Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Zouhoure Bousbih’s podcast:

- Review of the week – Financial markets, Warsh takes the helm at the Fed;

- Theme – The USMCA is up for review. What does that mean for Mexico and the peso?

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The USMCA is up for review. What does that mean for Mexico and the peso?

- The upcoming 2026 review of the United States-Mexico-Canada Agreement (USMCA) places Mexico at the center of geopolitical tensions between the United States and China.

- Mexico is caught between its structural dependence on the U.S. and its expanding economic ties with Asia, particularly with China through its nearshoring strategy.

- The Mexican economy relies heavily on U.S. trade and remittances from migrant workers, making it highly vulnerable to pressure from Washington.

- Significant uncertainty surrounding the negotiations is already dampening investment, while recent massive 50% tariffs on Chinese goods risk fueling inflation and disrupting supply chains, especially in the automotive sector.

- The upcoming US midterm elections in late 2026 risk turning the renegotiation into a campaign tool, fueling greater volatility for the Mexican peso.

US-Mexico: A Structural Dependency Under Strain

An Asymmetrical Trade Relationship

A close and asymmetrical trade dependence on the United States.

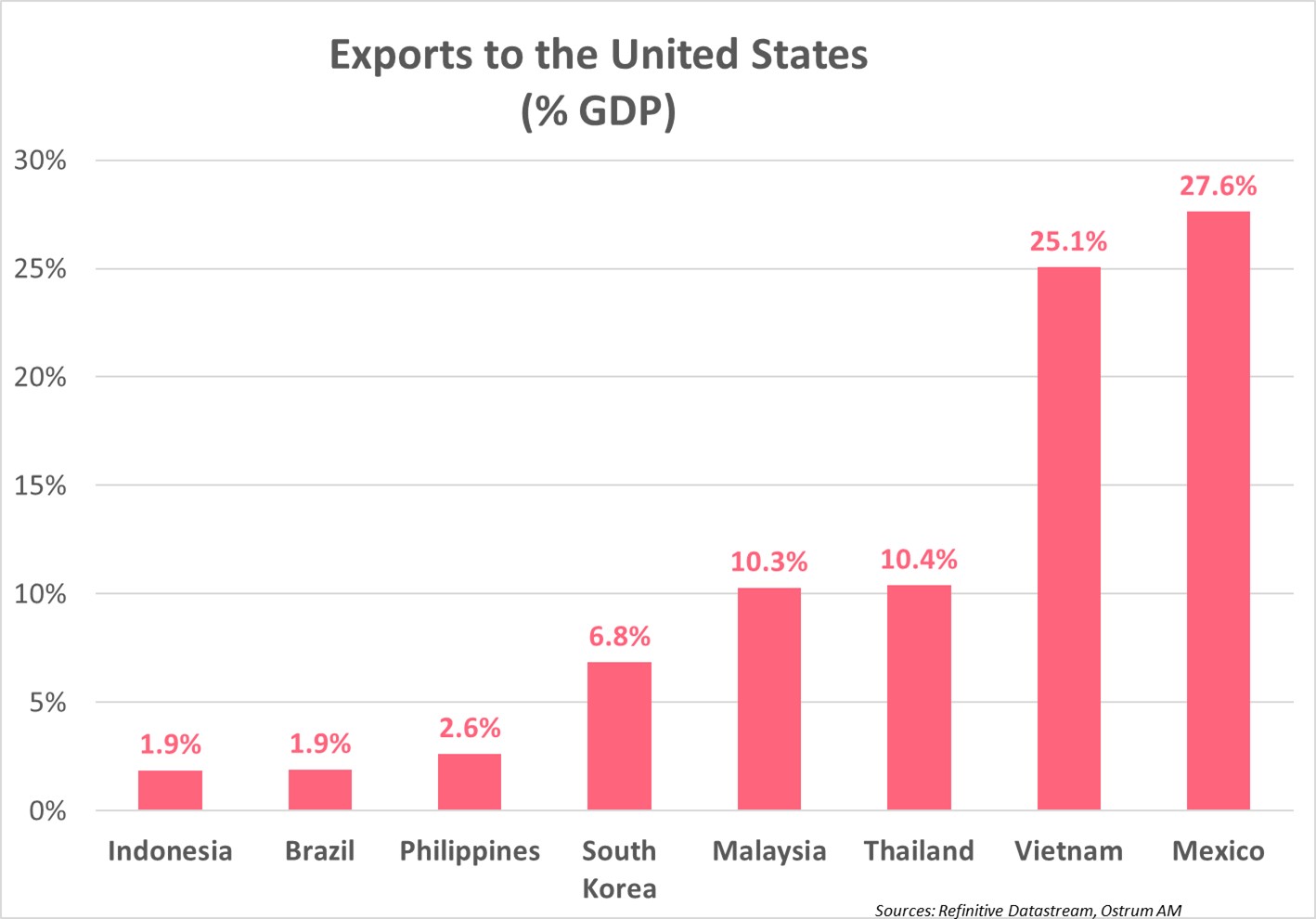

Mexico has cemented its status as the United States' top trading partner, eclipsing both Canada and China. With over 80% of its exports—a figure equivalent to more than 27% of its GDP—destined for the US market, and 40% of its imports sourced from its northern neighbor, Mexico's economy is acutely exposed to the slightest tariff fluctuation or the imposition of US national security measures, particularly on issues like immigration and fentanyl trafficking.

Conversely, Mexico absorbs a mere 16% of total American goods exports, accounting for just 1.4% of US GDP in 2024. It is this stark trade imbalance that the US administration leverages to demand Mexico's full alignment with its geopolitical agenda.

The Flashpoint: Rules of Origin

The USMCA renegotiation is set to hinge on the automotive sector.

The 2026 renegotiation is set to hinge on the automotive sector, a colossal engine for the nation's economy. As the world's seventh-largest producer and fourth-largest exporter of light vehicles, the industry contributes 4.7 percentage points to GDP annually and constitutes 18% of manufacturing output. Crucially, it is the linchpin of the trade relationship, single-handedly accounting for over 80% of Mexico's manufactured exports to the US. The American administration is demanding stricter rules-of-origin criteria in a direct move to curb the use of "non-North American" components, with China as the explicit target.

The Lifeline of Migrant Remittances

Mexico's economic fortunes are also exposed to the social and migratory climate in the United States.

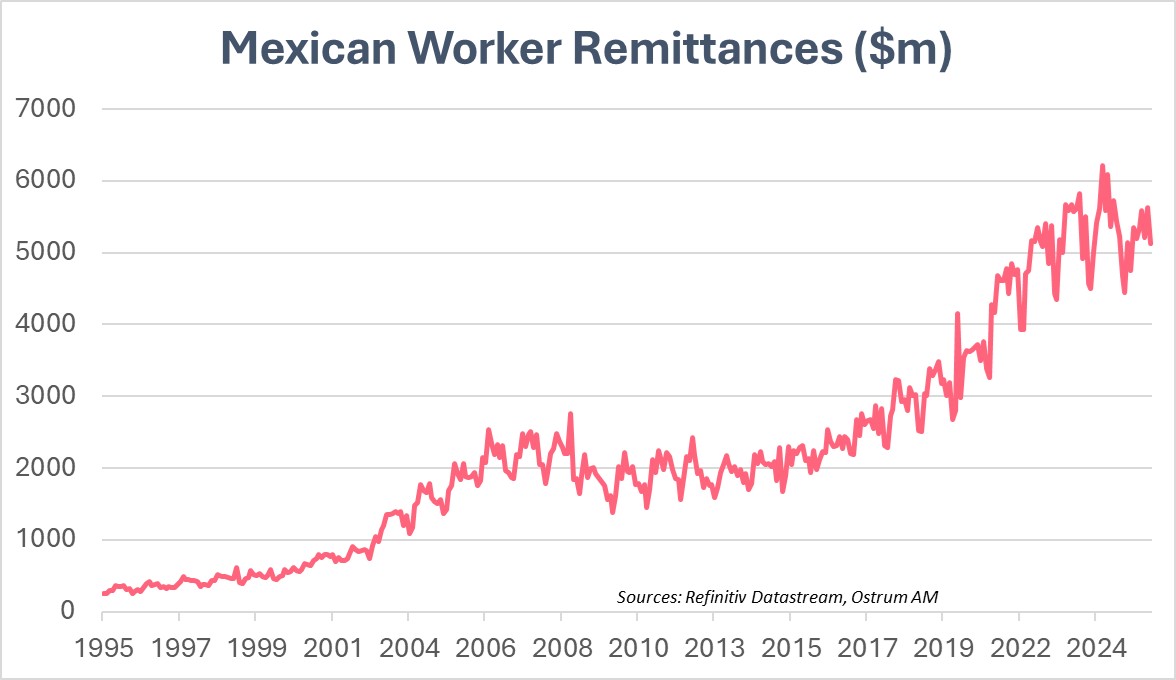

With annual remittances from migrant workers (remesas) surpassing a record $60 billion—equivalent to over 4% of GDP—Mexico's economy is also tethered to the social and migratory stability across its northern border.

However, a tougher US stance on immigration, enforced by agencies like ICE, has led to a significant decline in these financial inflows.

Between January and November 2025, total remittances reached just over $56 billion, marking a 5.1% year-on-year decline. These inflows are a vital lifeline for vulnerable families and are crucial for propping up domestic consumption in a country with severely limited fiscal headroom.

The USMCA's Geopolitical Flashpoint: China

Mexico’s "Asian Pivot"

Mexico has become China’s back door to the US market, a strategy to leverage the USMCA’s rules of origin and circumvent tariffs.

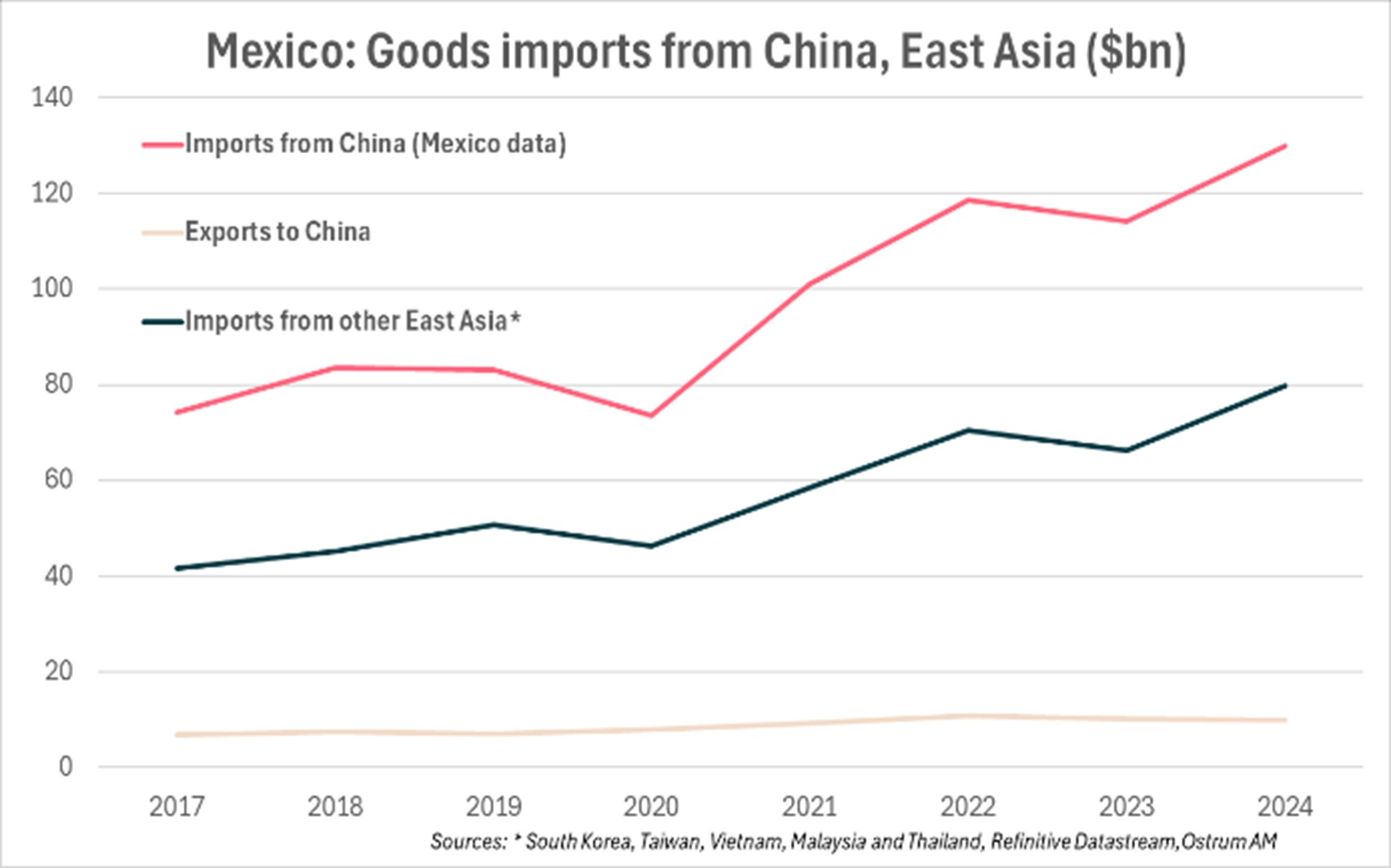

Trade between China and Mexico has surged, as the adjacent chart shows. Imports from China jumped from $70 billion in 2020 to nearly $130 billion in 2024. China now accounts for 21% of Mexico's imports, second only to the United States at 41%.

However, this trade relationship is markedly asymmetrical; Mexico's exports to China have plateaued at around $10 billion annually since 2017.

Mexico's supply chain integration with Asia extends beyond China. Imports from other East Asian countries, notably South Korea and Taiwan, have reinforced Mexico’s role in the global technology value chain.

China's Nearshoring Activity

The influx of Chinese Foreign Direct Investment (FDI), particularly in electric vehicles (EVs), is viewed by the US administration as a strategy to bypass its tariffs.

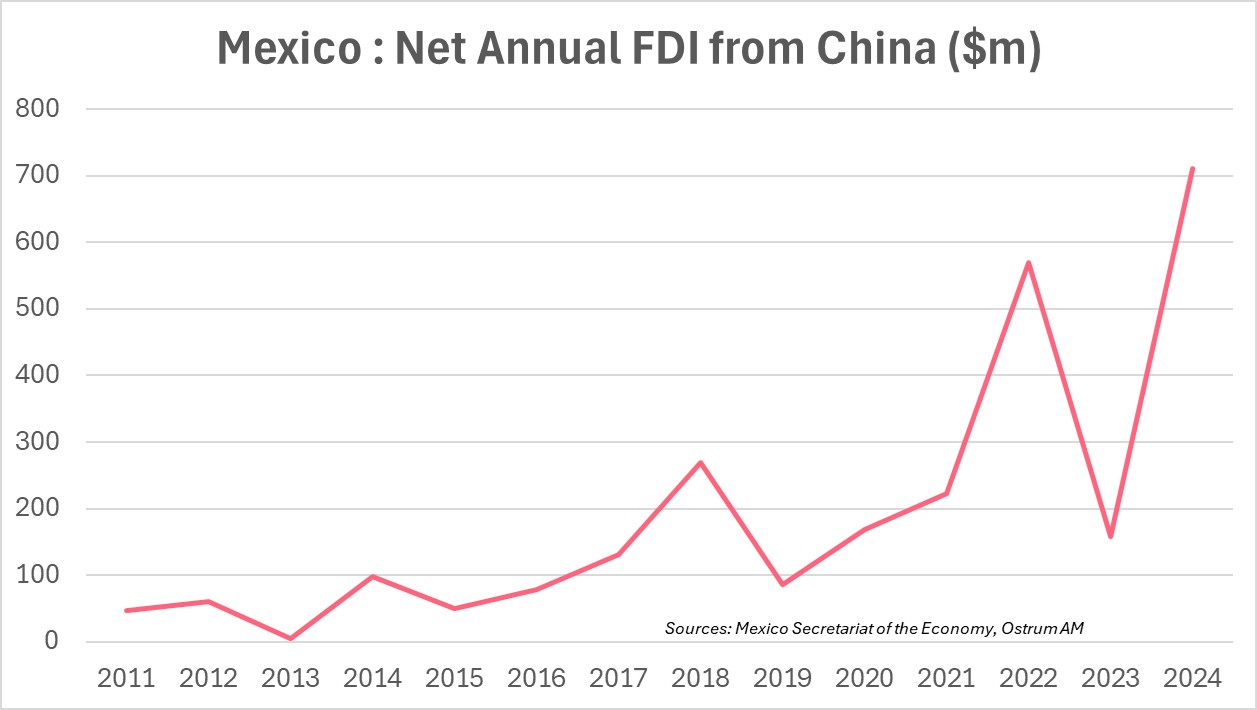

Net FDI flows from China have grown rapidly over the last decade, reflecting the nearshoring of Chinese firms to gain proximity to the US market.

After a gradual increase in 2014-2015, Chinese FDI re-accelerated following the 2018-2019 trade war and the 2020 implementation of the USMCA, NAFTA's replacement.

Sharp rebound in Chinese FDI reflects growing nearshoring activity.

Mexico officially received a total of $3.2 billion in net FDI from China between 2017 and 2024. However, this figure is likely an underestimate, as a significant portion of Chinese corporate investment globally is routed through offshore subsidiaries and thus does not appear in official data as originating from China. The Baker Institute has estimated the total stock of Chinese FDI in Mexico at $15 billion, a figure substantially higher than official records.

The Risk of Pivoting Back to the U.S.

To ease tensions with the US administration, Mexico recently imposed massive tariffs of up to 50% on over 1,400 products from countries with which it has no free trade agreement. The move primarily targets China, its second-largest supplier of auto parts and vehicles.

The Sheinbaum government hopes this will strengthen its negotiating position with its North American partner. However, it risks driving up costs for industries reliant on imported inputs, such as the automotive sector. Precedent is not encouraging: in 2018, while similar tariffs on steel and aluminum generated fiscal revenue, they failed to produce sustainable gains in local production.

Pivoting towards the US also risks depriving Mexico of a major source of capital and technological innovation essential for its industrial modernization.

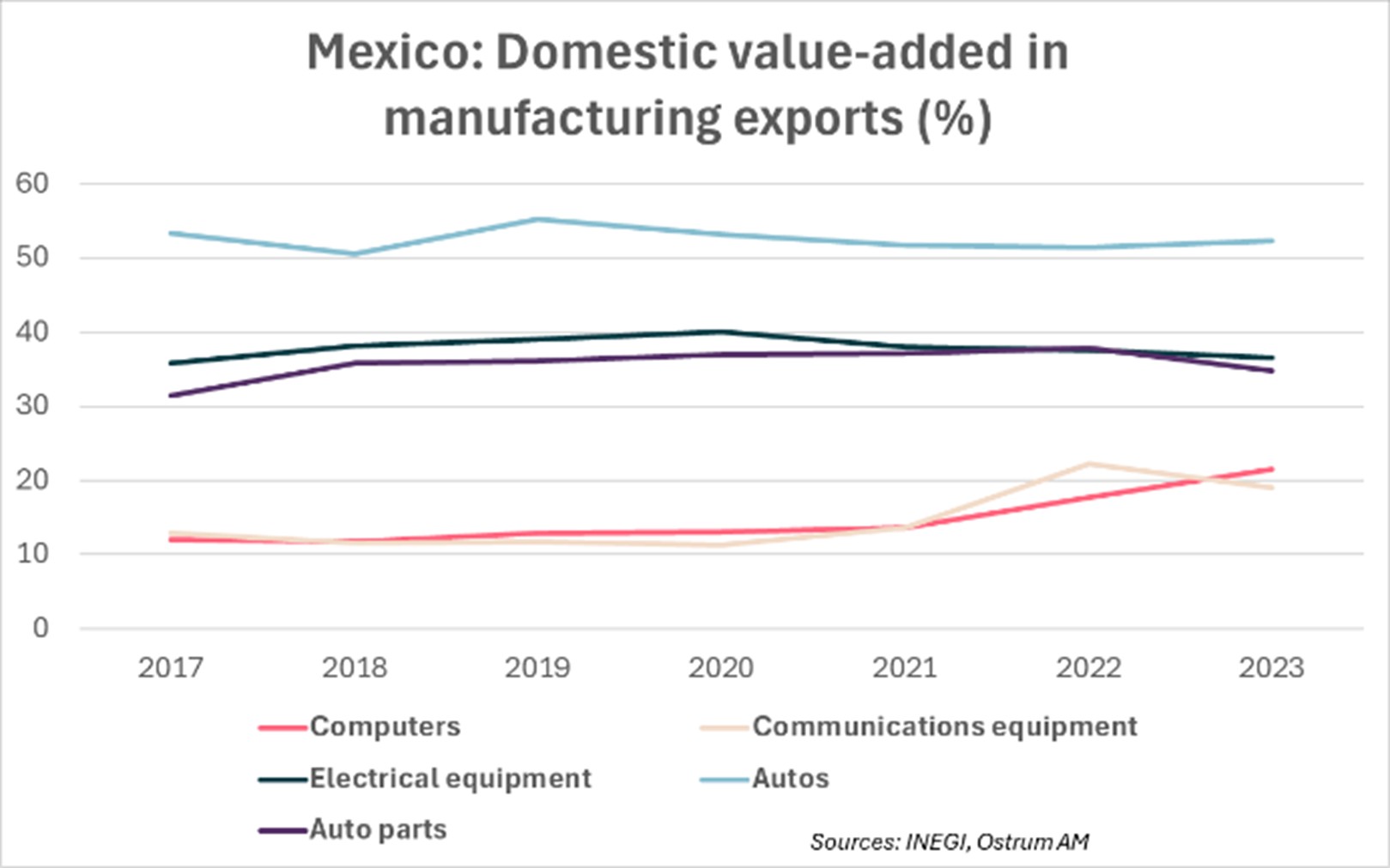

Value in Mexico's high-tech goods is predominantly imported from East Asia, resulting in low domestic value-added.

Indeed, Mexico demonstrates lower domestic value-added in its high-tech products compared to other goods. As shown in the chart, value-added in the semiconductor sector was just 16% in 2023, contrasting sharply with the over 50% generated by the automotive industry. The bulk of this value-added originates from East Asian imports. Without China and East Asia, these modernization goals seems scarcely attainable.

2026 Outlook: The Mexican Economy and Peso at a Crossroads

Mexico narrowly averted a recession in 2025, with projected growth of 0.5%, thanks to the USMCA agreement shielding 80% of its exports to the United States from tariffs. For 2026, GDP growth is forecast at 1.5% by the International Monetary Fund and 1.3% by the World Bank—a pace that remains well below potential.

Headwinds for Mexican growth have intensified due to the considerable trade uncertainty surrounding the USMCA negotiations. The upcoming US midterm elections in late 2026 risk turning the renegotiation into a campaign tool, fueling greater volatility for the Mexican peso.

Mounting uncertainty over the USMCA talks now poses a major risk to Mexico's growth prospects.

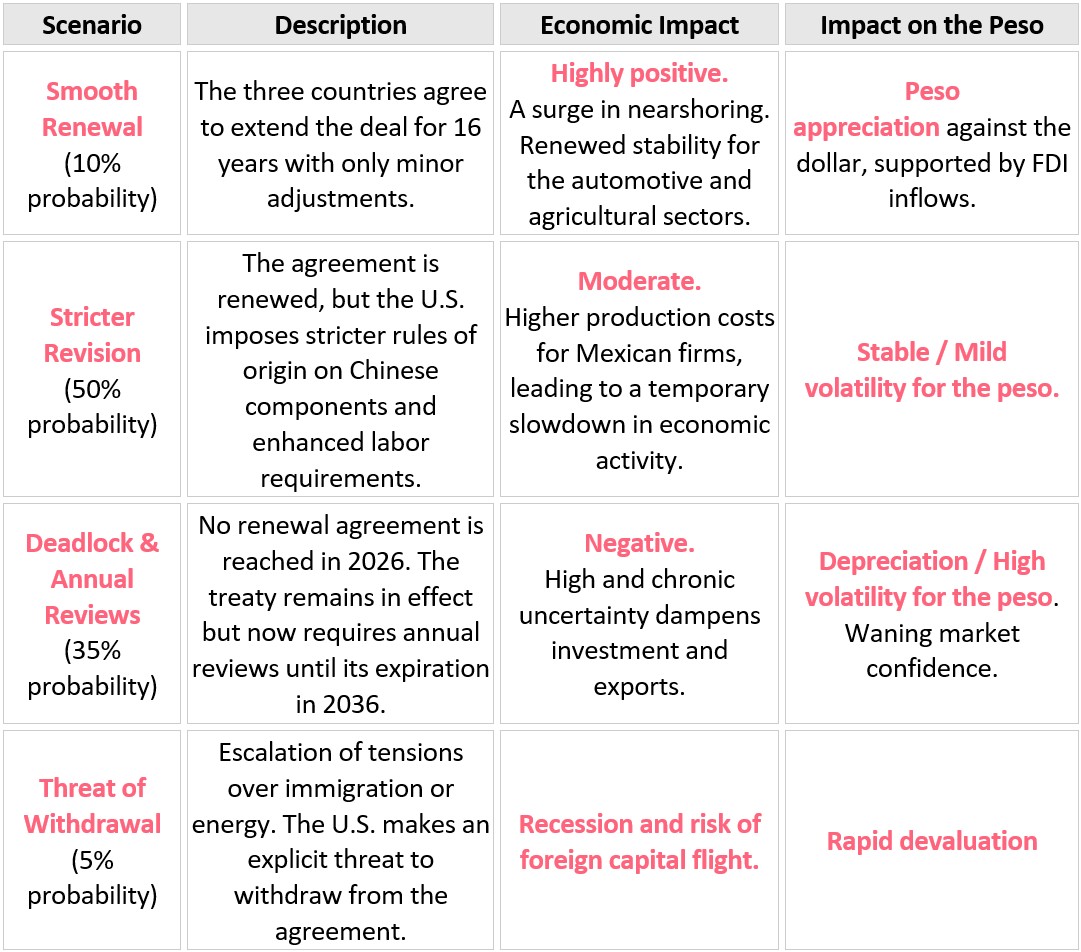

The table below outlines the four possible scenarios and their impacts on the economy and the Mexican peso.

Conclusion

The year 2026 places Mexico at a critical juncture, at the very heart of the geopolitical tensions between the United States and China. The USMCA renegotiation is not a mere formality but a true test for an economy caught between its structural dependence on its American neighbor and its growing ties with Asia. With very limited room for maneuver, any concession to Washington risks hampering Mexico's own industrial modernization and fueling inflation. This profound uncertainty, combined with domestic challenges, poses a significant risk to growth, investment, and the stability of the peso, whose future will depend directly on the outcome of these complex negotiations.

Zouhoure Bousbih

Chart of the week

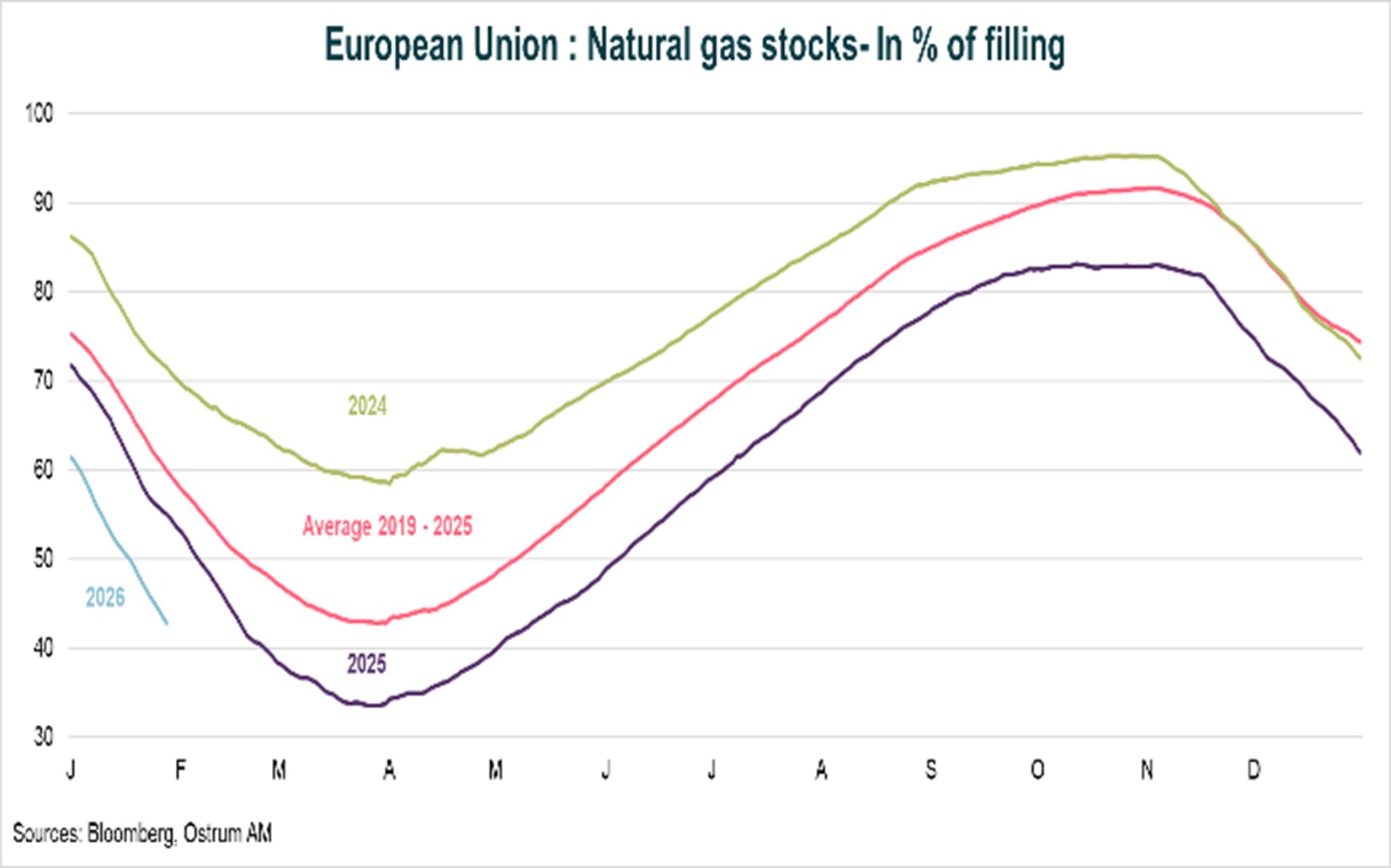

Natural gas stocks in the EU are low for this time of year. Storage capacities were only 43% full as of January 28, a lower level than in 2024 and 2025, and well below the average from 2019 to 2025 (by nearly 30%).

The rapid decline in stocks is attributed to higher demand due to a colder than expected winter, and reduced imports of liquefied natural gas.

In this context, the price of natural gas in Europe recorded its largest monthly increase since June 2022 in January: +39.5%, reaching €39.35 per megawatt hour, which is expected to put pressure on inflation in the Eurozone.

Figure of the week

-21 %

Gold buying by central banks decreased by 21% in 2025 yet remained at an elevated level of 863 tonnes.

Market review:

- Fed: Donald Trump appoints Kevin Warsh as the successor to Jerome Powell;

- Fed: Monetary policy holds steady at 3.50-3.75%;

- Equities: Earnings reports are mixed in the technology sector in the United States;

- Precious metals: Historical crash in gold and silver following Kevin Warsh's appointment.

Kevin Warsh Appointed Head of the Fed

The appointment of Kevin Warsh, perceived as hawkish, sparked an historical crash in precious metals and equity weakness amid tensions in Iran. Corporate earnings announcements also moved markets, amid disappointing news from Microsoft.

Donald Trump ended the suspense surrounding the nomination of Jerome Powell's successor by designating Kevin Warsh, a former Fed governor appointed by George W. Bush. His confirmation by the Senate could still take time, given the DoJ's subpoena regarding the Fed, which could lead to a criminal investigation. Vice-Chairman, Philip Jefferson, would serve as acting chairman. Jerome Powell has not yet clarified his position regarding his continued role on the Board of Governors after his term as Chairman. The markets are mindful of the restrictive stance advocated by Warsh, particularly during the financial crisis and his recent remarks favoring a significant reduction of the Fed's balance sheet. It remains to be seen how he might balance this reasoning with the imperative rate cuts. Although the Fed maintained its rates unchanged this week, the purchases of T-bills since mid-December have led to an expansion of the central bank's balance sheet.

The U.S. economic cycle remains difficult to interpret. Growth exceeding 4% in the second half is logically deemed robust by the Fed. However, the difficulty in estimating changes in the trade balance or the weakness in hours worked (<1% during the period) raises questions. Historically low unemployment claims contrast sharply with corporate restructuring announcements. The duration of unemployment is increasing, and returning to work is as challenging as in a recession. In the Eurozone, growth is reported at 0.3% in the fourth quarter. This improvement seems consistent with the message of recent surveys, including the INSEE indicator and PMIs. Germany (+0.3%) and Spain (+0.8%) performed better than expected. The French economy grew by 0.2% despite a contraction of 0.1% in private sector employment. However, the consumption of goods by French households remains poorly oriented (-1% in December). Inflation is expected to be below 2% in the first quarter, despite a marked rebound in energy prices. Brent crude is rising towards $70, and natural gas is soaring towards €40/MWh.

In financial markets, the geopolitical sequence has been replaced by quarterly earnings reports. Microsoft’s disappointing report led to a 10% correction in its stock, while Apple’s margins are worrying investors, and Sandisk benefits from exceptional pricing power on flash memory products (+22% upon the announcement of its results). Overall, the Nasdaq recorded a slight increase over the week. In Europe, banks and energy contributed to the modest weekly rise in stock indices. However, U.S. growth stocks are penalized by rising long-term rates following Kevin Warsh's appointment. His opposition to the expansion of the Fed's balance sheet tightens swap spreads and accentuates the yield curve steepening. Oil, however, weighs on short-term inflation expectations. The 2-year inflation swap has risen above the 10-year (2.61%). In the Eurozone, the Bund continues to fluctuate between 2.80% and 2.90%. The German stimulus seems well-accounted for by market participants. This stability in the Bund favors the search for yield: the OAT benefits significantly, especially as political tensions ease (albeit with the activation of Article 49.3). Italy, in line with OAT spreads, is likely to see its rating upgraded. European credit remains remarkably stable at 63 bps over swaps. High yield spreads widened by 5 bps and 14 bps in the United States.

Axel Botte

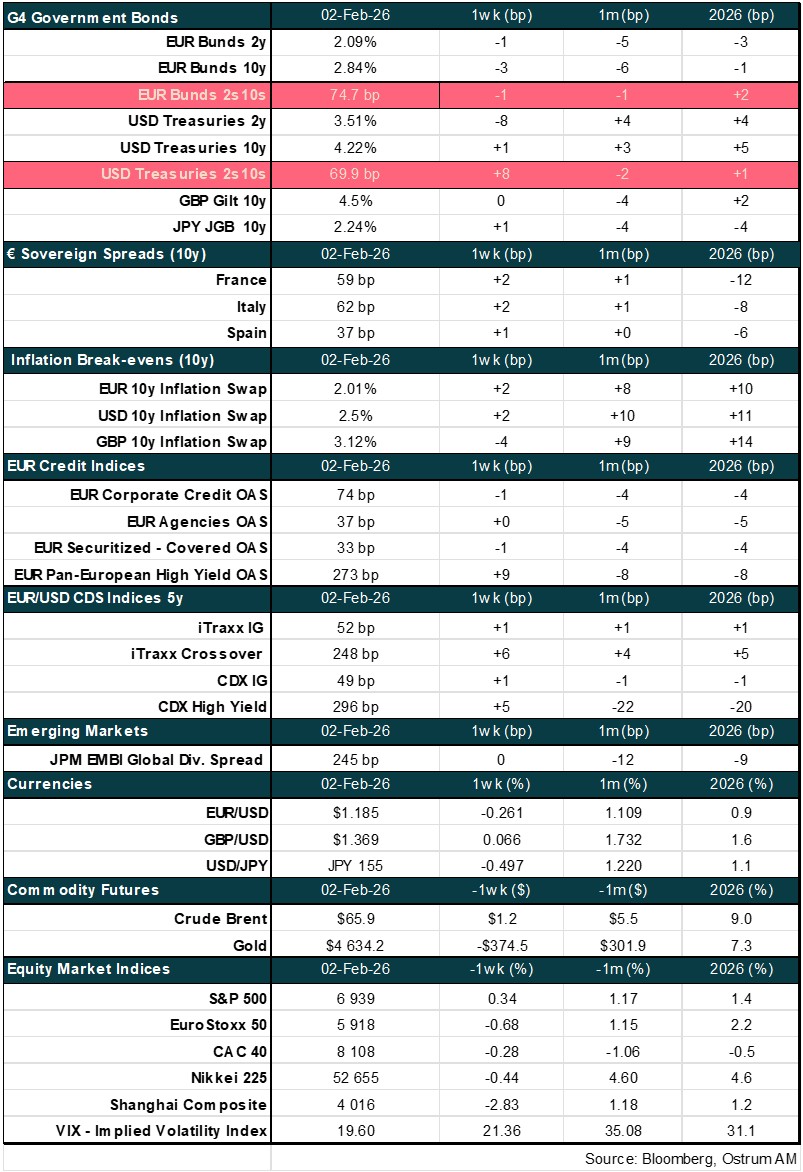

Main market indicators