Quarterly publication / October 2025

Analysis finalised on 19/09/2025 ; data as of 30/09/2025

Marketing communication for professional investors in accordance with MIFID II.

MARKETS OVERVIEW

THE FED HAS FINALLY CRACKED

Price action in the markets depicts an environment of economic recovery with little risks of persistent inflation or financial volatility. These stellar performances contrast with a still . These stellar performances contrast with a still troubled international context and the ongoing uncertainty surrounding U.S. economic policy. The resulting weakening of the U.S. labor market, which has reshaped Fed policy, paradoxically provides significant support to the markets. At the same time, questions regarding the independence of the monetary institution impose a risk premium on long-term real rates. This dual influence of sovereign credit risk (upward pressure on rates) and economic risk (downward pressure) makes the trajectory of the 10-year yield highly uncertain, but we lean towards a slightly bullish bias by the end of the year.

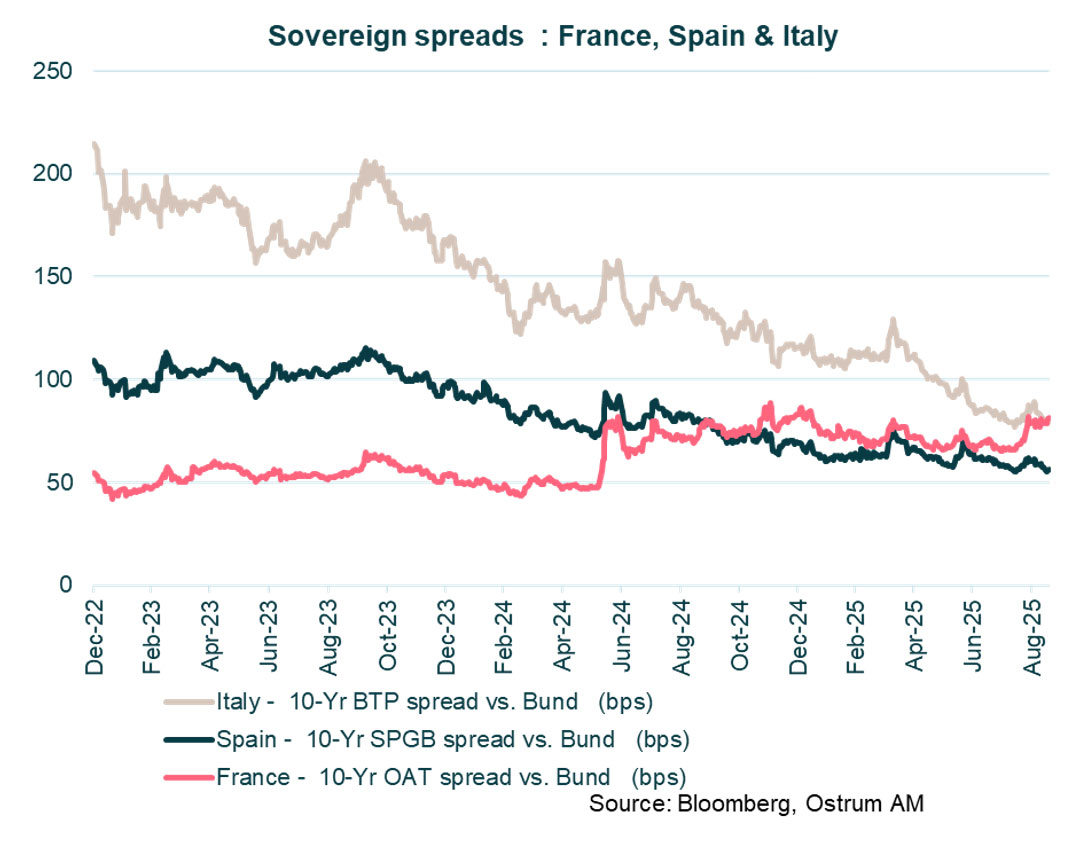

In the eurozone, economic growth will be stimulated by the rollout of public investments in Germany. The disinflation process is nearing its end, so the ECB is expected to maintain the status quo on rates through 2026. The French political crisis remains contained and does not require any intervention from the ECB at this stage. The OAT has already factored in the likely downgrades of France’s credit rating (S&P, Moody’s), given the difficulty in restoring public finances.

The dizzying rise in valuations of U.S. technology stocks is driving a broad upward movement across all risk assets, overshadowing geopolitical risks. The AI theme remains the engine of these excesses, amplified by the Fed's change in policy stance. The T-note is expected to hover about 4%, while the Bund will need to fully incorporate the status quo and fiscal stimulus (2.80%) by the end of the year. Pressure on OAT spreads has no consequences on other sovereigns. Credit is navigating this period without volatility, although the recent narrowing of spreads could mean the market is priced for perfection.

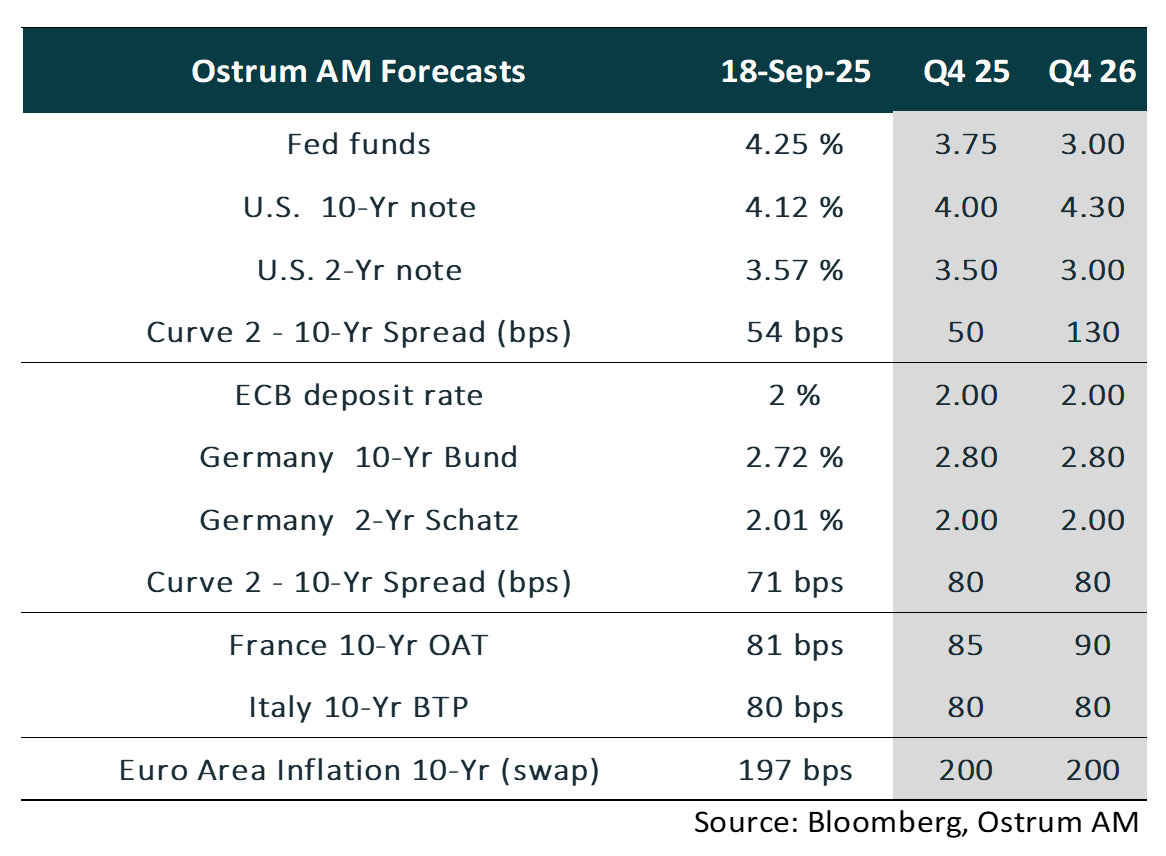

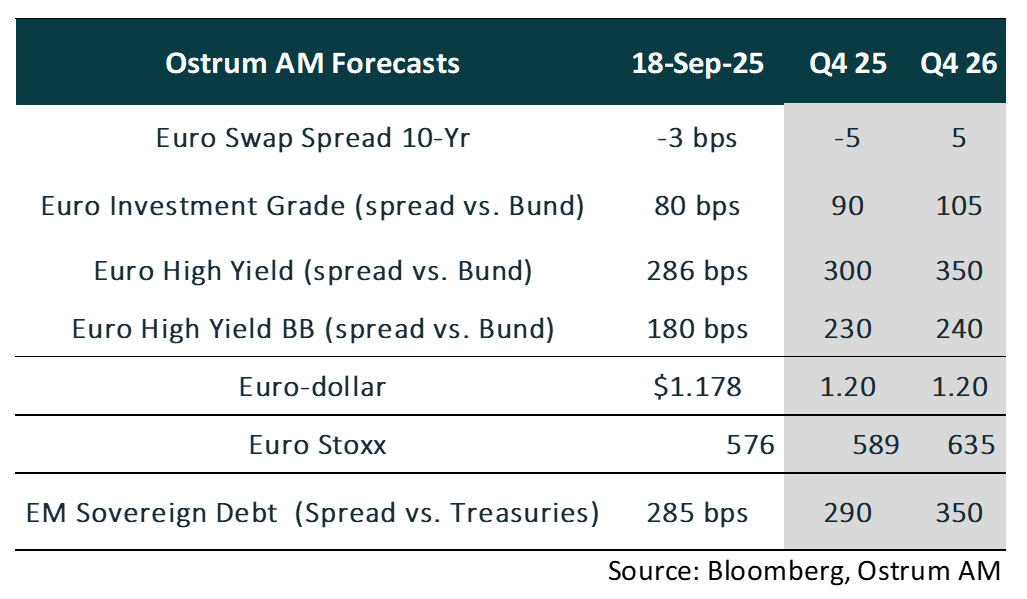

KEY INDICATORS

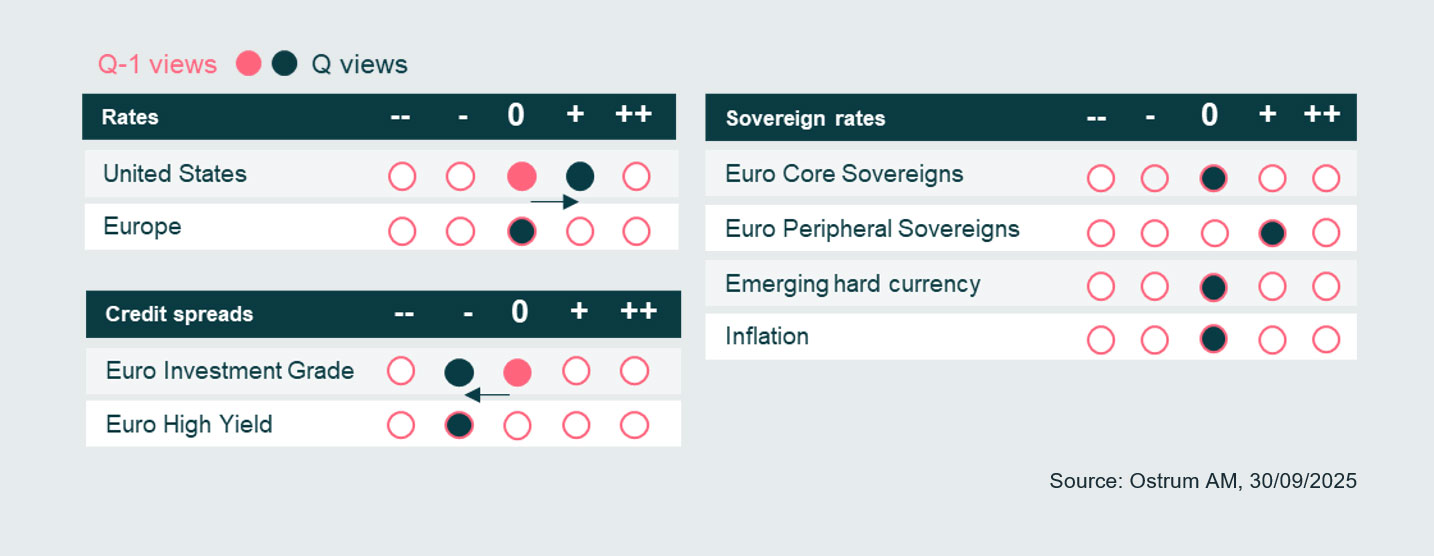

3 MONTH OUTLOOK ON BOND MARKETS

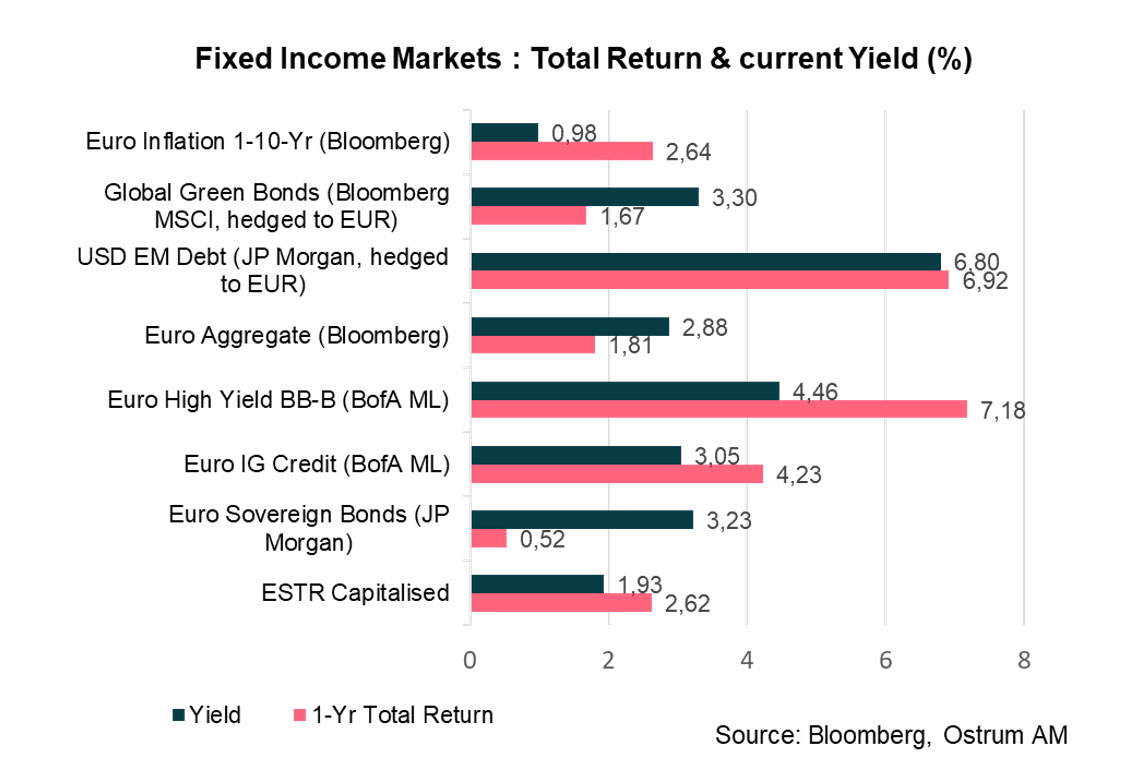

FIXED INCOME RETURNS & PERFORMANCES

GROWTH & INFLATION

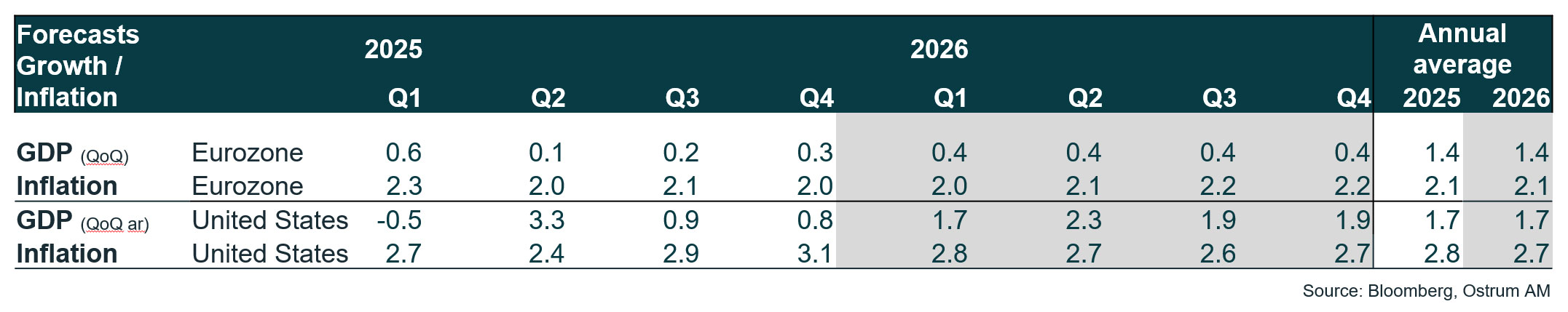

GROWTH

- The U.S. economy is adjusting to Donald Trump's policy. The second half of the year is expected to be below potential due to a slowdown in employment and investment, excluding AI. Furthermore, there is a risk of government shutdown starting at the end of September.

- In the eurozone, a gradual recovery is expected to continue thanks to the implementation of German investment plans.

- In China, the weakening of data at the beginning of Q3 does not call into question the growth target for 2025. The reduction of excess capacity will nevertheless need to be compensated by increased demand support.

INFLATION

- U.S. inflation stands at 2.9% in August. Price increases are expected to remain around 3% during the 4th quarter. Tariffs and price inertia in services offset the disinflationary effect of rents.

- In the eurozone, inflation is close to the ECB's target of 2%, but service prices remain high due to the still strong wage dynamics (3.5-4%).

- Combating Chinese deflation is a priority objective for the government, alongside the anti-involution policy. Consumer prices fell by 0.4% in August.

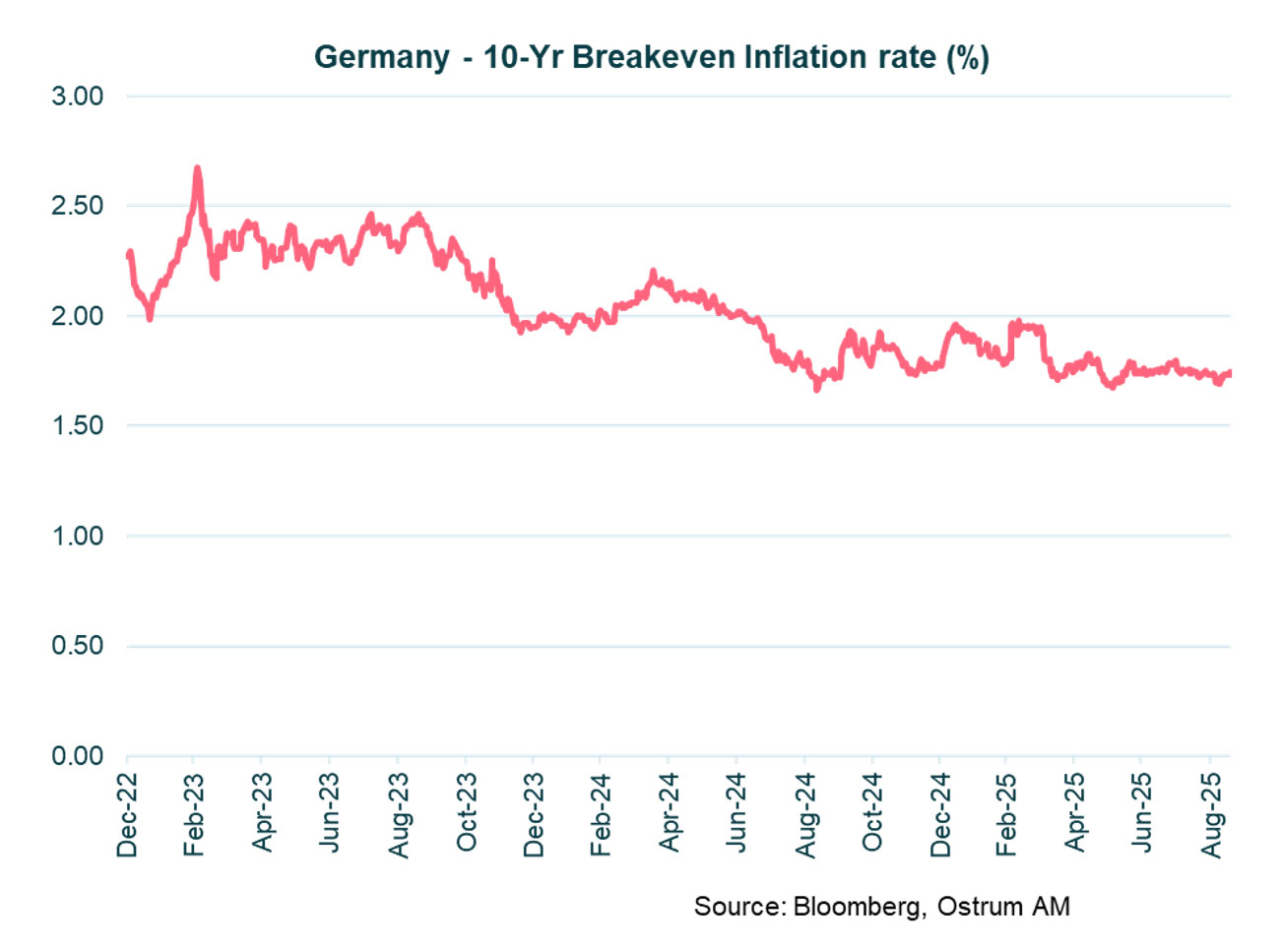

Eurozone inflation: Inflation expectations remain anchored around the 2% target.

CENTRAL BANKS RATES

MONETARY POLICIES

DIVERGENCE BETWEEN THE FED AND THE ECB

The Fed is resuming its rate-cutting cycle.

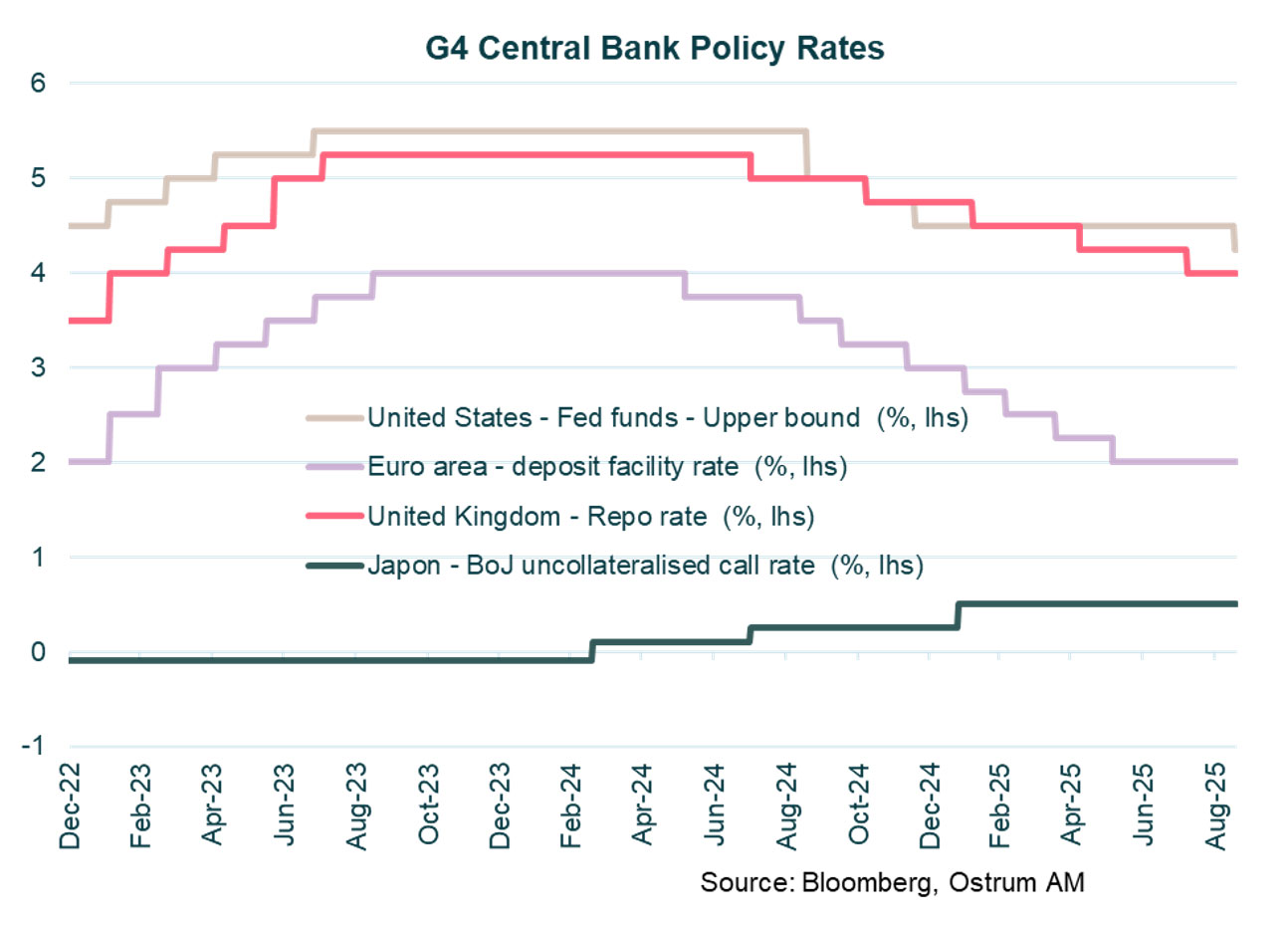

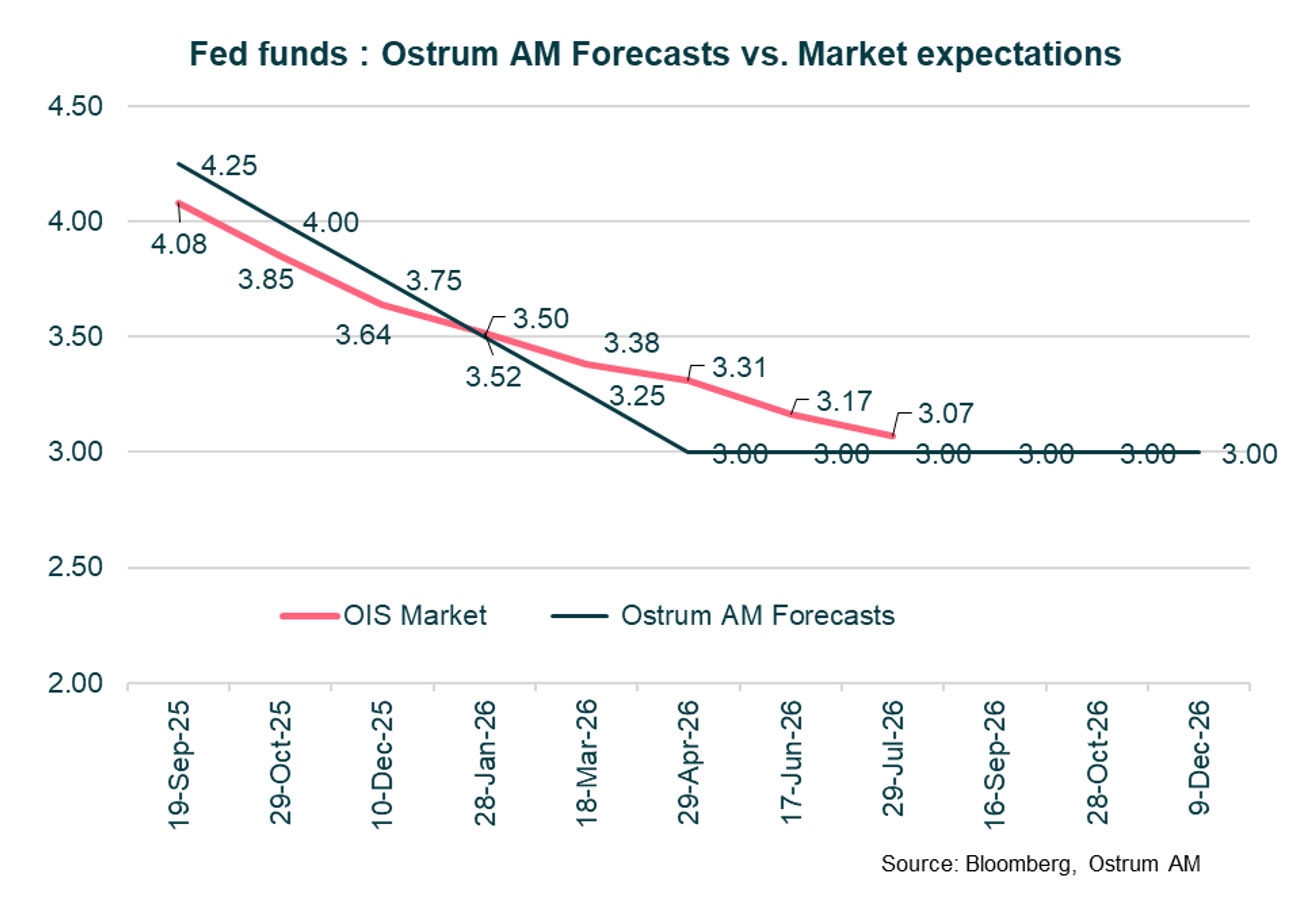

The Fed has decided to lower its rates by 25 basis points, bringing the federal funds rate to the range of [4.00 – 4.25%]. This marks the resumption of its rate-cutting cycle (-100 basis points between September and December 2024) after a 9-month period of maintaining the status quo.

This decision was motivated by increased downside risks to employment, following data revealing a significant slowdown in job creation over the past three months. While inflation risks remain tilted to the upside, the impact of tariffs is considered to be temporary.

Members of the monetary policy committee anticipate, on average, two more rate cuts by the end of the year (compared to just one during the June meeting), followed by further cuts in 2026 and 2027. We expect two more rate cuts by the end of the year and three additional cuts in 2026, aiming to return to the neutral rate, given the ongoing deterioration in the labor market and significant risks in the real estate market.

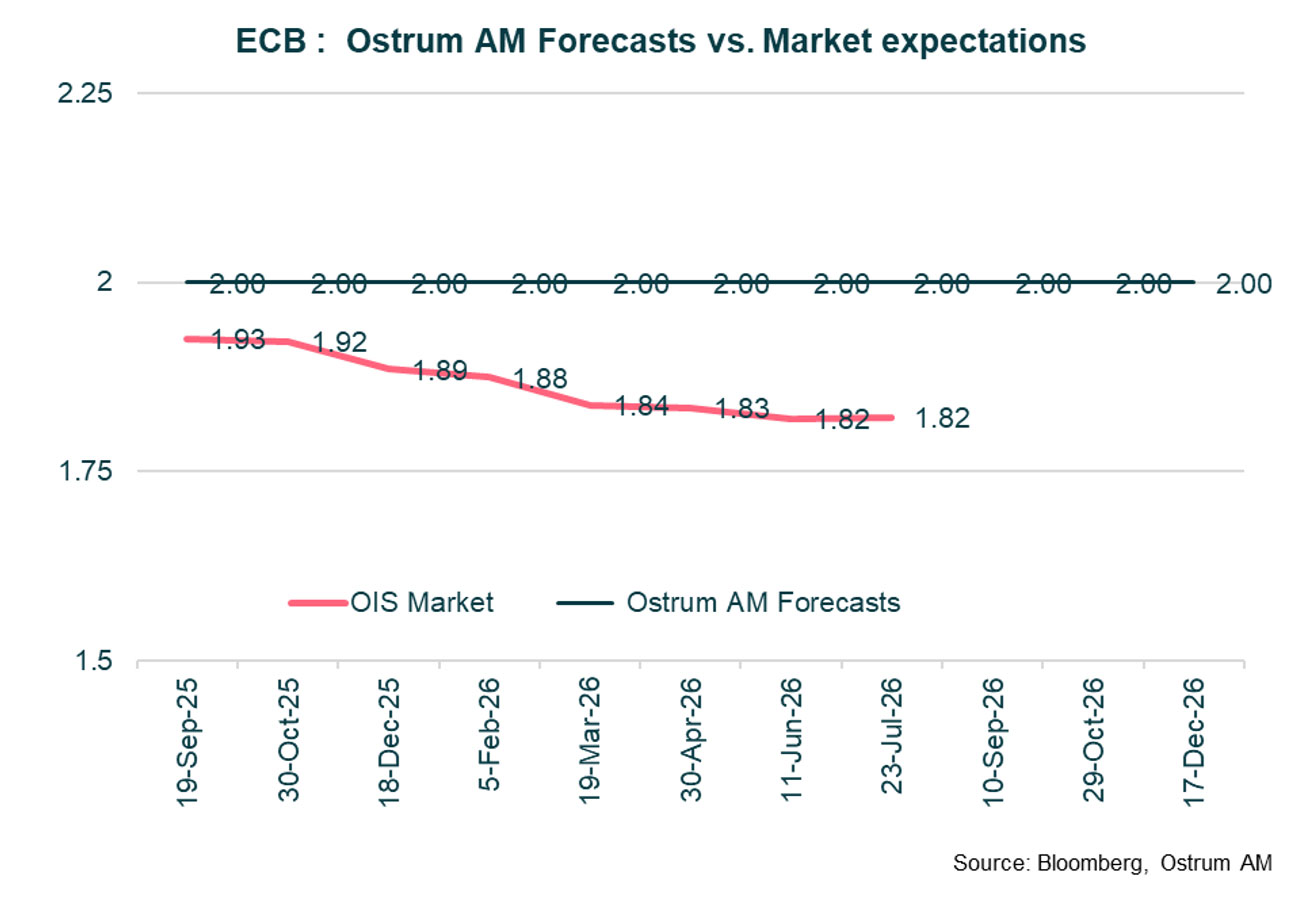

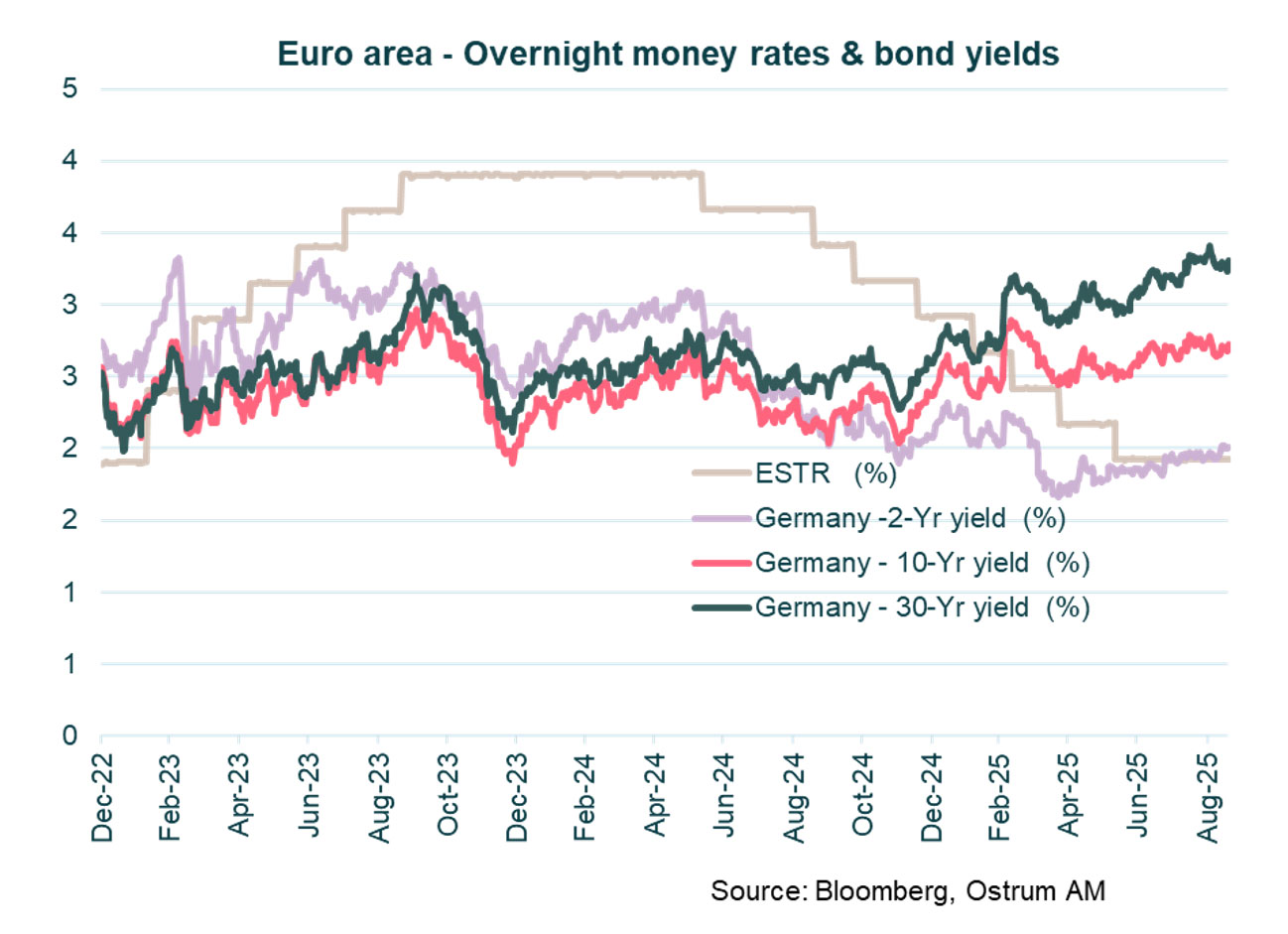

Extended status quo of the ECB

After lowering its rates 8 times over the course of a year (-200 basis points between June 2024 and June 2025), the ECB has kept its rates unchanged for the second consecutive meeting on September 11. Christine Lagarde indicated that the disinflation process is complete and that the ECB is still in "a good position" due to resilient growth, a strong labor market, and inflation expected to remain close to the 2% target in the medium term.

The risks to growth are considered more balanced following the trade agreement signed with the United States, although this agreement does not eliminate all uncertainties. The ECB will determine its rate policy meeting by meeting, based on incoming data. This suggests that rates will likely remain unchanged until the end of 2025 and into 2026. A final rate cut would only be considered in the event of a negative shock to growth.

INTEREST RATES INDICATORS

EURO SOVEREIGN BONDS

- U.S. Rates: The Federal Reserve responded to the deterioration in employment starting in September; despite upside risks to inflation. Fiscal risks will continue to weigh on long-term yields.

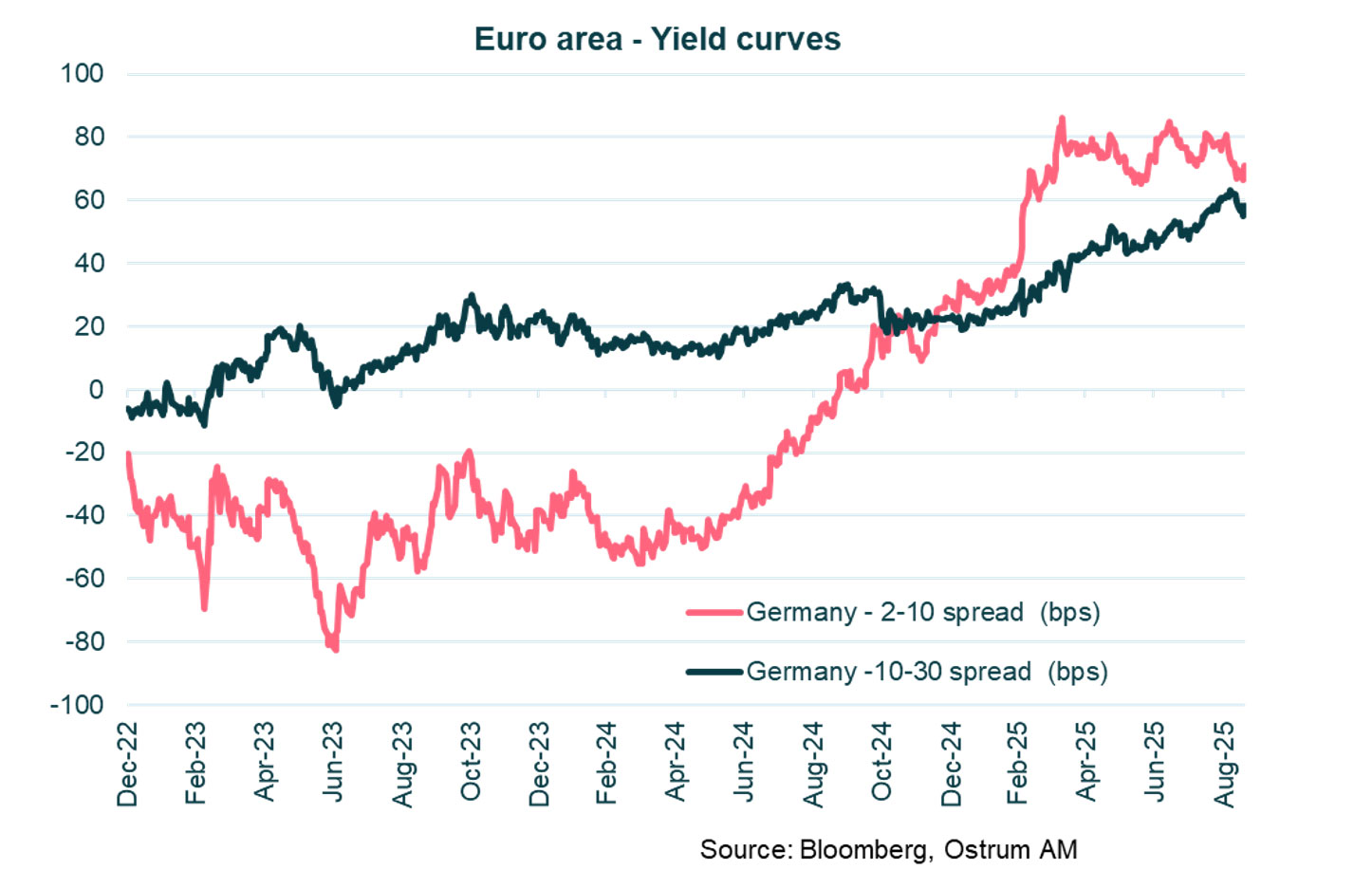

- European Rates: The ECB will keep rates unchanged at 2% until 2026. The 10-year Bund forecasted at 2.80% reflects a more ambitious fiscal policy in Germany.

- Sovereign Spreads: OAT spread forecasts reflect both political and fiscal woes. BTP spreads should be more stable.

- Euro Area Performance: The Euro Area returned -0.22% in 3Q2025. Countries like Belgium and Ireland also reported negative returns during this period (-0.50% and -0.02%, respectively).

- Italy vs. Germany: Italy exhibited the strongest performance among Euro sovereign bonds in 2025, achieving a total return of 2.28%, particularly excelling in the 5-10 year maturities. In stark contrast, Germany faced significant challenges (-1.09%) driven down by a steep loss of -6.80% in the 10-year plus category.

- Greece's Resilience: Greece demonstrated notable resilience with a total return of 1.48% for 2025 and a slight positive return of 0.09% in 3Q2025. This positions Greece favorably compared to countries like France (due to political woes) and Belgium.

- Mixed Results in AAA space: Nordic countries such as Finland and the Netherlands showed moderate returns, with Finland's total return at -0.35% and the Netherlands at -1.24% for 2025.

EMERGING BONDS

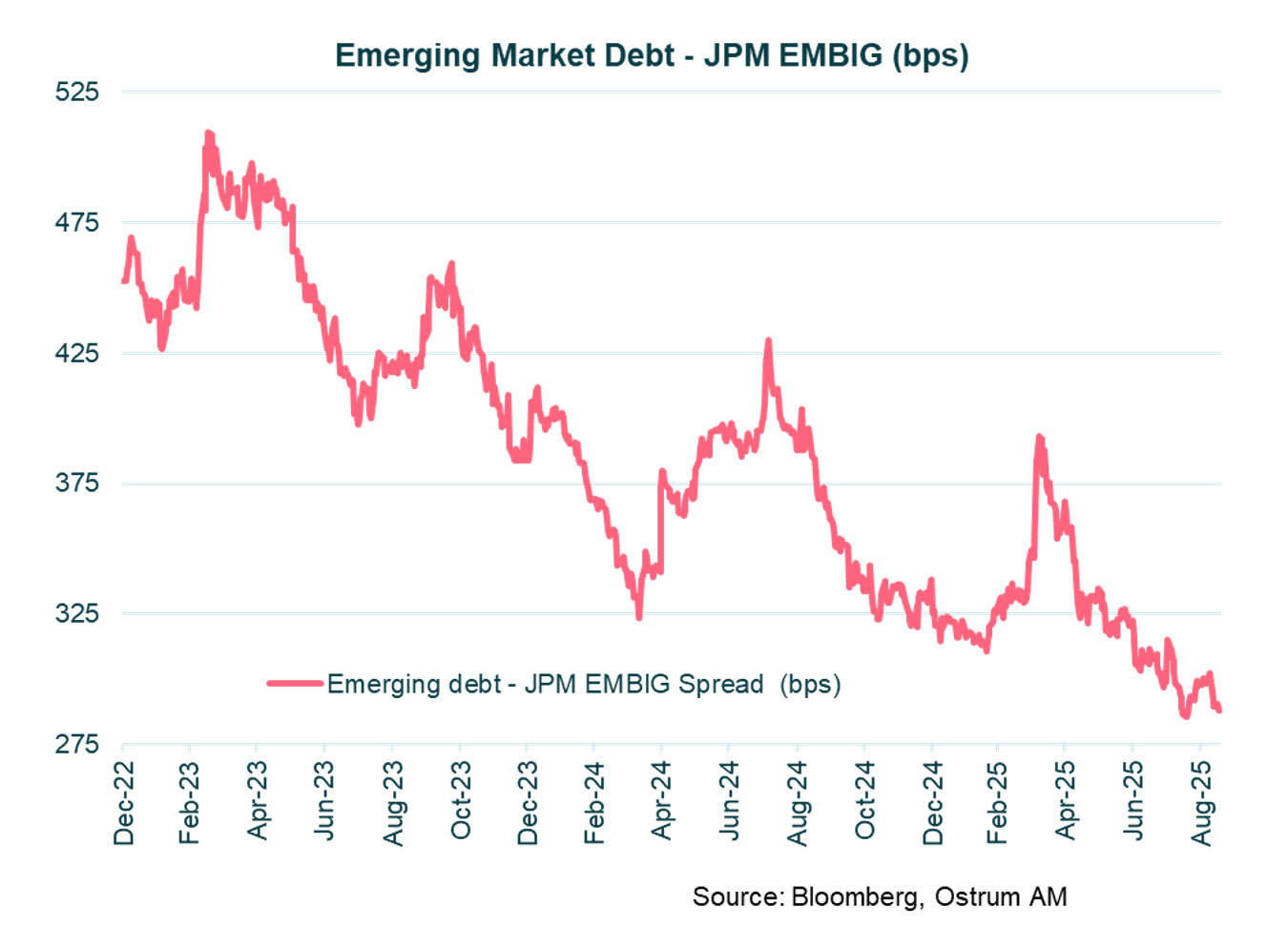

Emerging market spreads may remain close to current tight levels in the near term.

Strong performance namely on high yield emerging debt

- Strong Third Quarter Performance: The JP Morgan EMBI Global Diversified Index (EMBIG) demonstrated robust performance in the third quarter of 2025, achieving a total return of 8.23%. This strong quarterly return reflects positive sentiment in the emerging markets. Notably, the 10+ year segment saw an impressive return of 10.37%, indicating strong demand for long-dated securities.

- Significant Returns Across Maturities: Returns varied significantly across different maturities, with the 3-5 year and 5-7 year segments achieving total returns of 7.37% and 8.99%, respectively, in the third quarter. In contrast, the shorter 1-3 year segment recorded a more modest quarterly return of 5.55%, suggesting investors are favoring intermediate to longer maturities as they seek higher yields.

- Spread Dynamics and Market Sentiment: The EMBIG experienced an overall tightening of spreads, with a decrease of 19 basis points (bps) in the third quarter, contributing to a year-to-date tightening of -42 bps. Notably, the 1-3 year segment experienced a slight spread increase of 8 bps in 3Q 2025.

- High Yield Outperformance: Within the index, the High Yield segment outperformed the High Grade segment, achieving a total return of 10.24% in 3Q 2025 compared to the High Grade’s return of 6.19%. This trend illustrates a strong investor preference for higher-risk assets in the current economic environment.

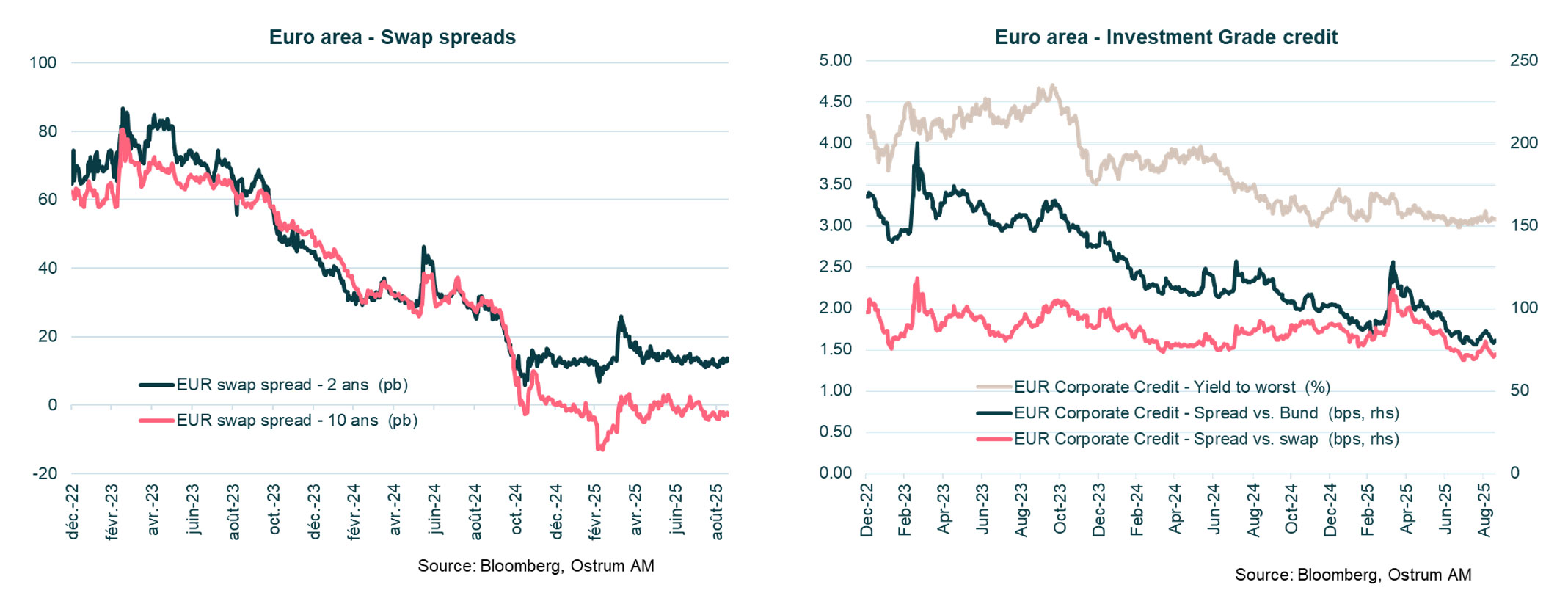

CREDIT INDICATORS

EURO INVESTMENT GRADE CREDIT

Investment Grade credit spreads have tightened significantly. A modest widening from current rich levels appears likely.

- Quarterly Trends Indicate Caution: The 3Q2025 figures reveal a general decline in returns compared to annual figures across most sectors. For example, the overall index* return dropped to 0.91%. Financials outperformed (0.97%), many sectors experienced lower returns.

- Strong Performance from Financials: The Financial sector outperformed other categories in 2025, with a total return of 3.21%. Within this sector, subordinated financial bonds led the way with a notable return of 4.05%. In contrast, the Industrials sector lagged behind, achieving only 2.48%, indicating a significant disparity between these sectors.

- Volatility in Subordinated Debt: Subordinated financial bonds and junior subordinated insurance both recorded impressive returns of 4.06% for 2025, highlighting a strong appetite for higher-risk investments.

- Mixed Results Across Non-Financial Sectors: Non-financial sectors showed varied performance, with Real Estate (3.12%) and Auto Group (3.11%) delivering solid returns, while sectors like Healthcare (1.82%) and Consumer Goods (2.08%) underperformed relative to the index* average of 2.77%. This reflects differing investor sentiment and market conditions across these industries.

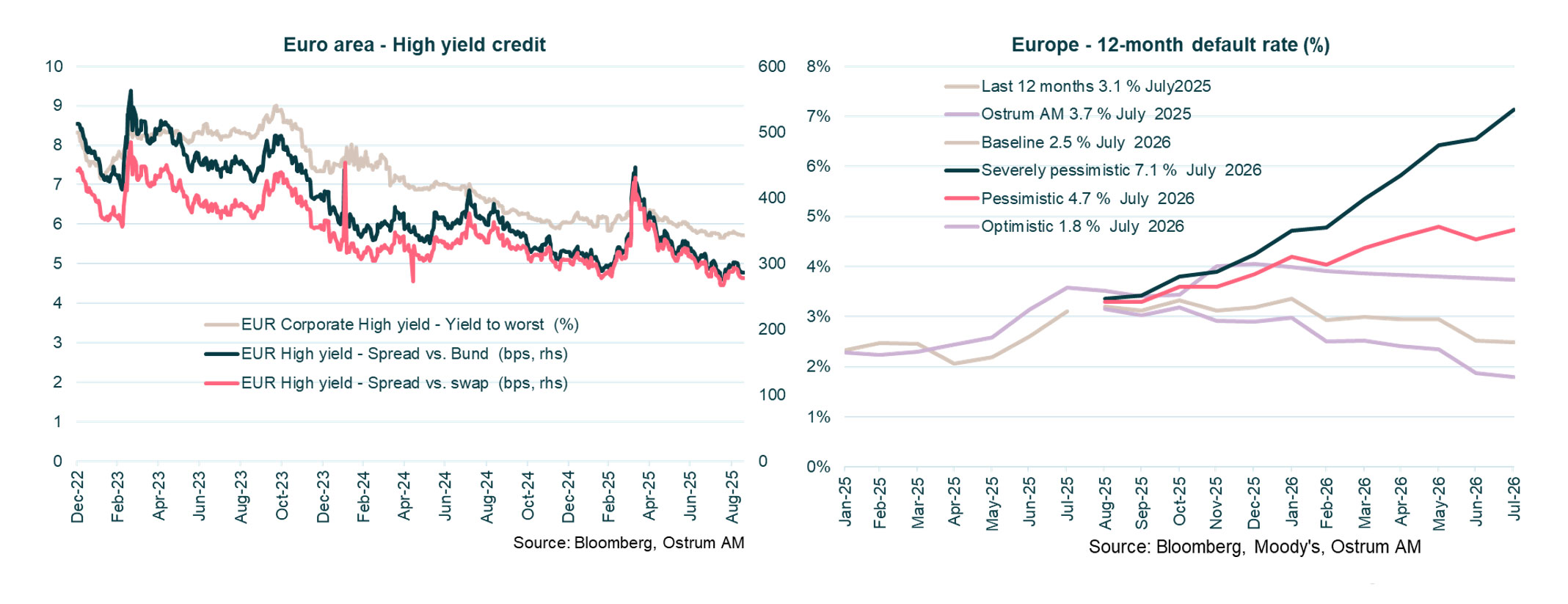

EURO HIGH YIELD CREDIT

Valuations in the high-yield sector are expected to normalize. However, the default rate remains low and below the historical average.

Strong overall performance

- Strong Overall Performance: The Euro High Yield Index delivered a solid total return of 4.60% in 2025, indicating a favorable environment for high-yield investments. Among the various segments, the Euro Fallen Angel High Yield category stood out with the highest return of 5.60%, reflecting investor confidence in recently downgraded bonds.

- Quarterly Trends and Volatility: In 3Q2025, the overall return for the Euro High Yield Index declined to 1.80%, with all segments showing reduced returns compared to their annual figures. The Euro Floating Rate High Yield segment, while still positive, lagged behind with a return of only 0.79%, indicating potential market volatility and investor caution.

- Sector Disparities: The Euro Non-Financial High Yield segment achieved a notable return of 4.66%, outperforming Financials which managed a lower return of 4.03%. This trend underscores the relative strength of non-financial issuers compared to their financial counterparts, which may face more regulatory and economic pressures.

FOCUS ON SUSTAINABLE BONDS

« Social bonds» special edition

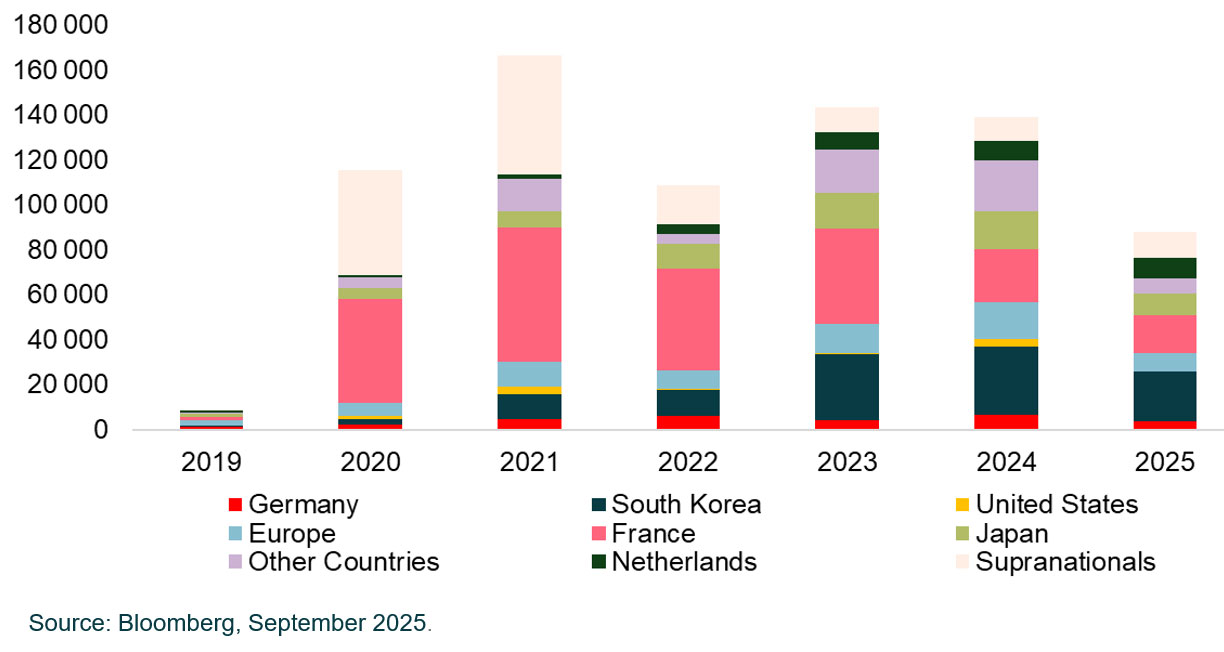

QUARTERLY GRAPH

Social bond issuances by country (in €M)

In 2024, France, Japan, and South Korea account for 51% of social bond issuances. Following a significant increase in their issuances due to the Covid-19 pandemic, supranational institutions have considerably reduced their issuance volume.

- Social bonds are intended to finance projects with a positive social impact, such as affordable housing, education, and access to healthcare. They require issuers to provide total transparency regarding the use of funds (measurability), thus giving investors the opportunity to contribute to tangible changes.

- In a disrupted economic context, marked by unemployment and pressure on healthcare systems, social risks have gained significance. 2020, marked by Covid-19, witnessed a spectacular expansion of social bonds, with issuances rising from €9 bn in 2019 to €115 bn in 2020. In this new environment, supranational institutions, which accounted for 40% of issuances, along with banks and government agencies, particularly stand out.

- Banks play a crucial role in the development of the social economy, representing 26% of social bond issuances in 2024. Their bonds target high-impact projects, such as affordable housing, support for SMEs, education, and healthcare infrastructure. In doing so, they contribute to strengthen economic resilience and social inclusion.

- Motability Operations (United Kingdom) assists individuals with disabilities by converting standard vehicles into adapted vehicles. These adaptations enable users to gain mobility and independence. Its latest issuance financed over 370,000 new vehicles for disabled beneficiaries in 2024. Thanks to specific modifications, such as access ramps and adapted driving systems, beneficiaries can easily access their vehicles and travel comfortably.

DASHBOARD - OSTRUM AM VIEWS

MACROECONOMIC OUTLOOK • EUROZONE AND UNITED STATES

MARKET VIEWS