Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO letter

- The ECB joins the club

The music is accelerating. Last month the title of this letter was “The Fed Unearths the Hatchet”. What about the ECB? After giving us a lot of visibility in December by announcing the EQ trajectory for all of 2022, the February 3 meeting took everyone to task with a sharp acceleration of the monetary tightening. The board is “unanimous” in its “inflation concerns”, the risks are “up”. More surprisingly, the reference to wage risks, a theme we expected, but not until the second half of the year.

It is very likely that the ECB will announce a more rapid reduction in EQ at its next meeting on 10 March. We expect it to end in September. This also opens the door to rate increases, especially since part of the Council wants to get out of the negative rates. We therefore expect an increase in the fourth quarter, followed by a second one early in 2023 to bring the repo to 0%.

What a change in a month!

From one excess to another: too many market expectations? The market has been forced to change its expectations. A very violent fit, on the curved part of the curve, a 5-sigma motion. A excessive fit we think on both sides of the Atlantic. We are very skeptical about the Fed’s ability to implement the end of EQ in March, the five expected rate hikes, and a QT (100 billion per month by consensus) for the second half of the year. Similarly the market expects at least two ECB rate hikes, perhaps more. While the economy is slowing, it is unlikely that risky assets will swallow up such a cure.

There are three consequences for the markets. First, of course, a trajectory of central banks much more aggressive than expected. Second, an overshoot of contracts that went from being too complacent to being too hawkish. Thirdly, as we have been aware for several months, a debate and thus a lack of visibility on the trajectory of central banks, which leads to a much riskier environment for investors.

Economic views

Three themes for the markets

-

Monetary policy

Monetary policy remains the dominant factor in market dynamics. The ECB’s press conference has been a game changer, but the Fed and other central banks are sliding towards an increasingly hawkish position. Monetary conditions are straining and uncertainty on the future path of it is increasing.

-

Inflation

Inflation continues to rise dramatically. This is obviously a subject for monetary policy but also for the purchasing power of households, and therefore growth, but also for corporate margins. These numbers continue to fuel uncertainty.

-

Energy

Europe continues to face an energy crisis. Between OPEC, which we are not sure can increase its production, the political crisis in Ukraine and rising needs, the situation should remain tense. This is in the context of an energy transition that contributes to tensions. This is yet another risk for the economy and for the markets.

Key macroeconomic signposts

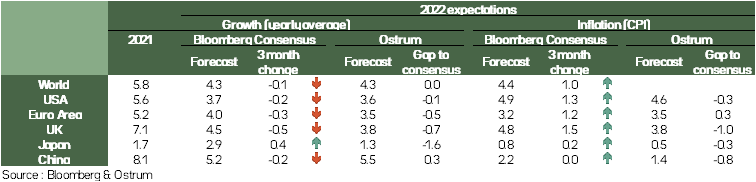

- In the final quarter of 2021, business momentum remained robust. For most developed countries, the level of activity has almost returned to its pre-crisis level. In Europe this is the case of the Eurozone, France and Italy. Germany and Spain are in the background. Over the Rhine, external impulses were lower than at the beginning of the year (China’s impact was lower). In Spain, tourism is always a weakness.

- In China, the economy continued to grow but in the last quarter of 2021, the pace of expansion was particularly slow due to insufficient domestic demand (consumption and real estate). This encourages the central bank of China to increase the accommodative nature of its monetary policy.

- In the United States, activity grew faster than employment, resulting in higher productivity gains than in other developed countries, giving the American economy a comparative advantage.

- In the short term, surveys show a slowdown in January. It simply reflects the impact of Omicron on behaviour, particularly in services. In view of the relaxation of constraints since the beginning of February, this inflection should only be temporary.

- In the USA, consumption slowed down in December. The level of expenditure, in volume terms, deviates from the pre-crisis trend. This reflects the health risks that were still high in December in the US, the exhaustion of the Biden recovery last spring and the purchasing power effect. The rise in inflation to 7.5% in January severely reduces purchasing power, which penalizes consumption. This phenomenon will not only be observed in the United States. Everywhere wages rise much less quickly than inflation.

In the final quarter of 2021, business momentum remained robust. For most developed countries, the level of activity has almost returned to its pre-crisis level.

Key macroeconomic signposts

- Inflation rates continue to rise rapidly. In January, the rate was 7.5% in the US and 5.1% in the Eurozone. These numbers far exceed the targets set by the central banks. They need to become more restrictive in their monetary policy.

- The demand shock following the Biden recovery and the catching-up dynamics explain this movement, which took prices away from companies that did not have sufficient stocks of both raw materials and intermediate goods.

- In January 2022, businesses continue to suffer from very high prices that they pass on to production prices. The latter are reflected only in a limited way in consumer prices but this is necessarily significant. The first graph shows that the situation has not returned to a certain normality. The accumulated excessive prices will have to be dissipated in productivity gains, cost savings but also in a transfer to consumer prices.

- The most striking aspect of price developments is the trend in energy prices. The rapid rise in the price of oil, gas and electricity is reflected in a very high contribution of energy to the rate of inflation. In the Eurozone, energy accounts for half of inflation, about a third in the US.

- The distribution of energy prices to the consumer will continue. Thus, in April, the British consumers' bill will increase by 54% due to the price of electricity and gas. This acceleration will be reflected in many European countries. In France, this cost is pooled by the government thus erasing an additional inflation point according to INSEE.

- The central banks intervene to weigh on the expectations so that the rise in inflation does not translate into phenomena of indexation of wages on prices making more persistent high inflation. That would be contrary to their mandate.

Budgetary Policy

The stimulus is largely a thing of the pas

- « Build back better » probably won’t happe

The $1.750 billion “Build Back Better” vote seems increasingly compromised by the reluctance of Democrat Senator Joe Manchin, whose vote is proving crucial. Joe Biden seems thus weakened before the mid-term elections. A new deadline is looming: the government will once again have to avoid a partial closure of certain public administrations by 18 February. To this end, the final 2022 budget will have to be adopted or, failing that, the 2021 budget will be extended.

- EU: more targeted measures for 202

The suspension of the Fiscal Compact rules has been extended until 2022 to allow countries to take targeted measures to support businesses that have been weakened by the impact of the Covid-19 outbreak. A number of countries, including France, have taken new measures at the beginning of the year due to the strong resurgence of the Covid-19 epidemic and the impact on the business of certain sectors (including hotels and restaurants). Most of the exceptional measures taken at the height of the crisis have been completed, which, combined with the strong rebound in growth, translates into a clear reduction in public deficits (e.g. Italy on the chart against), even if we remain very far from balance.

- Stability pact refor

Discussions on the necessary reform of the Stability Pact are proving crucial to avoid a sudden adjustment of public finances that could provoke a new recession in the Eurozone (as in 2013). This is all the more important as the ECB has tightened its tone by suggesting that it does not rule out stopping asset purchases and raising rates by the end of the year.

Monetary policy

Acceleration

Fed will start hiking in marc

- In the face of sustained high inflation lasting longer than expected and given the dynamism of the labor market, the Fed indicated at its January meeting that it would be “soon appropriate” to increase its interest rates and that it would end its asset purchases at the beginning of March. Discussions on how to reduce the size of its balance sheet will take place in the next two committees. This suggests a first increase in its rates as of March and a reduction in its balance sheet from July.

Major shift at the ECB

- The ECB surprised markets at the meeting on 3 February by indicating that it considered the short-term risks to inflation to be upward oriented. In addition, Christine Lagarde no longer mentioned the fact that a rise in key interest rates was unlikely in 2022. This boded for a faster-than-expected end to the ECB’s asset purchase programmes, which would be followed by a rise in key interest rates by the end of the year. The 10 March meeting will be important in this respect as the ECB’s new inflation forecasts will be issued. If the medium-term inflation outlook is revised upwards towards the 2% target, this will justify a tightening of monetary policy. The ECB’s communication will be important in this regard.

Towards an easing in em ?

- Emerging countries that had begun to raise their rates, as early as March 2021 for some, in order to cope with inflation, report that they have completed or are about to complete this monetary tightening due to the impact on growth. China, for its part, will continue to relax its monetary policy.

Strategic views

A need for fresh air

Synthetic market views: an unavoidable adjustment

Inflation upside surprises leave little room for doubt as to the monetary policy to be implemented. The ECB has toughened its stance whilst the RBA also seems to be joining the hawkish crowd including the Fed, the BoC or the BoE which is already cutting back on monetary stimulus. While the path for rates is now clear in the G10 countries (excluding Japan), many details of the tightening strategies remain to be discussed, particularly in the euro area, as the QE exit schedule announced in December already seems outdated. The increase in real rates signals a downward adjustment in financial asset valuations and the need to restore risk premia.

Allocation recommendations: sharp rotations in asset allocatio

The monetary environment is likely to accentuate strategy rotations across markets. The dollar remains an important barometer of the expected magnitude of Fed tightening and investor risk aversion. Yield curve flattening remains a powerful trend given the need to thwart inflation over time. Growth stocks suffer from the rise in real interest rates, to the benefit of stocks with larger payouts. The upward movement in bond yields affected credit spreads, the risky sovereign spreads (Italy, Greece) or even high yield. So far, emerging debt seems less sensitive to monetary tightening.

Inflation upside surprises leave little room for doubt as to the monetary policy to be implemented.

Asset classes

G4 rates

- The economic backdrop justifies a rate hike in March before the Fed begins winding down its balance sheet. Valuations still point to downside potential for the Treasuries, which argues for a short position.

- Belatedly, the ECB has toughened its stance on inflation and is no longer ruling out raising rates this year. An early exit from QE is also under discussion, which should lead to higher Bund yields.

- The MPC opted for 25 bps hike in February, but the bias is clearly restrictive and justifies a short stance on Gilts. In Japan, the BoJ keeps policy unchanged amid slight tensions on the JGB.

Other sovereigns

- Italian spreads are hovering around 160 bps. The political situation remains uncertain and Italian debt is the most exposed, along with Greece, to the probable end of QE this year.

- Overall sovereign spreads widened following the ECB meeting. The uncertainty surrounding QE, in particular the reinvestment policy, has a large impact on Greece bonds.

- Duration positioning is uniformly short in the G10 universe given the hawkish turn of the Central Banks. Norway presents the largest downside risk.

Inflation

- Inflation (7.5% in January) remains very high in the United States. The Fed's monetary tightening should push up real rates, without compressing breakeven inflation rates.

- In the euro area, inflation reached 5.1% in January. The energy crisis should point to higher breakevens but less supportive investor sentiment and outflows argue for a neutral stance on euro breakevens.

- In the United Kingdom, real yields should rise due to the ongoing monetary tightening. High inflation persists but inflation breakevens have stabilized.

Credit

- Despite strong fundamentals, IG spreads widened sharply in the wake of protection buying. The balance of flows has also become less favorable.

- A widening of IG euro spreads is likely on the one-month horizon as the market takes in the new monetary environment.

- Sentiment has deteriorated markedly on high yield, despite a consistently low default rate. Valuations are less stretched now.

Actions

- The economic growth expected for next year, with operating leverage that remains high, could generate EPS growth of around 8%.

- Inflationary pressures (logistics, raw materials, recruitment) weigh on costs and threaten profitability. The sectoral impact is very heterogeneous.

- For the coming month, we remain cautious targeting a decline towards 4.050 on the Euro Stoxx 50.

Pays émergents

- Emerging USD spreads are expected to move within a target range of 360-390bps. We remain neutral on the EMBI spread, despite attractive valuations on High Yield and relative to other asset classes.

- The geopolitical crisis in Ukraine and the evolution of US yields entail risk factors for the asset class. Valuations are nevertheless attractive.

- Flows to emerging funds declined despite reduced issuance in January. Synthetic indexes have stopped tightening.