Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Divergence between the Fed and the ECB

- The Fed made a significant change in communication by indicating that the possibility of rate cuts had been discussed;

- This appears premature given the resilience of growth, a robust job market and inflation still high;

- The ECB, for its part, remained cautious due to the sharp increase in unit labor costs. It’s waiting for data from the first half of 2024 to judge the evolution of wages;

- A major divergence thus took place between the Fed and the ECB. Despite the ECB's efforts to contain market expectations, they have retained the significant change in communication from the Fed and anticipate rate cuts that are still too aggressive.

Market review: The Fed uncorks the Champagne

- Powell delivers easing signal;

- Everything rally get yet another boost from Fed;

- ECB and BoE sound more cautious about inflation risks;

- PEPP to shrink by 7.5 billion a month from July..

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the week : Divergence between the Fed and the ECB;

- Theme : Market reaction to the Fed and BoJ decision.

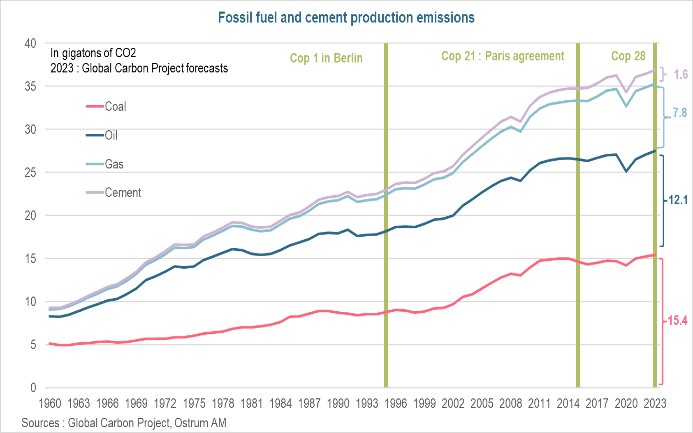

Chart of the week

The final communiqué of COP28 is mixed. For the first time, it calls on countries to undertake a “transition away from fossil fuels” in a fair, orderly and equitable manner, while accelerating action this decade to achieve carbon neutrality by 2050. On the other hand, the text does not set a deadline for phasing out fossil fuels, nor does it set specific objectives. The statement also calls for tripling global renewable energy capacity and doubling energy efficiency by 2030.

This text is a compromise allowing each country to adopt its own pace to move away from fossil fuels and the means to achieve this without creating a collective dynamic.

Figure of the week

Two days after his inauguration, the Argentine government of Javier Milei announced a 54% devaluation of the official exchange rate of the peso against the dollar (to 800 pesos to the dollar) and a reduction in public aid to try to stabilize the economy.

MyStratWeekly : Market views and strategy

MyStratWeekly – December 19th 2023