Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

- Calm before the tempest

A quick look at the markets after the summer period gives a rather encouraging view: rising rates, well-bid risky assets, very little volatility on all asset classes. All of this is consistent with a risk-on universe. Details are much more ambiguous though, with signs of underlying nervousness accumulating. We note for example that it is the least risky stocks that drove the rally while the “value” or cyclical stocks were penalized.

This validates our conservative view of markets. Valuations are very demanding at a time when growth has peaked. It is also interesting to note that economic data no longer surprises upwards, the reservoir of good surprises is exhausted, and so the support for the market. Our short-term outlook therefore does not change with the fall: in the coming months the markets should remain on a tepid trend. Too much good news is already priced-in to justify strong bullish moves. On the other hand, the strength of the recovery does not justify a correction either.

In the longer term, however, the end of the crisis is likely to be difficult. Signs of bottlenecks are growing and, more generally, the economy is already showing signs of overheating, especially in the United States. At the same time, inflation is setting in. While the term stagflation may seem excessive, the trend is there. This development, while the big central banks, especially the Fed, have not even begun the normalization of their monetary policy raises questions. Has there been too much stimulus for too long? More importantly, what steps could be taken if the economy slows down too much next year when central banks are still stuck with their ultra-lax policy calibrated for the covid crisis?

If we expect rather quiet markets until yearend, 2022 could be much more volatile and uncertain.

Economic views

Three themes for the markets

-

Tapering

Jackson Hole did not create any excitement in the markets and confirmed the forthcoming announcement of a tapering. Markets have reacted little to this statement. The September 22 FOMC should start to specify the exit modalities of the ultra-accommodative policy. This will be the major event in the coming weeks.

-

Inflation

Inflation figures are rising, and it is now clear that inflation is not only higher but also more sustainable than expected by the markets. Tensions on the production apparatus should maintain this trend.

-

GROWTH

Growth remains strong but the peak has obviously been passed. Economic indicators are no longer providing upward surprises and are merely validating expectations that are already very high. The signs of bottlenecks are increasing a sign of an overheating economy. The news could be disappointing in the future.

Key macroeconomic signposts

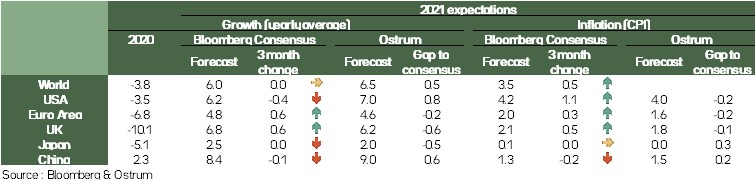

The recovery is making progress in Western countries. The lifting of health measures, the impact of vaccination and accommodative economic policies have led to a catch-up dynamic.

This is most obvious on consumption.

- These elements could be accentuated by the bonus distribution policy in the USA by the Trump administration at the end of 2020 and by the Biden administration in March.

- In Europe, manufacturing activity has benefited from stimulus from Asia and China. The acceleration of trade has been very profitable, especially in Germany. For the Euro area, this resulted in a series of positive shocks, the impact of which was accentuated by the high level of trade between the countries of the zone. This gives the expansion of the area a more endogenous and autonomous character.

- However, the catch-up dynamic is running out of steam. Normalization of activity is taking place. This is evident in the manufacturing sector surveys and in the global trade profile.

- Emerging economies, particularly in Asia, are being caught up by the delta variant and the latest survey data suggest a shift in activity and less stimulus to global growth.

- Some countries could be weakened in the event of a rise in US interest rates due to the implementation of the asset purchase reduction process by the Federal Reserve. This is a real concern.

- Inflation increased sharply in the USA because of the excess demand caused by the various stimulus packages which were reflected in purchases related to transport (used car, airline tickets). The acceleration of inflation is partly temporary, but wage pressures are beginning to appear. The persistence of inflation remains the central issue.

- In the Eurozone, the rise in oil and the shift in the balance period in 2020 explain the rapid rise in inflation in August. For the time being, it should not be considered more than a technical effect even if the inflation rate is higher than the ECB’s target.

- Central banks will remain durably accommodating due to the temporary nature of inflation even if the Fed starts to reduce its purchases in late autumn.

Budgetary policy

The need for a still active fiscal policy

-

Vote on 9/27 on US infrastructure plan

The plan, comprising $ 550 billion in new spending over 5 years, to renovate and develop American physical infrastructure (roads, railways, bridges, etc.), was voted by the Senate on August 10, and should be voted on by the House of Representatives by September 27. A reconciliation process of an initial amount of $ 3,500 billion is being prepared to adopt the rest of the measures announced by Joe Biden without the support of the Republicans. This involves spending on infrastructures intended to combat global warming and measures aimed in particular at expanding health coverage and facilitating access to university.

-

1st installments from Next Generation EU

After having successfully carried out its first issues to finance the European recovery plan, the European Commission made the first payments under the facility for recovery and resilience. To date, 10 countries have received pre-financing from the European Union representing 13% of the funds requested by them (9% for Germany at its request) and approved by the EU and the European Council. These include Italy, Spain, France and Germany. While countries requested all of the available grants, only Italy, Greece and Romania requested the full amount of available loans. The next payments are conditional on the implementation of reforms and public investments in digital technology and the green economy in particular.

-

Record SDR allocation by the IMF

The IMF has announced an allocation of Special Drawing Rights of a historic amount to enable countries to cope with the crisis: $ 650 billion, including $ 275 billion for emerging and developing countries.

Monetary policy

Towards a Fed tapering by the end of the year

-

Continued massive purchases by the ECB

The ECB should continue its asset purchases under the Pandemic Emergency Purchasing Program (PEPP) at a significantly higher pace than at the start of the year in order to maintain very accommodating financial conditions and facilitate the convergence of inflation towards the new symmetrical objective of 2% in the medium term. If the ECB maintains a purchasing rate close to the current rate, the entire program (€ 1,850 billion) will be used up by the end of March 2022. Discussions on the extension of the PEPP and its form will take place at the end of the year.

-

Upcoming tapering announcement

J. Powell's intervention in Jackson Hole was the highlight of the summer. The latter insisted on the temporary nature of the sharp acceleration in inflation and the uneven recovery and reiterated the fact that the labor market had not yet recovered to its pre-crisis level. Given the significant progress made on the symmetrical inflation target and the clear improvement in the labor market, the Fed chairman has suggested a reduction in asset purchases by the end of the year. if the economy developed as expected. Depending on the employment figures, the timing of the forthcoming announcement could change; a very gradual reduction from December or January is on the cards. Monetary policy will remain very accommodative as purchases will continue, albeit at a more moderate pace and rates will remain close to zero.

-

Tightening in some countries

Faced with accelerating inflation, some central banks are raising their key rates to preserve financial stability. These are mainly some emerging countries. South Korea is the first major country to increase its rates.

Strategic views

A shy “risk-on”

Synthetic market views: gently sloping autumn

The performance of the markets over the summer months is marginally positive, but with renewed nervousness. The risk / return trade-off therefore remains inconclusive and we expect a trend in the same direction over the coming weeks. We are therefore sticking to a “risk-on” strategy which is very timid. This approach maximizes the portfolio's return while minimizing exposure to directional risks, the potential of which seems very limited to us.

If our asset choices are therefore more of a "risk-on" typology, we remain cautious.

Allocation recommendations

We are slightly negative on German and US rates which offer limited carry and should rise. And indeed, we revised our yearend expectations for the Bund at -0.20% (vs. 0.00% on our previous numbers). On the other hand, we are more positive on spread products which continue to benefit from robust fundamentals but also from the flow of investors looking for yield. Same dilemma for equities, where fundamentals are improving, but valuations are very demanding, we can expect poor performance.

Asset Classes

G4 rates

- The Jackson Hole meeting makes it possible to consider the start of tapering at the end of the year. This bearish element is mitigated by the commitment not to change rates quickly. Neutrality prevails over the T-note.

- ECB hawks calling for a shutdown of the PEPP have rekindled some tensions. Stretched valuations and inflation at 3% argue for a short Bund position.

- The BoE remains on course for a gradual reduction in QE. The Gilt is trading around 0.65% with a tightening bias to the 10-30, however. We are neutral on JGBs, with the BoJ aiming for a 10-year 0%.

Other sovereigns

- The PEPP adjusted to weaker liquidity in August, but peripheral debt moved within a narrow range. Bund rally not associated with enlargement.

- The buying consensus has narrowed, but the improving economy and the reduction in deficits suggest a constructive stance on Italy and Spain in particular.

- The RBA must deal with the epidemic resumption, despite the prior announcement of the end of QE. We are opting for a buying bias, unlike other G10 markets where the resumption of inflation is putting pressure on rates.

Inflation

- American dead spots are relatively expensive. The inflationary bias of monetary policy nevertheless balances the risks. We are neutral.

- In the Euro Zone, inflation returned to around 3% in August. There is a potential for European breakeven points to appreciate in the order of 5bp over the month's horizon.

- In the United Kingdom, the gap between the RPI and the CPI is widening sharply (180bp) to the benefit of linker holders but the break-even points are highly valued, hence the neutrality.

Credit

- Spreads on IG in euros have changed little in recent months around 85 bps against the Bund. Valuations remain unattractive, especially as lower risk-free rates limit the positive-yielding credit universe.

- Issues are projected to rebound sharply at the end of the year with a significant repayment schedule. Any downside surprises would reinforce the IG credit scarcity effect.

- Despite an unprecedented primary this year, the search for yield is keeping spreads below 300bp vs. Bund. The reduced default rate (<2%) compensates for strained valuations.

Stock market

- The majority of results publications in Q2 2021 beat the consensus with a margin of 33% on average in the euro zone. However, the pressure on costs and rising inflation remains to be watched for 2022.

- After some profit-taking in July, flows to European equities rebounded, pushing European indices to new annual highs.

- The sharp rise in indices masks a preference for quality and stocks with lower volatility. The return to the shareholder is improving with the stock buyback plans and the increased dividends.

Emerging

- Emerging USD spreads stabilized, reacting little to the signal of a forthcoming tapering in the United States. We are lowering the target range of the EMBIG spread to 330-340bp.

- Valuations are relatively attractive at 347bp as the search for absolute return persists. The appetite for high yield ratings is not waning.

- Flows in emerging funds balance out over the summer. Long investor positioning has shrunk somewhat.