Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- The new framework for the French SRI Label 'V3', created by the Ministry of Economy and Finance and awarded by external auditing organisations, came into effect on January 1st, 2025, for funds that were already labelled. It incorporates a strengthening of the criteria for the selection of securities and establishes the fight against climate change as a key principle of the label.

- On January 7th, the Republic of Italy issued its 5th green bond (20Y maturity and €5Bn for the green tranche), making the government’s outstanding green bonds more that €45Bn as of today. This new issuance has been largely oversubscribed with a demand exceeding about €130Bn. These financings will contribute to Italy’s environmental and climate ambition, knowingly to achieve climate neutrality by 2050 and to achieve the goals set in the European Green Deal.

- In a report published this month, the ECB highlights that green investments in Europe are insufficient to meet the 2030 climate goal of reducing emissions by 55% compared to 1990 levels. Europe needs to mobilise additional investments of 2.9% to 4.0% of the EU's GDP each year until 2030, which equates to an additional €477Bn per year, on top of the already invested €764 Bn.

- Morgan Stanley, JP Morgan, Citigroup, and Bank of America recently withdrew from the Net Zero Banking Alliance, which aims to facilitate the transition towards reducing corporate carbon emissions. These departures follow the exits of Wells Fargo and Goldman Sachs, which also left the coalition last month. The exit of these banks occurs at a time when anti-ESG sentiments are being observed among Republicans.

Figure of the month

940

~940 funds (-30%) maintained the French SRI Label as of January 1, 2025, following the implementation of the new framework

Chart of the month

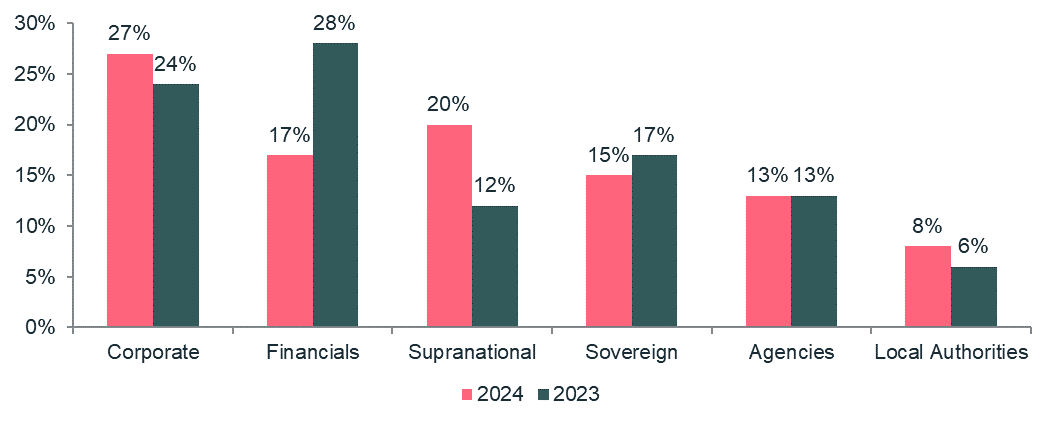

Sustainable bond issuances per sectors

The sustainable bond market has known significant evolutions between 2023 and 2024, notably on issuer types:

- Increase in the share of corporate issuers, from 24% to 27% and a more important increase for supranationals, from 12% to about 20%.

- Drop in Financial issuers from 28% in 2023 to only 17% in 2024.

Source: Market sources, January 2025