Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Aline Goupil-Raguénès' and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Concentration risk: dotcom bubble redux?

- The performance of the Magnificent 7 group has been stellar in the past few years;

- US equity performance has become increasingly concentrated with the 10 largest stock accounting for 30% of total market value;

- The current market backdrop can be compared to the Y2K period and the dotcom bubble;

- The AI investment theme has propelled the performance of the Mag7 group and productivity growth has indeed picked up;

- Despite faster productivity, high valuations of market leaders could justify portfolio rotation to restore diversification.

Market review: Record S&P 500

- Manufacturing surveys turning up;

- The S&P 500 clears the 5,000 mark;

- Dollar and bond yields higher;

- Downward pressure on swap spreads.

Aline Goupil-Raguénès' and Zouhoure Bousbih's podcast

- Topic of the week : Global manufacturing recovery, EM sovereign debt, and US inflation;

- Theme : ECB faces domestic price pressures.

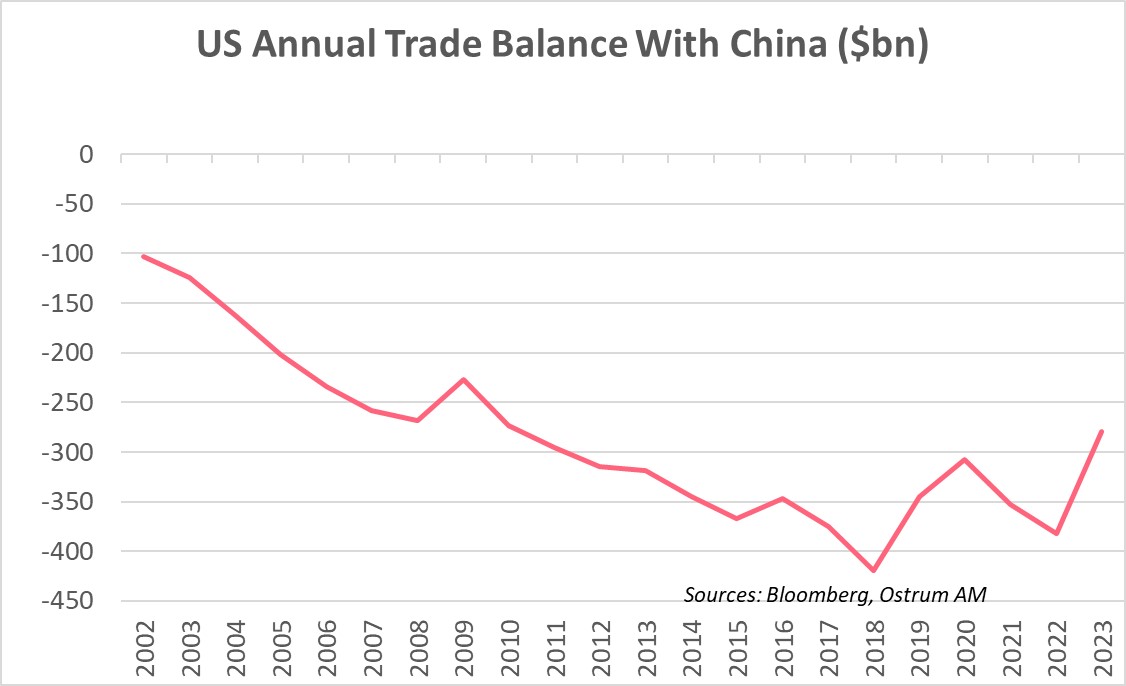

Chart of the week

The US bilateral trade deficit with China narrowed in 2023 compared to 2022, going from $382 billion (1.5% of GDP) to $279 billion (1% of GDP), the lowest since 2018 when Donald Trump had launched his trade war against China.

The implementation of customs tariffs on Chinese products has completely reshaped American trade, favoring countries like Vietnam and Mexico.

Donald Trump, candidate for the White House, has indicated that he wants to implement customs tariffs of 60% for Chinese products.

Figure of the week

This is the record amount in billions of U.S. dollars of the 10-year note auction on Wednesday, February 7. This US Treasury bond auction attracted strong demand.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – February 13th 2024