimate.

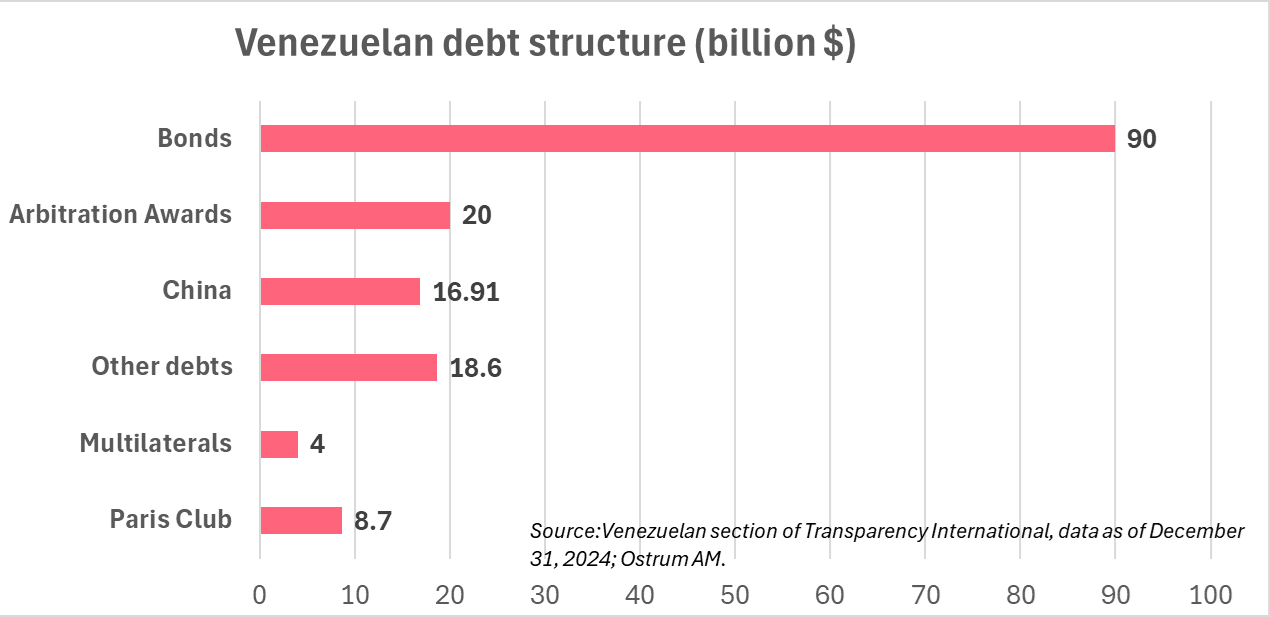

Indeed, calculating the total debt amount depends on the accounting method used for this interest and the legal awards. According to the October 2025 report from Transparency International's Venezuelan chapter, Venezuela's debt was estimated at $157.5 billion as of December 31, 2024. This represents 137% of GDP, based on the International Monetary Fund's 2024 GDP estimate of $119 billion. In addition to the considerable size of the debt to be repaid, a widely dispersed creditor base makes coordination—essential for any restructuring—particularly arduous.

The debt structure is illustrated in the accompanying chart.

The bulk of the debt is in the form of sovereign bonds ($90 billion) that went into default in 2017. This comprises debt from the Venezuelan state ($52 billion), the national oil company PDVSA ($41.6 billion), and the state-owned electricity company Elecar ($1.06 billion).

Non-financial debt totals $66.5 billion, with the following breakdown: Paris Club ($8 billion), China ($16.91 billion), Multilateral Institutions ($4 billion), arbitration proceedings ($20 billion), and others ($18.6 billion). The debt contracted with China is being repaid by the state company PDVSA through deliveries of oil barrels at a 30% to 40% discount to the spot price. The potentially divergent agendas of these different creditor groups could generate tension, if not outright conflict.

Conclusion

In our view, the optimism among private creditors for a swift restructuring of Venezuela's debt is premature. The situation is complex on economic, political, and financial fronts. The Venezuelan scenario also draws parallels with that of Iraq, whose 2003 debt restructuring set a precedent. That process led to the cancellation of private agreements and the creation of a UN development fund to sequester Iraqi oil revenues, followed by an executive order signed by G. Bush to shield those assets from any legal seizure. The hopes of private creditors could similarly be dashed if the U.S. administration were to pursue this type of restructuring. However, the greatest challenge for creditors will be dealing with a D. Trump administration that often disregards the rule of law, particularly international.

Zouhoure Bousbih

Chart of the week

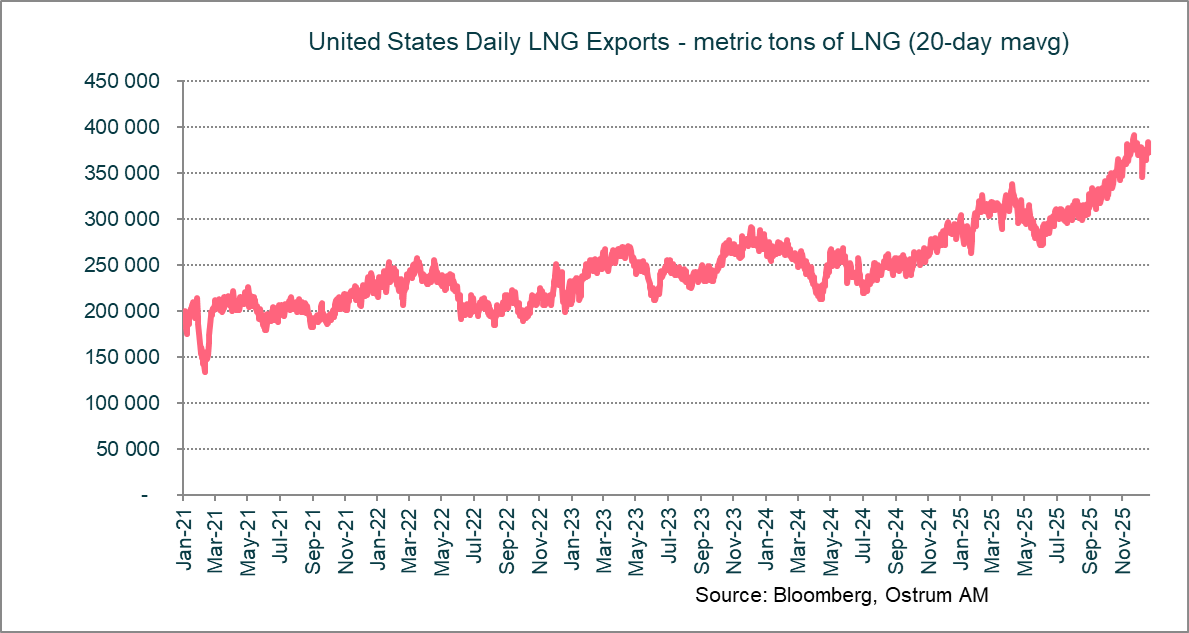

The spectacular improvement in the U.S. trade balance in October is partly attributable to a rebound in exports of business supplies. This category includes petroleum products, including LNG exports to Europe. Russian gas imports have been gradually replaced by contracts with the United States, Qatar, and to a lesser extent Algeria. Consequently, the volume of U.S. LNG exports has surged since the middle of 2024. The volume of LNG exports increased from an average of 250 tons per day in Q4 2024 to approximately 350 tons per day now. This increase in supply has facilitated a price reduction in Europe from an average of €32/MWh in the second half of 2025 to €28 currently.

Figure of the week

124

The Caracas stock exchange has surged 124% since the capture of the Venezuelan president by U.S. armed forces.

Market review:

- Venezuela: Maduro's Capture Marks a New Chapter in Sino-American Cold War;

- United States: Employment Rises by 50,000 in December, Unemployment at 4.4%;

- Equities: A Strong Start to the Year for European Stocks;

- Fixed Income: Limited Movement in T-Notes and Bunds, Tightening Spreads.

Teflon Markets: A Resilient Start Amid Geopolitical Turmoil

The toxic backdrop has not deterred a robust start of year for risk assets.

The recent capture of Nicolás Maduro in Venezuela has opened a new front in the international crisis. American pressure is mounting on both Greenland and Iran, while Chinese military exercises around Taiwan at the end of last year contribute to a deteriorating climate. The contours of a new Cold War between the United States and China are becoming clearer each day, compounded by Vladimir Putin’s dismissal of peace plans for Ukraine. In stark contrast, financial markets have remained unperturbed. Equities are gaining traction, and bond markets are absorbing record issuance amounts at the year's onset with little difficulty. The dollar is on the rise, and oil prices hover around $60 per barrel without a definitive trend.

U.S. economic data presents a somewhat incoherent picture. Overall surveys lack excitement, despite a slight improvement in the ISM for services. However, the trade deficit saw a considerable contraction in October, driven by a decline in imports of consumer goods—particularly pharmaceuticals—and decreases in exports of intermediate consumer goods, including oil products. Job growth increased by 50,000, but repeated downward revisions over several quarters have erased another 76,000 positions for October and November. The private sector added only 37,000 jobs, primarily concentrated once again in leisure and healthcare. Conversely, the unemployment rate has dipped to 4.4%, partly reflecting a decline in labor force participation, while underemployment is improving. Thus, the employment situation may not be as bleak as Federal Reserve Chair Jerome Powell had feared. In the Eurozone, however, recent surveys have stalled but do not jeopardize the economic recovery. The rebound in industrial orders and falling gas prices are positive indicators for the German economy. Meanwhile, in China, domestic demand remains subdued, but deflationary pressures appear to be easing somewhat.

Financial markets are largely ignoring international political developments. The volatility of stocks (VIX, V2X) remains remarkably low at 15%. European equities have gained 3% since the annual close, while the Russell 2000 and the Korean Kospi have risen 5% and 9%, respectively. The AI theme continues to thrive, particularly for semiconductor manufacturers such as TSMC and Samsung, who are significantly outperforming consensus expectations, along with their equipment suppliers. The S&P 500 has edged up by 1% as we approach the onset of quarterly earnings reports.

In the fixed-income markets, the Bund is trading at 2.86%, and sovereign debt spreads are tightening uniformly. Yield curves are flattening despite a very active primary market. Demand was notably strong during the auction of 30-year JGBs. The anticipated decline in inflation is likely providing support to the bond market, with the T-note oscillating within a narrow range of 4.10%-4.20%. The risk of a government shutdown at the end of the month could further enhance the outperformance of Treasuries against swaps, especially as the SOFR rate, indicative of the money market, remains under pressure despite the Fed's T-bill purchases. In the credit market, the stability of spreads continues to prevail. Investment-grade bonds are trading at 66 basis points over swaps, while high yield has commenced the year with vigor, buoyed by the rally in equities and supported by the low volatility environment.

Axel Botte

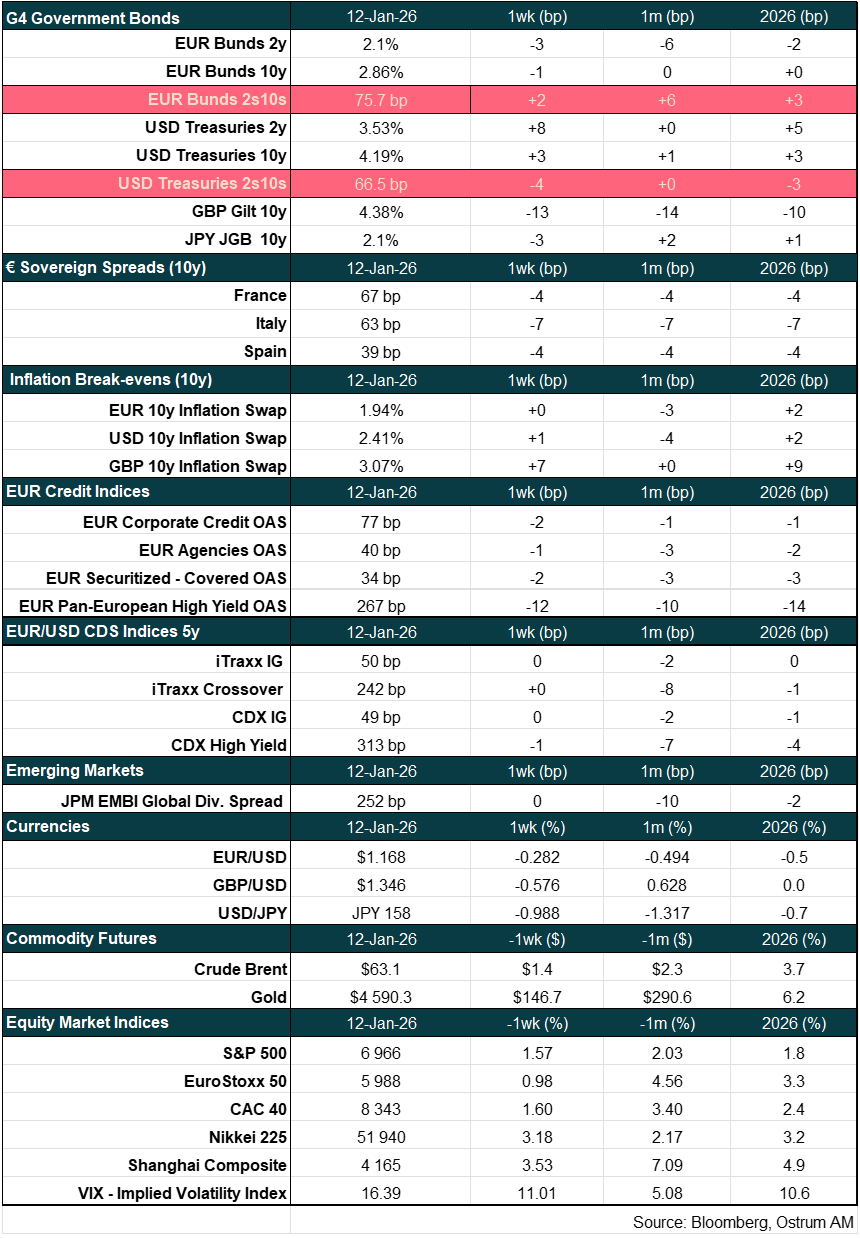

Main market indicators