Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The New Gold Rush

- Gold prices have reached historic highs;

- Financial conditions are determinants of short-term prices prospects;

- However, demand, particularly from central banks, is an important determinant in the long term;

- Since 2008, the demand for gold from central banks in emerging countries has more than doubled;

- This reflects a willingness to diversify away from the dollar for economic and geopolitical reasons;

- The precious yellow metal also serves as a means to circumvent international sanctions.

Market review: The return of specific risk

- United States: growth in 4Q revised to 3.4%;

- Global stocks up 8.8% in the 1st quarter;

- The budget deficit weighs on the OAT spread;

- The specific risk returns to high yield.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week: 1T 2024 – Review of US Markets and Real Estate;

- Theme: The New Gold Rush.

Chart of the week

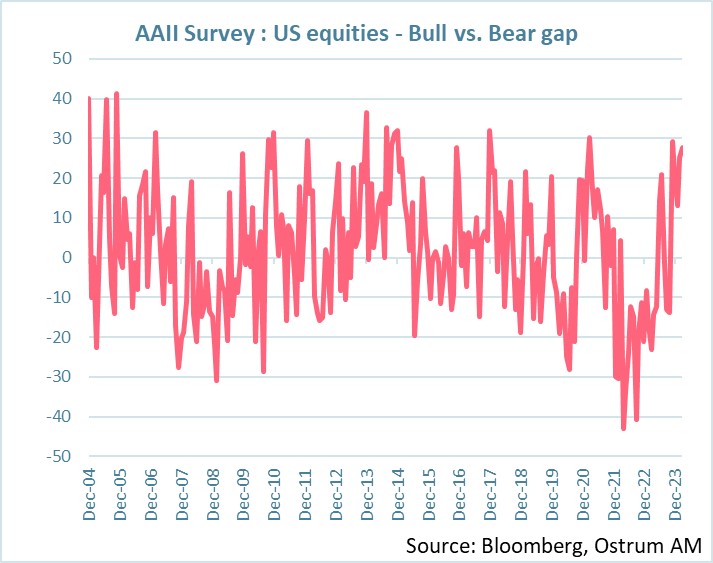

The American Association of Individual Investors (AAII) produces a survey of market participants to gauge sentiment across financial markets.

The chart shows investor responses regarding the US equity markets. The bull vs. bear gap stands at 27.6 % indicating a high level of bullishness among US stock investors.

Excessive optimism is sometimes followed by a market correction.

Figure of the week

This represents France’s fiscal deficit as a share of GDP in 2023. Revised data came in much higher than anticipated due to a revenue shortfall of close to 20 billion euros.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – April 2nd 2024