Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast:

- Review of the week – Financial markets, the US labor market shows signs of weakness;

- Theme – The dollar’s structural headwinds and near-term challenges.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The dollar’s structural headwinds and near-term challenges

- ‘The U.S. dollar is our currency, but it is your problem’ used to say former State Secretary Kissinger, reflecting the central role of the dollar in the global economic and financial world. Greenback remains unchallenged as the world reserve currency. This has allowed the U.S. to run large external imbalances. Net U.S. liabilities to the rest of the world are worth $27 trillion. A confidence crisis in the dollar would therefore have serious consequences.

- However, the coercive trade tactics under of President Donald Trump, treating friends and foes alike, has upended financial markets. Security guarantees for the U.S. have become questionable, as is the use of the U.S. dollar. U.S. allies have sought trade deals with China, Latin America or India which could redefine the dollar-centric economic order. Xi Jinping and Christine Lagarde have called for a greater international role of the Renminbi and the euro.

- Furthermore, there is a risk of cyclical weakness in the dollar. The AI boom will come under investor scrutiny and underperformance of U.S. stocks would likely spark portfolio outflows and dollar hedging. A risk premium on the dollar may be required.

The exorbitant privilege that cannot be shared

The dollar has a lot to lose if its privilege as the global reserve currency is challenged.

The U.S. dollar is the anchor of the global monetary system. For decades, the U.S. has enjoyed an exorbitant privilege as the sole issuer of the global reserve currency. Former State Secretary Henry Kissinger used to say that ‘the dollar is our currency, but it is your problem’. It is estimated that the advantage could be worth 0.2 pp of U.S. GDP. This greenback has remained unchallenged even as the euro was launched in 1999 and economic growth picked up in Eastern Europe and Asia.

After the balance-of-payment crisis in Asia in the late 1990s, the Washington consensus was that Asian nations needed to build up foreign exchange reserves in U.S. dollars to mitigate the risk of capital outflows. The U.S. dollar became the anchor of the so-called Bretton Woods II arrangement. Under this tacit agreement, mercantilist Asian nations recycled their current account surpluses into dollar-denominated asset holdings. The entry of China in the World Trade Organization in 2002 spurred economic growth and world trade, whilst commodity producing countries enjoyed windfall gains in export revenue denominated in dollars. The accumulation of large trade surpluses in China and other emerging economies (including Gulf countries and Latin America) eventually led to U.S. capital account imbalances. The dollar anchor thus prevented a rebalancing of global trade via exchange rate movements. As the U.S. economy imported capital from abroad, investment spending accelerated in the technology sector, but also in low-productivity sectors like housing. The external imbalances, lax loan underwriting standards in the mortgage market and a bubble and fraud mindset resulted in the mother of all housing and financial crises.

The U.S. dollar is facing structural headwinds

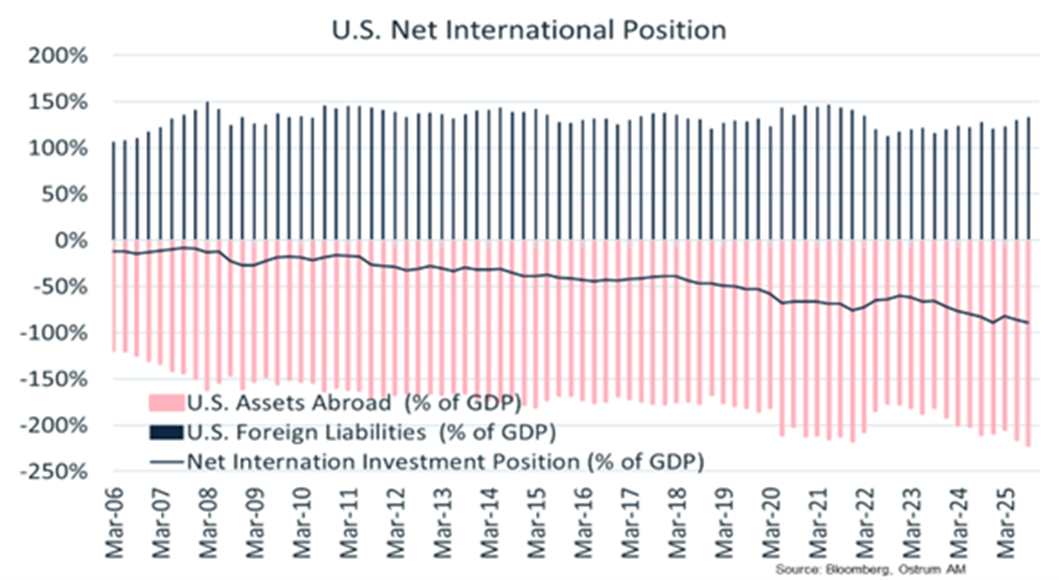

Dollar stability is of utmost importance as U.S. net external liabilities hover about 90% of GDP.

De-dollarization is on everyone’s mind but the search for a new monetary anchor is still unfinished work.

The U.S. Treasury has long advocated for a strong dollar policy, but Donald Trump surprised market participants by calling for a weaker dollar in Davos... before Treasury Secretary Scott Bessent reaffirmed that a strong dollar was in the best interest of the United States. In essence, Trump wants to sell cars, Bessent knows he needs to sell bonds. A weaker dollar helps the competitive position of U.S. producers but risks undermining the appeal of U.S. financial assets.

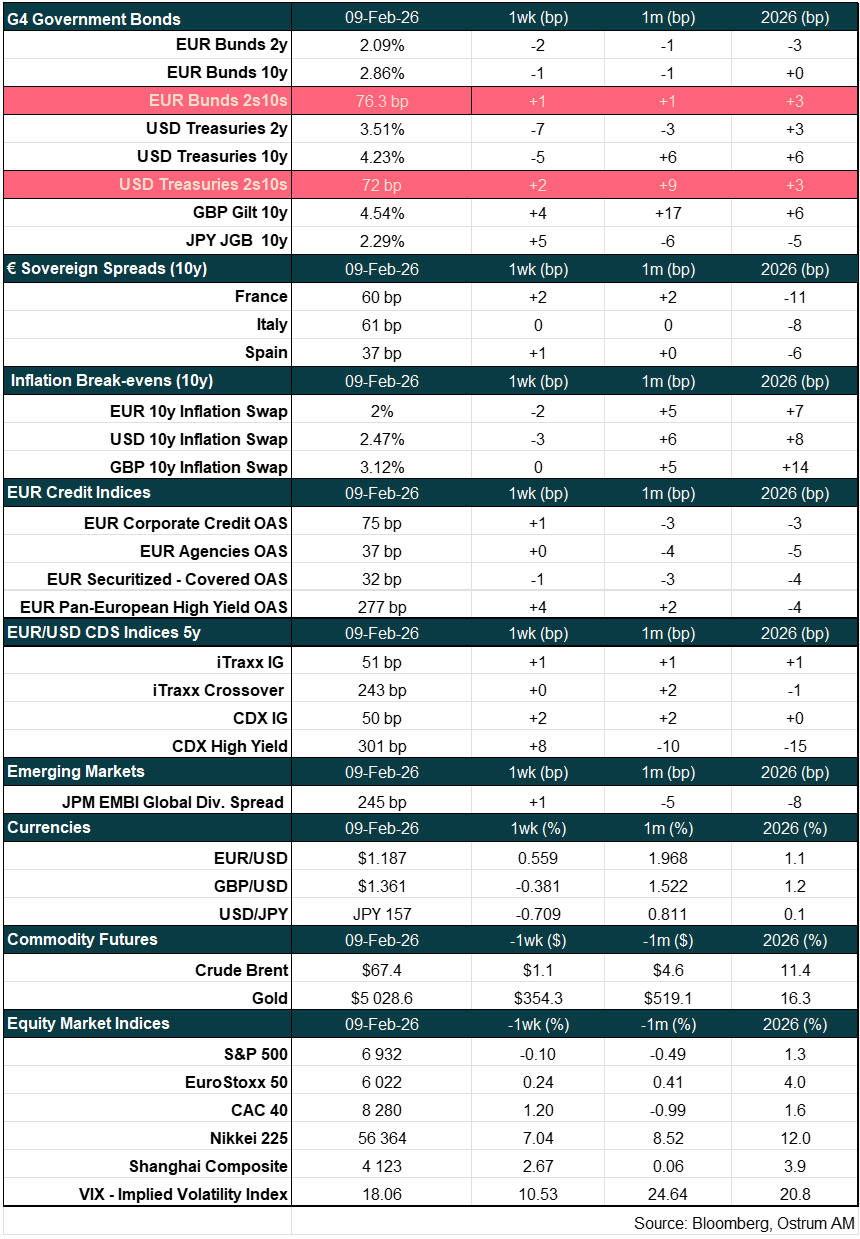

The U.S. has indeed accumulated very large external imbalances. The gross foreign liabilities position of the U.S. amounts to $68 trillion according to BEA estimates compared with $41 trillion in U.S. assets held abroad. The international position of the U.S. therefore represents net liabilities worth $27 trillion or 89 percent of GDP. The Inflation Reduction Act spurred (domestic and) foreign direct investment into the U.S. Indeed, FDI flows skyrocketed to $80 billion between 2021 and 2025 but appear to stall under the current Administration. As regards portfolio flows, the sheer size of U.S. equity markets may argue for rebalancing as growth rebounds in Europe and Asia.

Meanwhile, the Trump Administration’s initiatives to promote the development of cryptocurrencies - including floating the idea of a strategic Bitcoin reserve - go against a strong dollar. Nevertheless, it is very unlikely that cryptocurrencies will be used as a meaningful means of exchange anytime soon. The search for a new monetary anchor also propelled gold and other metals to record highs. Monetary authorities, with the notable exception of the Central Bank of Russia, have indeed been adding to gold reserves.

Since his return to the White House, Donald Trump has adopted an aggressive approach to international trade relations. The burden of U.S. tariffs and the America First agenda have incited other countries to enhance trade relations with one another (e.g. trade deals between Canada and China, EU and India, EU and Mercosur…). The multi-faceted isolationism of the U.S. (militarily, economically, technologically….) should make the global economy less prone to adhere to a dollar-centric world economy. If America First turns out to be America Alone, that new world order will have implications for the dollar.

The dollar in 2026

Rethinking U.S. exceptionalism and dollar hedging policy

As stated above, the greenback is likely to face structural headwinds for years to come. In the near term, the market narrative and drivers appear, however, uncertain. The ‘U.S. exceptionalism narrative’ may still be supportive of the greenback. The consensus forecast on U.S. GDP growth is 2.3% in 2026 compared with 1.3% in the euro area. The current AI race with China spurs investment spending by the U.S. technology companies (up to $650 billion in 2026 for the Big Tech companies), which adds fuel to expectations of sustained productivity gains. AI adoption across all economic sectors will transform the way business is done. Of course, there will be winners and losers in the AI race and some businesses will be disrupted and a lot of capital employed currently will have to be written down. For 2026, headline GDP growth will be in favor of the U.S. compared to Europe, as Chinese growth slows further. Equity investors may keep buying into the AI hype even as they could turn more selective along the way. Negative headlines stemming from a stressed private credit market may hit parts of U.S. stock markets including software.

As per the U.S. dollar outlook, equity inflows from abroad have not been hedged for currency risk to a large extent. Dollar strength went hand in hand with the U.S. comparative advantage on technology. The dollar outlook thus depends on the willingness of foreign equity investors to hedge their U.S. dollar risk. Dollar hedging still comes at a cost since the Fed funds rate at 3.50-3.75% remains elevated compared to interest rates in Europe, Japan and most G10 peers. As Fed policy rates resume decreasing in response to labor market weakness, hedging demand may gather pace. The carry on the U.S. dollar will decline to around 100 bps against the euro and turn negative against Sterling and the Australian dollar this year.

Valuations and the safe haven status of the dollar

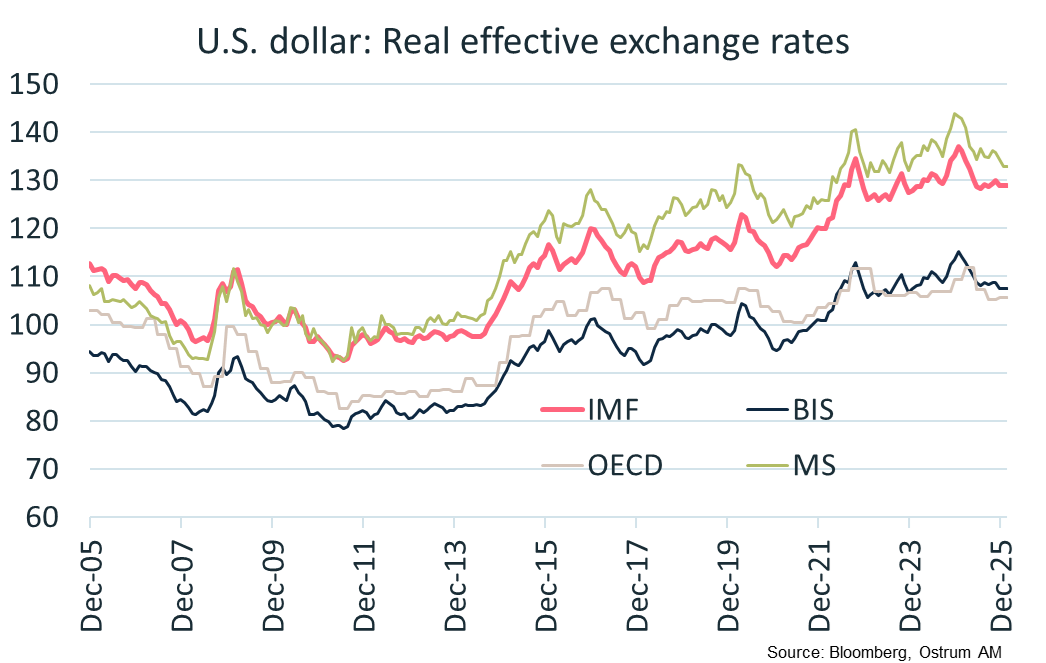

Currencies are relative prices and can be hard to evaluate. An effective exchange rate is a measure of the value of a currency against a `basket' of other currencies, relative to a base date. It is calculated as a weighted geometric average of the exchange rates, expressed in the form of an index. The trade weights reflect aggregated trade flows. REER estimates from selected international and financial institutions are shown in the chart. On these REER measures, the U.S. dollar appears rich relative to its 20-year average by 7 to 15%.

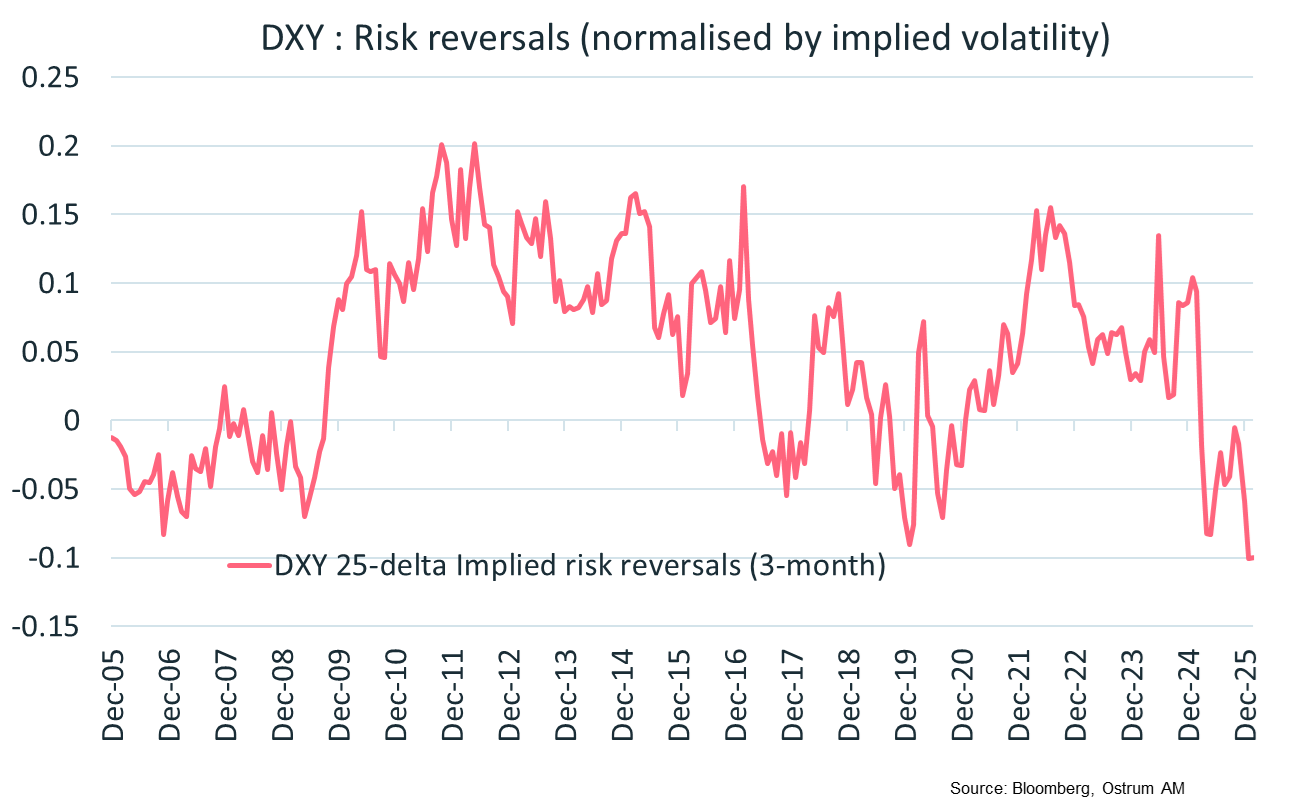

The safe haven status of the dollar is in jeopardy. The greenback no longer serves as a reliable cushion against downside risk in times of financial market stress. Much like in the case of emerging economies faced with external financing pressure, the dollar can fall in tandem with U.S. equities and bonds. This is the so-called ‘Sell America’ trade. There are other symptoms of a risk premium embedded in the pricing of the U.S. dollar. The risk reversals (i.e. the upside/downside asymmetry in implied volatilities) is no longer positive. Much like risky foreign exchange carry plays, the downside volatility on the dollar now exceeds implied volatility on the upside.

Conclusion

The U.S. trade policy under President Donald Trump has upended trade relations. Tariffs and coerced trade deals have forced U.S. trading partners to seek other international arrangements. In the process, the legitimacy of the dollar monetary anchor has been put into question. U.S. external imbalances are large and Scott Bessent knows all too well that it can’t afford a confidence crisis. The ‘Sell America’ trade showed that the U.S. dollar is no longer the safe haven currency. U.S. exceptionalism will also put to the test as the AI boom comes under greater scrutiny from investors. Dollar hedging flows may increase and valuation measures suggest that the greenback has room to adjust to the downside.

Axel Botte

Chart of the week

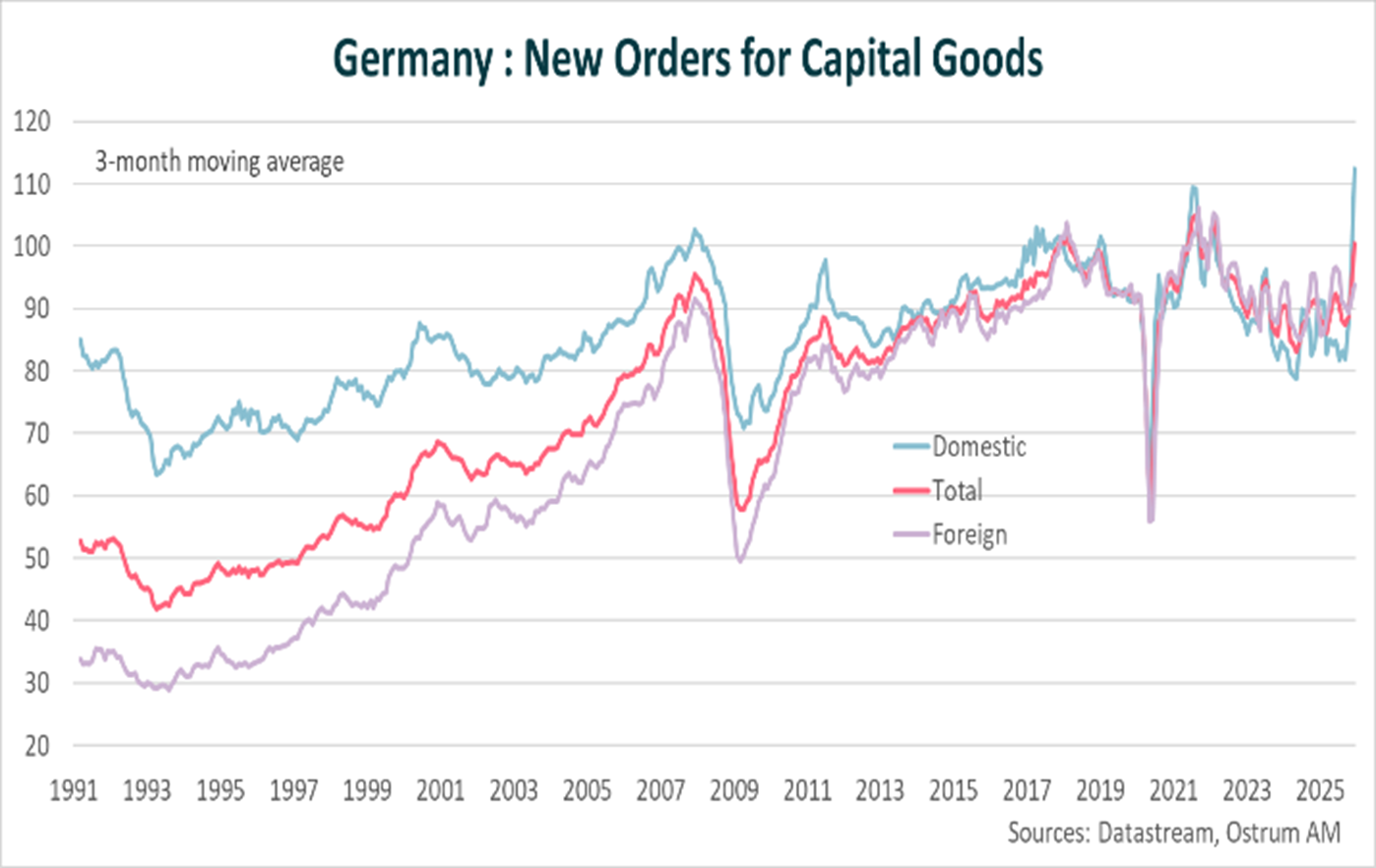

New orders for capital goods addressed to German manufacturers have been rising sharply since October. This strong rebound is linked to domestic new orders reaching an all-time high in December, even when data are smoothed over three months due to the volatility of this series. These capital goods orders are a reliable indicator of the likely evolution of company's investment.

This reflects the implementation of measures adopted by the government. The debt brake reform allows higher military spending, and the creation of the €500 billion infrastructure fund, over 12 years, translates into a rebound in public investment in infrastructure. German growth is set to accelerate in 2026.

Figure of the week

-16

-16%: the cost to emit one metric ton of CO2 is down by 16% from January 2026 highs to €76.

Market review:

- United States: the labor market continues to deteriorate.

- ECB/BoE: monetary policy stays on hold, but the bias remains toward easing in the United Kingdom.

- Equities/High Yield: the software sector is under pressure amid competition from AI.

- Currencies: The Japanese yen plunges ahead of general elections.

Geopolitical, Economic and Financial Risk Convergence

Advances in AI are disrupting the software sector. Private credit and equity markets are faltering. At the same time, the risk of war with Iran is rising despite ongoing negotiations. Meanwhile, the U.S. labor market is sending fresh signs of weakness.

Artificial intelligence is set to upend our economies and corporate strategies. The software sector bears the brunt this week as the four major U.S. technology firms unveil colossal investments totaling about $650 billion this year, a level of profitability that remains far from assured. The major technological breakthroughs usher in a productivity-creating disruption that will, in its wake, generate an array of bankruptcies. Leveraged loans extended to software companies (rated B or below) have fallen by 10–15 percentage points in some cases over the past two weeks. Not all will be refinanced. In this environment, the ECB has held its course while the BoE has reinforced its easing bias. The dollar wobbles, the yen heads lower again, gold remains volatile as the Nasdaq and cryptocurrencies sink in tandem, albeit with limited overall volatility.

On a macro front, this week’s disappointing U.S. labor-market data merit attention. Ahead of the release of payrolls and the unemployment rate, shifted to Wednesday 11 March, January payrolls totaled 108,000 job losses—the worst January since 2029. AI is named as the stated cause in 7% of cases. Jobless claims have risen modestly while vacancies are plunging below the warning threshold recently flagged by Christopher Waller, a proponent of monetary relief at the last FOMC meeting. In the euro area, publicly reported orders from German industry are set to spur quarter-one growth after a constructive end to 2025. A gradual recovery continues to take shape.

In equities, the relative underperformance of U.S. tech names persists, with software companies retreating. The Nasdaq lags the Russell 2000 amid heightened risk aversion. In Europe, indices advance about 1% aided by telecommunications and cyclicals. The yen’s renewed slide ahead of this weekend’s parliamentary elections supports a 1.75% weekly gain for the Nikkei. In rates, the T-note briefly breached the bottom end of its 4.20–4.30% range ahead of the weekend consumer sentiment release. The decline in consumer inflation expectations is welcome news as Iran-related tensions continue to influence crude prices. In the UK, the BoE kept rates unchanged at 3.75% with a dovish bias (4 of 9 votes favored a cut) which resulted in curve steepening. Bund yields oscillate between 2.80% and 2.90% in tandem with Treasuries. Sovereign-spread spreads have widened slightly by about 2 basis points. The French 10-Yr OAT is quoted at 60 basis points, 2 bps tighter than the BTP despite Italy’s upgraded outlook. Spread movements remain modest for both sovereign debt and credit. Credit demand remains robust, keeping spreads versus swaps at their multi-year lows. The credit market offers roughly a 64-bp pick‑up over swaps. The high yield sector remains more volatile and susceptible to idiosyncratic risks, notably within software. Finally, the yen again tests the 157-per-dollar level ahead of weekend elections.

Axel Botte

Main market indicators