Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Aline Goupil-Raguénès podcast :

- Review of the week – Financial markets, activity in the U.S.;

- Theme – Budget and political crisis in France

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Budget and political crisis in France

- François Bayrou surprised everyone on August 25 by deciding to submit his government to a confidence vote in the National Assembly on Monday, September 8. Opposition parties declared that they would not grant him this, which is likely to result in the government's downfall due to the lack of a majority;

- The question concerns the aftermath. Among all possible scenarios, the risk of a new dissolution of the National Assembly seems to us the highest, which would result in a widening of the spread between 10-year French rates and those of Germany;

- In this case, tensions on the spreads of peripheral countries should be more limited, not justifying an intervention by the ECB;

- In the extreme scenario of President Emmanuel Macron's resignation, the French spread would far exceed 100 bp, justifying an intervention by the ECB to limit the contagion effects on the rates of peripheral countries, within the framework of the transmission protection instrument.

Towards the downfall of the Bayrou government.

Confidence vote on September 8.

The government of François Bayrou is expected to fall following the confidence vote...

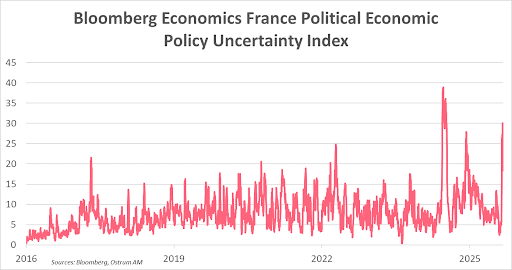

Budgetary issues promised to liven up the start of the school year, given the criticisms from various opposition parties regarding the main budget lines presented on July 15 by Prime Minister François Bayrou (https://www.ostrum.com/en/news-insights/news/mystratweekly-july-22th-2025). But not so soon and not in this manner. The debates were supposed to begin on October 1, with a vote on the budget by December 31. The government was exposed to a motion of no confidence on the budget, as was the case in December 2024 with Michel Barnier's government, despite the concessions made by him. François Bayrou decided otherwise and surprised everyone by submitting his government to a confidence vote in the National Assembly on Monday, September 8, significantly increasing political uncertainty.

…The first time since 1958 and the beginning of the Fifth Republic.

To win it, the government must obtain the majority of expressed votes, with abstentions not being counted. Lacking an absolute majority, the support of opposition parties becomes crucial. The latter declared over the past two weeks that they would vote against confidence, which is likely to result in the government's downfall. François Bayrou would then have to submit his resignation to the President of the Republic and remain in office to manage current affairs until a new Prime Minister is appointed (the 5th in 2 years). The downfall of a government following a confidence vote would be a first since 1958 and the beginning of the Fifth Republic.

The Aftermath of the Confidence Vote: Possible Scenarios.

Appointment of a new Prime Minister.

It will be difficult for the President to find a Prime Minister capable of broadening the government's support in the National Assembly.

The first scenario is the appointment of a new Prime Minister capable of garnering enough support in the National Assembly to pass the 2026 budget and ensure the stability of the government. This would be the preferred option of President Emmanuel Macron in order to avoid new early legislative elections. This scenario seems difficult given that the three blocs within the National Assembly are diametrically opposed on the scope and modalities of the budgetary adjustment to be made and on the approach to the presidential election in 2027. Since the dissolution in June 2024, the government has been led by a right-wing Prime Minister, Michel Barnier, and then by a centrist, François Bayrou. To broaden the government's support in the National Assembly, some advocate for the appointment of a left-wing Prime Minister so that the government can secure the support of the Socialist Party in the Assembly.

However, the leader of the center-right party, Les Républicains, has indicated that he rules out any alliance with the Socialist Party. Furthermore, the leader of the PS has excluded a coalition agreement with the centrist bloc.

Moreover, the proposals made by the Socialist Party regarding public deficit reduction are in stark contrast to those of the central bloc. The effort proposed for 2026 is half as much (22 billion euros in savings compared to 44 billion for the Bayrou government), and the deficit would not fall below 3% of GDP until 2031, compared to 2029 for the current government.

Given all these factors, the appointment of a new Prime Minister does not seem to be the favored scenario.

Technical Government.

Low probability of appointing a technical government.

Emmanuel Macron could decide to appoint a Prime Minister who is not a politician to lead a technical government. This has never happened in France, unlike in Italy (notably with Mario Monti and Mario Draghi). Additionally, he would need to obtain a political consensus to implement the necessary measures, which seems complicated. The likelihood of a technical government is low.

Dissolution of the National Assembly.

The favored scenario is that of a dissolution of the National Assembly and early legislative elections.

The most probable scenario, in our view, is the dissolution of the National Assembly given the impossibility of finding a new Prime Minister capable of broadening the government's support in the Assembly. New early legislative elections would need to be held within 20 to 40 days following the dissolution. The result is likely to once again lead to a highly divided National Assembly with a probable increase in seats won by the far right, according to the latest polls, although they would not hold a majority. The risk of social instability, already present with the planned social movements on September 10 and 18, would be greater.

The risk of social instability and confrontation with Brussels would increase.

Uncertainty would increase with the risk of an insufficient budget adjustment that could keep the deficit high and result in a rise in the public debt-to-GDP ratio. The far-right party seeks the repeal of the pension reform. The European Commission has put France under excessive deficit procedure. The risk of confrontation with Brussels would increase.

Resignation of President Emmanuel Macron.

The resignation of the President of the Republic is an extreme scenario.

Finally, the extreme risk of the resignation of the President of the Republic is very low. Emmanuel Macron has ruled it out, stating that he would see his mandate through to the end. This would mark a regime crisis and lead to speculation about a possible Sixth Republic.

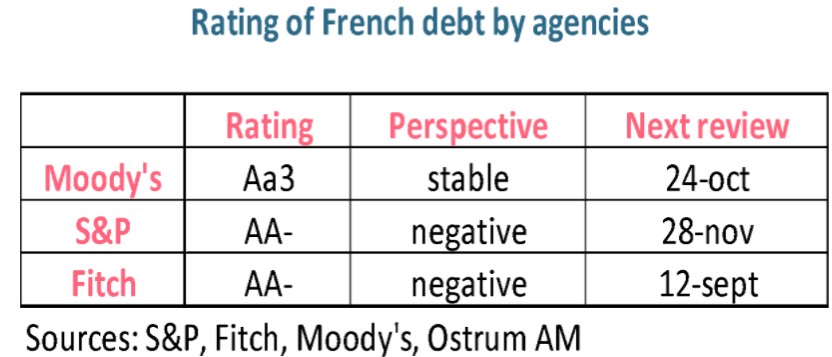

Upcoming downgrade of France's rating by the agencies.

One thing is certain: France's rating will be downgraded. This will happen more quickly in the case of the appointment of a new Prime Minister, given the compromises that need to be made, a dissolution of the National Assembly, or the resignation of the President.

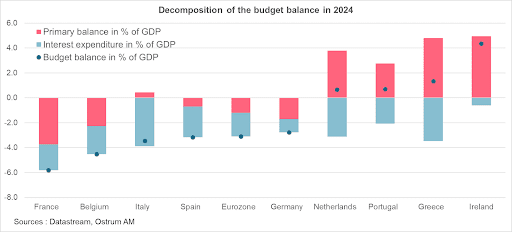

In 2024, France recorded the largest budget deficit among the eurozone countries, primarily due to the magnitude of its primary deficit (budget deficit excluding interest charges). It has committed to the European Commission to bring its deficit below 3% of GDP by 2029, which requires a significant budgetary consolidation given the substantial overshoots recorded in the last two years. This implies returning to a primary surplus by that time, something that has not occurred since the late 1990s and early 2000s, and doing so sustainably.

Political instability represents an additional risk to the necessary adjustment of public finances. Rating agencies Fitch and S&P have assigned a negative outlook to France's rating, which could lead them to downgrade it in their next reviews: September 12 for Fitch and November 28 for S&P. Thus, the rating would drop from AA- to A+. Moody’s might initially change its outlook from stable to negative before downgrading the rating to A1. In the event of the establishment of a technical government or in the unlikely case of a confidence vote granted to François Bayrou's government, the agencies might adopt a wait-and-see approach to assess the consolidation measures that will be taken.

Market Reactions Based on Different Scenarios.

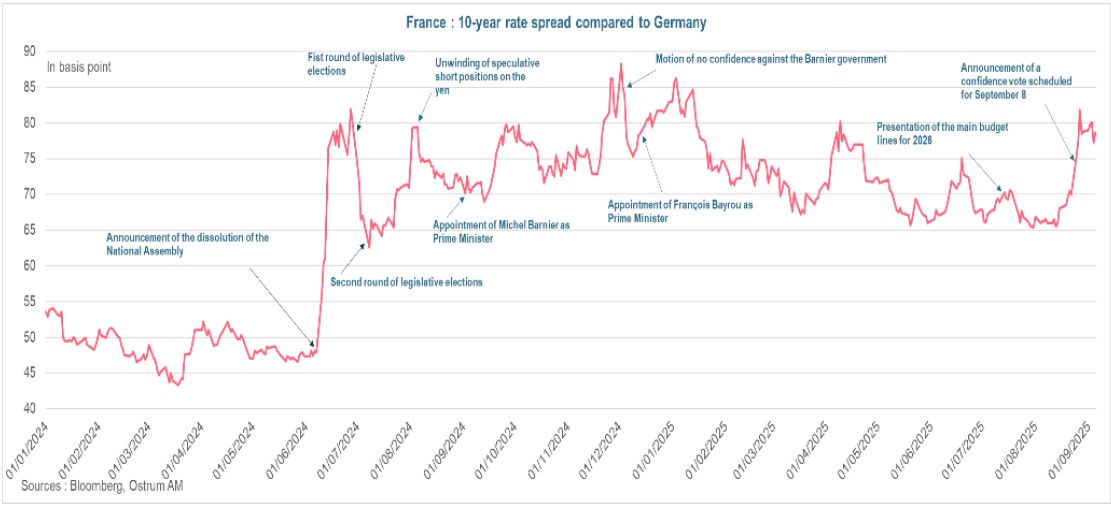

On August 27, the 10-year French spread reached the level of 82 bp.

At the announcement of the confidence vote on August 25, the French spread widened significantly, rising from 70 to 75 basis points and reaching 82 bp by August 27. Since then, it has slightly moderated to remain around 80 bp, holding at its highest levels since April. At 82 bp, the spread reached the peak seen just before the first round of the legislative elections in June 2024 and was approaching the levels of 88 bp that prevailed just before the vote on a motion of no confidence against the Barnier government.

And after?

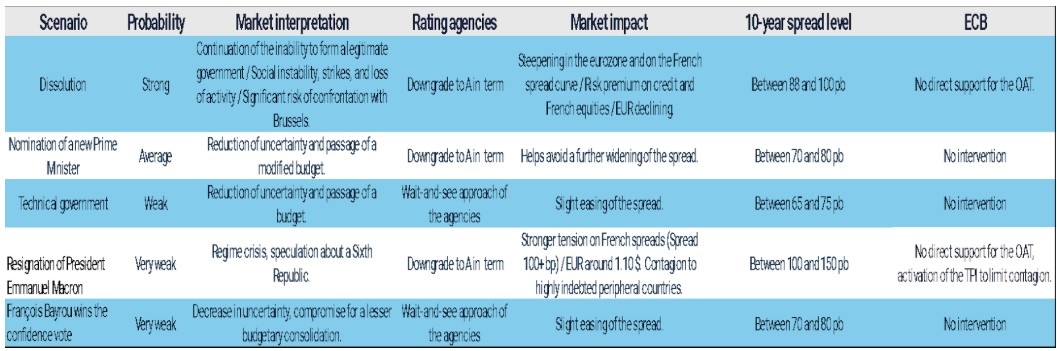

In the highly unlikely event that François Bayrou wins the confidence vote, uncertainty would decrease, and the parties would find a compromise on the 2026 budget, leading to more limited consolidation measures. The rating agencies would likely adopt a wait-and-see approach before a downgrade in 2026. This would help avoid a further widening of the spread, which should fluctuate between 70 and 80 bp.

The most favorable scenario for the French bond market would be the appointment of a technical government capable of increasing the likelihood of adopting budget consolidation measures. In this case, the rating agencies would also be cautious, and the spread should range between 65 and 75 bp.

If, following the government's downfall, a new Prime Minister is appointed who can broaden the government's support in the National Assembly, uncertainty would diminish. A budget proposing a more gradual reduction of the budget deficit would be adopted, which would eventually lead the agencies to downgrade France's rating. The passage of a budget would help avoid further widening of the spread, which would fluctuate between 70 and 80 bp.

In the scenario of a dissolution of the National Assembly, the French spread could reach 100 bp.

In the case of a dissolution of the National Assembly, uncertainty would increase further with the risk of a still fragmented Assembly and the difficulty of forming a new government in a context of social instability. The higher risk regarding the government's ability to adopt the necessary budgetary measures would lead to a greater widening of the spread, likely between 88 and 100 bp, and a steepening of the yield curve. The risk premium would also increase in the credit and equity markets, and the euro would depreciate.

Finally, in the extreme case of President Emmanuel Macron's resignation, the uncertainty would be such that strong tensions would exert pressure on French long-term rates. The spread could range between 100 and 150 bp. The tensions would significantly spread to the most indebted peripheral countries.

And the ECB?

The ECB would potentially intervene only in the event of significant tensions on rates that could generate a risk to financial stability or to the transmission of monetary policy, which is not currently the case.

The ECB will only intervene in the event of excessive tensions on the rates of peripheral countries to limit contagion effects. It will then use the TPI.

The ECB could intervene in the event of the President's resignation to limit tensions on the spreads of peripheral countries related to contagion effects. It could activate the Transmission Protection Instrument (TPI). Announced in July 2022 and never used, it aims to 'combat unjustified and disorderly market dynamics that pose a serious threat to the transmission of monetary policy within the Eurozone.' For this, countries must meet a number of criteria:

- Compliance with the EU budgetary program

- Absence of serious macroeconomic imbalances

- Fiscal sustainability: sustainability of the public debt trajectory

- Adherence to sound and sustainable macroeconomic policies in line with the recovery and resilience plan

Under the TPI, the ECB can purchase public securities in the secondary, and possibly private, bond markets, with maturities ranging from 1 to 10 years and for an unlimited amount. The scale of the purchases will depend on the severity of the risks to the transmission of monetary policy.

While the ECB would intervene in the case of excessive tensions on the spreads of peripheral countries, it should not use the TPI to limit tensions on the French spread given that France is under excessive deficit procedure and must comply with the European Commission's recommendations to benefit from the TPI. The tensions on the OAT are indeed related to the reassessment of budgetary risk linked to the political crisis. Another available instrument is the OMT (Outright Monetary Transactions). Its use seems unlikely given that it is initiated at the request of the country, which would have to seek assistance from the European Stability Mechanism, a process that proves to be politically difficult.

The table below summarizes the scenarios and their impacts on financial markets.

Conclusion

After the downfall of the Bayrou government, the most probable scenario is the dissolution of the National Assembly, which would lead to greater tensions on the French spread, potentially reaching up to 100 basis points. Tensions on the spreads of peripheral countries would be more limited, not justifying an intervention by the ECB. In the extreme scenario of President Emmanuel Macron's resignation, the French spread would far exceed 100 bp, justifying an intervention by the ECB to limit contagion effects on the rates of peripheral countries, within the framework of the transmission protection instrument.

Aline Goupil-Raguénès

Chart of the week

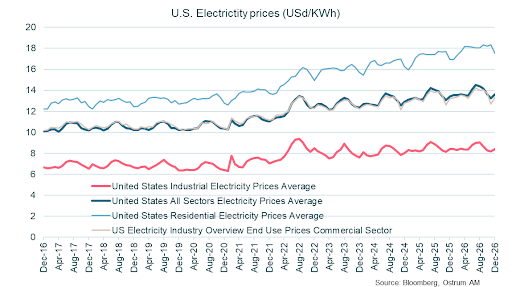

Electricity prices are up in the United States. This increase comes at a time when natural gas prices remain very low (43% of electricity generation relies on natural gas).

Grid capacity constraints continue to be significant, causing occasional price spikes.

A new factor driving this trend is the demand associated with the growth of data centers and the broader adoption of artificial intelligence. The crowding-out effects from rising electricity prices are likely to increase the risk of recession in the United States.

Figure of the week

21

Demand for the Fed's reverse repurchase agreement facility (RRP) has reached a new low since 2021 at $21 billion. This compares to levels of over $2 trillion reached between June 2022 and June 2023. The resumption of T-bill issuances by the U.S. Treasury since the raising of the debt ceiling is the cause.

Market review: The Fed Set to Resume Easing Measures.

- U.S. job growth at a standstill since May with just 22k new jobs in August;

- The Fed cut in September is a near certainty;

- Le T-note plunges below the 4.10% threshold;

- OAT spreads still under stress but contagion to other asset classes is limited.

The Fed Set to Resume Easing Measures.

Employment data bolster expectations of a Fed rate cut in September. Nevertheless, bond and equity markets are responding positively to these "bad" news.

The U.S. labor market remains paralyzed by the economic uncertainties stemming from the Trump administration's policies. With job creation stalled and pressures mounting on FOMC members, there is little doubt that a 25 bp cut in the Fed funds rate is imminent. Yet, financial conditions continue to be highly accommodative, evidenced by the decline in the dollar, bond yields, and risk premiums since the start of the year. In the Eurozone, a monetary status quo appears to be taking hold. The ECB will closely monitor developments in the political crisis in France, but this is unlikely to influence its rate policy. Meanwhile, the dollar has stabilized as the steepening pressure for yield curve is easing.

The U.S. economy is suffering from tariff-induced headwinds. Hiring and investment decisions have been postponed, resulting in job creation coming to a standstill since May. In August, the private sector generated a meager 38k jobs. Although layoffs remain moderate, re-entering the job market is proving more difficult than before, even for graduates. Job openings have dropped below the number of available unemployed. The unemployment rate stands at 4.3%. The shrinking labor force is hindering potential growth while simultaneously lowering the hiring threshold needed to stabilize unemployment. Investment intentions remain poorly oriented, except for the technology sector, where spending on equipment and infrastructure is experiencing exponential growth. Investments in data centers have quadrupled since 2021, reaching $40 billion annually. In the Eurozone, surveys align with a moderate growth environment despite a surprising drop in industrial orders in Germany (-2.9% in August).

In the markets, disappointing news merely cements the anticipated rate cuts in September. Consequently, the decline in real rates following the employment figures provides support for risk assets. The 10-year T-note has plunged below 4.10% in a broad decline in yields and a flattening of the curve. The 25-bp cut in September is fully priced in. The Bund is gravitating back toward the 2.70% mark. Tensions have eased somewhat on the OAT, with the 10-year spread sitting just below 80 bps. In the event of a dissolution, the peak of 88 bps observed during the fall of the Barnier government in December 2024 would likely serve as a target for traders. Overall, the market's reaction to the OAT has remained relatively contained, with contagion effects under control given the ECB's arsenal. The BTP is trading around 85 bps.

The lack of financial volatility in an uncertain global environment is indeed surprising, allowing equity markets to continue their ascent. The S&P 500 remains buoyed by a virtuous cycle benefiting technology stocks. This performance, however, comes at a cost: a reduction in diversification, as the weight of these stocks has significantly increased within the S&P 500 index. There is even a concerning level of interdependence among these large-cap stocks, with Nvidia's revenue being 40% reliant on five of the other six stocks in the group. Credit has somewhat cheapened with the return of primary issuance at the end of August, with the average spread coming in at 78 bps over swaps. European high yield remains expensive at 182 bps for BB-rated issuers. Nonetheless, moderate and stable growth, without a drift in leverage ratios, remains favorable for the asset class.

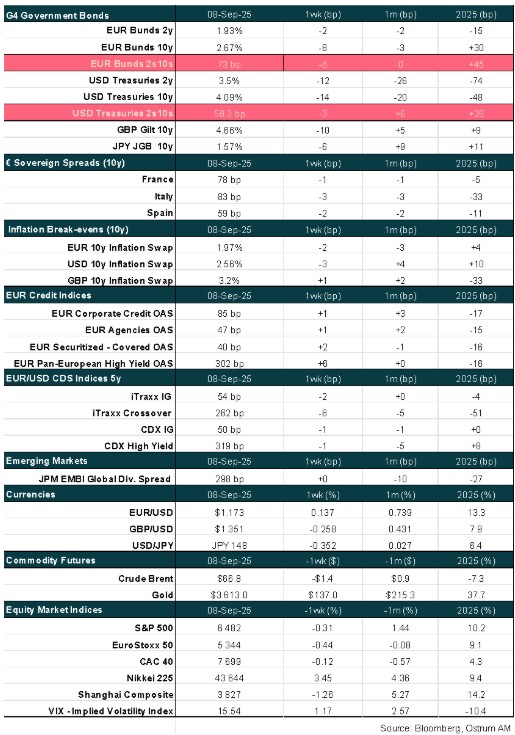

Main market indicators