Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Will India realize its dream of becoming a developed market by 2047, the year of its independence centenary?

- India has benefited from the mistrust of China by attracting foreign direct investment (FDI);

- In 2023, the country contributed at 17.5% to global economic growth;

- Public investment remains the main driver of Indian growth;

- To achieve high-income status, India must continue to attract FDI by improving its infrastructures;

- The development of its domestic sovereign bond market should enable financing at lower costs;

- Regional stability is also a necessary condition for its economic growth.

Market review: A New Scenario from J. Powell!

- Bear steepening of the US yield curve;

- Widening of spreads for peripheral countries due to the return of budgetary risk;

- Decline in US stock markets, particularly in the technology sector;

- Low oil prices volatility given rising tensions in the Middle East.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week: Market news, Fed change of discourse, Mag7 drop;

- Theme: Will India surpass China?

Chart of the week

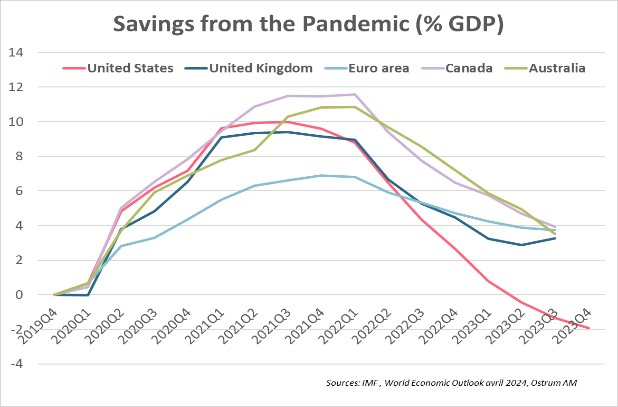

Despite the strong monetary tightening, the global economy has shown incredible resilience.

This is explained in part by households' ability to draw on their accumulated savings during the pandemic, particularly in developed countries.

This represented 10% of GDP for the United States and 7% for the Eurozone.

This savings cushion has been depleted in the United States as of Q2 2023 but remains available for other countries mentioned in the chart.

Figure of the week

39 bp of Fed fund rate cuts are now expected by markets, compared to 170 bp, or 6 rate cuts, at the beginning of the year.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – April 16th 2024