Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

The consequences of war

The immediate. Beyond the human tragedy, the Ukrainian conflict is a major uncertainty for the markets and has contributed to increasing risk premiums. The impact on economic growth is of course negative, while inflation is receiving additional support. To estimate the scale of the war on these economic variables, the key variable is the duration of the conflict, by nature totally unpredictable. So, visibility remains close to zero. Our central scenario, implicitly, assumes a crisis that doesn’t drag on past the summer.

As a result of the policy mix, central banks face a dilemma. The Fed and the ECB (but also the BoE or the BoC) favor fighting against inflation and we must therefore add to the picture a fundamental trend towards monetary tightening. The support of activity will fall to fiscal policy, and we must again expect rising deficits and therefore a significant supply of sovereign paper.

The world after. Beyond these immediate effects, it is very likely that the next world after will be different. The security of energy supply will involve diversifying suppliers, and thus using more expensive sources. Ambitious investment programs will also have to be launched. Here too, State budgets will be impacted well beyond the short-term recessionary effect of the conflict.

The military effort will be increased with, once again, budgetary consequences but also an impact in industrial and research terms. In both cases, defense and energy, the European response is partly common with a new integration of the financial effort at the federal level.

Finally, the “deglobalization” movement, which began with the Covid crisis, will certainly be strengthened, with, in particular, implications for price trajectories.

Even if the conflict ends soon, which we can only hope for, the lifting of geopolitical uncertainty will give way to profound changes in the world economy with the inherent risks and contingencies. So, there will be a sort of “memory effect”, with an uncertainty that will only partially disappear.

Economic views

Three themes for the markets

-

Ukraine

At the time of writing, the Ukrainian conflict remains the major factor for the markets. It is the source of the very sharp increase in the risk premium and the recent volatility in the markets. The main issue for markets and its duration, which will determine the extent of the impact but also the ability of economies to rebound.

-

Inflation

Once again, inflation continues to surprise to the upside dramatically. This is obviously a subject for monetary policy, but also for the purchasing power of households, and therefore growth. This is also a concern for business margins. These figures continue to fuel uncertainty.

-

Monetary Policy

Caught between sluggish growth and accelerating inflation, central banks are in a very uncomfortable position. They have very clearly chosen their priority: inflation. And so, they continue to tighten their monetary policy. And so, the financial conditions, which take into account the evolution of the markets, are much less favorable.

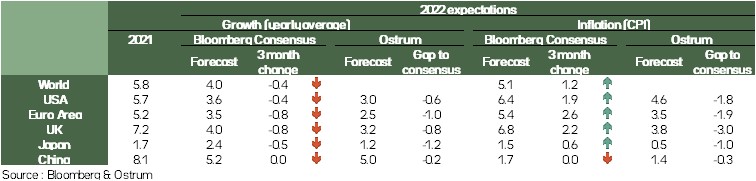

Key macroeconomic signposts

- Activity had started in 2022 in a robust manner despite the resurgence of the January epidemic. The inflection in the first month of the year was quickly offset in February. Only the American ISM due to a fragility of services had weakened in February.

- Since then, the invasion of Ukraine by Russia has thrown the cards around. It is a great shock of uncertainty on the activity because of the conflict itself, especially since it is at the gates of Europe, also because of the impact on the price of raw materials and the consequences this could have on the production processes.

- Commodity prices surged after the invasion raising fears of shortages in certain products or components.

- From the point of view of business leaders, the shock can be understood through the price of carbon, which dropped very sharply after February 24. It has since recovered but remains well below the high points hit in February. INSEE made a similar observation in mid-March regarding the perception of activity in France.

- To this negative phenomenon on the activity are added the closures observed in China (Shenzhen) which given the policy of 0 Covid of the Chinese government could translate there also by ruptures in the production chains for lack of supply.

- The analysis of an energy shock, such as the one we might be aware of, must be made by considering the levy on foreign suppliers through higher prices and also by taking into account the financing of this levy. In 1975, enterprises were generally penalized in favour of employees whose earnings were indexed to inflation.

Activity had started in 2022 in a robust manner despite the resurgence of the January epidemic. The inflection in the first month of the year was quickly offset in February.

Key macroeconomic signposts

- The invasion of Ukraine has accentuated the energy crisis observed in Europe mainly since the autumn. This situation must lead to greater energy autonomy and accelerate the energy transition.

- In the short term, the conflict situation in Eastern Europe is causing more inflationary pressures. The scale of this phenomenon will be conditioned by the duration of the conflict and the risk of a shortage of fossil fuels. This situation is reflected in Russia’s power relationship with Europe.

- The question of agricultural prices is more complex since production involves a longer process. The price of wheat is historically high because seedlings in Ukraine are going to be very severely disrupted. In view of the good correlation with the price of the FAO agricultural price index, all food prices will continue to increase. Emerging countries that are already experiencing a very high inflation rate will be further penalized at the risk of a period of famine and social and political instability.

- The dynamics of consumer prices have recently become more pronounced in the US with the rise in wages for both new contracts and existing employment contracts. it is because of the marked accentuation of this chain between salary and price that the Fed has tightened the tone more significantly than expected. It stalled on 7 rate increases this year with an increase already on March 16. The fear of the US monetary authorities is that this price-wage loop is long term.

- In Europe, wages have not accelerated despite higher inflation since spring 2021. This is probably due to the very different wage negotiation method than the very decentralized one in the US. The ECB is still more involved in prevention than in a binding strategy.

In the short term, the conflict situation in Eastern Europe is causing more inflationary pressures.

Budgetary policy

The consequences of the conflict in Ukraine will weigh on deficits

- Vote on the 2022 federal budget

While the vote for the "Build Back Better" plan is very compromised, the government has finally reached an agreement to finance the 2022 federal budget and thus avoid the partial closure of American federal administrations. Expenditures total $1.5 trillion, the largest in four years. While special aid to fight Covid has been cut, the plan contains $13.6 billion in emergency aid to help Ukraine militarily, economically and socially.

- Towards an increase in EU deficits and debts

Given the EU's greater dependence on Russia, public deficits and debts will increase more compared to other countries. This will come from lower tax revenues following weaker growth but also from additional expenditure linked, in particular, to the partial coverage of the impact of the sharp rise in energy prices for the most affected households and SMEs, vast investments needed to reduce energy dependence on Russia and to strengthen and modernize European defense. In this context, the European Commission could once again postpone the reinstatement of the rules of the stability pact to 2024.

- Towards a partial sharing of the shock

Faced with the exogenous shock linked to the conflict, the impact in EU countries will be differentiated according to their exposure to Russia. The countries of Eastern Europe, but also Italy and Germany, due to their heavy dependence on Russian energy, will be the most affected. In this context, discussions began at the Versailles summit to provide funding at European level for the measures to be taken and the vast investments to be made, as during the Covid 19 crisis.

Monetary policy

Normalization of monetary policies in the face of high inflation

- The Fed begins its series of rate hikes

Faced with the risks linked to inflation at its highest level in 40 years and an "extremely" tight labor market, the FED decided to raise its rates by 25 basis points, for the 1st time since 2018, during the meeting of March 15 and 16. The members of the committee have revised their inflation outlook for 2022 sharply upwards and therefore plan to raise rates 7 times over the year, compared to 4 at the December meeting. After having just ended its asset purchases, the Fed has indicated that it will begin reducing its balance sheet at an upcoming committee meeting (May or June).

- The ECB surprises us again in March

While the strong uncertainty linked to the impact of the conflict in Ukraine pleaded for a status quo at the March 10 meeting, the ECB announced an acceleration in the pace of the reduction in its asset purchases. This aims to contain inflation expectations which are converging in the medium term towards the 2% target (1.9% expected in 2024). The PEPP ends at the end of March as expected and the APP will be increased to 40 billion euros per month in April, 30 billion per month in May and 20 billion in June (compared to 40 billion per month in Q2 announced in December). Thereafter, all options are possible depending on data. The purchases may end in the 3rd quarter or be extended, or even increased in size and duration. The ECB has also given itself more time between the end of its purchases and the first increase in rates.

- Divergence is growing with China

While developed countries are normalizing their monetary policy and emerging countries are tightening theirs to deal with inflationary and financial tensions, China will continue to ease its monetary policy given the risks to growth (real estate and recovery in the Covid epidemic).

Strategic views

Valuation more attractive, zero visibility

Synthetic market views: valuation vs. risks

The Ukrainian crisis has contributed to a significant rally in risk premiums, although our risk appetite indicator remains within a standard deviation from its long-term average. The consequence remains a relaxation of valuations that we considered excessive and that are becoming more interesting especially for a medium-term investor. In the immediate future, there remains the total lack of visibility linked to Ukraine. We therefore remain cautious in the short term even if we are more constructive in the medium term with the hope of a solution not too distant to the conflict.

Allocation recommendations: entry point ?

The rise in long-term interest rates is expected to remain marginal in an environment where interest rate rises are widely anticipated and growth is expected to be at risk in the second half of the year. A context where the flattening of the curves remains a basic trend, given the need to counteract inflation, breakeven inflation are attractive. The dollar remains an important barometer of the intensity of the Fed tightening and risk aversion. Equities are becoming more attractive in terms of valuation, but fears about growth and margin pressures are raising concerns about a potentially disappointing earnings growth. The movement of interest rates and risk premium has influenced the riskiest credit and sovereign spreads (Italy, Greece) and high yield. EM debt appears more resilient in the face of monetary tightening.

Relaxation of valuations that we considered excessive and that are becoming more interesting especially for a medium-term investor.

Asset classes

G4 rates

- The Federal Reserve raised its rate despite the war in Ukraine. The next step concerns the winding down of the balance sheet which should limit the extent of the flattening. Extreme volatility nevertheless pleads for neutrality.

- The ECB adopted a more hawkish stance by accelerating the exit from QE. Rate hikes will come later. Public spending and inflation point to higher yields but the safety bid limits the upside, hence a position of neutrality.

- The MPC continues to tighten monetary policy, and the bias remains restrictive. The international backdrop favors a neutral stance. In Japan, the BoJ is staying the course, overexposure remains justified.

Other sovereigns

- Italian spreads are hovering around 160 bps. The early exit from QE sparked high volatility in sovereign spreads. The risk remains on the rise in Italian spreads.

- All sovereign spreads widened, swap spreads show a high level of risk aversion. However, neutrality prevails on semi-core debt (France) given attractive valuations.

- The bias in duration positioning is mostly short in the G10 universe (Sweden, Norway, New Zealand), given the hawkish turn of central banks and the sensitivity to commodity prices in G10.

Inflation

- Inflation (7.9% in February) will continue to accelerate in the United States, as a result of the Ukraine war. The monetary tightening of the Fed does not prevent a rise in inflation expectations.

- In the euro area, inflation reached 5.9% in February and the ECB is concerned about risks to price stability. The Ukrainian crisis is pointing to higher breakeven inflation rates. Flows into the asset class are improving.

- In the United Kingdom, real rates failed to respond to monetary tightening. High inflation will persist, notably the RPI index which determines UK linker flows..

Credit

- IG spreads are widening as the war in Ukraine sparks renewed risk aversion. Apart from Russian issuers, rating reviews remain favorable. Valuations are now attractive.

- The primary market activity slowed sharply in February, New issue premiums increased. Primary market may reopen should volatility falls. Credit funds record outflows. The ECB remained nevertheless active on the secondary market (CSPP).

- Sentiment has deteriorated markedly on high yield, despite a consistently low default rate. Valuations have become attractive again.

Stock market

- Economic growth may exhibit downside risks due to renewed concerns on costs and supply chain disruptions. Annual EPS growth could be marked down to 0-6%.

- Inflationary pressures (logistics, raw materials, recruitment) threaten profitability. The sectoral impact is very heterogeneous. Value and high dividend are outperforming though quality and visibility should be rewarded.

- For the coming month, we remain cautious targeting a decline towards 3.750 on the Euro Stoxx 50.

Emerging

- Spreads on emerging USD debt are expected to move in a wide 450bp-525bp range. We remain neutral on the EMBI spread, despite attractive valuations.

- The war induces considerable differences in terms of fiscal balances depending on the evolution of commodity prices. There is significant uncertainty regarding the risk of default of Russia.

- Flows to emerging funds have deteriorated, despite reduced issues in 2022. Redemptions are significant in the short term.