2022 Corporate Social Responsibility Report

Discover 2022 Corporate Social Responsibility Report

Our Mission Statement: To extend our clients’ commitments through investment in order to help ensure the life, health and retirement plans of Europe’s citizens.

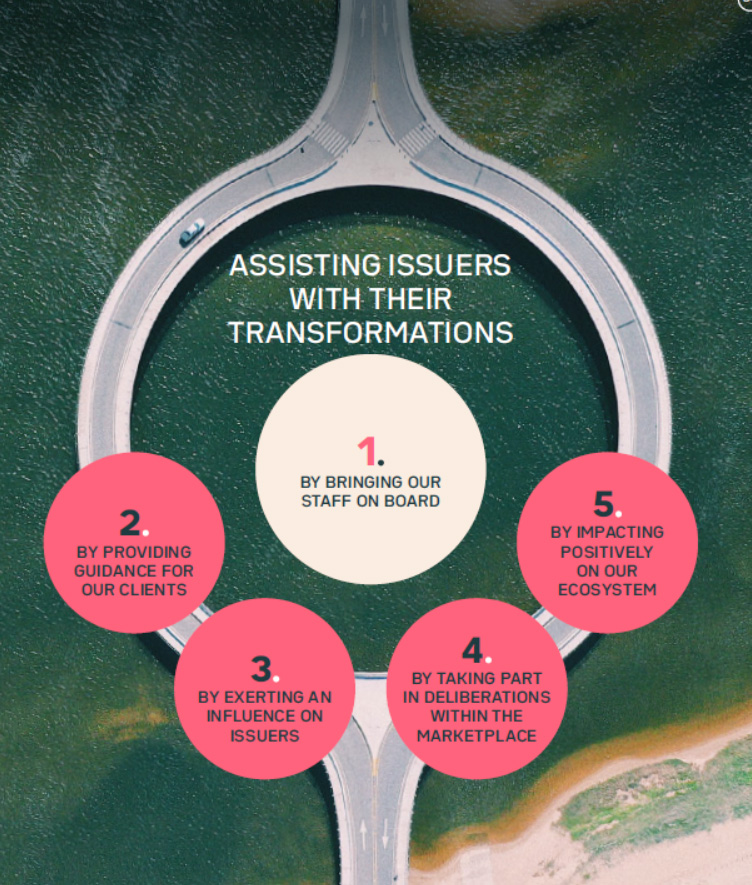

OUR CORPORATE RESPONSIBILITY: ASSISTING WITH TRANSFORMATION

We place corporate responsibility at the core of what we do as asset managers and the way we operate as a company.

We have been committed to responsible investment for many years now, endeavouring to build lasting relations with our clients on the foundations of responsibility and transparency while also being an exemplary employer and a company capable of contributing positively to our society.

Pillar 1: MAKING OUR EMPLOYEES THE DRIVERS OF OUR TRANSFORMATION

Ostrum AM places employee engagement at the very core of its CSR strategy by providing staff with what they need to become actively involved in its relations with its various stakeholders.

At the same time, we continue to roll out our responsible employer policy in an effort to promote workforce diversity and give each of our employees an opportunity to develop their skills.

- Create a community together geared towards fulfilling our ambitions;

- Promote all forms of diversity and inclusion.

Key Figures

- 92% of staff members having received training

- 41% women in managerial positions

- 6.26% share of disabled employees

Our 2023 Goals

- Enable our members to become engaged drivers of our transformation and promote our corporate culture

- Provide 100% of our staff with training in Diversity & Inclusion (D&I) issues

- Improve on our 2021 D&I score

Pillar 2: GUIDING OUR CLIENTS TOWARDS A MORE RESPONSIBLE FORM OF INVESTMENT

OUR OBJECTIVES

To help our clients incorporate corporate responsibility into their investments while ensuring their needs are met. As an asset manager, we are committed to being entirely transparent when providing support and information to our clients. We adapt their ESG policies to their dedicated funds and management mandates and keep them informed of regulatory developments. We also offer them a range of products that are able to meet precise ESG criteria.

A RESPONSIBLE AND BESPOKE RANGE OF SOLUTIONS

Each of our clients is unique. Our organisation, experts and information system therefore seek to cater precisely to the specific features of their responsible investment policies. For instance, we provide bespoke solutions for their climate strategies: carbon footprint management portfolios, specific exclusions, products geared towards the energy transition, etc.

And in an effort to take things further and provide proper guidance for our clients, we must assist them in preparing their own investment policies based on their objectives and in compliance with a stringent regulatory framework and inform them of our own convictions and responsible investment policy, which we apply to our range of open-ended funds.

Key Figures

- €43bn of assets invested in green, social and sustainability bonds

- 100 %des demandes de labellisation des clients satisfaites

Our 2023 Goal

Over 90% of AUM classified as Article 8

Pillar 3: ASSISTING ISSUERS WITH THEIR TRANSFORMATIONS

As an asset manager, we are responsible for steering share and bond issuers towards best practices in the environmental, social and governance arenas.

For this purpose, we make use of:

- constructive dialogue with issuers;

- a strict voting policy.

In 2022, for instance, we stepped up our climate engagement by determining our dialogue priorities by sector. We also engaged in dialogue with issuers on the topic of biodiversity.

Key Figures

- 242 engagement initiatives in 2022

- 123 companies were engaged as part of an engagement mission

Our 2023 Goals

- Step up our biodiversity strategy;

- To be engaged with 100% of the issuers targeted by our coal, oil and gas policies.

Pillar 4: PROMOTING PROGRESS IN THE MARKET PLACE

Ostrum AM is actively engaged within the financial marketplace in a drive to help the industry transition towards more responsible investment practices:

- We are stepping up our SRI labelling policy;

- We are active participants in efforts to establish CSR-SRI standards;

- We are also involved in specific financial market initiatives.

Key Figures

- 12 collaborative engagements

- 4 stars for all the asset classes under our management, according to the PRI

Our 2023 Goal

Be transparent in a qualitative way and sharing Ostrum’s conviction within market bodies.

Pillar 5: CREATING A POSITIVE IMPACT ON OUR ECOSYSTEM

Ostrum AM wishes to build a more sustainable economic and financial development model. We apply the same standards required of the companies in which we invest to ourselves, and thus strive to be exemplary in the way we operate as a company.

We are also eager to contribute to civil society. Our staff members play a leading role in our approach to corporate responsibility, whether by managing resources in a responsible manner, recycling materials, applying ethical business practices or participating in our patronage activities.

Key Figures

- -97% paper used between 2017 and 2022

- Offsetting 100% our its direct carbon emissions each year

Our 2023 Goal

100% of staff members with a CSR or ESG criterion factored into their variable pay.